The Macro Test - Can Crypto Decouple?

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 58

Macro remains the big uncertainty for crypto markets. At a fundamental level, activity is solid.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | ETH bounces back |

| On-chain | Signs of a bottom |

| Investment Flows | Solid and unwavering |

| Macro | Uncertainty across the board |

| Cryptonomy | Business as usual |

Technicals

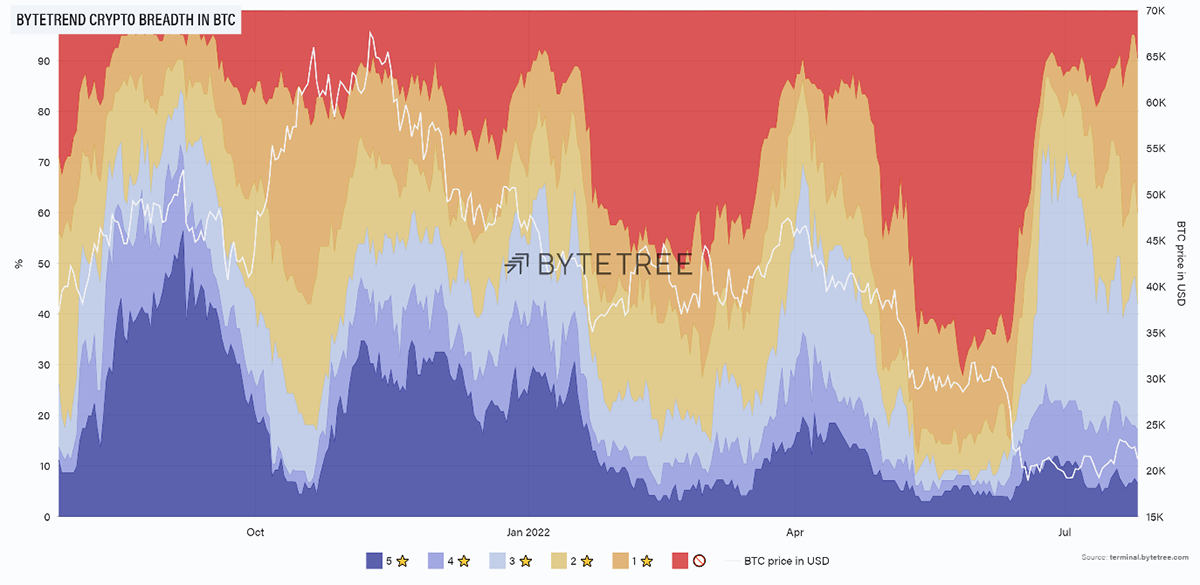

Breadth in the crypto world has been better in BTC terms but worse in ETH. This tells us firstly that altcoins have had a bounce (which leaves behind the more defensive BTC) and, more importantly, that ETH is resurgent and leading the way.

Lots of stars in the BTC breadth chart shows that the internals of the crypto space have improved markedly. The white line is the BTC price.

Source: ByteTree. ByteTrend scores for the top 100 crypto tokens, viewed in BTC, with the BTC price (in USD) in white.

Meanwhile, the recent emergence of a red sky when looking at the space relative to ETH shows us that ETH has been strong. At the bottom of the market, investors tend to be much more selective, so trend strength at this juncture should be revealing. The narrative around ETH’s move to Proof of Stake has recently become much more confident, with a date set for 18 September for the “Merge” to take place. Successful execution of this incredibly complex shift will be a huge positive.

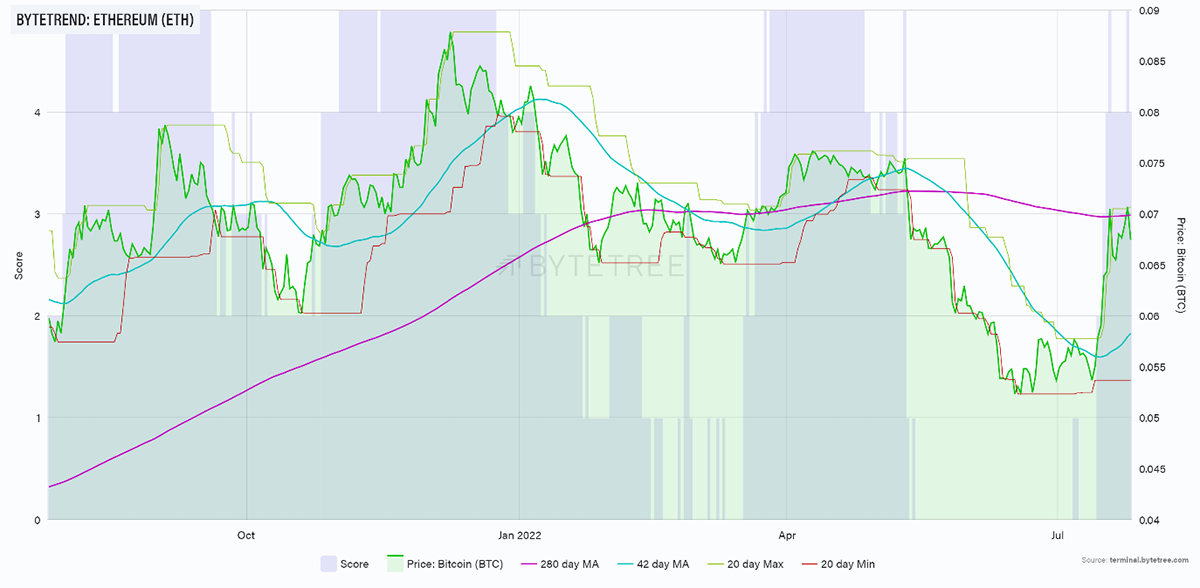

We can see this in ETH’s performance relative to BTC, shown below, which is on 4 stars out of 5. There appears to be resistance at current levels but watch for a break above on ByteTrend to see whether the trend is alive and well.

Source: ByteTree. ByteTrend for ETH, measured in BTC, over the past year.

On-chain

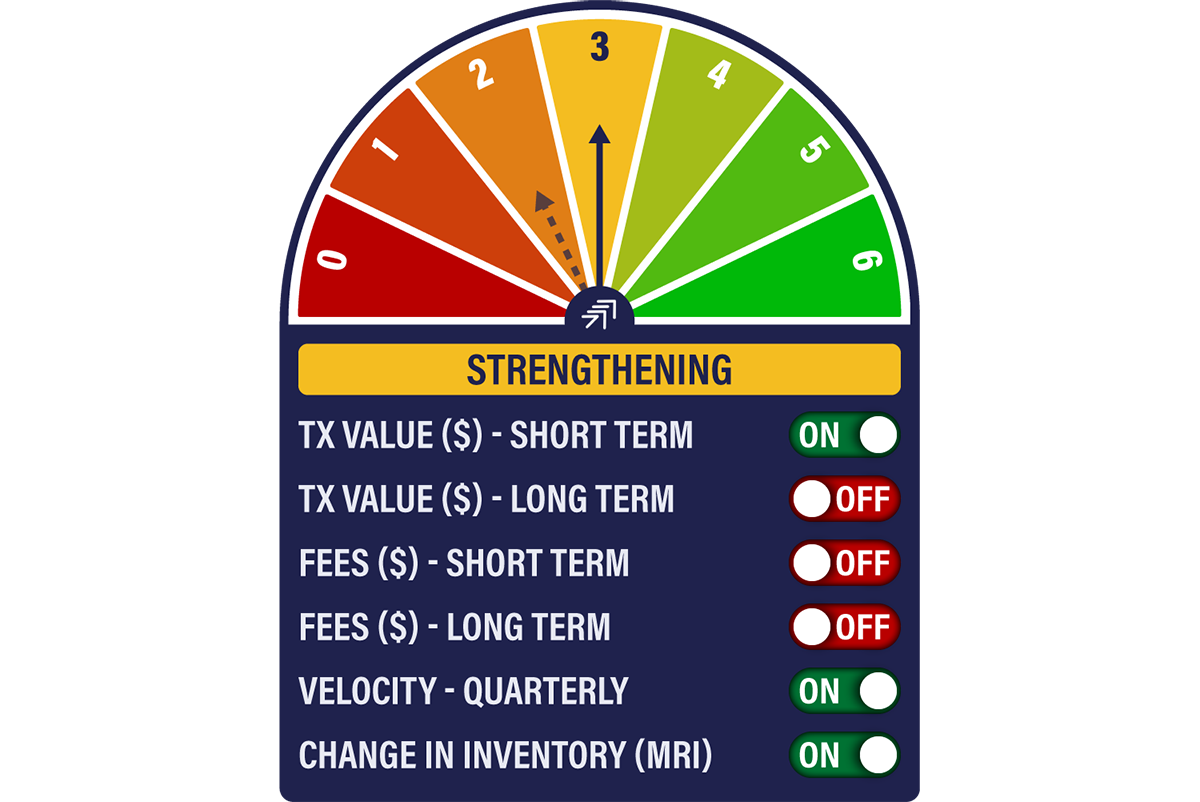

The Network Demand Model has shifted up from 2 to 3/6 this week as the short-term transactions indicator turns on again.

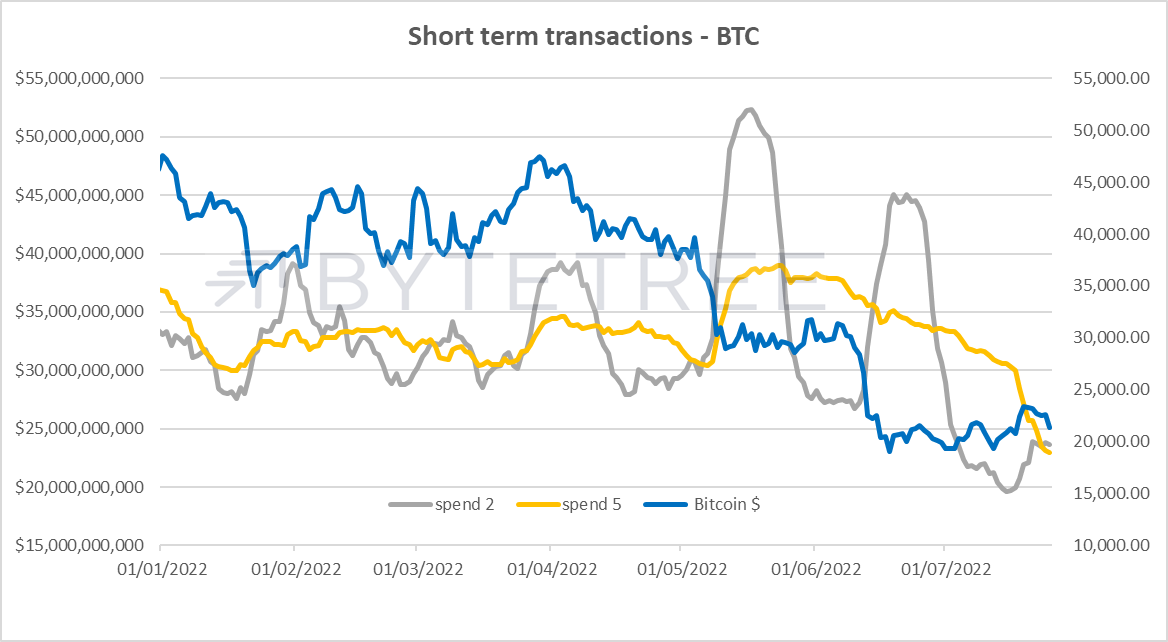

This is a healthy development, reflecting a steadying out in network activity as the recent capitulation surges come out of the numbers. That said, the longer-term trends continue to point south (consistent with the price fall), so we need these levels to hold for confirmation that we are at the bottom.

Source: ByteTree

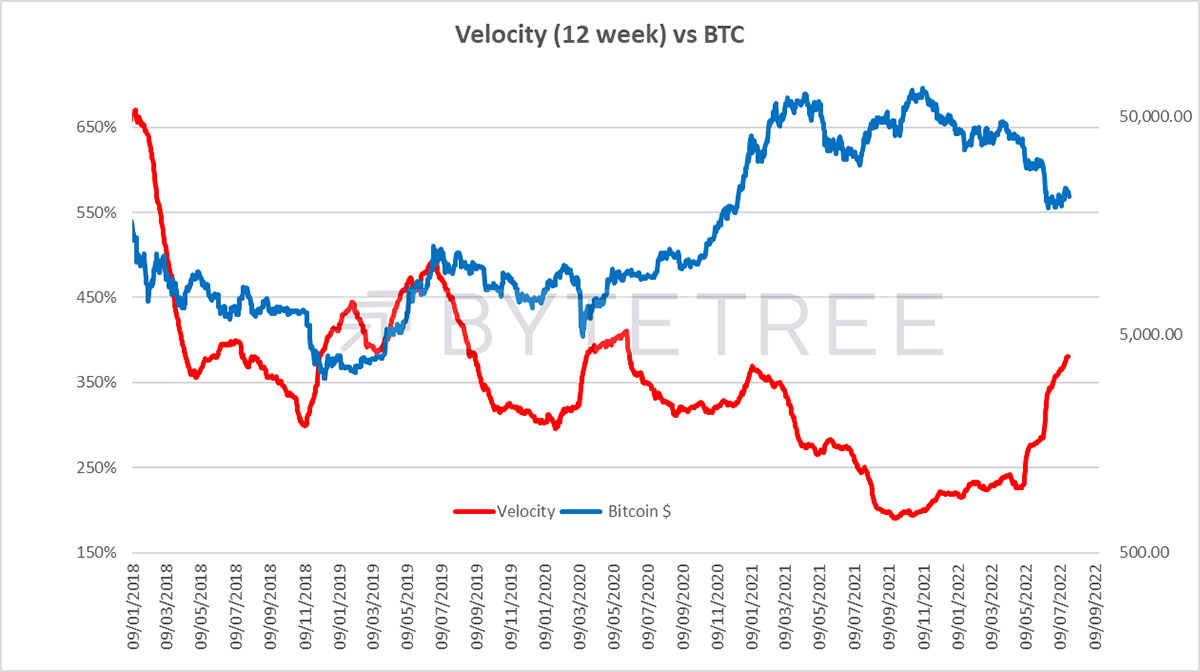

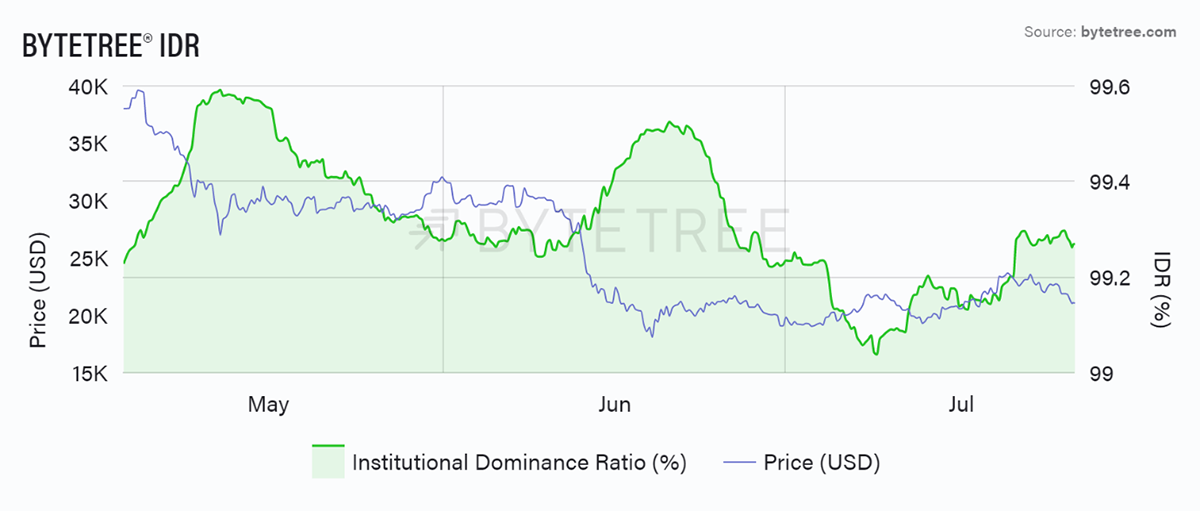

The on-chain data point to some powerful accumulation at these levels, although the low level of fees and a rising Institutional Dominance Ratio (IDR, see below) suggest these are large hands rather than mass-market retail. The velocity of coins remains high, implying a change of guard, while it’s also heartening to see continued absorption of miner inventory into the market. It’s not always the case, but spiking velocity has frequently been a good indicator of turning points.

Source: ByteTree

Source: ByteTree. Institutional Dominance Ratio (%) and the bitcoin price (USD) over the past 12 weeks.

Macro

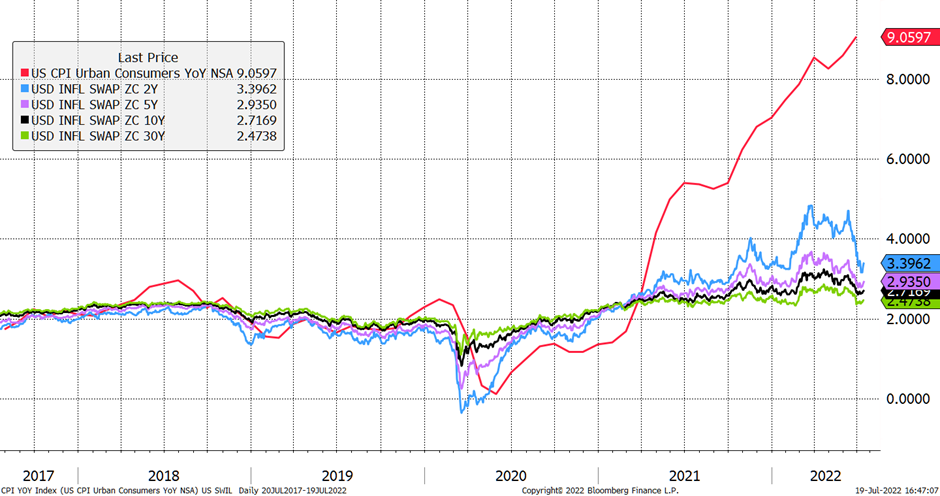

It’s a nervous week, with corporate results in full flow and an imminent FOMC meeting, hot on the heels of a 9.1% June CPI print in the USA. Commodities have rallied, and there has been little let up in US$ strength. Markets are wracked with uncertainty, and fears of recession dominate.

Distortions in economic activity are evident across the board. Walmart produced a second consecutive profit warning, showing that consumers are focussing on needs not wants, labour costs are increasing, and surplus inventory is being discounted to clear. Numbers from tech giants Alphabet, Apple, Tesla and Meta will set the scene for appetite for risk as we head through the third quarter. It will be hugely instructive to see how closely crypto tracks tech over the course of the next couple of months, as so far, we haven’t seen any signs of decoupling.

Meanwhile, the bond market continues to signal that inflationary pressures are transitory. This comes in the teeth of evidence to the contrary, whether it be the CPI data (see below) or the recent surge in Natural Gas prices, which doesn’t bode well for the European winter.

Source: Bloomberg

Source: IG

Central banks have an unenviable task. Growth is slowing, yet the leading indicators of inflation refuse to lie down.

Having been through a massive correction already, crypto must hope that its long-term aspirations as a new technology begin to assert themselves and price performance is driven by the growth outlook rather than macro. The other positive catalyst would be a change in emphasis from policymakers and a relaxation in tightening rhetoric. We wait and see.

Investment Flows

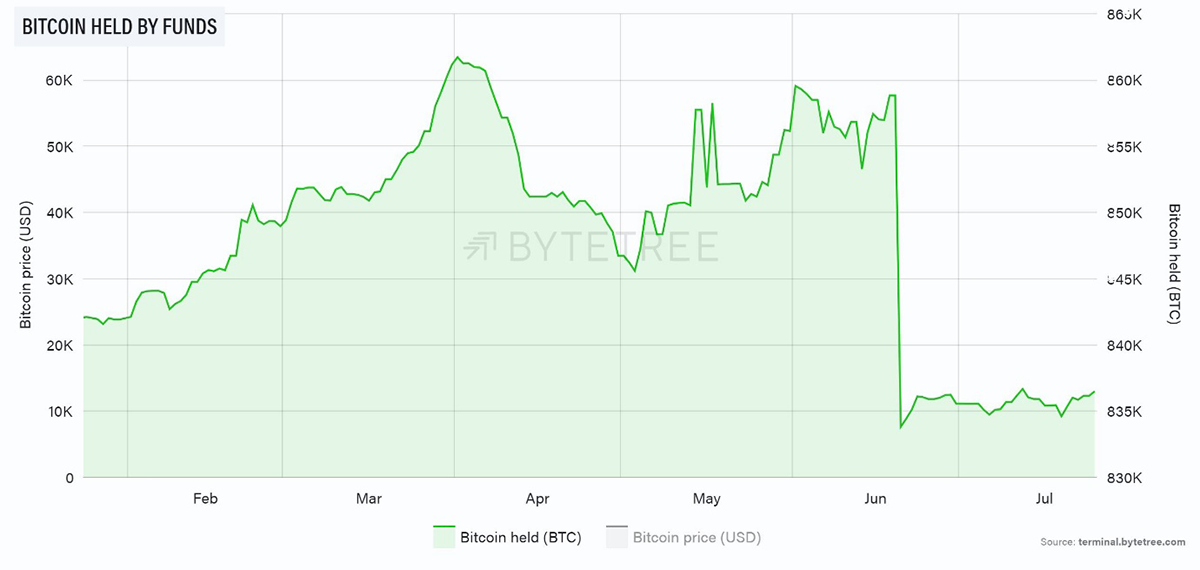

Bitcoin flows continue to hold up well, with gradual accumulation being seen since late June.

Source: ByteTree. BTC held by ETFs for the past six months.

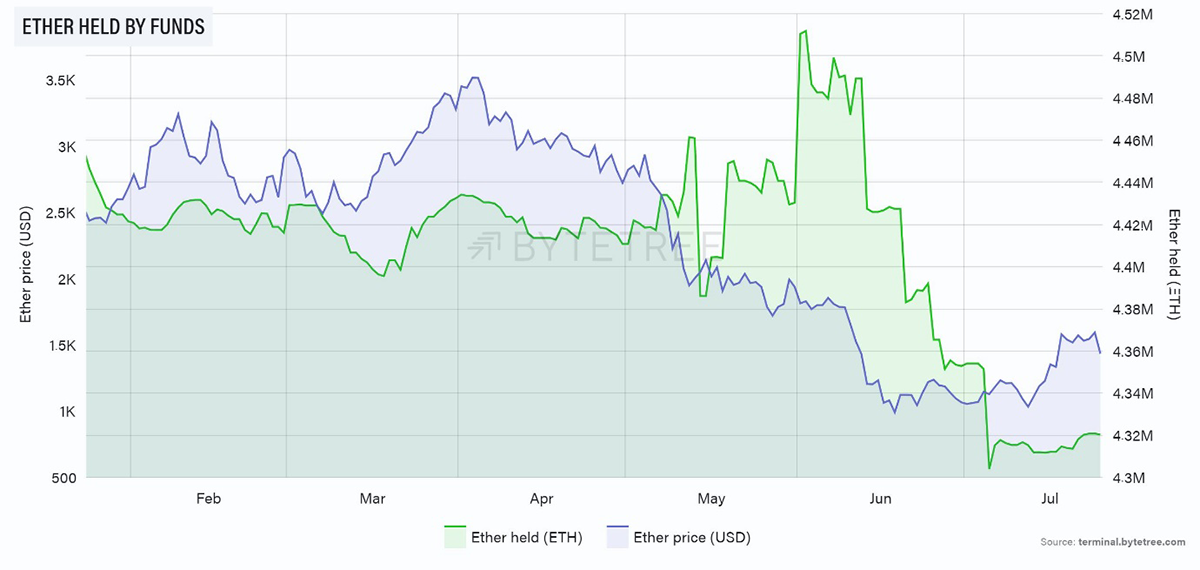

Similarly, Ethereum fund ownership has found a solid level over the past fortnight, clearly providing relief from the selling pressure of April, May and June.

Source: ByteTree. ETH held by ETFs and the price of ETH (in USD), for the past six months.

Cryptonomy: Business as usual

By: Laura Johansson

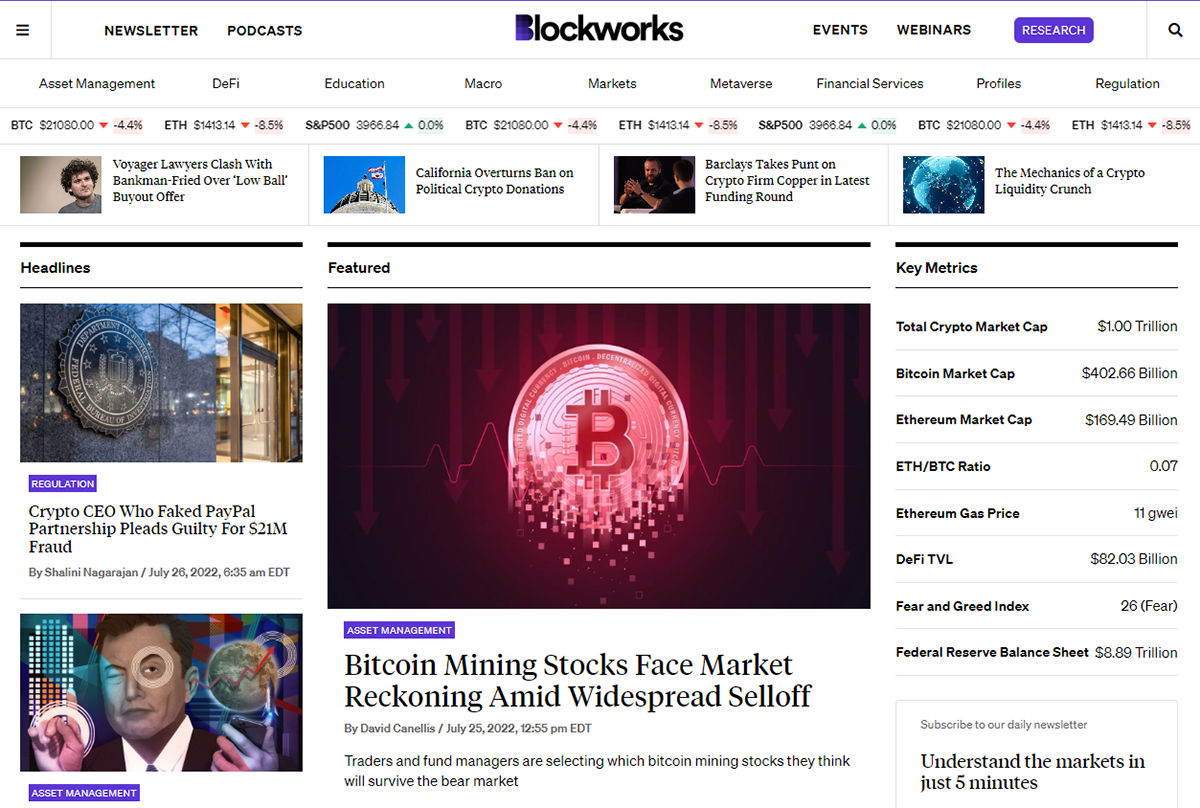

I’ve lost count of how many headlines I’ve seen stating that “Bitcoin is dead” since the price collapse in May. Unsurprisingly, most seem to derive from mainstream media companies rather than crypto-specific news sites. Saying that, this morning’s headlines on Blockworks aren’t particularly cheerful either.

Source: Blockworks. Front-page news on Tuesday 26 July 2022.

What strikes me about the above headlines though, is that they are of a macroeconomic and political nature. That is reassuring because it means that the underlying technology remains sound. The Bitcoin Network ticks on, unaware of the turmoil that is unfolding in the real world.

Some of the more positive news headlines I’ve seen over the past week related to Bitcoin adoption and business expansion in countries with emerging markets. Something of note is that the Paraguay government passed a crypto billthis month, with the hopes that the regulation will attract new business to the country. Not long after, it emerged that the Singapore-based Commons Foundation had secured a deal(on the same day as the passing of the crypto bill) for a 100 MW, 10-year power purchasing agreement to buy surplus energy derived from hydroelectric power to set up bitcoin mining farms. The project, named Golden Goose, will create 1000 new jobs (great for the local economy) and source cheap and clean electricity (great for combatting the environmental impact of Bitcoin).

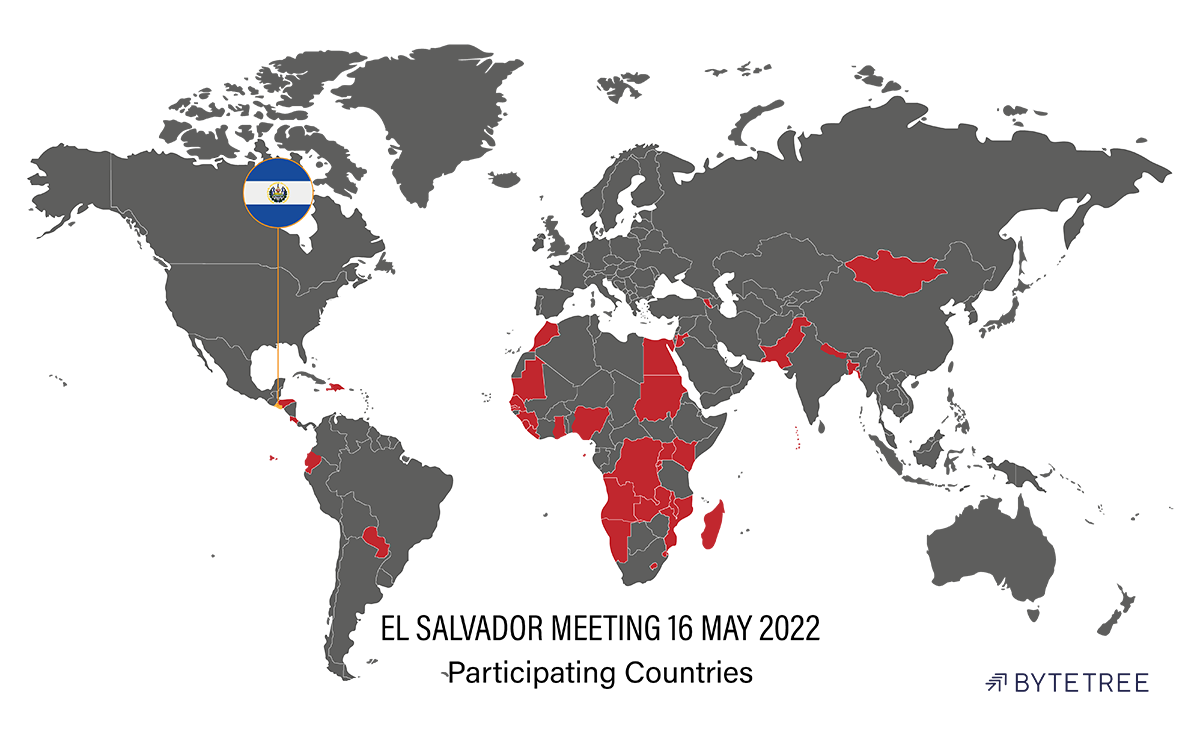

I would expect to see crypto business expansion to emerging markets become a common theme over the coming years. Representatives from Paraguay attended the notable meeting in El Salvador in mid-May this year, which otherwise had a very low attendance from nations in South America.

If the above map is anything to go by, there are another 43 nations that have at least expressed an interest in attracting business in the crypto industry. Despite what the front-page news would have you believe, it’s business as usual if you look hard enough.

Summary

Crypto fundamentals appear to be finding a bottom, with activity and ownership indicators at worst flattening out and at best seeing continued traction. Against that, the problems in the real world continue to loom large. Whether crypto can decouple over the next couple of months is a critical test.

Comments ()