Bitcoin Is Dead, Long Live Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 54

Over the weekend, many commentators were quick to write off Bitcoin. I reiterate, they should be more worried about TradFi in general rather than using crypto as a scapegoat.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Deeply oversold |

| On-chain | Velocity spikes on stressed selling |

| Investment Flows | Still hodling, despite Purpose |

| Macro | Rates around the world |

| Cryptonomy | The dominos keep falling |

Technical

By: Charlie Morris

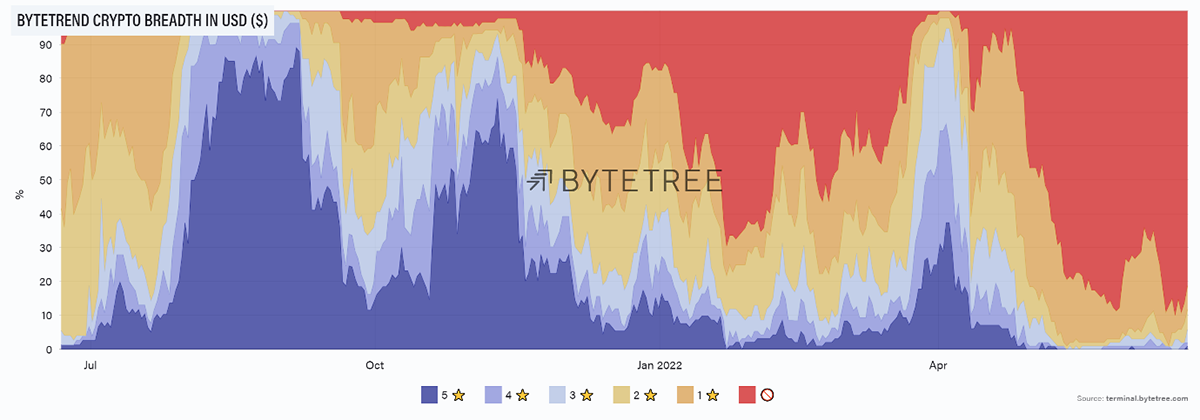

Crypto breadth in USD remains weak.

Source: ByteTree. ByteTree crypto breadth in USD over the past year.

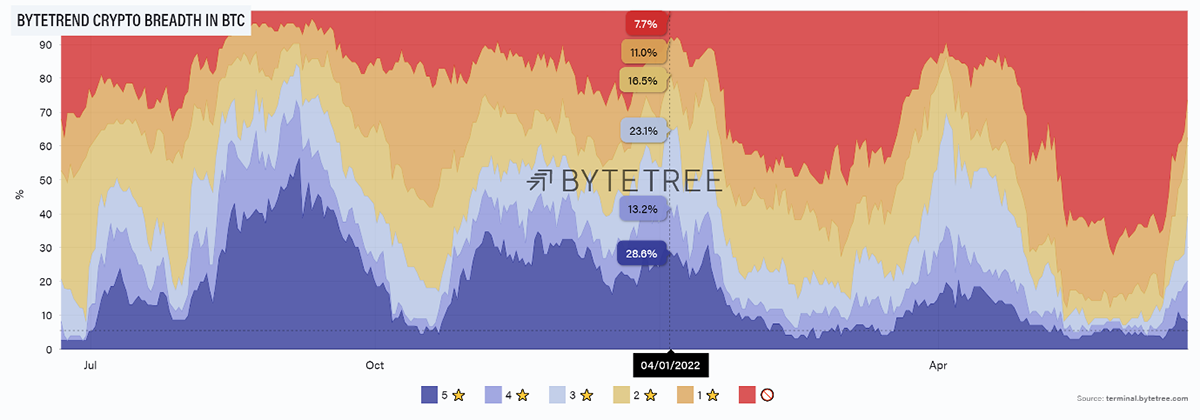

Yet in crypto terms, BTC seems to be turning the corner, as the red skies are in retreat. This reflects BTC is falling less than alts during the bear, and most alts have already done their worst.

Source: ByteTree. ByteTree crypto breadth in BTC over the past year.

Time to reload on the good stuff, and yesterday, ByteFolio added Helium (HNT), Polkadot (DOT) and Chainlink (LINK).

Assuming bitcoin is not dead, this seems to be a distressed level within an uptrend.

Bitcoin is deeply oversold (again)

Source: Bloomberg

Over the weekend, many commentators were quick to write off Bitcoin. I reiterate they should be more worried about TradFi in general rather than using crypto as a scapegoat.

On-chain

By: Charlie Erith

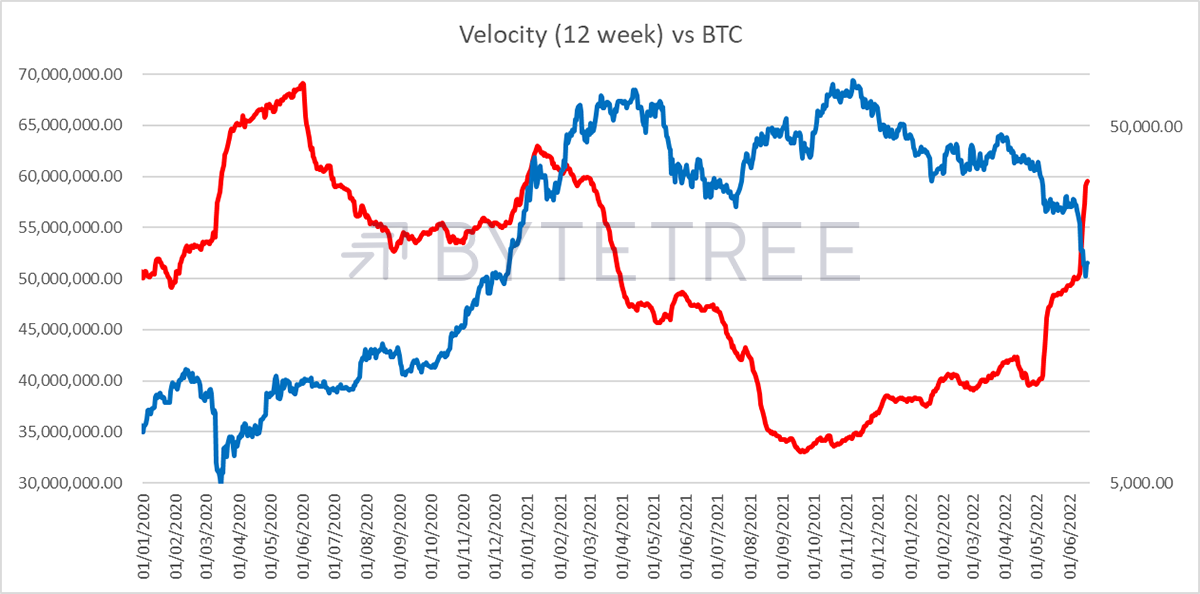

The velocity of coins around the network reveals the mood of the market. Velocity tends to be high at extremes and low during periods of calm. It has reached a level last seen in the “Musk” bounce of April 2021. Could it be that those who bought then are giving up now?

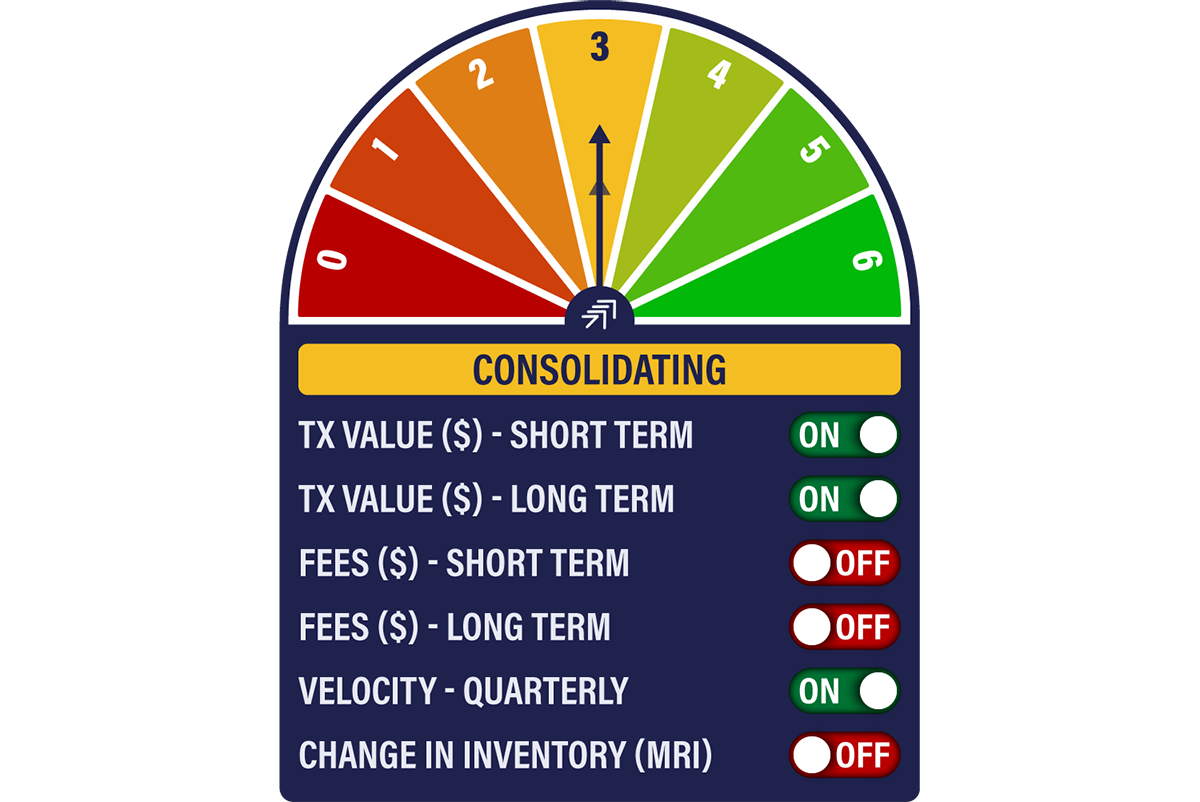

The Network Demand Model remains unchanged from last week. The bitcoin network has transferred a rising amount of value which, given the decline in bitcoin’s price, is quite an achievement. Fees are flatlining.

Velocity measures the number of coins transacted over the network. We usually look at it in relation to its own history (by looking at its deviation from a 2-year mean), but the chart below shows the actual number of coins transacted on an average 12-week basis. We note that the last time “spend” was this elevated was when Tesla announced they would accept payment in BTC, and there was a FOMO melt-up. Has FOMO been replaced by FOBI (Fear of Being In - you heard it here first)?

Source: ByteTree

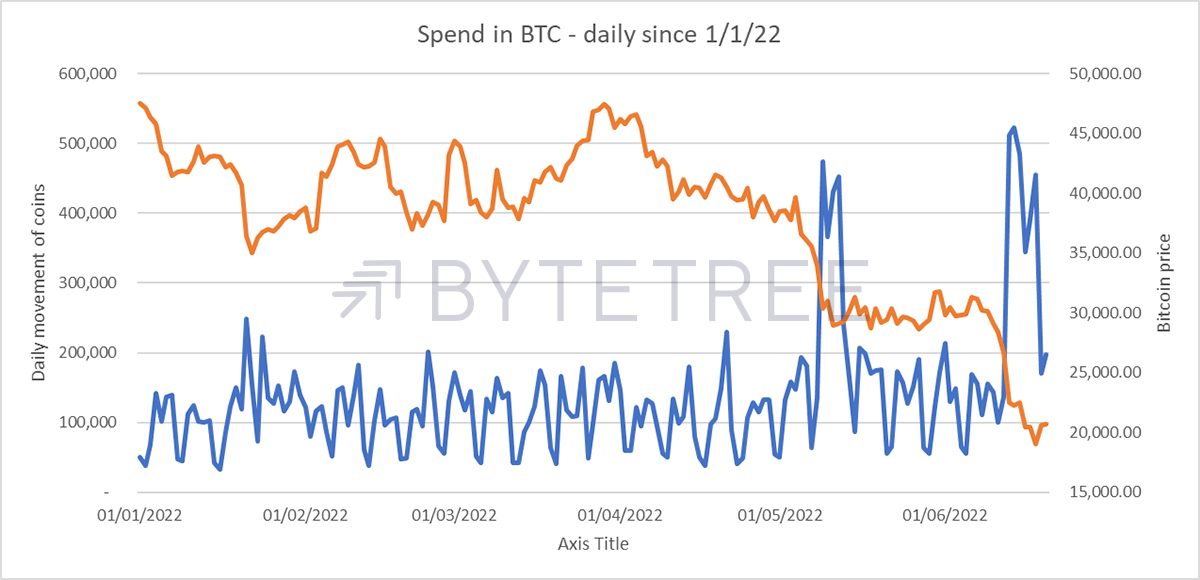

Zooming in on the chart below, you can see that recent spikes in velocity have occurred in the two sudden slumps this year. Roughly speaking, the network has been transferring around 100,000 coins per day, just over US$2bn at today’s price. These “risk-off” moments have seen this increase 4 to 5-fold, presumably reflecting forced liquidations related to the Terra LUNA collapse and, more recently, the stresses at Celsius and 3AC. A return to a steady state should allow the market to recover.

Source: ByteTree

The Network Demand Model shows no changes from last week, remaining on 3/6. The activity shown above has driven transaction values significantly higher, which is healthy. MRI is hovering in a range, and there’s no indication at all of forced selling. If miners are financially stressed, it’s not showing up in this data.

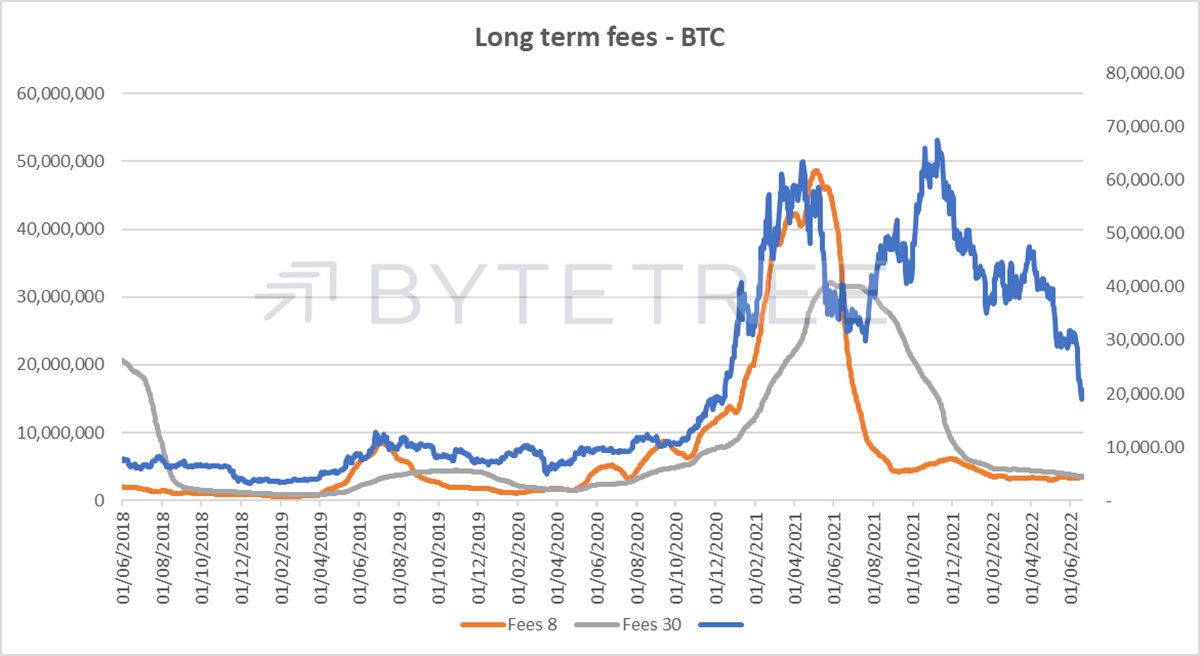

Meanwhile, fees continue to rumble along the bottom. History relates that a flattening of fees is consistent with a period of shock followed by medium-term consolidation. We’ve had the shock, roll on the consolidation.

Source: ByteTree

Investment Flows

By: Charlie Erith

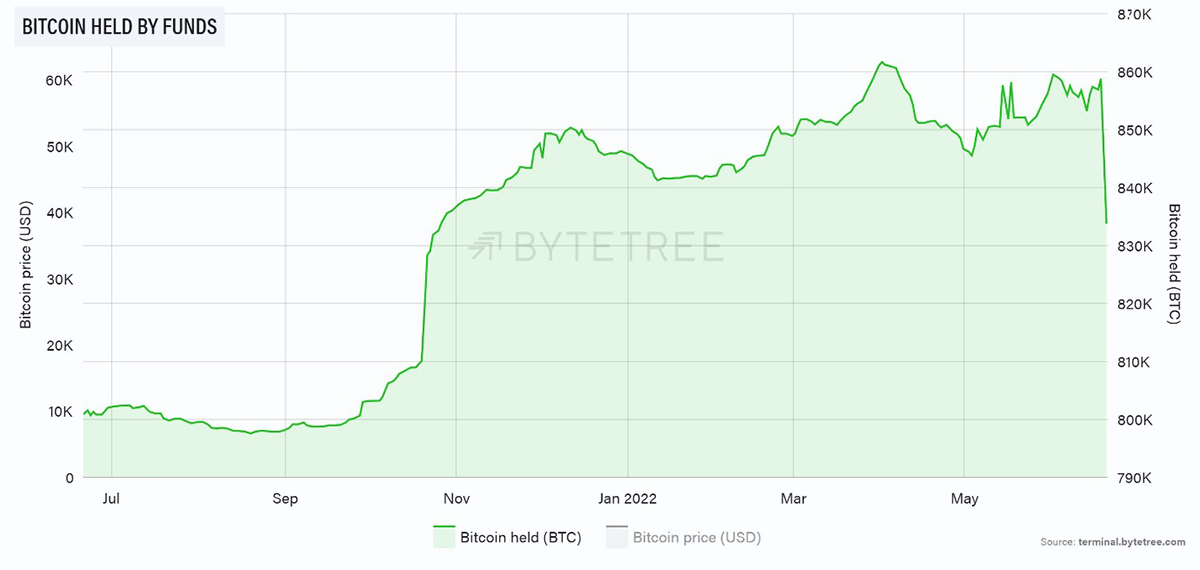

Ownership of BTC in funds has held up well in all funds except one, the Purpose Bitcoin ETF. Because it is one fund that has caused the sudden drop (see below), we’re inclined to think this is for fund-specific reasons rather than representing an overall trend. The fact that the Purpose Ether ETF has done something similar reinforces the point.

Assuming that is the case, the behaviour of overall fund flows thus far is pleasing. By not panic selling, it suggests that ETF investors (unlike various hedge funds) have sized exposure sensibly and are holding for the long term. If bitcoin can hold these levels against tough markets, expect to see confidence pick up and holdings continue to rise.

Source: ByteTree. BTC held by funds over the past year.

Macro

By: Charlie Morris

I wrote a jovial tweet about how the UK 2068 Inflation-linked bond (linker) had failed as an inflation hedge. Hasn’t pretty much everything? The performance is so close it appears that gilts have been backed by bitcoin. If only.

The long linker and bitcoin

Source: Bloomberg

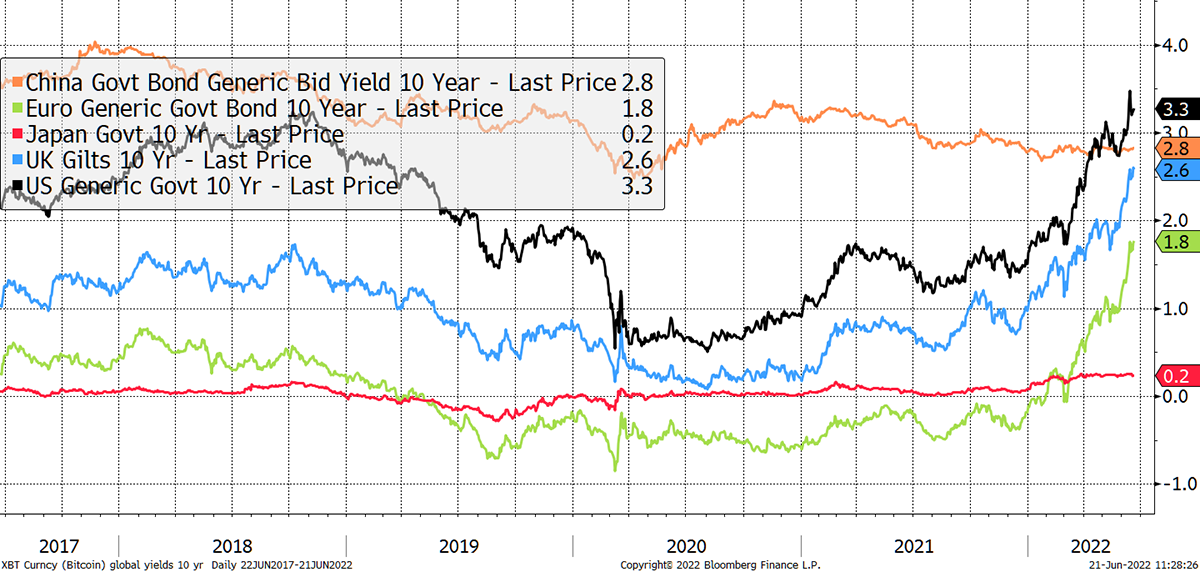

What is killing asset prices is rising rates. This is being mirrored around the developed world except for Japan, where they continue to apply yield curve controls, which has sunk the yen instead.

Higher rates in most places

Source: Bloomberg

China is another outlier, but according to their statistics, there is no inflation problem. That is despite rice behaving like a 2017 ICO. Fat chance of that being the truth.

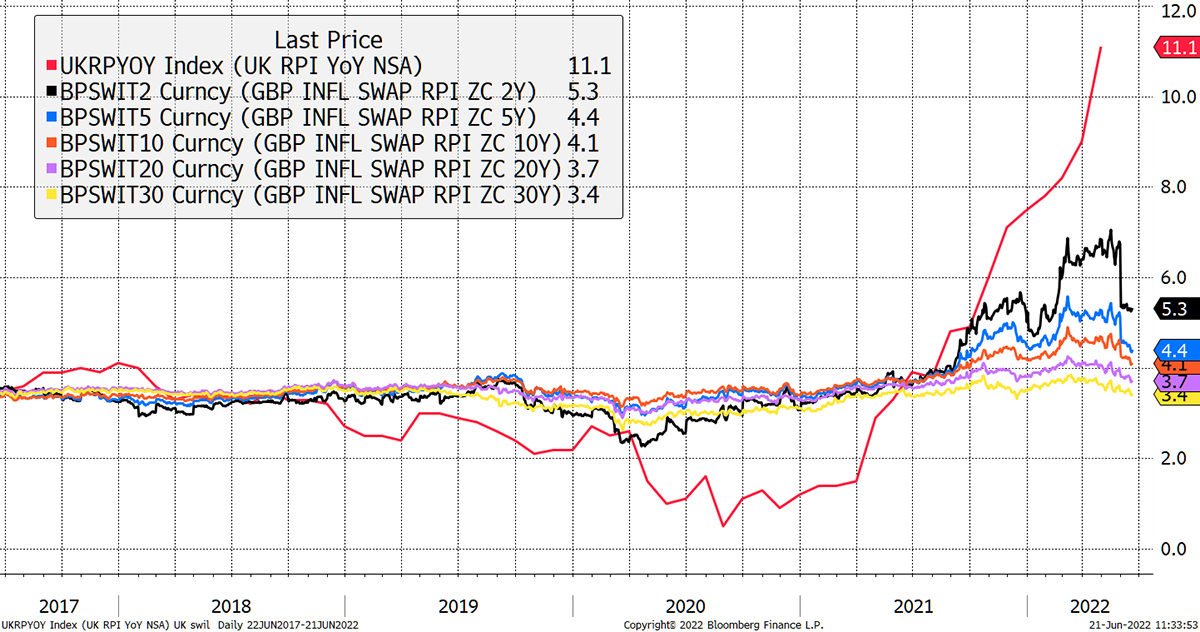

The surprise for me is how inflation expectations seem to think the fight is already won. I often show US breakeven of inflation expectations, but this week will show the UK and Japan.

RPI Inflation at 11.1% but nothing to worry about in the UK

Source: Bloomberg

It is odd that RPI recently touched 11.1% YoY, yet longer-term expectations ignore this. They believe inflation is going away and is in no way structural. This is repeated across many countries as Davos thinking seeming controls global yield curves.

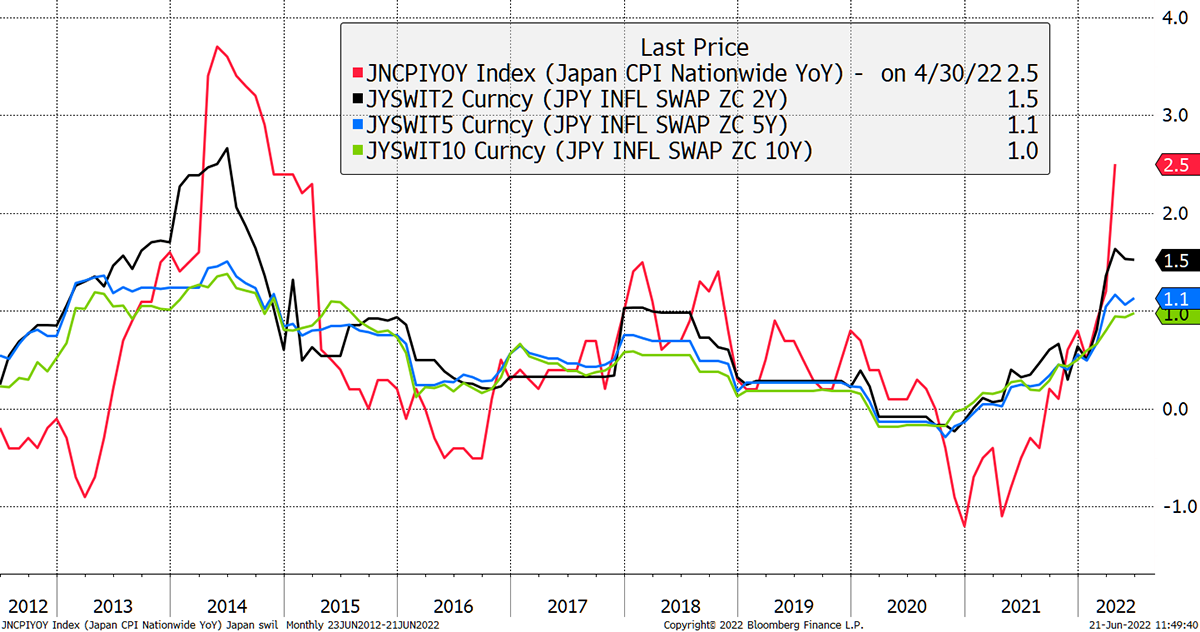

Japan is a little different. The inflation (red) has been slower to come through, but at least the market seems to believe it. This hasn’t happened since the 1980s.

Japan is reflating

Source: Bloomberg

Cryptonomy: The Dominos Keep Falling

By: Laura Johansson

The problem when something as big as Terra comes crashing down is that long-term aftershocks are repeatedly felt throughout the crypto ecosystem. Three Arrows Capital (3AC) is the latest domino to fall. On Wednesday last week, The Block was the first to reportthat the crypto hedge fund (one of the biggest in the world) may be insolvent after failing to meet margin calls from several lenders, including BlockFi and Genesis.

If the name 3AC sounds familiar, it should. It has frequently been mentioned in our Token Takeaways as a supporter of many large crypto projects like Bitcoin, Ethereum, Avalanche, Solana, Axie Infinity, and Terra. 3AC has been around since 2012 and hold assets in the “multi-billion dollar range”, so they have their fingers in all the pies, which is great until things go wrong.

Reportedly, 3AC’s $559.6 million investment in LUNA (now LUNC) is worth $670.45 - no, I didn’t miss out any zeros. It was a big bet with a heavy loss. Furthermore, 3AC was also backed the $1.5bn Bitcoin purchasethat the Luna Foundation Guard made in early May to support its stablecoin reserves. A Financial Times articlefurther highlighted that 3AC was a big investor in the Grayscale Bitcoin Trust (GBTC), which has traded at a discount since February 2021, currently at -41.1%.

Source: ByteTree. GBTC premium/discount history since September 2019.

Last week, 3AC started selling assets to prevent multi-million dollar loans from Aave and Compound from going into liquidation. With the crypto market turning sour, Messari.io estimatedthat 3AC would have lost 60% of their investments year to date. As 3AC is a big client to global crypto lenders, their collapse would have a further knock-on effect on the market.

Summary

Bitcoin has done nothing wrong this cycle. The network has remained robust and underlying activity in the ecosystem remains strong. Perhaps we drank the Kool-Aid in accepting what, in hindsight, might have been high valuations. The asset class is now being heavily stress-tested and when that happens there are bargains to be found.

Nothing is an effective inflation hedge when rates are rising, and valuations have room to correct. Now that is underway, bitcoin and other high quality crypto assets should start to have greater appeal.

Comments ()