Beating the BOLD1 Index - It Is Possible

Disclaimer: Your capital is at risk. This is not investment advice.

There are 137 equity ETFs listed on the London Exchange that have traded for five years or more (with USD tickers). Over that period, the ByteTree BOLD Index (BOLD1) returned 150.3%, and not a single one of those ETFs has kept up.

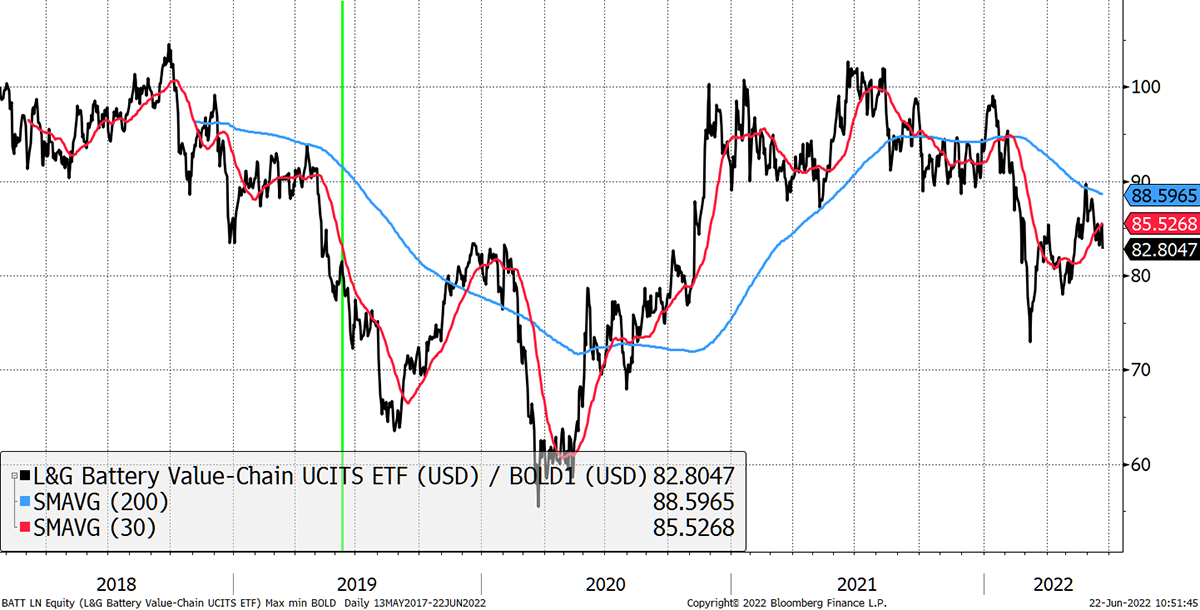

Over the past three years, the list has grown to 184 ETFs, and BOLD1 has returned 68.2% over the period. I am pleased to tell you there has been a winner that managed to beat BOLD1 with an impressive 83.8% return. Our congratulations to the L&G Battery Value-Chain ETF (BATT), which holds an interesting bunch of stocks.

BATT has done well courtesy of holding the likes of Tesla (TSLA +1,502%), followed by BYD (1211 HK + 527%), Solaredge (SEDG US +376%) and Pilbara Minerals (PLS AU +278%). BATT was held back by GSS Tech (GWH US -63%), Renault (RNO FP -54%) and Largo (LGO CN -47%). It’s an eclectic mix of old car companies and US tech combined with mineral extraction; a diversified strategy from a macro/factor perspective, even if coincidental.

It was all going well for BATT until 2022 when basically everything slumped. BATT has once again been lagging BOLD1.

BATT versus BOLD1

The chart shows BATT relative to BOLD1 (black line) with a 200- and 30-day moving average. BATT is below the 200-day, which is negatively sloping. It is also below the 30-day, which is positively sloping. Out of a possible 4 points, today BATT gets one point. It would have scored 4 in late 2020 when price was ahead of the moving averages, both positively sloping at the time. 4 strong, 0 weak. This points system is not dissimilar to the ByteTrend scoring system.

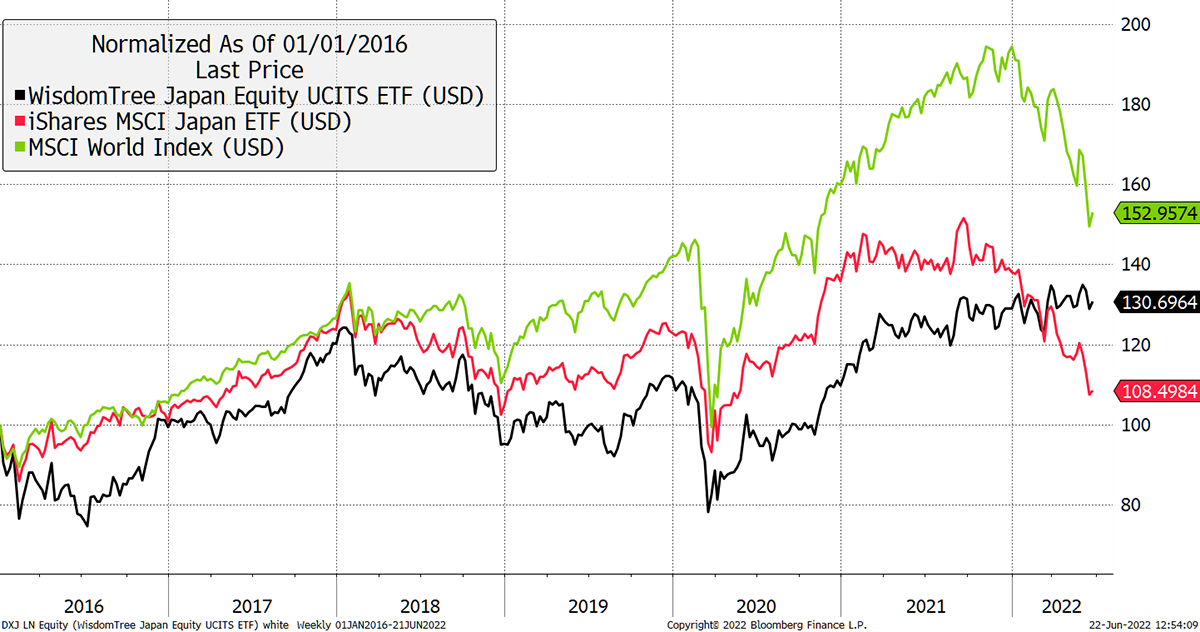

I ran this data across the current 266 ETFs to see where the market is today. There is currently just one ETF with a score of 4 (strong outperform) versus the BOLD1 Index. That is WisdomTree’s Japan USD Hedged ETF. It owns the Japanese stockmarket with an additional bet that the yen will fall versus the US dollar. On this occasion, because the yen has collapsed, and the bet has paid off. EWJ is up 2% this year in USD terms.

Hedging a Falling Yen Sometimes Comes Off

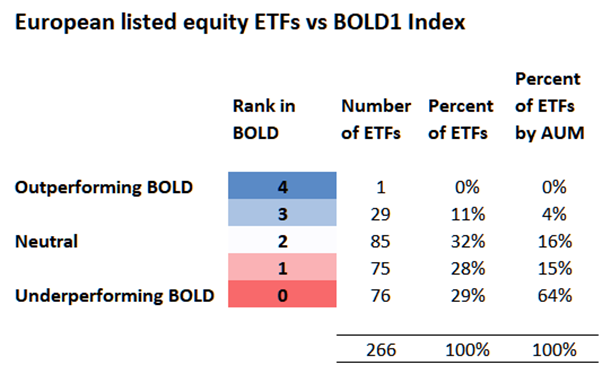

Next, there are 29 ETFs that score 3 vs BOLD1, which have enjoyed a modest degree of outperformance. 29 of 266 means 11% of the ETF universe has beaten BOLD1 in recent history, yet that same gang represents just 4% of assets. I will share the list at the end.

Looking at the 151 underperforming ETFs (vs BOLD1), they make up 79% of all assets, which is remarkable. It is telling you that the money is sitting in the wrong vehicles and investors are underperforming.

BOLD1 makes an interesting comparison because it’s the closest thing we have to neutrality within an inflationary environment. By combining bitcoin and gold on a risk-weighted basis, you have a 20/80 mix (approx.) in favour of gold, which is independent of the financial system.

Bond prices have been heavily influenced by central banks in recent years, so much so that we haven’t had a free market for years. Since the bond market defines the “risk-free” rate, all asset prices, from equities to property and infrastructure, are priced off bonds.

Without a free market, we have no idea what the price of money ought to be. We know it was too low because stimulus was too high, but whatever the new neutral rates might be, remains a mystery.

If we don’t know the price of money, then we don’t know the correct price for assets.

That is why this comparison to BOLD1 is a useful exercise. Both bitcoin and gold are liquid alternative assets, that are insulated from the financial system. They neither get printed nor bailed out. They trade freely and are left to their own devices.

Whatever criticisms about liquid alternative assets some may have, at least their pricing is independent of the financial system, and therefore this comparison offers an interesting and alternative perspective.

In the past, I would have carried out this same exercise with just gold. Today, there is a liquid alternative asset, bitcoin, which I believe is progress. The resulting risk-weighted blend enables BOLD1 to be used during both bull and bear markets.

What is remarkable is how well BOLD1 ranks despite a recent crash in the price of bitcoin. Now that’s behind us, it’s only going to get harder for equity ETFs to keep up from here.

ETF Scores versus BOLD1 Index

The groups by score are ranked by AUM.

Score 4 - Strong outperformance versus BOLD1

Lucky.

DXJ WISDOMTREE JAPAN USD HEDGED

Score 3 - Modest outperformance versus BOLD1

Healthcare and quality dividends worth consideration. The gold miners made it too! Not so sure about China.

| CNYA | ISHARES MSCI CHINA A |

| IUHC | SHARES S&P HEALTH CARE |

| GLDV | SPDR GLOBAL DIV ARISTOCRATS |

| WHEA | SPDR WORLD HEALTH CARE |

| HSTE | HSBC HANG SENG TECH UCITS ET |

| LCCN | LYXOR MSCI CHINA UCITS ETF |

| SXLV | SPDR S&P US HEALTH SELECT |

| IJPD | ISHARES MSC JAPAN USD-H ACC |

| TUCS | ISH S&P500 CONSUMER STAPLES |

| LGAP | L&G ASIA PACIFIC EX JAPAN EQ |

| DGRA | WISDOMTREE US QLY DIV GRWTH |

| SXLP | SPDR S&P US CON STAP SELECT |

| AUCO | L&G GOLD MINING UCITS ETF |

| EDVD | SPDR EM DVD ARSTCT UCITS ETF |

| MCHN | INVESCO MSA CHINA ALL SHS |

| WCOS | SPDR WORLD CON STAPLES |

| MKUW | INVESCO MS@ KUWAIT |

| CHIN | ICBCCS WT SPC500 ETF B USD |

| MCHT | IVZ MSCI CHINA TECH ALL SHS |

| ISUN | INVESCO SOLAR ENERGY ETF |

| CASH | L&G E FUND MSCI CHINA A |

| LDEM | L&G QUALITY DVD ESG EM ETF |

| FVD | FIRST TRUST VALUE LINE DVD |

| FTCS | FIRST TRUST CAPITAL STRENGTH |

| TANN | SOLAR ENERGY UCITS ETF |

| ESPJ | IVZ MSCI PAC EX JAPAN ESG |

| ESGO | HAN ESG MINING UCTIS ETF |

| XMVU | X USA MINIMUM VOLATILITY |

| KA50 | KRANESHARES MSCI CHINA A USD |

Score 2 - Neutral versus BOLD1

Much of the energy landscape has drifted back down to neutral. Once again, the message is dividends and min vol strategies, along with healthcare, are not such a bad place to hide.

| UDVD | SPDR US DIV ARISTOCRATS |

| MVOL | ISH EDG MSCI WLD MNVL USD A |

| SUSM | ISHARES MSCI EM SRI UCITS |

| VDEM | VANG FTSE EM USDD |

| SAEM | ISHARES MSCI EM IMI ESG SCRN |

| SPMV | ISHARES EDGE S&P500 MIN VOL |

| IUES | ISHARES S&P 500 ENERGY |

| HEAL | ISHR HEALTHCARE INNOVATION |

| HMEM | HSBC MSCI EMERGING MARKETS U |

| EMAD | SPDR EM ASIA |

| ISAG | ISHARES AGRIBUSINESS |

| AGED | ISHARES AGEING POPULATION |

| JREM | JPM GL EM REI ESG UCITS ETF |

| GDX | VANECK GOLD MINERS ETF |

| MSAU | INVESCO MSCI SAUDI ARABIA |

| SXLE | SPDR S&P US ENERGY SELECT |

| WNRG | SPDR WORLD ENERGY |

| MXFS | INVESCO MSCI EMERGING MKTS |

| SBIO | INVESCO NASDAQ BIOTECH |

| XLVS | INVESCO US HEALTH CARE S&P |

| KWEB | KRANESHARES CSI CHINA INTRNT |

| IOGP | ISHARES OIL & GAS EXPL&PROD |

| QDIV | ISHARES MSCI USA QUALITY DIV |

| HMAD | HSBC MSCI AC FAR EAST EX JAP |

| IKSA | ISHARES MSCI SAUDI CAPD USDA |

| BTEC | ISHARES NSDQ US BIOTECH UCIT |

| EMMV | ISHARES EDGE MSCI EM MIN VOL |

| EEDM | ISH MSCI EM ESG EHNCD USD-D |

| GDIG | VANECK GLOBAL MINING ETF |

| HDLV | INVESCO S&P 500 HDLV DIST |

| HSXD | HSBC APAC EX JAPAN SUS EQ |

| EMRD | SPDR EMERGING MARKETS |

| IPXJ | ISHARES MSCI PACIFIC EX-JPN |

| MLPD | INVESCO MORNINGSTAR MLP DIST |

| ROAI | LYXOR MSCI ROBOTICS & AI ESG |

| AIAI | L&G ARTIFICIAL INTELLIGENCE |

| EMQQ | EM INTRNET & ECOMM UCITS ETF |

| XLPS | INVESCO US CONS STAP S&P SEC |

| HSEM | HSBC EMERGING MARKET SUS EQ |

| IUMS | ISH S&P500 MATERIALS |

| LOWV | SPDR S&P 500 LOW VOLATILITY |

| ASDV | SPDR ASIA DVD ARISTOCRATS |

| DOCT | L&G HEALTHCR BRKTH UCITS ETF |

| IUUS | ISH S&P500 UTILITIES |

| FEMR | FIDELITY SRE EM EQUITY -ACC |

| XLUS | INVESCO US UTILITIES S&P |

| CYBR | RIZE CYBERSECURITY UCITS ETF |

| XLES | INVESCO US ENERGY S&P |

| ITEK | HAN-GINS TECH MEGATREND EQL |

| EQQS | INVESCO NASDAQ-100 SWAP ACC |

| FPXR | FIDELITY SRE PXJ EQUITY -ACC |

| CEMG | ISHARES MSCI EM CONSUM GRWTH |

| ESEM | INVESCO MSCI EM ESG ACC |

| CLMA | ICLIMA GLOBAL DECARBONISATIO |

| SXLU | SPDR S&P US UTILITIES SELECT |

| MMLP | ALERIAN MIDSTRM ENRGY DIV |

| QCLU | FIRST TRUST NSDQ CLN EDG NRG |

| BIOT | L&G PHARMA BREAKTHROUGH |

| MLPI | L&G US ENERGY INFRASTR MLP |

| WCOD | SPDR WORLD CON DISCRETIONRY |

| HEDJ | WISDOMTREE EUR EQUITY-USD HG |

| HMBR | HSBC MSCI BRAZIL UCITS ETF |

| HPAU | HSBC MSCI USA CLIMATE PARIS |

| HMFD | HSBC MSCI EM FAR EAST UCITS |

| KESG | KRANESHS ICAV/SHS CL-USD |

| HMLD | HSBC MSCI EM LATIN AMERICA U |

| WUTI | SPDR WORLD UTILITIES |

| WTEL | SPDR MSCI WORLD COMMUNICATIO |

| SKYY | HAN-GINS CLOUD TECH EQUAL WT |

| HERU | GX VGAMESESPORTS UCITS |

| PQVM | INVESCO S&P 500 QVM |

| JPUS | JPM US EQ MULTIFAC UCITS ETF |

| EFIM | INVESCO GS EQ FACTOR EM |

| GSEM | GS ACTIVEBETA EM EQ |

| SPLW | INVESCO SP 500 LOW VOL UCITS |

| FEMI | FIDELITY EM QUAL INCOME-ACC |

| WELL | HAN-GINS INDXX HLTH EQL WT |

| FBTU | FIRST TRUST BIOTECHNOLOGY |

| KURE | KRANESHARES MSCI CH HEALTH |

| FDIU | FIRST TRUST DJ INTNL INTRNET |

| EDOC | GX TELMED DIG HLTH UCITS |

| ZERO | HAN GLOBAL CLEAN UCITS ETF |

| DGEN | ICLIMA SMART ENERGY ETF |

| XSOE | WT EM XSTATE OWNED ESG UCITS |

| KSTR | KRANESHARES ICBCCS INDEX USD |

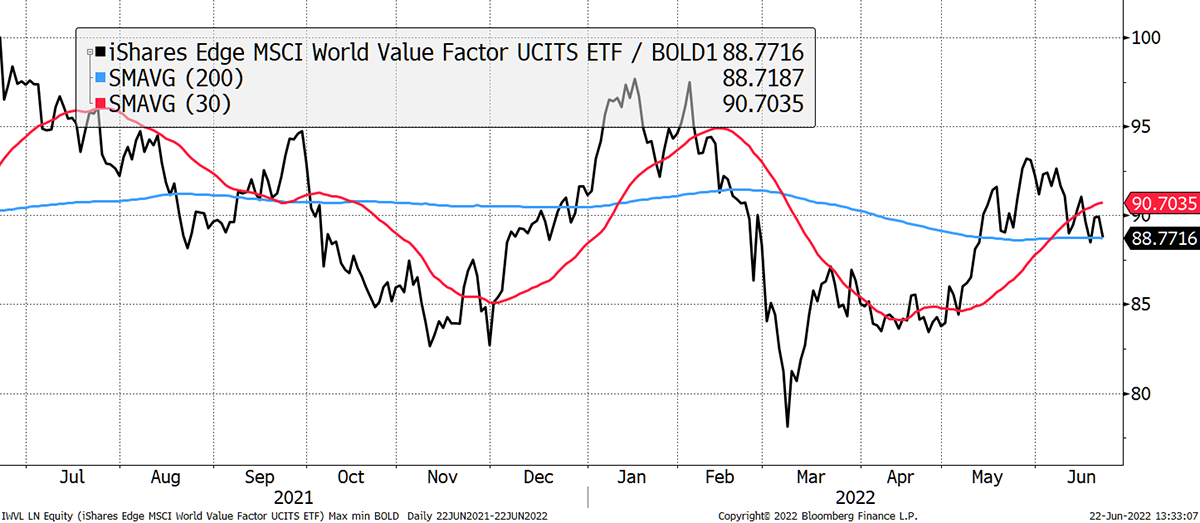

Score 1 - Modest underperformance versus BOLD1

Despite being the 3-year winner, BATT now lives here.

The World Value Factor is starting to wane. Wowsers, had better check. It turns out the moving averages are both downward sloping. Peak value already?? This bear is going to be tough.

Value tired!

| IWVL | ISHARES EDGE MSCI WRLD VALUE |

| ACWD | SPDR ACWI |

| IAUP | ISHARES GOLD PRODUCERS |

| SPXE | INVESCO S&P 500 ESG ACC |

| IWMO | ISHR EDGE MSCI WRLD MOMENTUM |

| VDJP | VANG FTSE JPN USDD |

| ESGU | IVZ MSCI USA ESG UCITS ETF |

| SAWD | ISHARES MSCI WORLD ESG SCRND |

| R2US | SPDR RUSSELL 2000 US S/C |

| LOCK | ISHARES DIGITAL SCRTY USD-A |

| NDIA | ISHARES MSCI INDIA UCITS ETF |

| SAJP | ISHARES MSCI JAPAN ESG SCRND |

| ROBO | L&G ROBO GLOBAL ROBOTICS&AUT |

| BATT | L&G BATTERY VALUE-CHAIN |

| FUSR | FIDELITY SRE US EQUITY-ACC |

| ECAR | ISHARES EV & E DRIV TECH |

| WQDV | ISH MSCI WLD QLY DIV-USD DIS |

| HSUD | HSBC USA SUSTAINABLE EQUITY |

| ESPO | VANECK VIDEO GAME ESPORT ETF |

| HTWO | L&G HYDROGEN ECONOMY ETF |

| IWSZ | ISHARES EDGE MSCI WRLD SIZE |

| IMID | SPDR ACWI IMI |

| MOAT | VANECK MORNINGST US MOAT ETF |

| CIBR | FIRST TRUST CYBERSECURITY |

| VOLT | WT BATTERY SOLUTIONS-USD ACC |

| IUMO | ISHARES EDGE MSCI USA MMNTM |

| LGUS | L&G US EQUITY UCITS ETF |

| WTEC | SPDR WORLD TECHNOLOGY |

| WFIN | SPDR WORLD FINANCIALS |

| WCLD | WT CLOUD COMPUTING USD ACC |

| IEMS | ISHARES MSCI EM SMALL CAP |

| GLUG | L&G CLEAN WATER UCITS ETF |

| LGJP | L&G JAPAN EQUITY UCITS ETF |

| ECOM | L&G ECOMMERCE LOGISTICS |

| FGQI | FIDELITY GBL QUAL INCOME-INC |

| EFIW | INVESCO GS EQ FACTOR WORLD |

| EEWD | ISH MSCI WLD ESG EHNCD USD-D |

| ESGW | IVZ MSCI WORLD ESG UCITS ETF |

| HPAW | HSBC MSCI WORLD CLIMATE PARI |

| EMSD | SPDR EM SMALL CAP |

| WMAT | SPDR WORLD MATERIALS |

| EEJD | ISH MSCI JPN ESG EHNCD USD-D |

| HSJD | HSBC JAPAN SUSTAINABLE EQY |

| ISDE | ISHARES MSCI EM ISLAMIC |

| OUFU | OSSIAM US ESG LC EQUITY FACT |

| HSWD | HSBC DEV WORLD SUSTAINABLE E |

| HDRO | VANECK HYDROGEN ETF |

| ESGJ | INVESCO MSCI JAPAN ESG ACC |

| GOAT | VANECK MSTAR GLOBAL MOAT ETF |

| OPEN | ISHARES REF INCL & DIVRSTY |

| FJPR | FIDELITY SRE JP EQUITY -ACC |

| GSLC | GS ACTIVEBETA US LC EQ |

| IPOL | ISHARES MSCI POLAND |

| USML | INVESCO S&P SMALLCAP 600 |

| WCBR | WT CYBERSECURITY-USD ACC |

| FTEK | INVESCO KBW NASDAQ FINTECH |

| GCLE | IVZ GLOBAL CLEAN ENERGY ACC |

| LGGL | L&G GLOBAL EQUITY UCITS ETF |

| WNDU | SPDR WORLD INDUSTRIALS |

| JPCT | JPM CARBON TRANSITION GLOBAL |

| RTWO | L&G RUSSELL 2000 SM CAP QUAL |

| EQQJ | IVZ NASDAQ NEXT GEN 100 ACC |

| FLWR | RIZE MED CANNABIS UCITS ETF |

| FGLR | FIDELITY SRE GLB EQUITY-ACC |

| DIGI | HAN DIGITAL INFRA CONN ETF |

| LDAP | L&G QUALITY DIV ESG APAC XJP |

| LIFE | RIZE ENVIRONMENTAL ETF |

| BBUS | JPM BETAB US EQ UCITS USD-A |

| YODA | PROCURE SPACE UCITS ETF |

| DPAY | L&G DIGITAL PAYMENTS |

| NXTU | FIRST TRUST INDXX NETG ETF |

| AMAL | SATURNA AL-KAWTHAR GLB FOCUS |

| SESG | SATURNA HAN SUSTAINABLE ETF |

| BETS | FISCHER BETTING UCITS ETF |

| SOFT | HAN SOFTWARE ESG-S UCITS ETF |

Score 0 - Strong underperformance versus BOLD1

If the S&P is in group 0, that’ll take the assets. Again, US value is down here along with Robots, buybacks, Turkey and Cannabis.

| CSPX | ISHARES CORE S&P 500 |

| SPXS | INVESCO S&P 500 ACC |

| VWRD | VANG FTSE AW USDD |

| XDWD | X MSCI WORLD 1C |

| SUAS | ISHARES SUST MSCI USA SRI |

| ISAC | ISHARES MSCI ACWI |

| SPY5 | SPDR S&P 500 UCITS ETF DIST |

| HMWD | HSBC MSCI WORLD UCITS ETF |

| SASU | ISHARES MSCI USA ESG SCREEND |

| IUVL | ISHARES EDGE MSCI USA VALUE |

| IUIT | ISHARES S&P 500 IT SECTOR |

| VHYD | VANG FTSE HDY USDD |

| RBOT | ISHARES AUTOMATION&ROBOTIC-A |

| WSML | ISHARES MSCI WLD SMALL CAP |

| IWQU | ISHR EDGE MSCI WRLD QLY FCTR |

| IDWP | ISHARES DVL MKT PROPERTY YLD |

| VDNR | VANG FTSE NA USDD |

| IUFS | ISHARES S&P 500 FINANCIALS |

| VDEV | VANG FTSE DW USDD |

| IUQA | ISHARES EDGE MSCI USA QLY |

| EEDS | ISH MSCI USA ESG EHNCD USD-D |

| IDP6 | ISHARES S&P SMALL CAP 600 |

| SPY4 | SPDR S&P 400 US MID CAP |

| DGTL | ISHARES DIGITALISATION |

| JREU | JPM US REI ESG UCITS ETF |

| RIUS | L&G US EQ RESP EX UCITS ETF |

| SUJP | ISHARES MSCI JAPAN SRI USD-A |

| VDPX | VANG FTSEAPXJ USDD |

| SMH | VANECK SEMICONDUCTOR ETF |

| IGSU | ISHARES GLOBAL SUST SCREENED |

| WDSC | SPDR WORLD SMALL CAP |

| BNKS | ISHARES S&P US BANKS UCITS |

| BCHN | IVZ COINSHRS BLOCKCHAIN UCIT |

| JREG | JPM GLOBAL REI ESG UCITS ETF |

| XLKS | INVESCO US TECHNOLOGY S&P |

| SXLK | SPDR S&P US TECH SELECT |

| IFSW | ISH EDG MSCI WLD MLTFC USD A |

| 5HED | OSSIAM ESG LW CRB SHL BRC US |

| SXLF | SPDR S&P US FINANCIAL SELECT |

| XLFS | INVESCO US FINANCIALS S&P |

| IEDY | ISHARES EM DIVIDEND |

| GDXJ | VANECK JR. GOLD MINERS ETF |

| XLCS | INVESCO US COMMUNICATION S&P |

| RUSG | LYXOR RUSSELL 1000 GROWTH |

| WTAI | WT ART INTELLIGENCE -USD ACC |

| USSC | SPDR USA S/C VALUE |

| SXLI | SPDR S&P US INDUST SELECT |

| IUCD | ISHARES S&P CONSUMER DSCRTN |

| FUSA | FIDELITY US QUAL INCOME-ACC |

| GLRE | SPDR GLOBAL REAL ESTATE |

| IUIS | ISH S&P500 INDUSTRIALS |

| GGRA | WISDOMTREE GLB QLY DIV GRWTH |

| USVL | SPDR USA VALUE |

| EMHD | INVESCO FTSE EM H DIV LW VOL |

| EMXC | LYX MSCI EM EX CHINA |

| IUSZ | ISHARES EDGE MSCI USA SIZE |

| IUCM | ISHARES S&P500 COMMUNICATION |

| XLIS | INVESCO US INDUSTRIALS S&P |

| JPGL | JPM GL EQ MULTIFAC UCITS ETF |

| SXLY | SPDR S&P US CON DIS SELECT |

| SXLB | SPDR S&P US MATERIALS SELECT |

| XLYS | INVESCO US CONS DISC S&P SEC |

| IQSA | IQS ESG EQUITY GLOBAL |

| BUYB | INVESCO GLOB BUYBACK ACHIEVE |

| IFSU | ISHARES EDGE MSCI US MLTFCTR |

| XRES | INVESCO US REAL ESTATE S&P |

| TRYP | AHCL UCITS ETF |

| CBDX | HAN MED CANNABIS UCITS ETF |

| DAPP | VANECK DIGITAL ASSETS ETF |

| USUF | SCIBETA HFI US EQY 6F EW USD |

| SPEQ | IVZ SP 500 EQUAL WEIGHT ACC |

| JETS | U.S. Global Jets UCITS ETF |

| HTRD | HSBC MSCI TURKEY UCITS ETF |

| XLBS | INVESCO US MATERIALS S&P |

| IBUY | HAN GLB ONLINE RETAIL UCITS |

| USEF | MS SCIENTIFIC BETA US EQ FTR |

Comments ()