So Bad It's Good

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 48

The network is thriving while the price is sliding. Past observations, such as November 2018 and March 2020, would see that as a buy. As the famous technician Ned Davis would say, “so bad it’s good”. We upgrade to BULL.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Oversold |

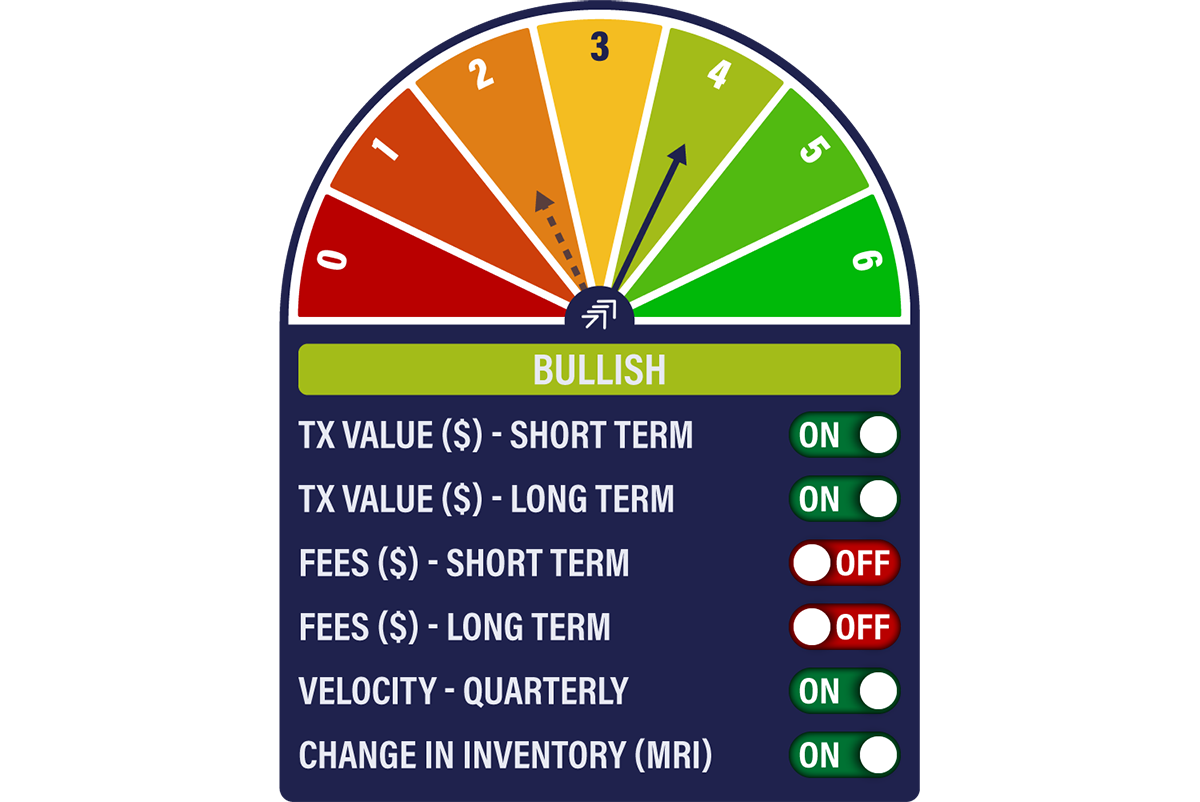

| On-chain | Network Demand Model turns to buy |

| Investment Flows | Inflows return |

| Macro | Policy may reverse |

| Crypto | Terra stablecoin breaks the buck |

The price shock is down to external events. TERRA has been dumping bitcoin to support their algorithmic stablecoin, and back in the real world, the NASDAQ has been tanking. The Network Demand Model turned bullish on Sunday. That means the network is growing, and price will follow. We have upgraded the dial to bull market.

Source: ByteTree

Technical

The ByteTrend star count for the top 15 tokens fell to 8/75. Strip out TRON (TRX) and it’s 4/75. This is dismal, or, as the famous technician Ned Davis would say, “so bad it’s good”.

If all 15 coins had a 5-star trend, that would be 75 stars, which would reflect the max bullish technical conditions.

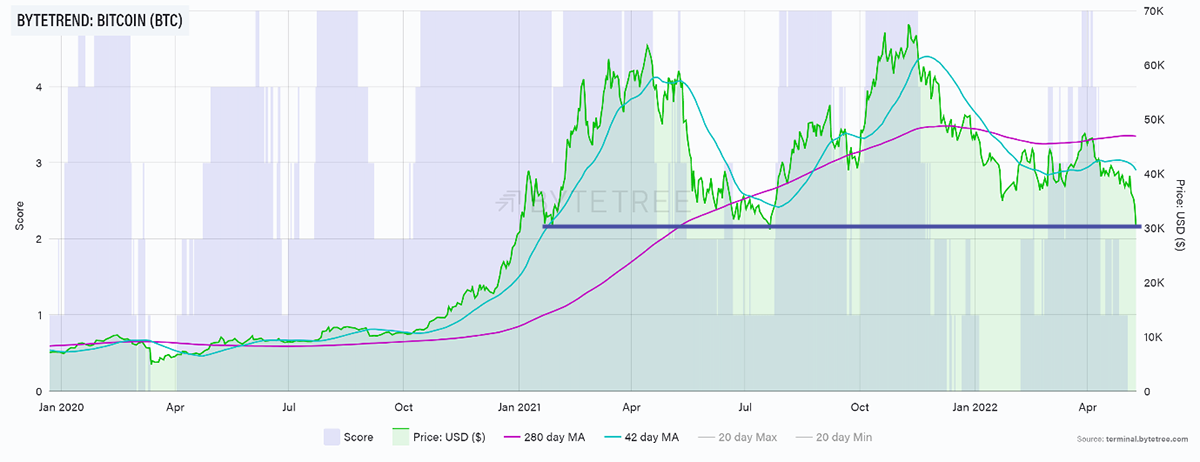

Bitcoin back to 0/5

Source: ByteTree. Bitcoin (BTC) ByteTrend, measured in USD, since January 2020.

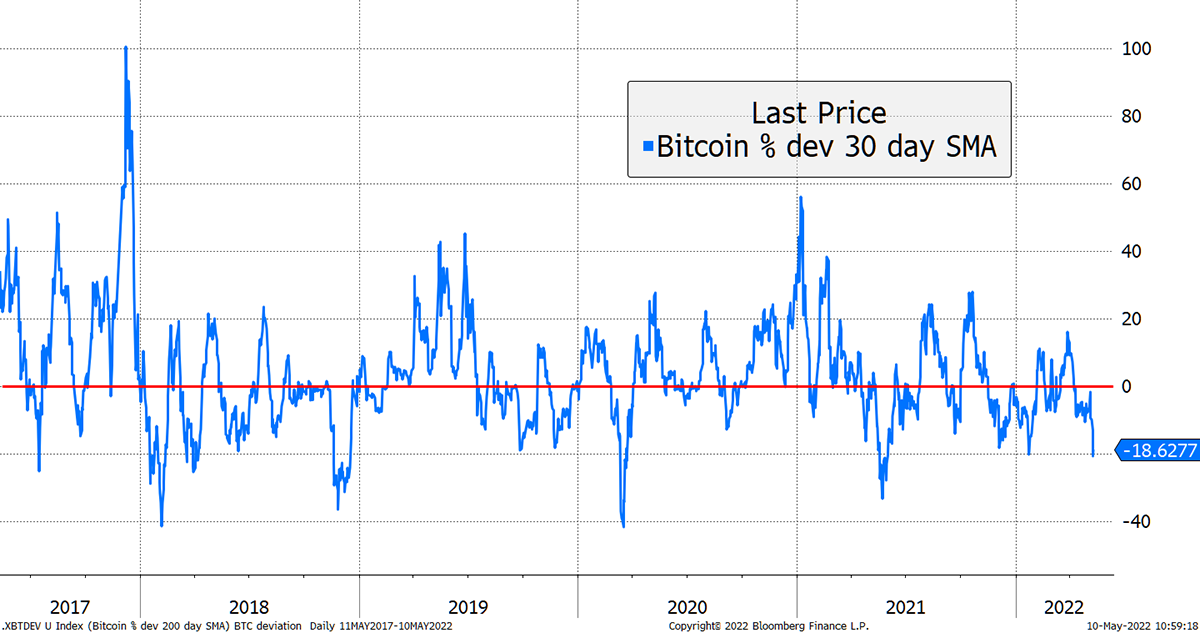

The 280-day moving average has turned down again, so the trend scores no points. The point is that price is oversold. That isn’t quite March 2020, nor the China crash last year, but the price is oversold while hovering at a major support level.

Bitcoin trades 20% below the 30-day moving average

Source: Bloomberg

Support levels work better in bull markets than bears, and that is an important consideration in deciding how much weight to give them. At ByteTree, we have always trusted the blockchain, which has turned bullish. We believe this bull market is real, and bitcoiners will be rewarded with higher prices in due course.

On-chain

The Network Demand Model is telling us to buy. It rose to 4/6 on Sunday when the price was $38,844. Then came the UST/Terra blow up, which Charlie Erith covers in Cryptonomy below. I’ll focus on the chain.

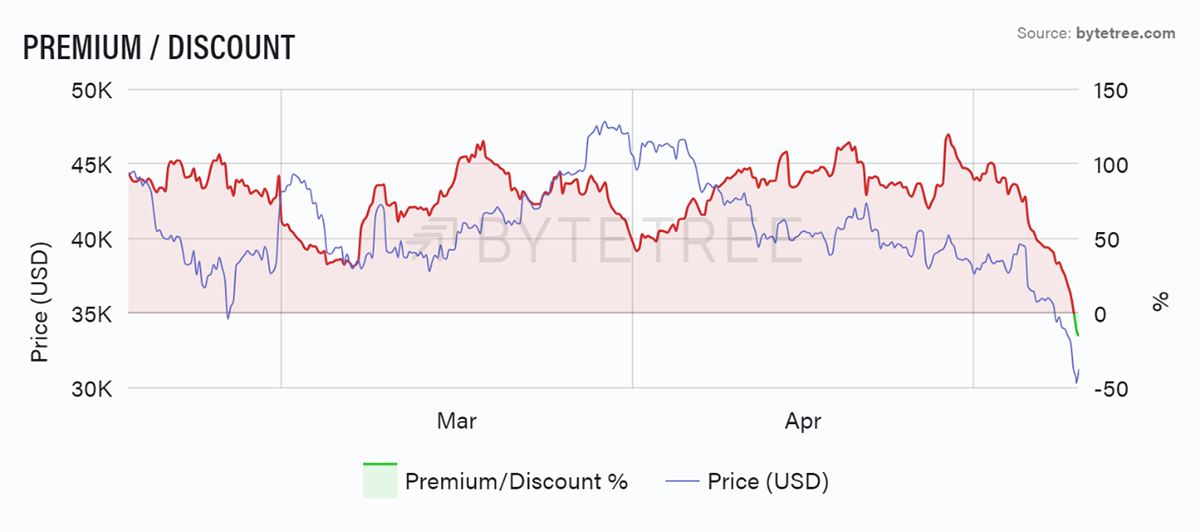

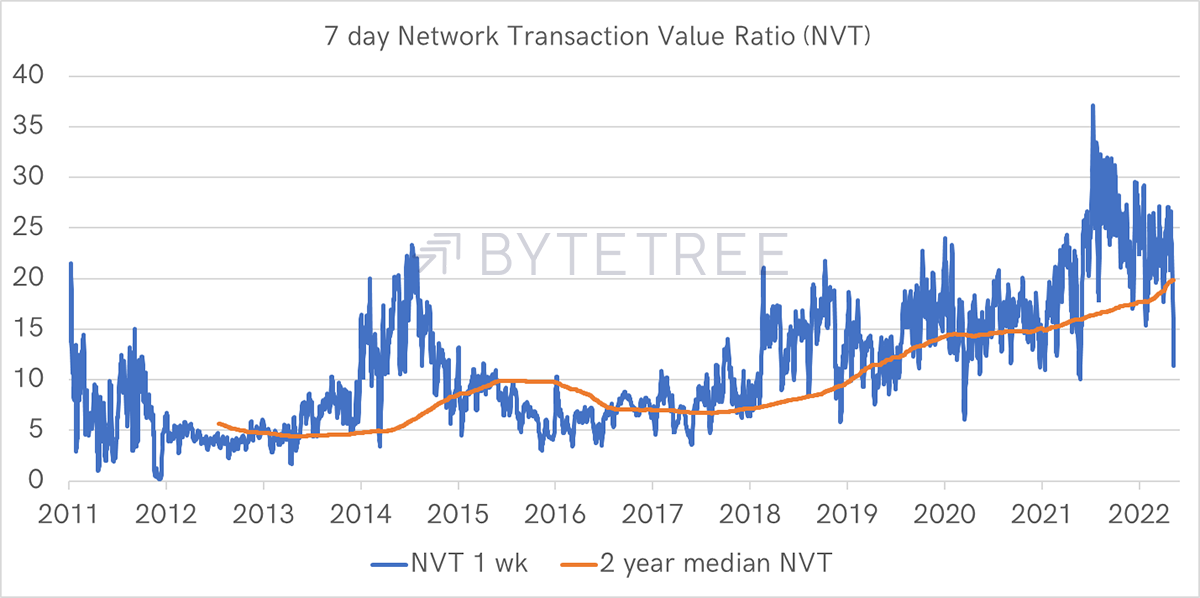

I’ll start with valuation. One-week fair value, which is based on the historical average NVT of 7.7x, suggests you buy this dip. As things have evolved, this model appears to be overly conservative, but even this suggests bitcoin is undervalued.

Source: ByteTree. Bitcoin premium/discount (%) and price over the past 3 months.

I say it is conservative because the historical average pre-2018 was indeed 7.7x, but it has increased ever since. Charlie Erith and I use a two-year rolling median, which accepts that things have changed.

The doubters would simply say the valuation is higher, so there is a bubble. Yet when you consider that as coins have been lost or permanently HODLed, the actual market cap (network value) is materially lower than the total market cap. This rolling measure, shown below, observes a two-year median and takes this into account.

Source: ByteTree

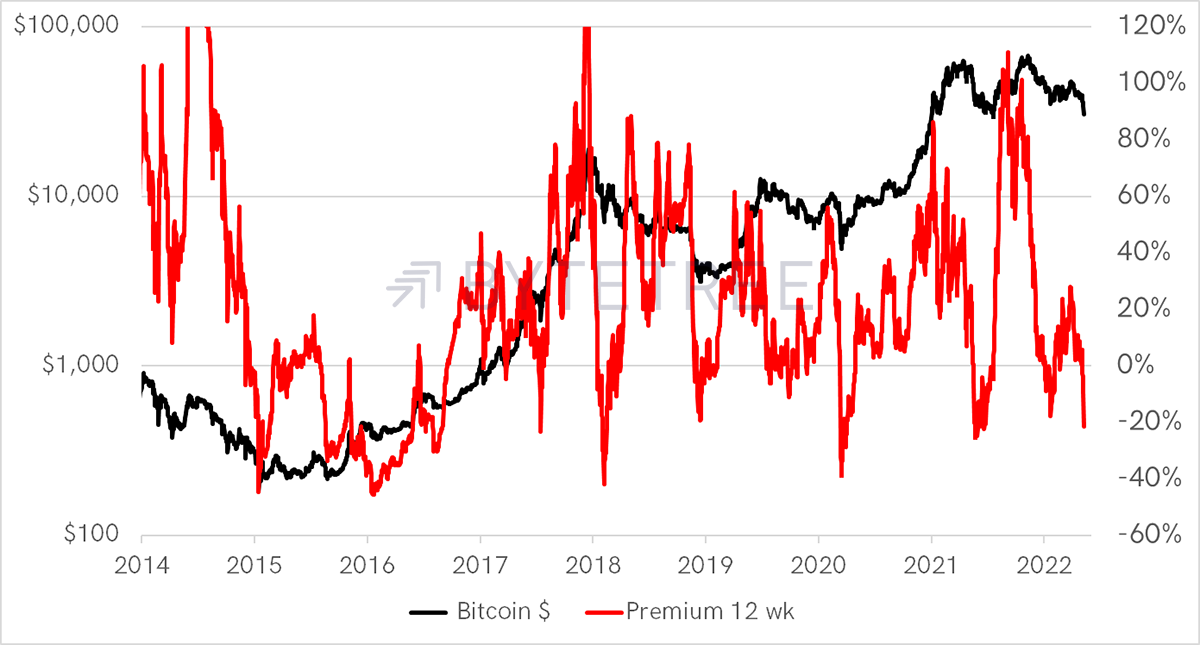

Reverting to our smoother 12-week valuation anchor, we can see the price is now around 25% below fair value. The only bad signal came about in Feb 2018 after the price fell from ~$20k to ~$7k in a short space of time. It wasn’t that bad, but later that year, the price visited ~$3k, so it wasn’t back in profit until May 2019. The results from other undervalued signals were strong.

Source: ByteTree

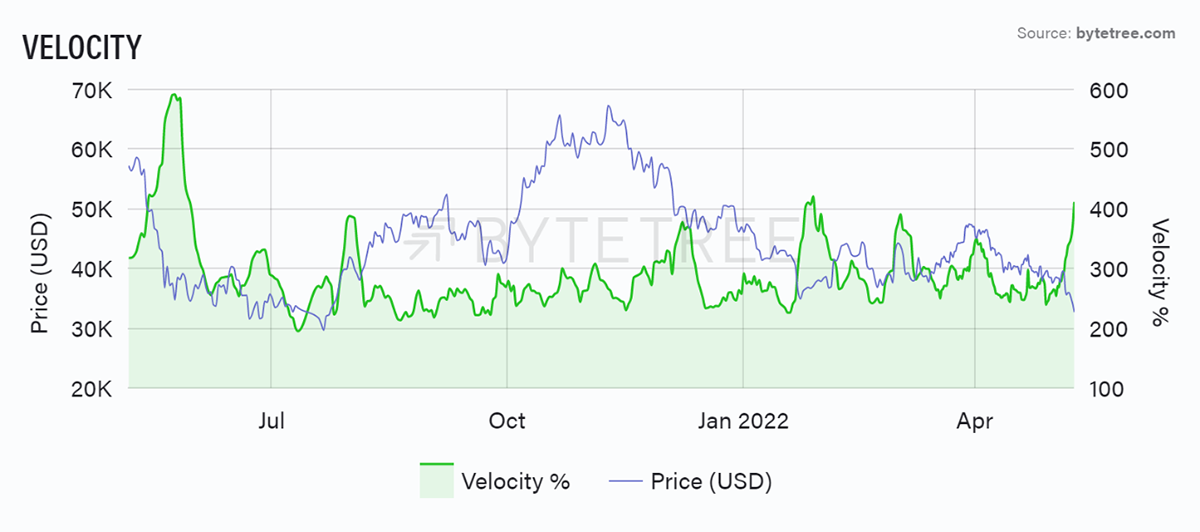

The other chart worth highlighting is velocity, which is a non-price indicator as there is just BTC and no dollars in the calculation. When the price falls and velocity spikes at the same time, that has always led to a rebound. If bitcoin was a shitcoin, velocity wouldn’t spike, telling you the network was in decline. Bitcoin isn’t a shitcoin.

Source: ByteTree. Bitcoin (BTC) held by funds over the past 3 months.

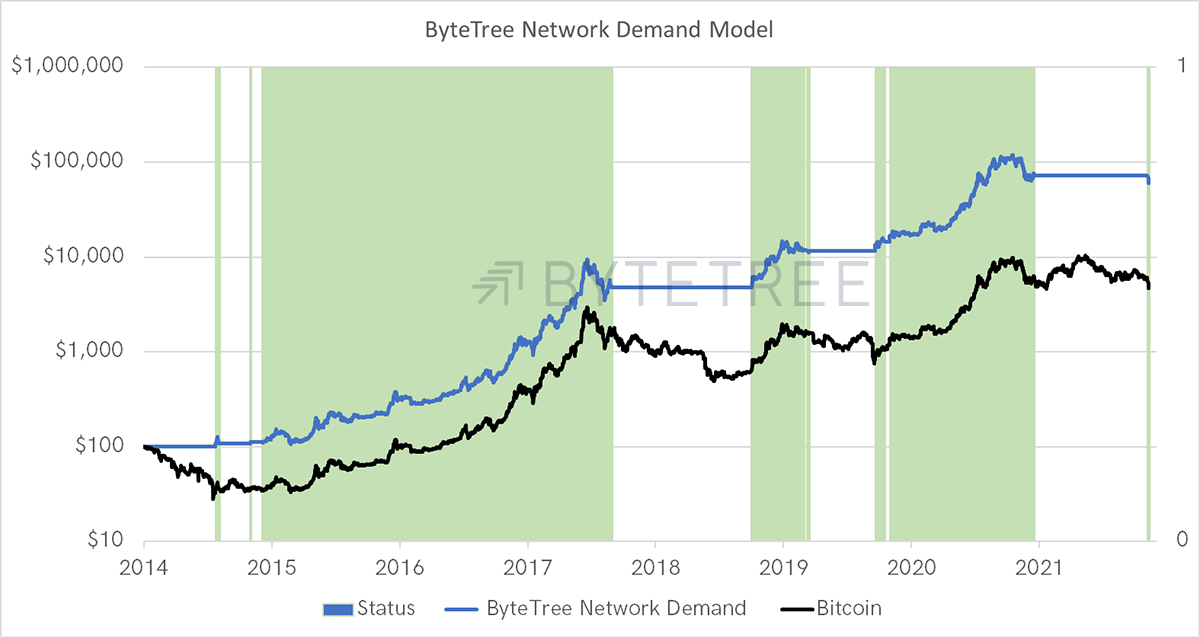

The Network Demand Model was designed for the armchair investor to identify good entry and exit points. When owning a high-growth company, the only thing that matters is growth, and you should relax about price swings. The same is true in bitcoin. When the blockchain is growing, own it.

The last sell signal was in June after the China bitcoin ban. The NDM is telling you that over the past 11 months, the underlying bitcoin network has been back into growth mode.

Fund Flows

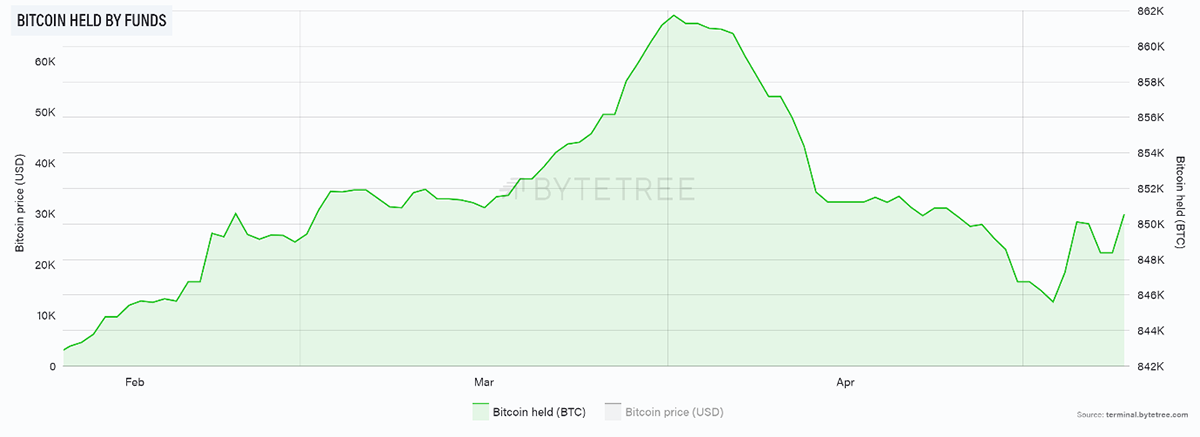

While TERRA has been dumping BTC (see below), the smart money has been buying. It is remarkable to see such fine countercyclical investor behaviour among institutional investors.

Source: ByteTree. Bitcoin (BTC) held by funds over the past 3 months.

This is good news.

Macro

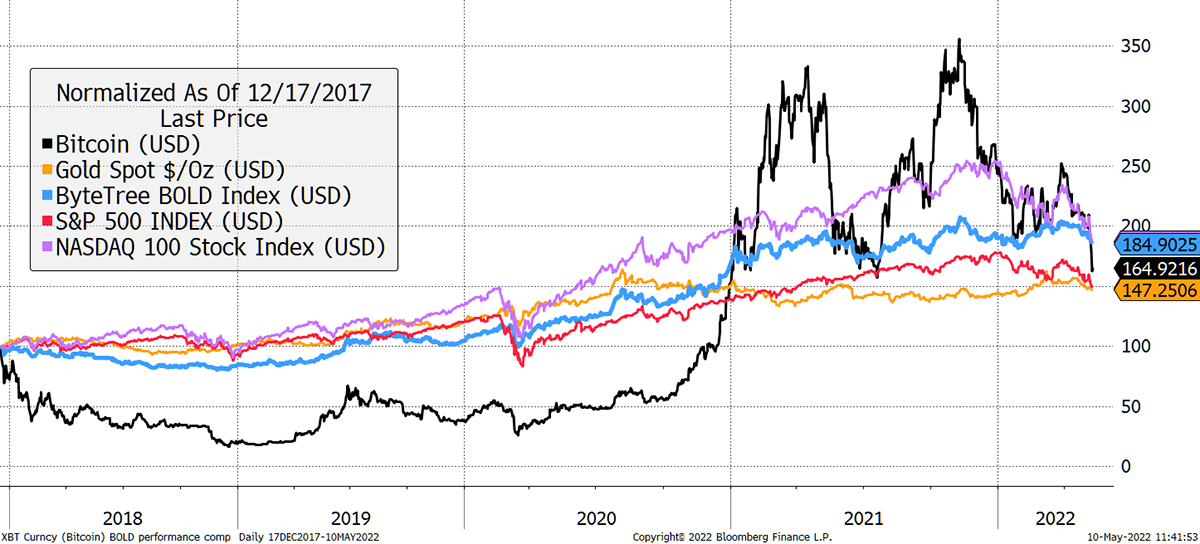

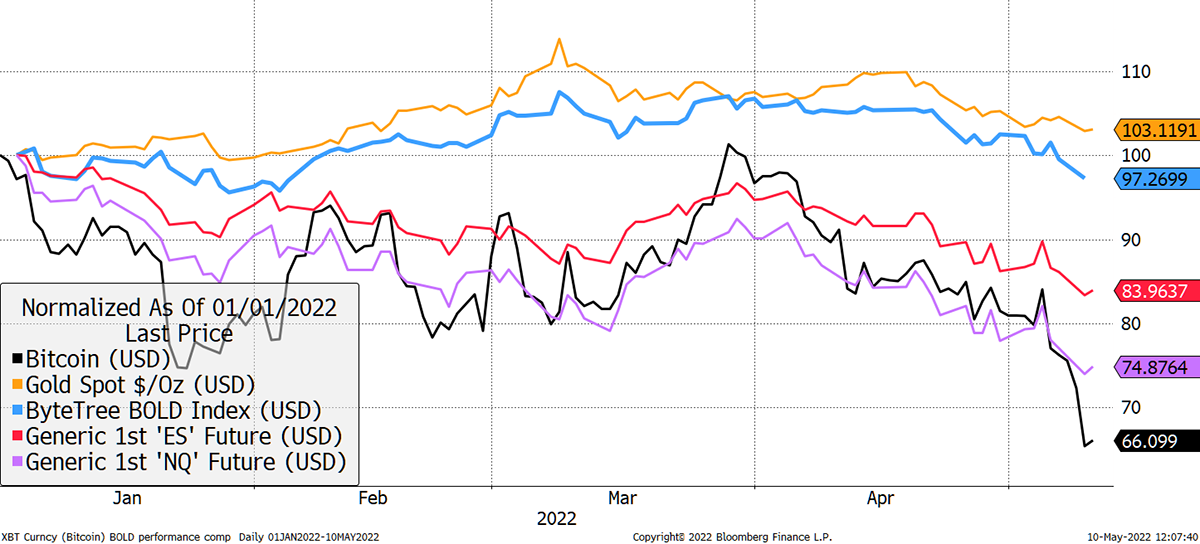

I find it remarkable that since the December 2017 bitcoin peak, bitcoin, gold, the S&P500, and the NASDAQ have all got to roughly the same place in capital terms. The ByteTree BOLD Index just got there with style.

Different investments have similar outcomes

Source: Bloomberg

Looking at 2022, bitcoin held the NASDAQ until the TERRA capitulation of recent days. As a result, BitDAQ has slipped as BTC has lagged the NASDAQ.

Risky assets have stuck together this year

Source: Bloomberg

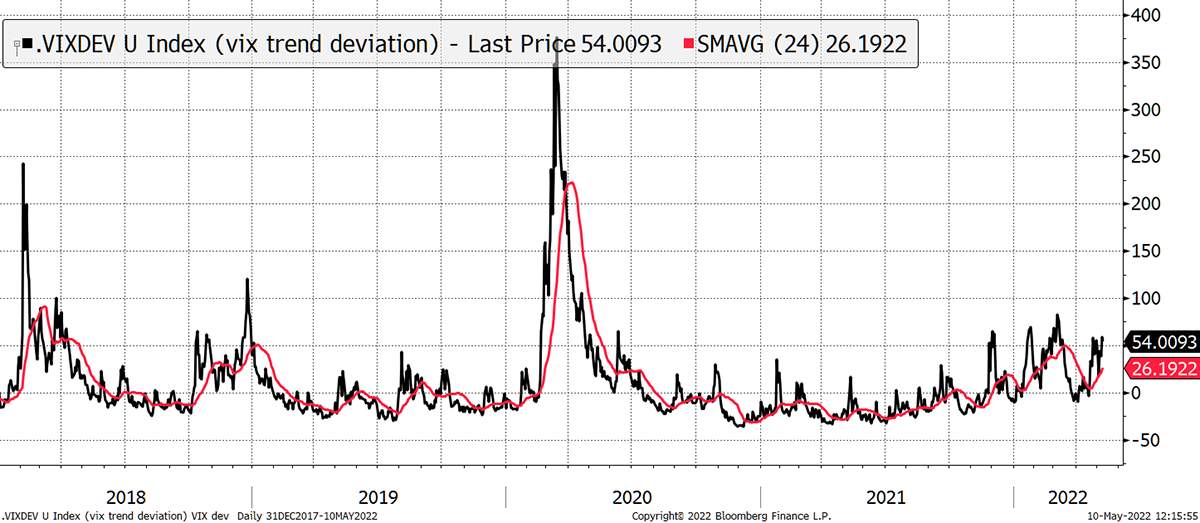

In the old world, the usual market stress indicators, such as the VIX, have woken up.

The VIX trends higher

Source: Bloomberg

The problems of the old world are real. The Federal Reserve is tightening aggressively, and bad things will happen.

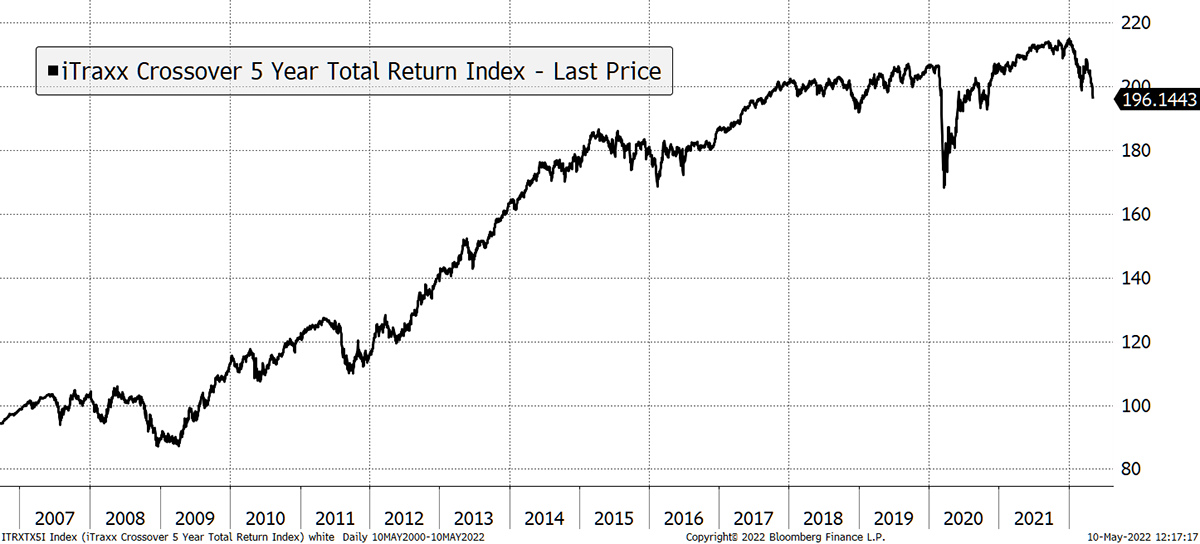

Stress is rising in the multi-trillion-dollar corporate bond market as shown by the iTraxx Index. Every time we have seen this collapse in the past, the Fed have reversed course. Notable examples came in 2008, during the credit crisis, the 2011 Greek debt default and the March 2020 Covid crash.

The problem with corporate bonds falling is that it leads to defaults and job losses in the real world. No one wants that.

Corporate bonds under pressure

Source: Bloomberg

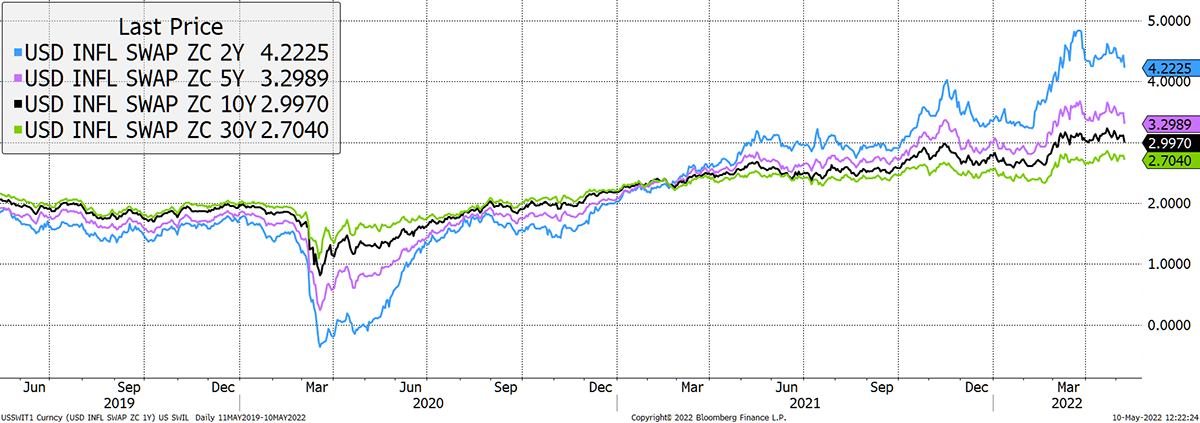

The Fed is fighting inflation, and they might be about to win, at least in the short term. That is to be expected as tightening reduces demand for goods and services in the real economy. The question is how far this goes, and when will they believe they have done enough?

Inflation expectations are now cooling

Source: Bloomberg

It all comes back to the oil price. The world can’t afford high prices for long, so perhaps that will be their signal. It is my belief that in bull markets, you buy the dips.

In the coming years, old world financial markets (equities and bonds) will come under pressure, and the strategy should be to sell the rallies. In contrast, real assets (bitcoin, gold, crypto, commodities, value) are in a bull market and you buy the dips.

It is not obvious yet, but that is how I believe the next few years will play out.

Terra stablecoin breaks the buck

By Charlie Erith

More explosions this week inside the laboratory known as DeFi. UST- the algorithmic stablecoin created by the Luna Foundation – came unstuck, trading as low as US$0.65 on Coinbase yesterday. At the time of writing, the price of a US$ in UST holds just above 90c. This is not what a stablecoin should do.

Source: CoinMarketCap

The UST algorithmic stablecoin has been devised by the South Korean Terra Foundation as an alternative to more conventional stablecoins that are backed by dollars or sovereign grade assets. Algorithmic stablecoins try to retain the peg via a process of minting and burning tokens. When there is too much demand for the stablecoin (which would drive the price higher than US$1), LUNA tokens (the native tokens of Terra) will automatically be “burned” while they will be “minted” if the pressure is in the other direction. The idea is that traders will constantly be incentivised to keep the peg at US$1.00.

One can only speculate whether the fact that the Terra Foundation felt it wise to build up a bitcoin reserve over the last couple of months suggests that they spied an inherent weakness in the algorithm. Just as well that they did because over the last 24 hours, some of that treasury has been released in the form of loans to OTC traders to “shore up the peg”. Clearly, the algo-stablecoin has a weakness when stress-tested, and the breaking of this particular buck is a bloody nose for both Terra and the ambitions of Decentralised Finance more generally.

What are the broader consequences? If confidence isn’t quickly restored, prices might fall further, but there appears to be no systemic risk to crypto here. Anyone familiar with the space will know that crypto is still in a highly experimental stage, and one of the notable features of the space is that it has always recovered from setbacks on its own terms and without government bail-outs. These things happen, and they will continue to happen as crypto searches for decentralised alternatives to traditional financial constructs. It is all part of the learning process, and it will emerge stronger.

Financial regulators will doubtless be taking notes. One imagines that most regulators would see the replication of traditional currencies inside the cryptosphere as something that should be properly overseen by them rather than left to the whims of the private sector. We have sympathy with that position. Properly regulated and properly understood stablecoins would engage rather than antagonise traditional finance.

Bitcoin itself is an innocent party in all this. Earlier in the year, it was boosted by the news that the Terra Foundation would be looking to buy up to US$10 billion. Now, it is suffering as this story unravels. It doesn’t change its properties or its long-term prospects. As discussed elsewhere, our on-chain data suggests a high degree of capitulation at prices lower than our fair value. Once again, bitcoin moves from weak to strong hands. We dust ourselves down and head back into the laboratory.

Summary

The bottom line is that bitcoin is alive and well and has been caught up in the broader mess. The price seems to be underpinned and sits at a key support level. The evidence suggests a bounce is likely, but in the absence of a bullish view for the old world, it is a big call to suggest they will decouple quickly.

That will happen but will take time. ByteTree has turned bullish.