What if the Fed Bottle it?

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 59

There has never been a period of dollar weakness that hasn’t worked out well for bitcoin. If the Fed bottles it, and hikes less than they should, the good times for bitcoin will return.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

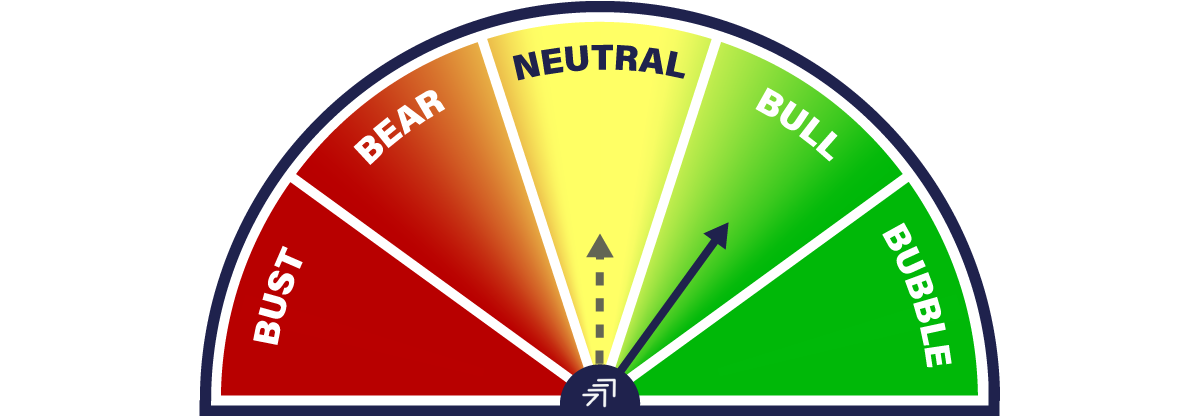

| Technicals | Better, but far from a bull |

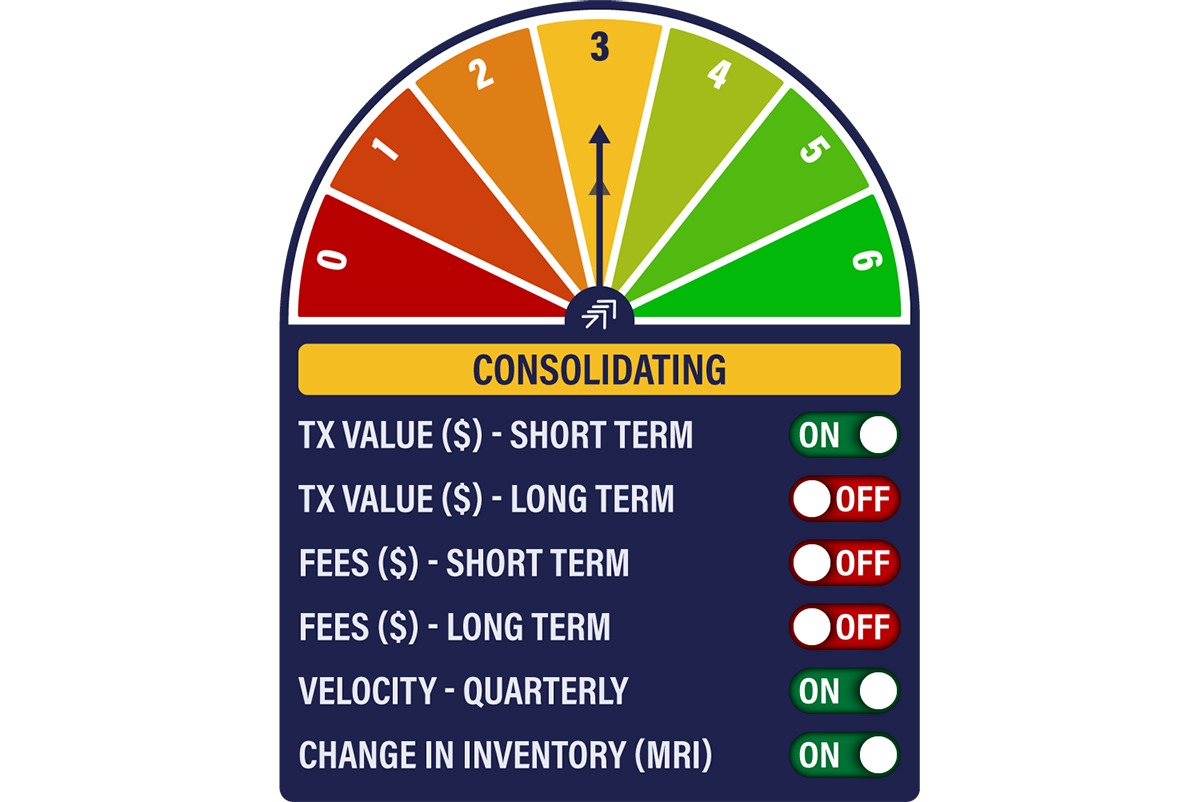

| On-chain | Transactions ticking higher |

| Macro | A weaker dollar would be helpful |

| Investment Flows | BTC profit-taking, ETH accumulating |

| Cryptonomy | Sorting the sheep from the goats |

Technicals

Bitcoin is more stable than a month ago as the 42-day moving average has turned up with price above it. It has also been following the blue 20-day max line which is nice. But we can’t escape that Q2 was horrendous and the 280-day moving average is nearly twice the current level.

Bitcoin 3 out of 5

Source: Bloomberg

Being oversold can be a good thing, but the technical picture is a long way from a bull market. We hold the dial on value grounds because bitcoin will become increasingly attractive in this era of uncertainty, and we believe it can sustain a higher price.

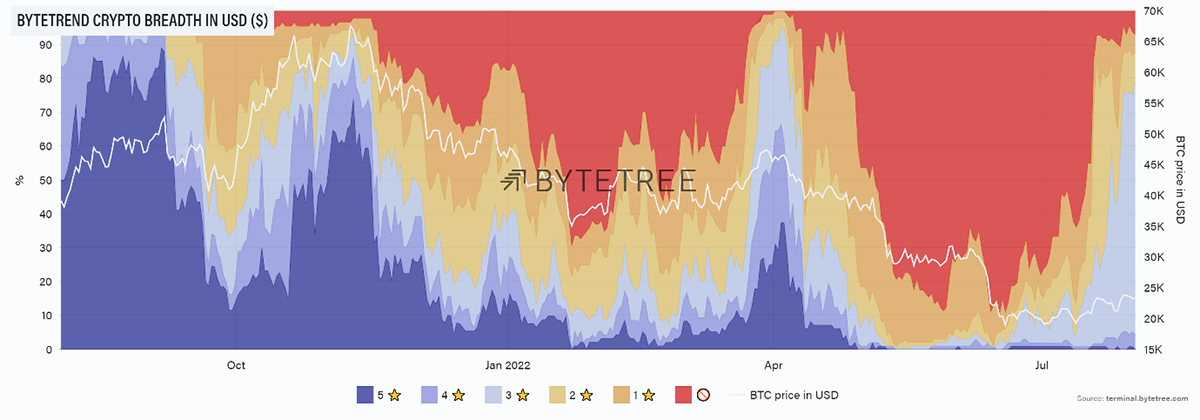

Looking at the broader space, the red skies have retreated which means few tokens are in strong downtrends. Yet with little blue, few are rising strongly in dollar terms either. The message is continued consolidation in the crypto market.

Source: ByteTree. ByteTrend scores for the top 100 crypto tokens, viewed in USD, with the BTC price (in USD) in white.

The ByteFolio model is approximately 70% invested with 30% in BTC. The aim here is to identify and lock onto the best projects we can find. It must presumably be a much better time to be embracing this now than earlier this year.

We have a simple objective which is to lock onto future winners.

On-chain

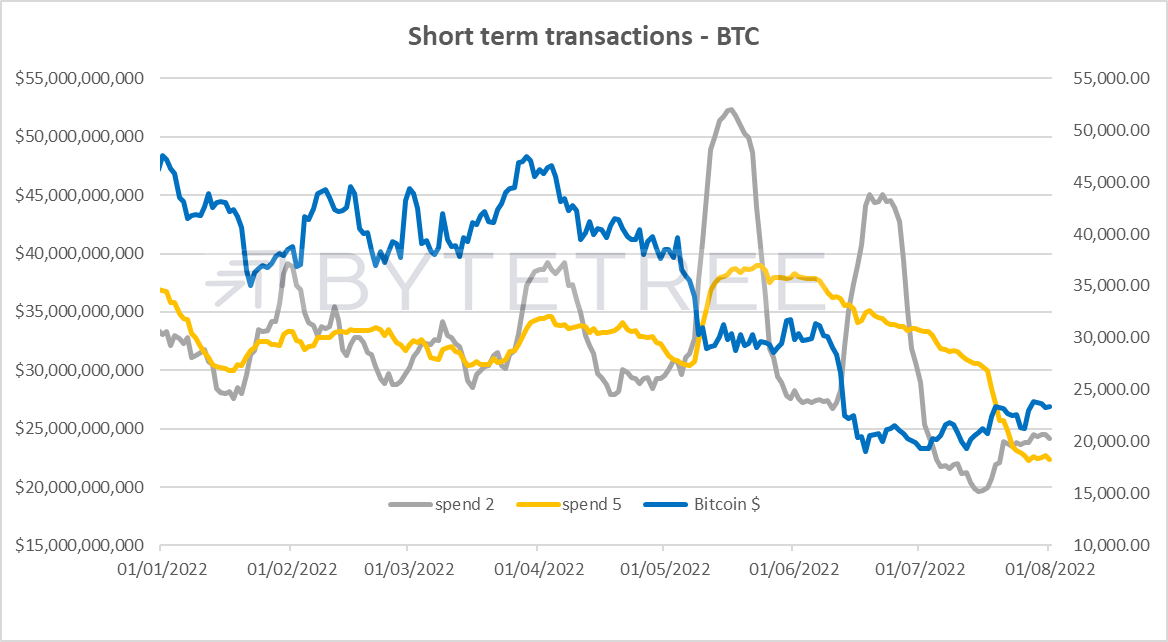

On-chain activity tells a story of resilience rather than exuberance. The Network Demand Model remains at 3/6 with no changes from last week - short term transactions, velocity and MRI remain on, while long-term transactions and the two fee indicators remain off.

The amount of value transacted over the Bitcoin Network will be a key indicator of whether prices have truly hit the bottom. As it stands the indications are decent. The high levels of volume seen in the May and June capitulations have now come out of the 2- and 5-week numbers, with on-chain weekly transaction value sitting in the US$23-25bn range. The hope is that it stays here, but also worth noting that unless there is a renewed spike in activity it is unlikely that the price explodes to the upside, and we should expect a period of range-trading.

Source: ByteTree Asset Management

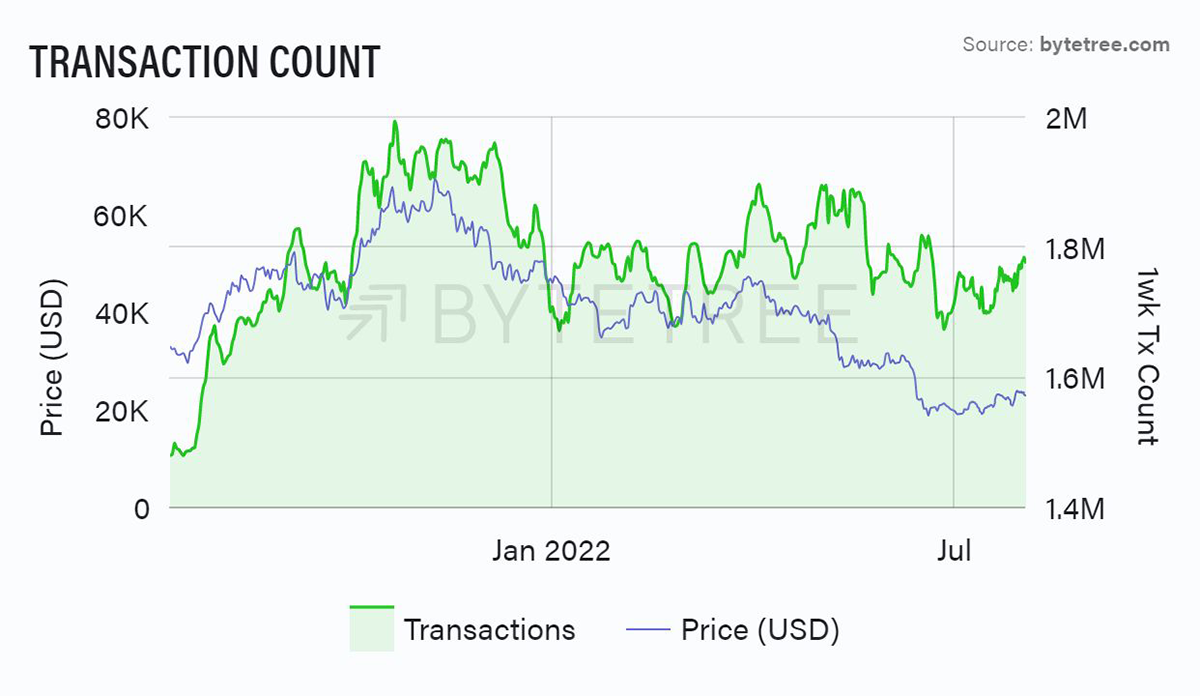

A source of better news comes from the number of transactions, which have been ticking higher since the end of June. While there’s no intuitive reason why the number (as opposed to the value) of transactions should correlate with price, it has often been the case. It’s a good sign of network utilisation, nonetheless, and that can only be a positive in terms of its intended use case. Perhaps it’s also a sign of reduced institutional dominance and greater retail involvement, which for the purists is a good thing.

Source: ByteTree

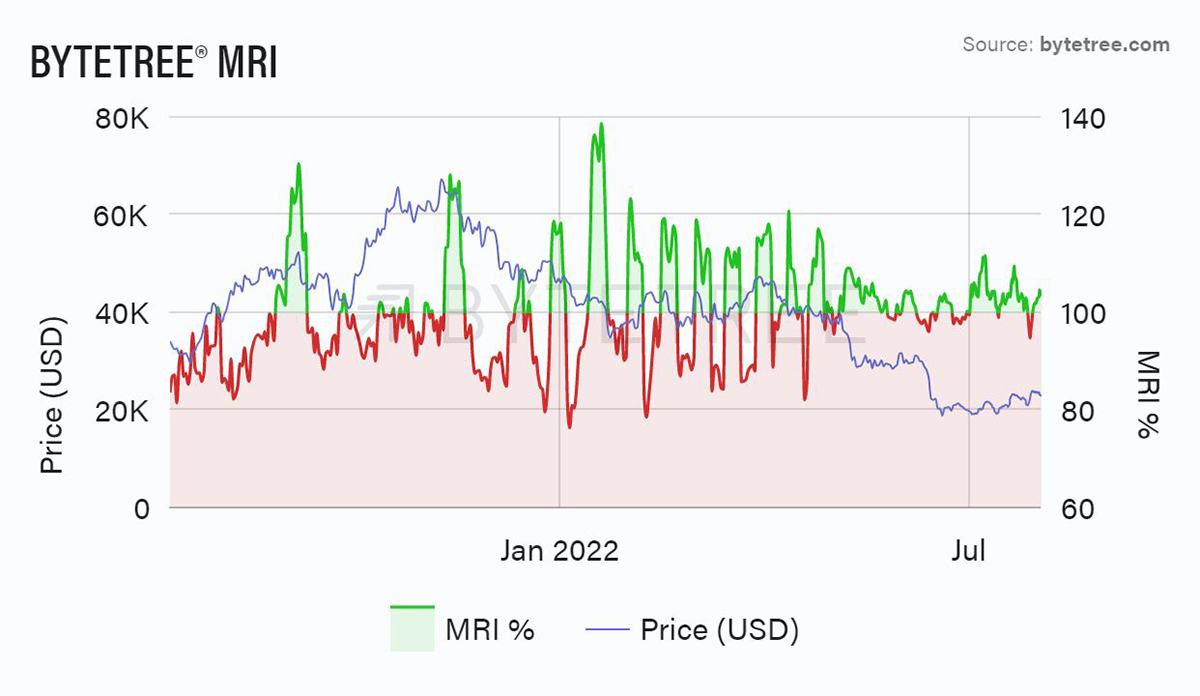

While there’s been a lot of fretting about miner stress and forced selling, it doesn’t show in the on-chain data. The reality is that the miners did a pretty good job of unloading at higher levels, with a lot of selling activity (shown by the green spikes, below) in the first 4 months of the year when the price was trading around the US$40,000 level. Selling activity has recently been more subdued. With 4 drops in “difficulty” since May, costs are coming down and inefficient miners will be taking a break.

Source: ByteTree

Macro

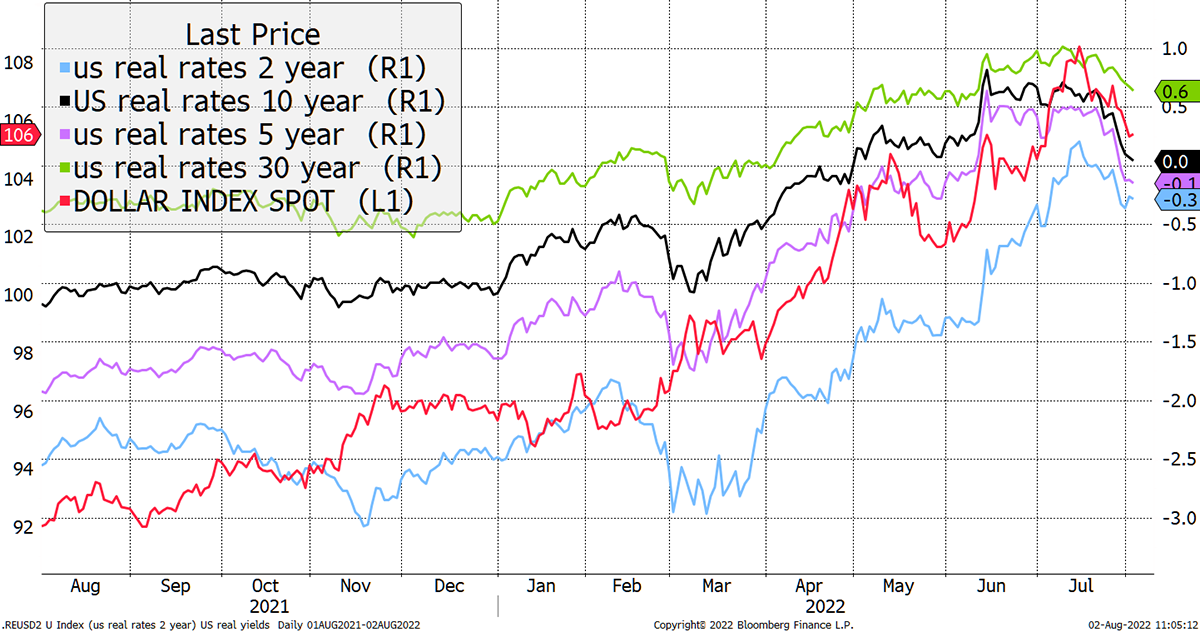

The latest Federal Reserve meeting gave the impression that the worst of the hikes were behind us. True or not, that is what the market chose to hear. We have seen bond yields fall, as fewer hikes are expected, and that has seen inflation expectations jump slightly.

Inflation is not dead yet

Source: Bloomberg

This is hardly a notable signal that will be remembered, but has been enough to reduce real interest rates which has seen the dollar fall. A softer dollar is a welcome development for risky asset prices in general.

Real rates fall - and soften the dollar

Source: Bloomberg

This is a relationship we can be fairly sure of. The chart shows the dollar inverted. There has never been a period of dollar weakness that hasn’t worked out well for bitcoin. If the Fed bottles it, and hikes less than they should, the good times for bitcoin will return.

Bitcoin likes a weak dollar

Source: Bloomberg

Investment Flows

August 1st has seen some rebalancing in bitcoin fund holdings, with around US$74m coming out on the first day of the month. This has undone all the hard work in July, when we saw steady gains, but is still comfortably the low on 20th June. The lumpy nature of these moves (a large chunk comes from the Purpose ETF) suggest institutional rather than retail selling, although that’s conjecture.

It also helps explain the weak start to the month.

Source: ByteTree

Ethereum, by contrast, saw no such adjustment. Flows have held up strongly through July.

Source: ByteTree

Cryptonomy

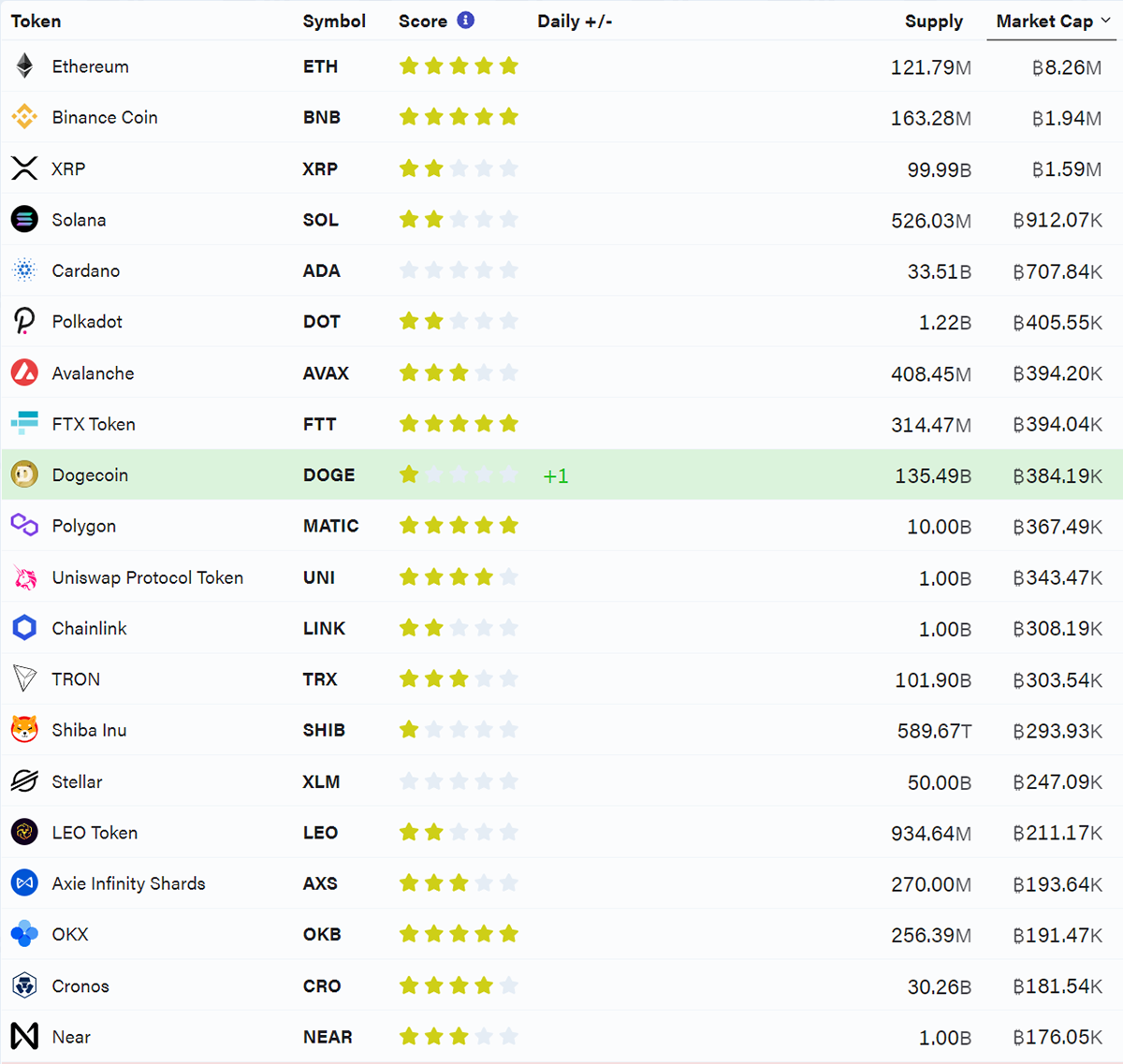

This week a quick glance at how the top coins and tokens have been performing relative to bitcoin. In the table below we show the ByteTrend scores of the top 20 coins measured relative to Bitcoin. Remember, this is a powerful method of showing trend strength within an asset class. What is clear is that we’re seeing strong dispersion.

First, the Ethereum ecosystem is strong. Both ETH and MATIC show 5 stars. The leader is being favoured and the pretenders, Solana, Polkadot, Avalanche, Cardano (zero!) and Near, are lagging.

Second, the market is favouring solid, identifiable, profitable business cases. Note how all the exchanges are strong: Binance, FTX, Uniswap and OKX are all on either 4 or 5 stars.

Lastly, you can see that the uber-speculative coins are being shunned. Dogecoin and Shiba Inu sit on 1 star each. This is no time for mindless speculation.

This is a good sign that the market is orderly and is sorting the sheep from the goats. We’ll keep you posted with further trend developments as they emerge.

Source: ByteTree

Summary

Bitcoin has work to do. The chain is stable, but it must rebuild trust with investors and demonstrate how it is ready to deliver in an era of stagflation.

Comments ()