Everyone Is Hiking Now

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 66

In the eyes of the market, two-year inflation expectations have been cooling since late March, when bitcoin was $48,000. This relationship is far from perfect because bitcoin is driven by many different things. But forward-looking inflation is very clearly an influential force.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

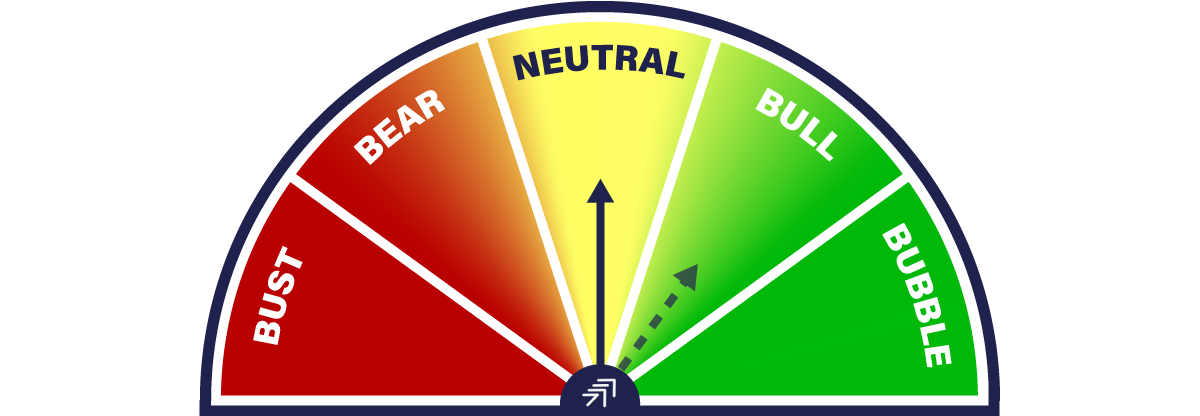

| Technicals | Weakness returns |

| On-chain | Soft but stable |

| Macro | Real rates are getting out of hand |

| Investment Flows | Small ETH inflows post-Merge |

Technical

By Charlie Morris

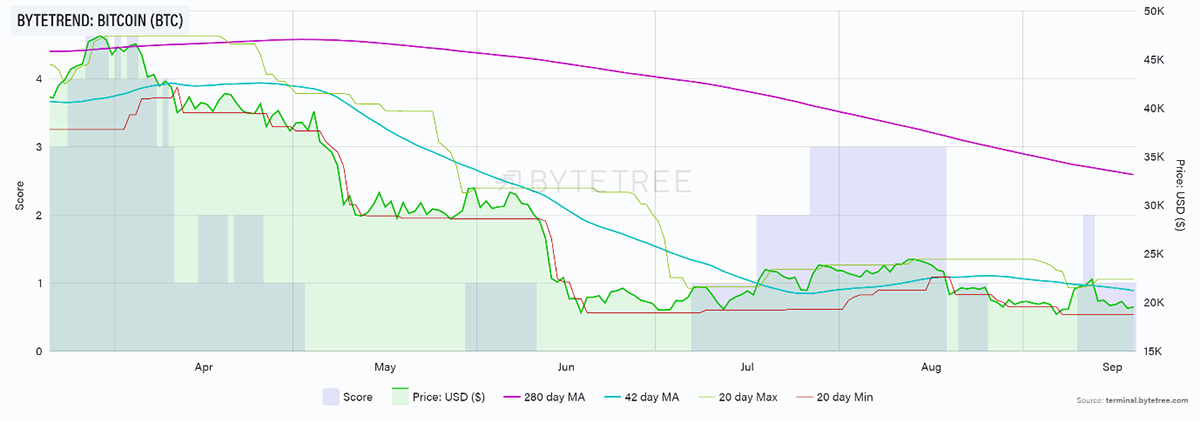

The recent rally hasn’t come to much. BTC is back to a 1-star, with the broader crypto space showing weakness.

Bitcoin 1-star

Source: ByteTree. Bitcoin (BTC) ByteTrend, in USD, over the past six months.

The Ethereum Merge (ETH) went without a glitch, but the price retreated regardless. It has been a rough week, and Bitcoin is once again the relative safe haven as most altcoins have started to lag.

On-chain

By Charlie Erith

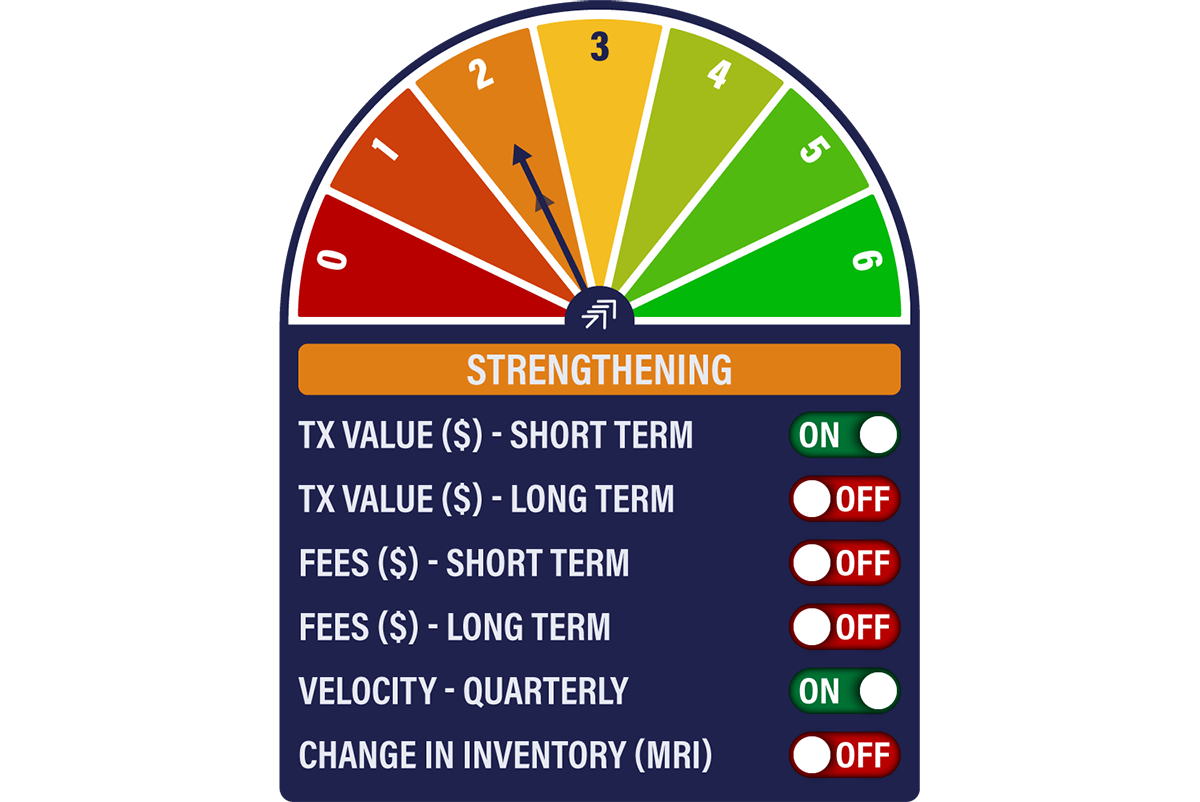

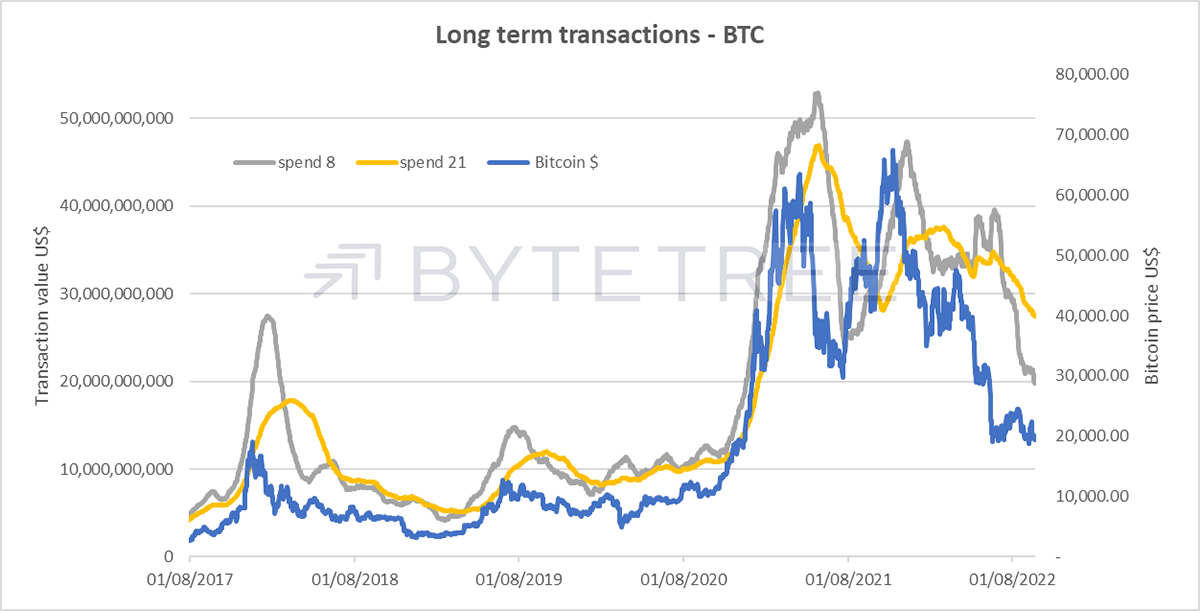

The Network Demand Model remains at 2/6. There has been a recent pick-up in transaction value, but not enough to change the long-term trends, while fees remain depressed. In terms of miner activity, the network is humming along nicely, with the block interval where it should be and miners selling as much as they are minting. Overall, there is nothing here that would alter a cautious view on the market.

The cross-over (of the grey and yellow lines, below) remains a long way off for the long-term transaction signal to come back on.

Source: ByteTree

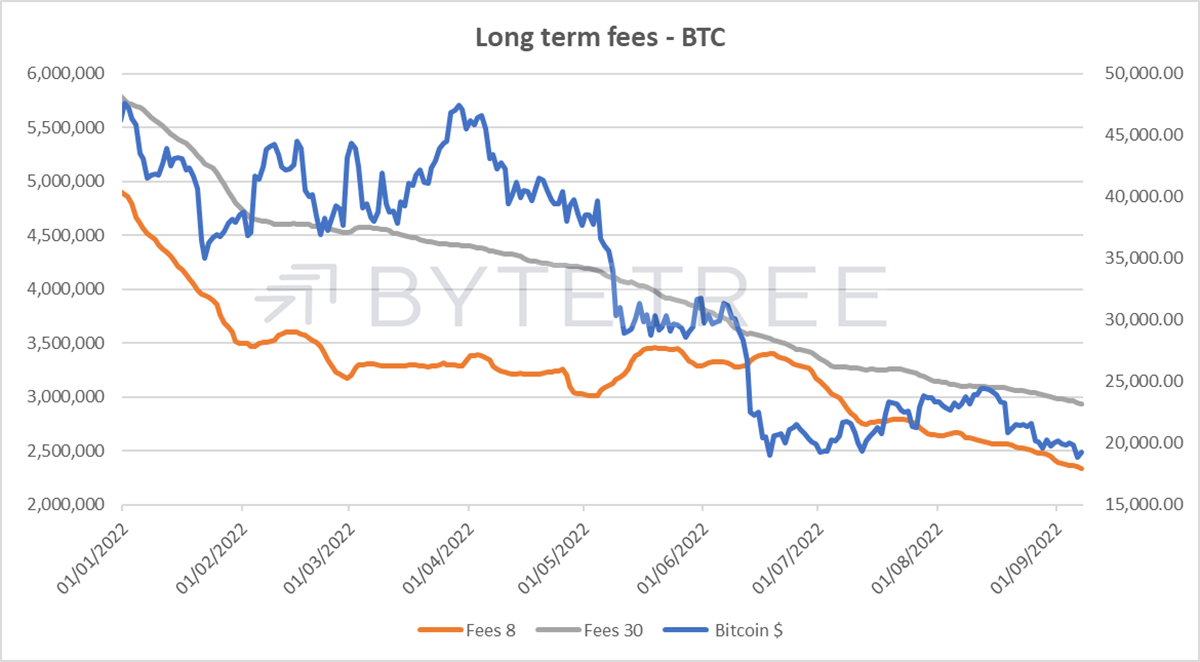

Fees being paid to process and validate transactions have continued on a downward trend.

Source: ByteTree

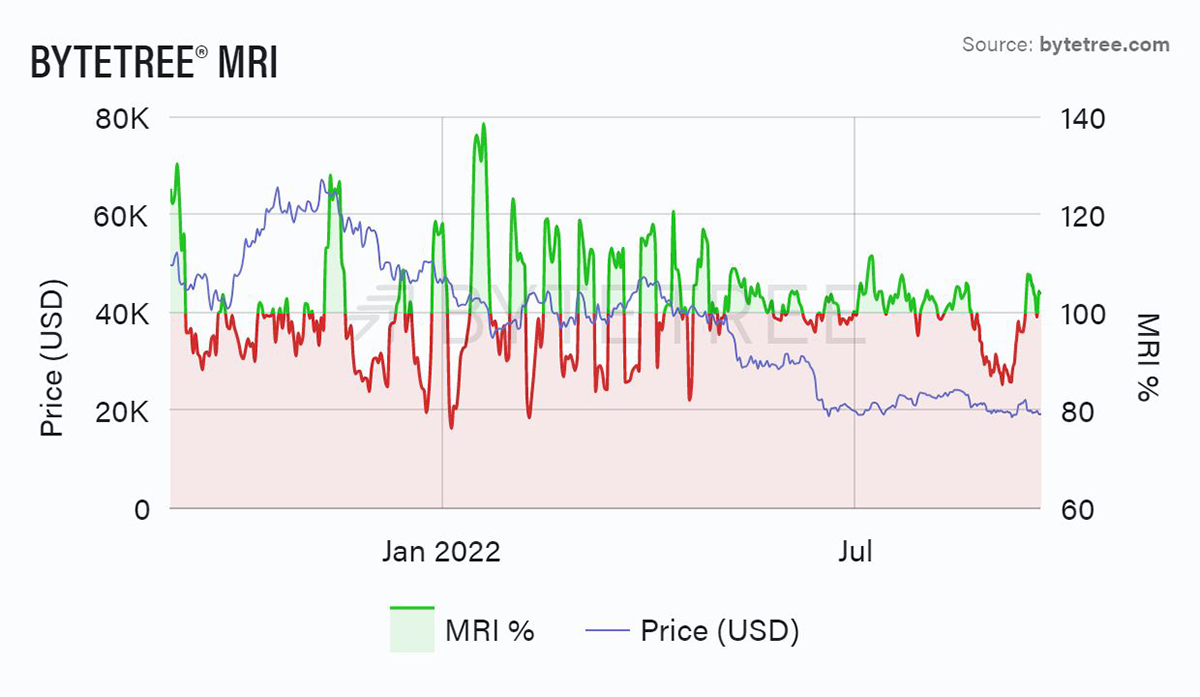

After the recent dip, miner selling has returned to normal levels. It suggests that around the US$20,000 level, there is a decent bid for fresh inventory.

Source: ByteTree. Bitcoin Miner’s Rolling Inventory (%) and BTC price (USD) over the past year.

Institutional Flows

By Charlie Erith

Ethereum flows have been negative since the recent mid-August price peak at just under US$2,000. There was clearly some selling in advance of The Merge, but with that behind us, and following a large price correction, there has been some small accumulation.

Source: ByteTree. ETH held by funds (ETH) and Ether price (USD) over the past 6 months.

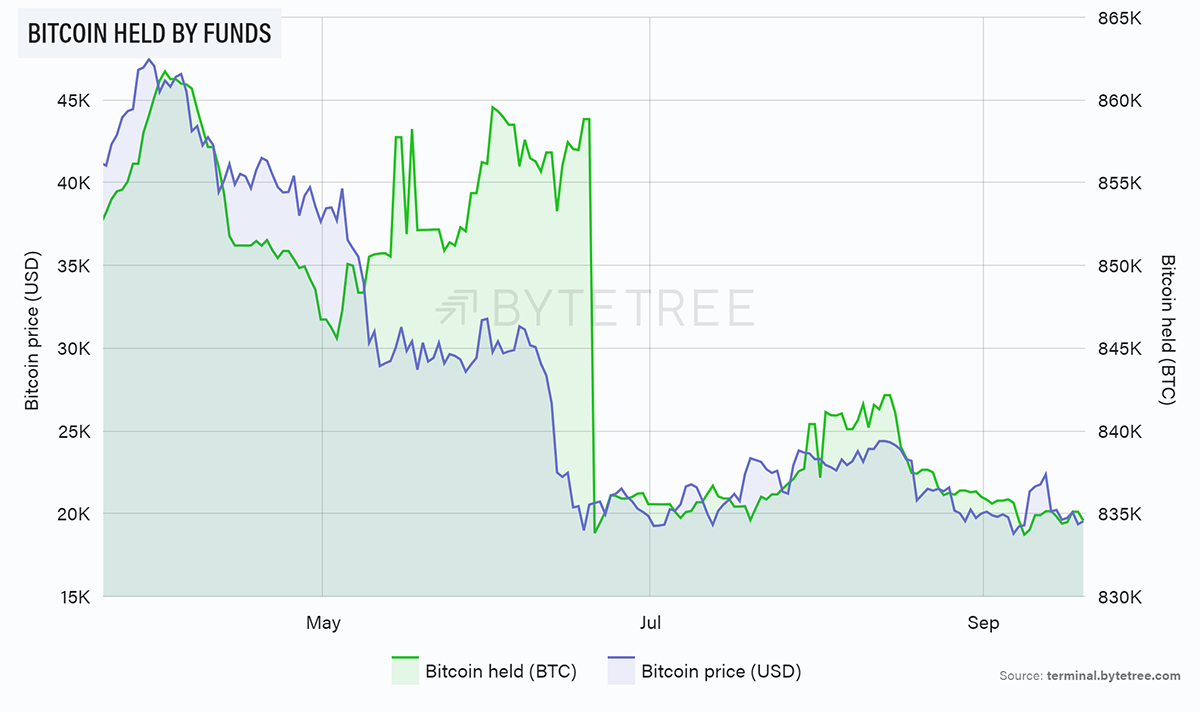

Bitcoin held by funds remains flat.

Source: ByteTree. Bitcoin held by funds (BTC) and BTC price (USD) over the past 6 months.

Macro

By Charlie Morris

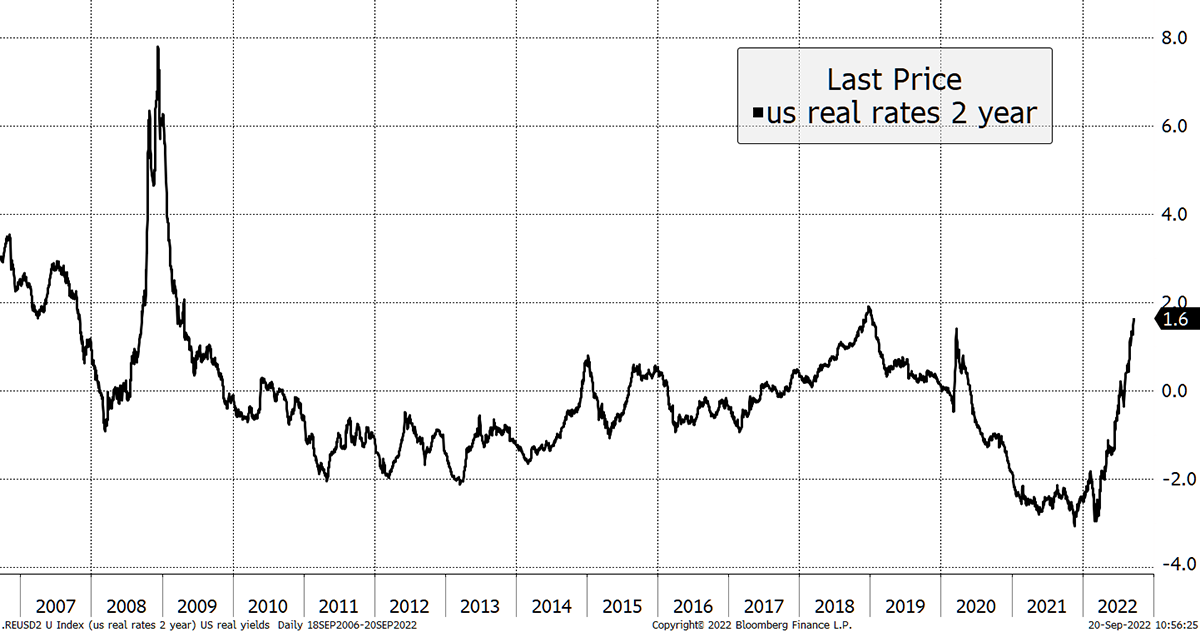

This chart says it all. The difference between the 2-year bond yield and 2-year expected inflation - the 2-year real rate - keeps on surging.

Tight, very tight

Source: Bloomberg

In 2008, the 2-year real rate surged from -1% to over 7%, which is an +8% move. This time it rose from -3% to 1.6%, which is a +4.6% move. Previous bitcoin bear markets in 2014 and 2018 both faced +2% moves. If +2% was enough, little wonder +4.6% is causing problems.

Yet people are saying bitcoin has failed as an inflation hedge. Since the Covid crisis, total US CPI has been 15.5%, and bitcoin is still up more than 100%.

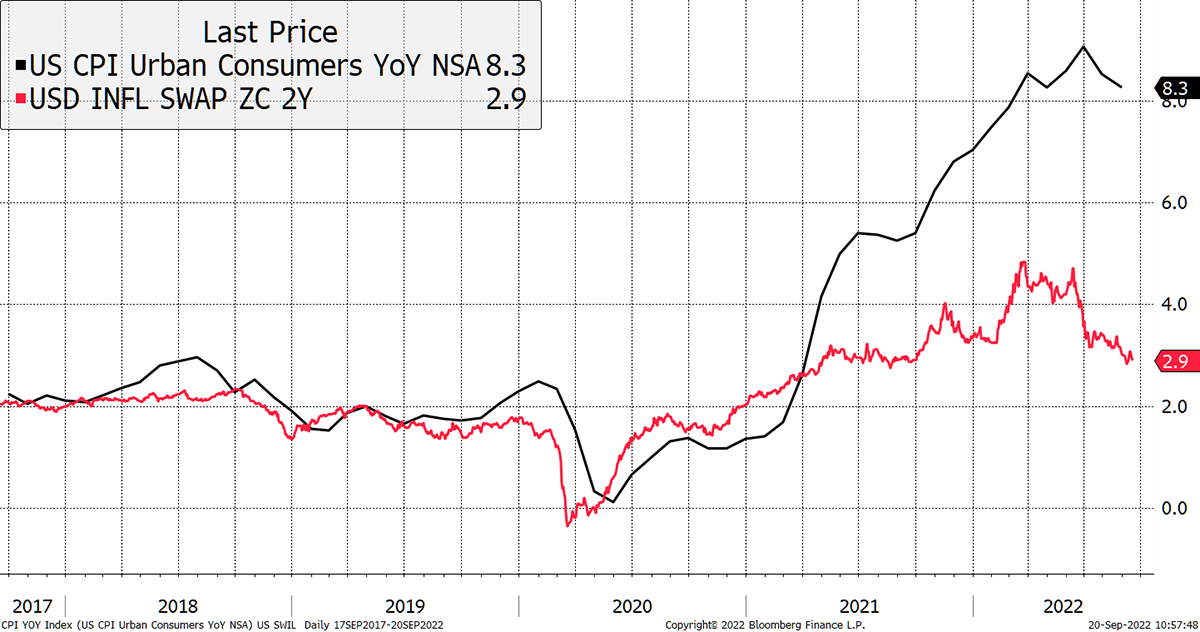

Inflation may be high, but the bond market thinks it will rapidly come back under control.

Bitcoin moves with inflation

Source: Bloomberg

In the eyes of the market, two-year inflation expectations have been cooling since late March, when bitcoin was $48,000. This relationship is far from perfect because bitcoin is driven by many different things. But forward-looking inflation is very clearly an influential force.

Bitcoin moves in line with inflation

Source: Bloomberg

I say bitcoin has succeeded in being a successful inflation hedge and continues to be driven by macro forces.

Summary

October (Uptober) is ten days away. Perhaps that will help. More importantly, you have to assume the Federal Reserve will soon start to cool because they have done so much. They are not the only ones to have moved quickly. This morning, Sweden’s Riksbank hiked rates by 1%, when 0.75% was expected. The Fed has started a trend. Everyone’s hiking now.

Comments ()