Not China Again

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 61

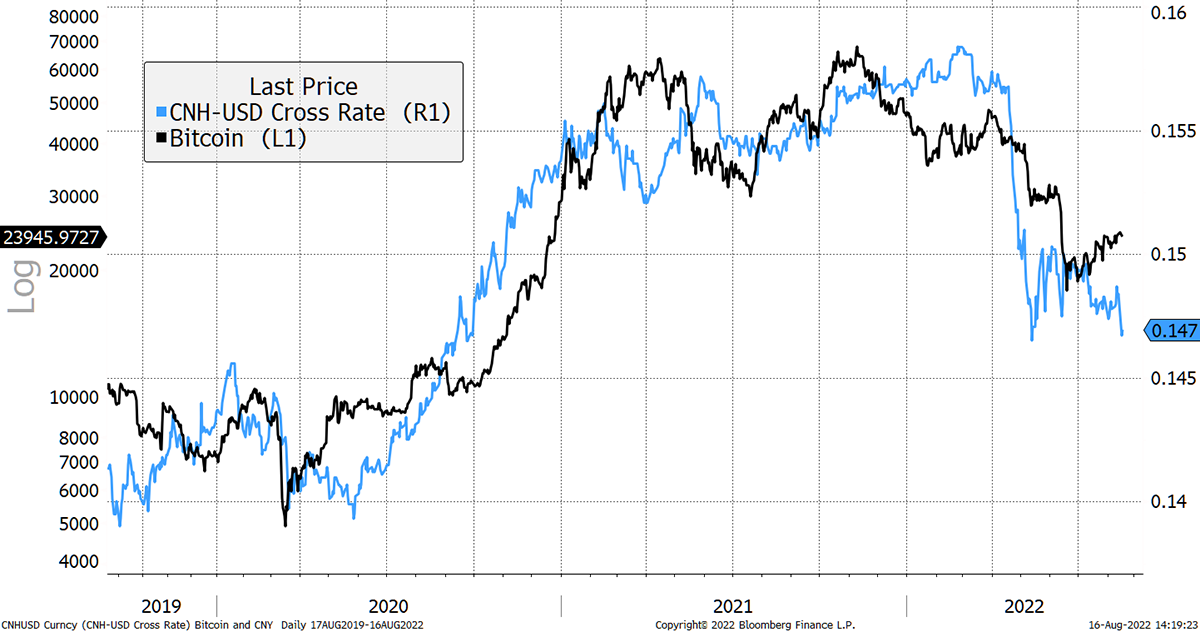

The relationship between the Chinese Renminbi and bitcoin has been striking over the years. There is no doubt you’d rather be long bitcoin when the CNY is rising than falling - 2022 in particular.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | A view from above |

| On-chain | Miners are selling |

| Macro | China’s Renminbi falls |

| Cryptonomy | Tornado warning |

Technical

Charlie Morris

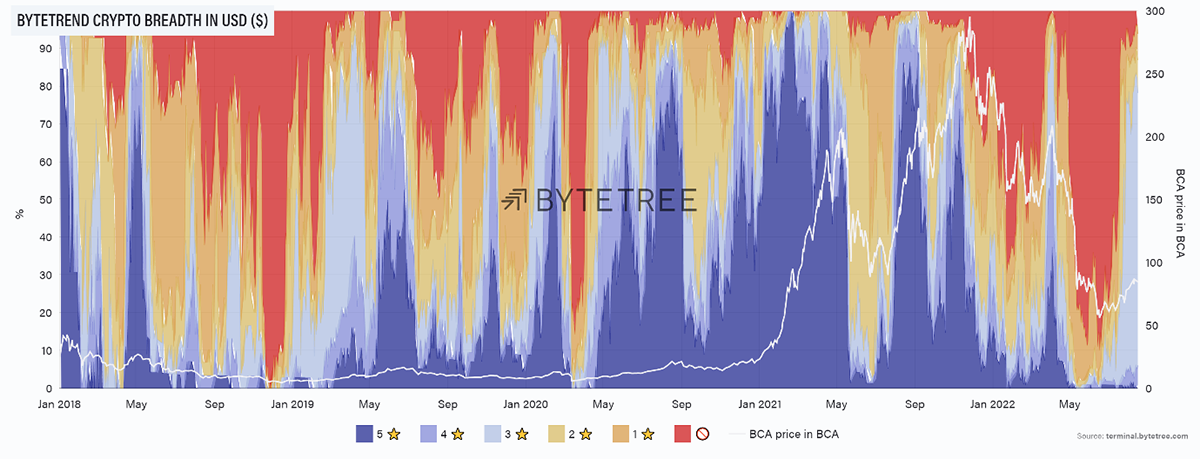

Having been bearish, the crypto space has neutralised but is a long way from overblown. The breadth chart shows crypto in USD. Overlaid is the ByteTree Crypto Average (BCA), which gives an idea of the journey of a hypothetical “average” token. Naturally, the likes of bitcoin and Ethereum have fared much better.

Source: ByteTree. ByteTrend Crypto Breadth in USD and price in BCA, since January 2018.

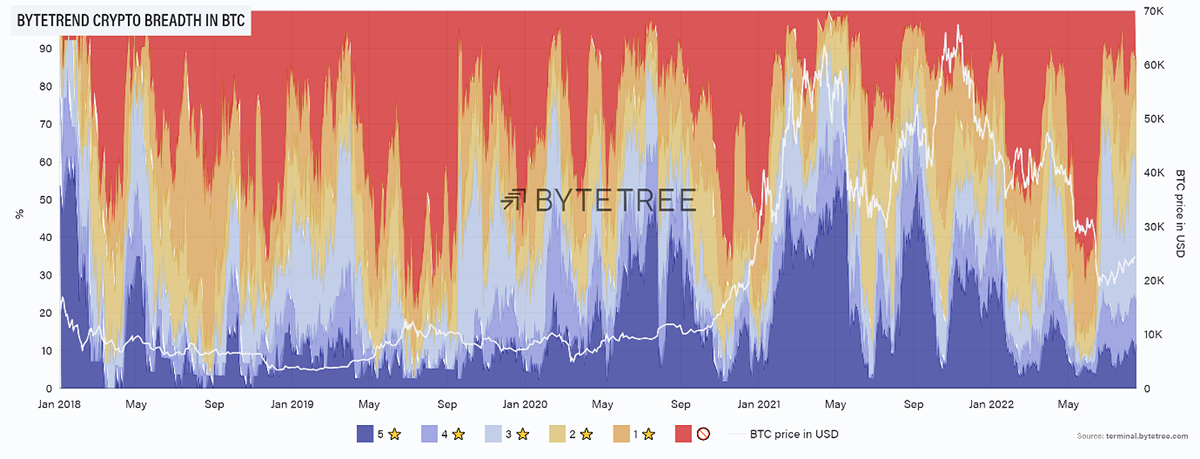

That same data in BTC shows more 4- and 5-star trends versus bitcoin and appears to be rising from low levels. That’s positive, but a higher reading would bring comfort.

Source: ByteTree. ByteTrend Crypto Breadth in BTC and BTC price in USD, since January 2018.

A reading that is too high, of course, is a contrary indicator. At least we now know that a reading above 40% in 5-star trends in BTC is a sign of excess (>40% of tokens are beating BTC). Along the same lines, we should be wary of 80% readings when measured in US dollars. We know that because those conditions don’t tend to last for long. These charts will be powerful in the next cycle.

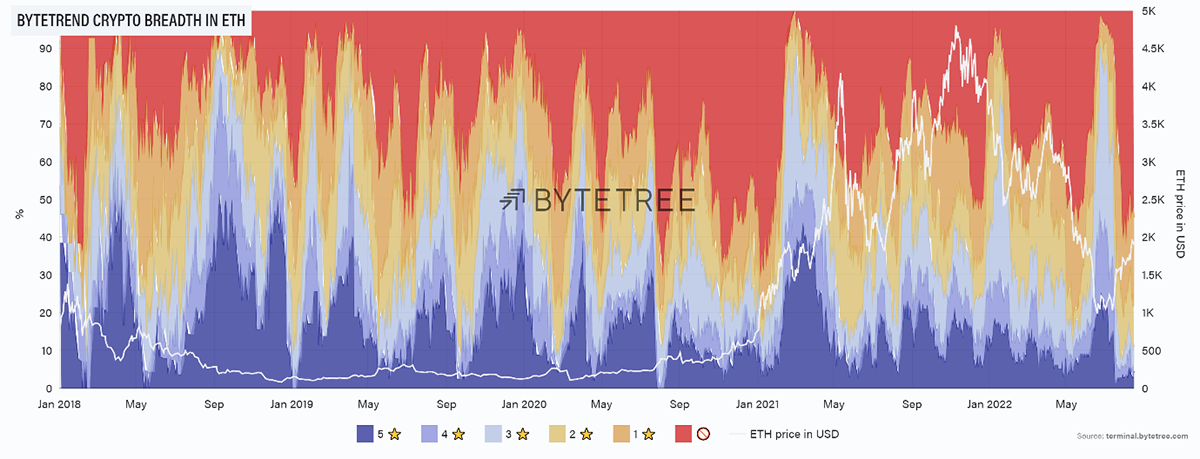

Finally, the view from ETH with ETH overlaid. There are very few 5-star trends, meaning it is currently hard to beat ETH. Moreover, there has been a surge of red over the last month, which means it’s easy for a token to be lagging ETH.

Source: ByteTree. ByteTrend Crypto Breadth in ETH and ETH price in USD, since January 2018.

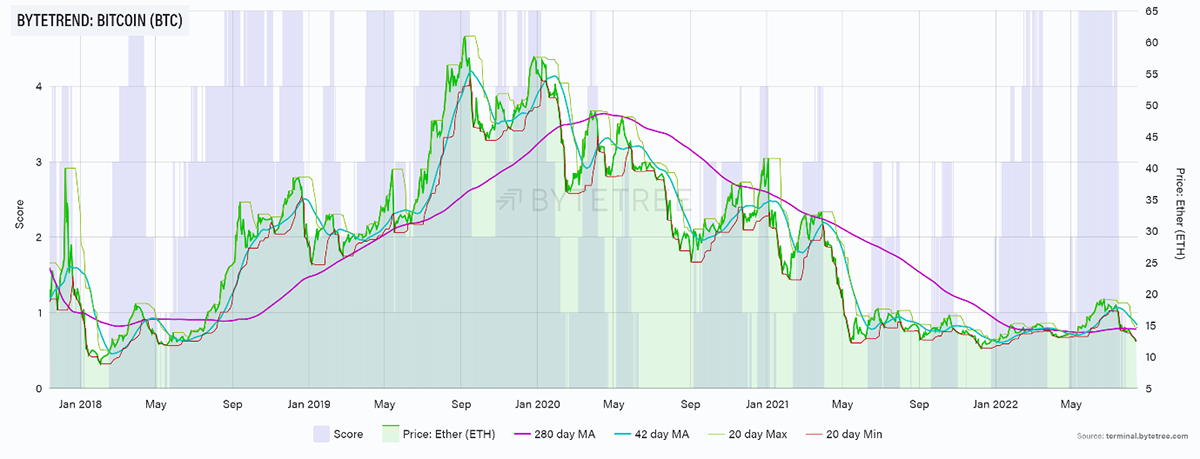

Bitcoin in ETH is one of the laggards. Bitcoin beat ETH in 2018 and 2019, only to reverse in 2020 and 2021. The move to 0-stars for BTC in ETH isn’t a panic, as it has been a regular feature over the past year, with BTC regaining ground when the market was weak.

Source: ByteTree. ByteTrend in BTC with the price measured in ETH, since January 2018.

The impending ETH merge from proof of work to proof of stake is an important moment for crypto as ETH morphs into the institutional investor’s friend. Energy consumption will be vastly reduced as ETH willingly sets off down the path toward regulation.

Aside from some macro relief, this is the centrepiece of the current rally, which has basically ignored NFTs and peripheral crypto projects. As we often see when things are bad, the focus moves to cashflow, and the ETH “business model” is seen to be a lasting cash cow, as transactional demand is structural, and fees will be earned long into the future.

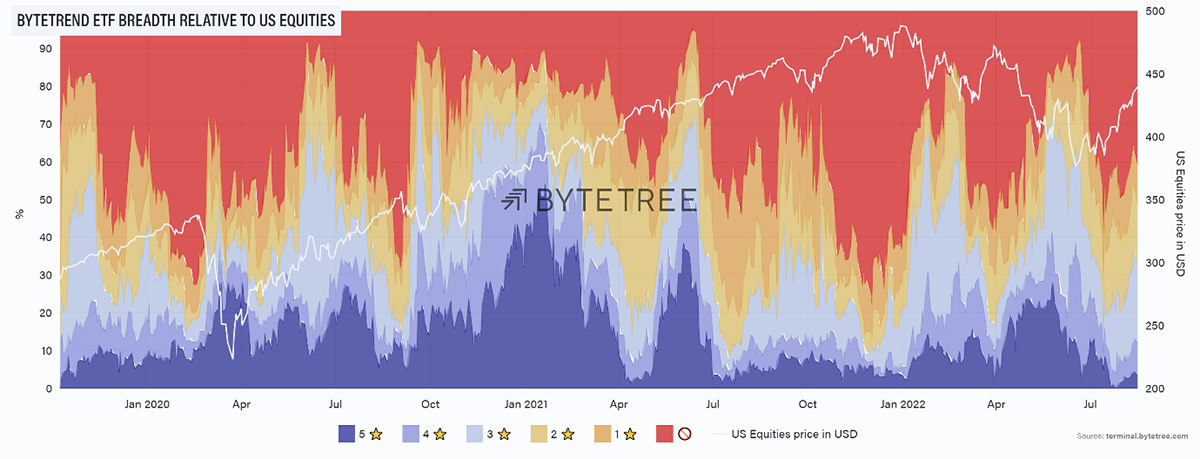

But bitcoin is still the king of crypto, and just as ETH is the leader in this market rally, so are US equities against the world. Of the 300 ETFs we track, very few are capable of beating the US market. The few winners are basically US industrials, and that outperformance is driven by defence stocks, and shorter term, a bit of tech.

Source: ByteTree. ByteTrend ETF Breadth relative to US Equities and price in USD, since October 2019.

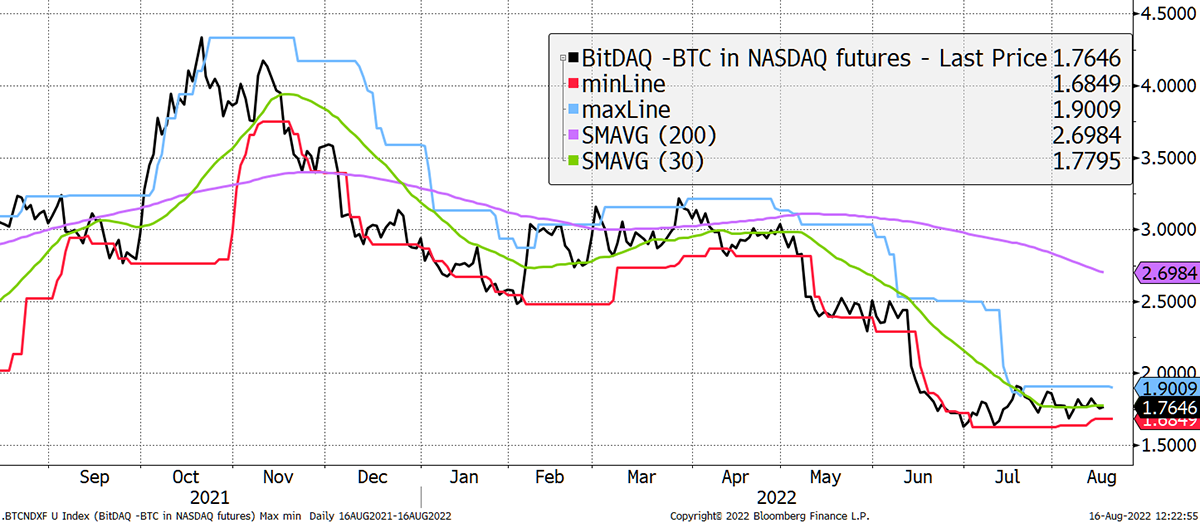

So when you look at bitcoin, which is lagging ETH, against the NASDAQ, which is marginally leading the S&P 500 in this rally, it is remarkable how bitcoin is as strong as the best of the equity trends on earth.

Yet there has been two savage down legs for bitcoin in NASDAQ over the past year, the latter of which occurred in Q2.

BitDAQ holds its ground

Source: Bloomberg

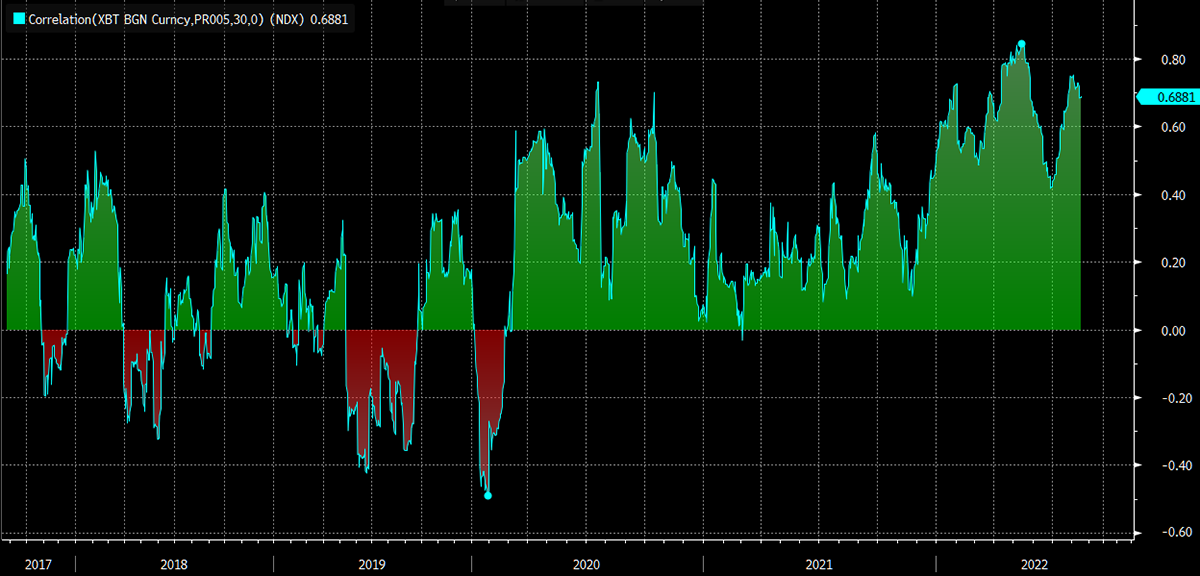

What has always been true on a year-by-year basis has recently become true on a day-by-day basis. Perhaps it is Bitcoin’s increased financialisation, as more investment products have been created, or maybe it’s just the world of post-covid funny money. But for whatever reason, the correlation with the NASDAQ has been high, especially this year.

Peak correlation for bitcoin and NASDAQ?

Source: Bloomberg

It would be a bonus if this correlation would fall, as let’s not forget that the surge in demand for bitcoin was born out of the 2018/9 era when investors believed they were getting high returns that differed from the rest of their portfolio.

I believe the correlation will fall because these things come and go, but I doubt we see it until the post-pandemic boom-bust cycle is truly behind us.

On-chain

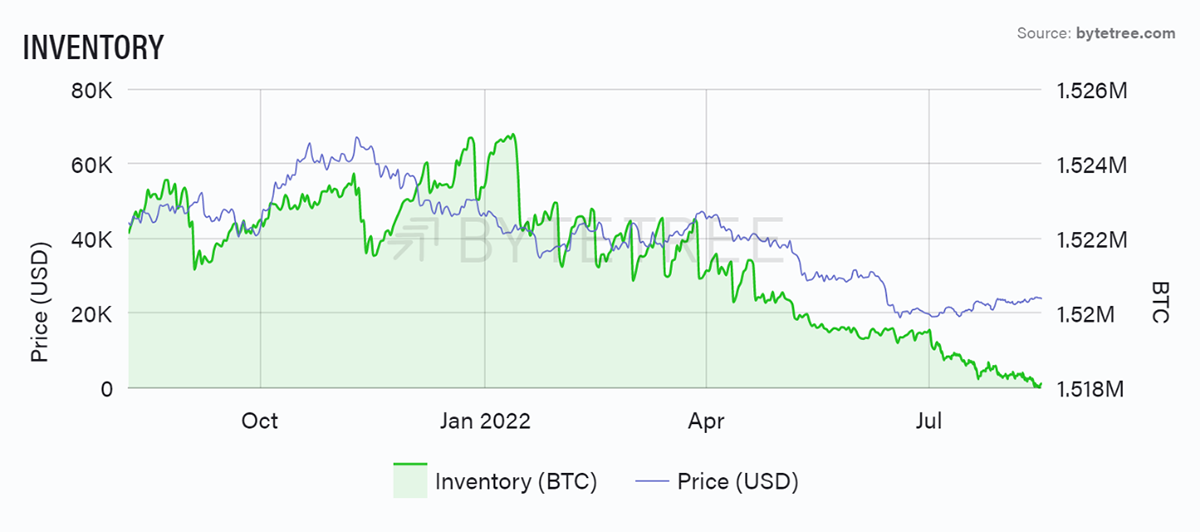

The on-chain charts are neutral this week, but this stands out as the miners have been selling into this recovery as they dump their inventory. Price has held in the face of this, and there are two interpretations.

Source: ByteTree. Bitcoin miner inventory and BTC price in USD, over the past year.

The first is bullish as price is holding in the face of selling pressure. That means the market must be strong, which is the ByteTree core view.

However, this year, it clearly hasn’t been true, as falling inventory has coexisted with a falling price. That could be coincidental because 10 years of data agree with option 1, despite it being counterintuitive.

But it is telling us that the miners want out.

Macro

The Chinese Renminbi (CNY) is on the move again, making a 20-day new low. This is unquestionably a reaffirmed 0-star trend that looks ready to move again following a period of consolidation.

Renminbi falls

Source: Bloomberg

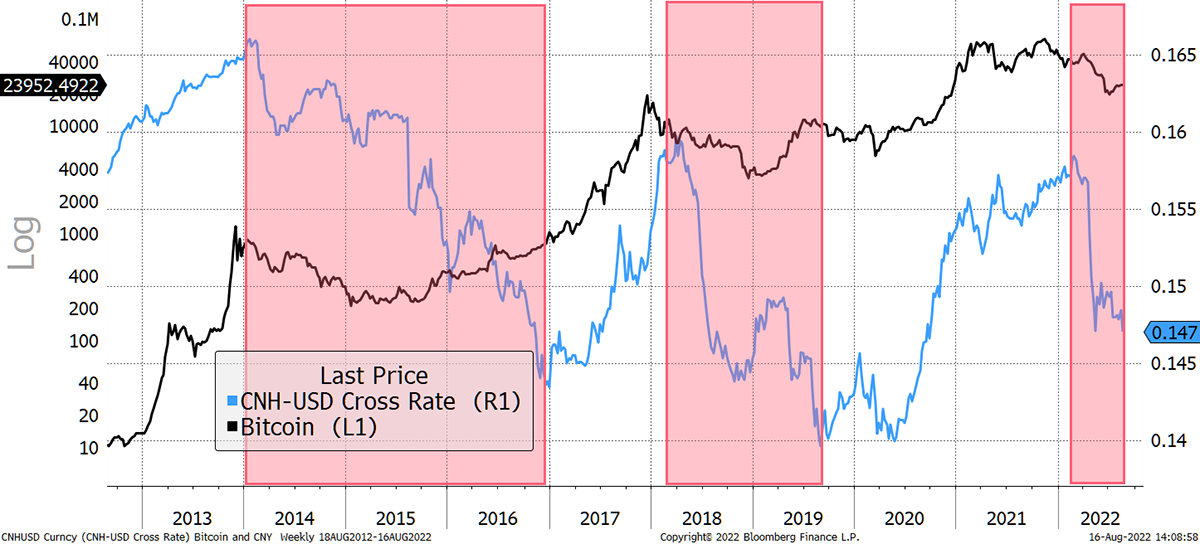

The relationship between the Chinese Renminbi and bitcoin has been striking over the years. In red, I highlight the bear markets for the Chinese currency with bitcoin overlaid. There is no doubt you’d rather be long bitcoin when the CNY is rising than falling – 2022 in particular.

Avoid Renminbi bears

Source: Bloomberg

Perhaps you could turn the CNY bear on its head and call it a dollar bull. You could, but the fit is so much more convincing when shown against CNY, as you can see.

A remarkable fit

Source: Bloomberg

Cryptonomy - Tornado Warning

Laura Johansson

It’s a continuous battle between financial privacy for users and government control. This is one of the reasons that made Bitcoin attractive in the early days, and in some ways still does. As the coders built methods to trace bitcoin transactions, protocols like Monerogained traction because they offered more privacy. Then, as the crypto space expanded further, we had the introduction of coin mixers, which, up until last week, had remained largely under the regulatory radar.

On Monday 8 August, the news broke that the US Treasury had blacklisted Tornado Cash, a mixing-service for Ethereum. Practically, this means that all US citizens and entities are now banned from using Tornado Cash or any wallet addresses connected with the service. The reasoning behind the ban cited Tornado Cash as the go-to mixer for cybercriminals, specifically the North Korean hacking group, the Lazarus Group, which was behind the $625 million hack on Axie Infinity’s Ronin Network in March this year.

Labelling Tornado Cash as the “go-to mixer” for criminals is an over-generalisation. Elliptic, a blockchain analytics firm, has identifiedthat $1.54 billion of the total $7bn transacted through the mixer had ties to criminal activity. That means roughly 78% of the Tornado Cash transactions were lawful. Even Vitalik Buterin confirmedthat he had used the service to donate money to Ukraine. But rather than separating the ‘good’ from the ‘bad’, the blacklist automatically assumes all is bad, and it didn’t take long for someone to take advantage of that maliciously. Shortly after the blacklisting was announced, several high-profile Ethereum wallets were sent small transactions through Tornado Cash in a so-called dust attack. Because crypto wallets cannot refuse incoming transactions, these wallets were inadvertently breaching the ban.

Tornado Cash aside, this situation has brought the user-privacy discussion right to the forefront. At the end of the day, crypto technology is just neutral code, which can be manipulated by user intent. Should the US Treasury sanction notable DeFi services, could we see a repeat of this situation on a much larger scale? Is this the start of an ultimatum where crypto services must choose between operating non-compliantly to maintain the core crypto principle of user privacy, or bending to government control? As we’ve already seen with the aforementioned dust attacks, practically it’s not so simple to enforce. What’s more, Tornado Cash is an open-source project, meaning the code is out there for anyone to replicate should they want to.

Over the past 14 years, crypto has taken a life force of its own. It’s all out in the open, and while sanctions may slow progress, crypto is here to stay. What has unfolded over the past week is by no means the end of the discussion. If anything, it serves as a warning of what’s to come.

Summary

August is always full of surprises. A good outcome in the near term would be falling correlations and continued consolidation. A bad outcome would see a return of macro instability, and that is why I highlighted the CNY.