Shepherd's Delight

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 51

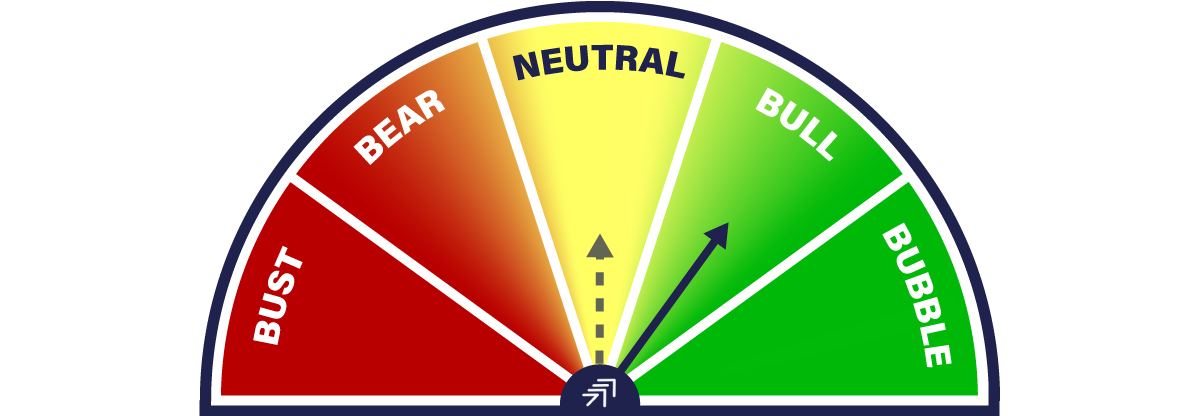

ATOMIC sticks at BULL this week. Price resilience continues. There are few signs of inflation going away, yet already politicians are in giveaway mode. Red skies on the breadth chart - is that good or bad?

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Red skies and a single star |

| On-chain | Consolidation after capitulation |

| Investment Flows | Chugging higher |

| Macro | Rishi’s dishing out |

| Crypto | Old [watch]dog, new tricks |

Technical

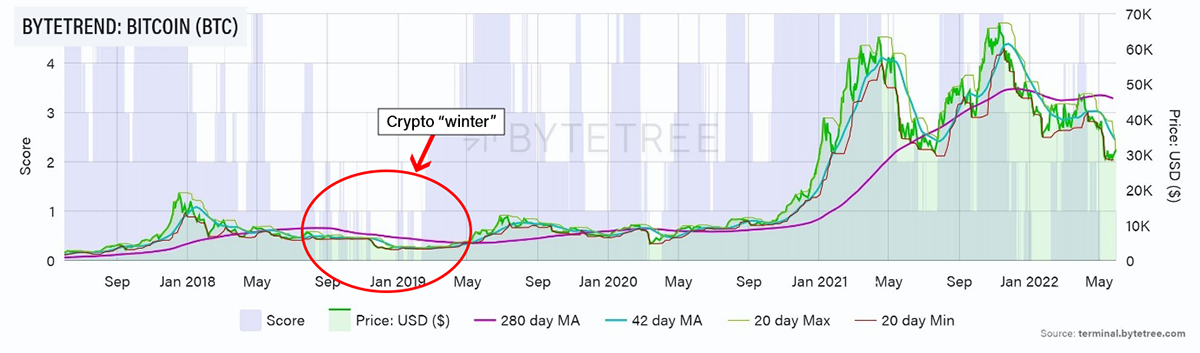

Today we see bitcoin moving to 1 star against the US$ on ByteTrend. You’ve got to start somewhere. It’s rare you get such a long period on zero, like the ones we’ve just had. We have to go back to late 2018/early 2019 to see such a sustained period of grimness, but in hindsight, it wasn’t a bad time to be averaging in. The one good thing about being on zero is that it can’t get worse.

It will take time for the picture to look genuinely robust and for the ByteTrend score to recover. The price has to hit US$34,000 before an intersection with the 42-day moving average, and around US$46,000 before touching the 280-day MA. As ever, expect choppiness.

Source: ByteTree. ByteTrend for Bitcoin (BTC), measured in USD, since May 2017.

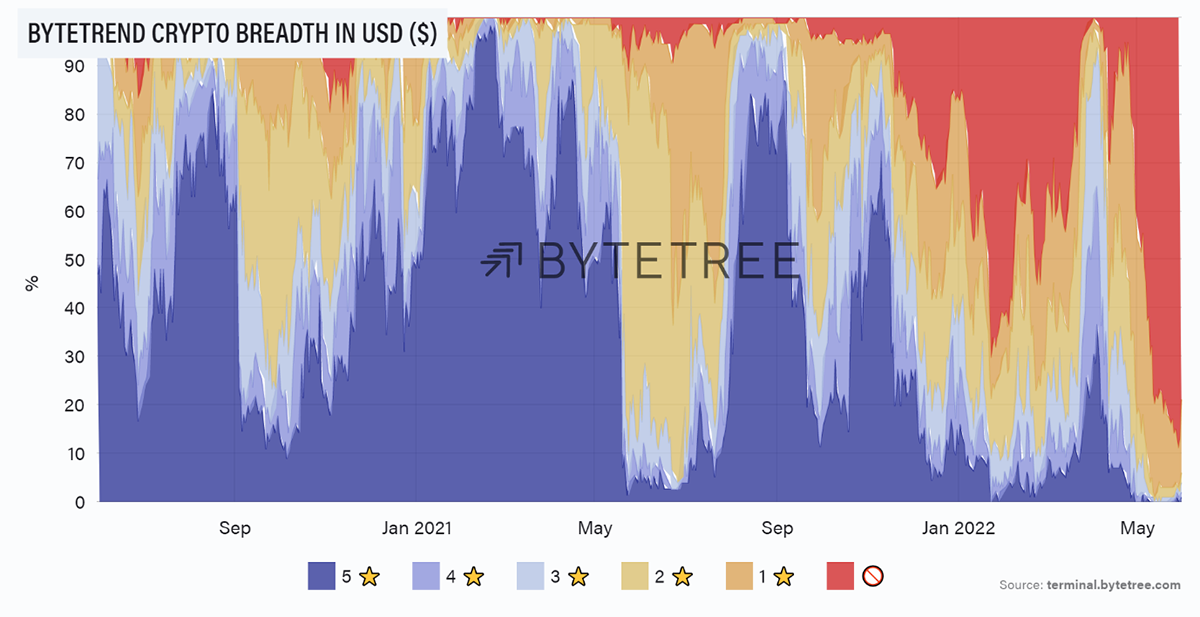

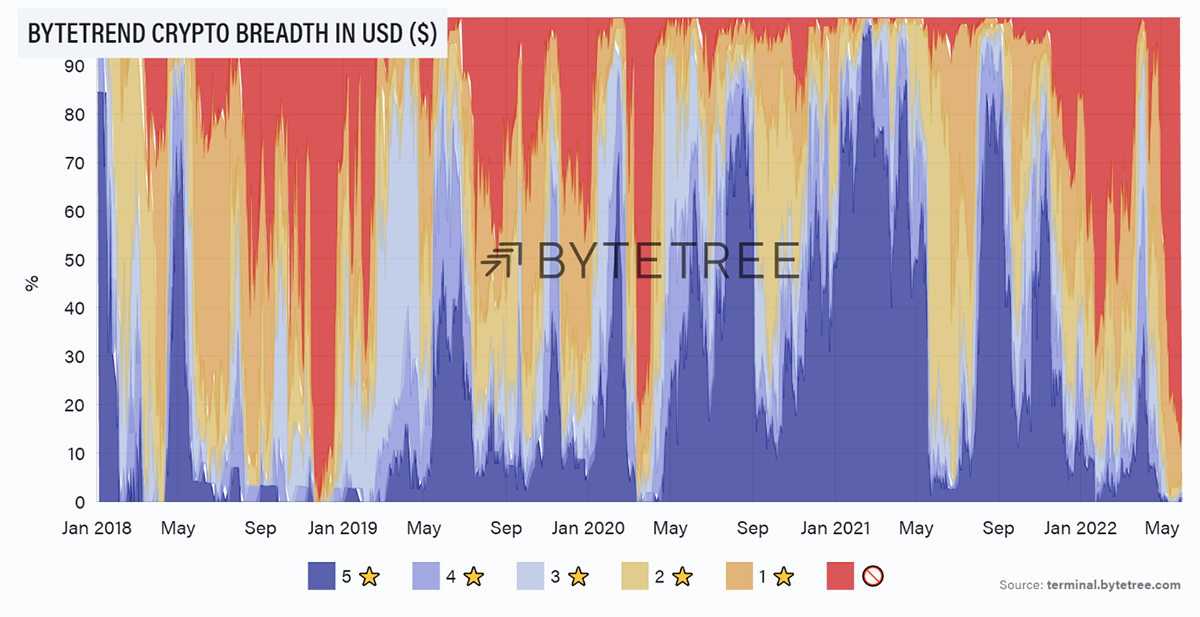

You can now also visualise the state of the crypto market in ByteTrend. A big red sky means that the vast majority of coins and tokens have a score of zero. In other words, the trend is very unfriendly.

Source: ByteTree. ByteTrend crypto breadth chart in USD (%), since May 2020.

Go back further, however, and these periods herald happier times ahead. Red skies at night, shepherd’s delight, as they say.

Source: ByteTree. ByteTrend crypto breadth chart in USD (%), since January 2018.

On-Chain

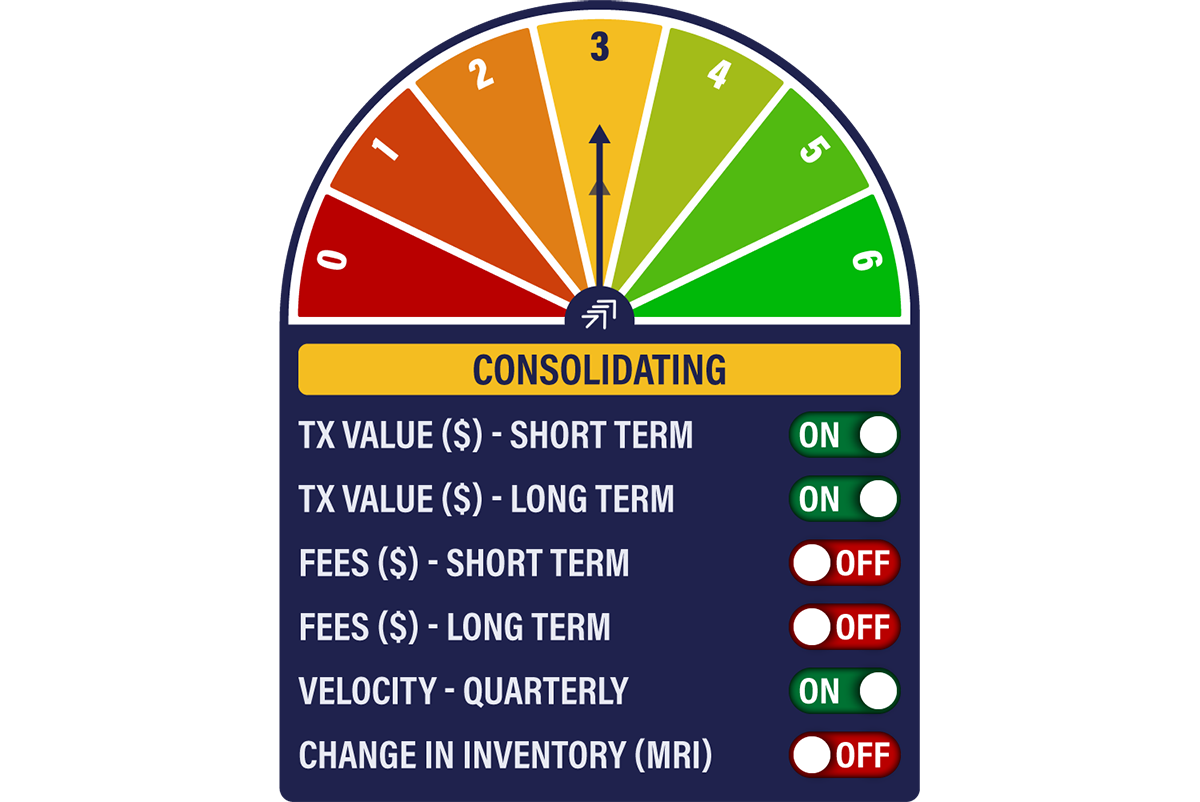

The Network Demand Model remains on 3/6 this week.

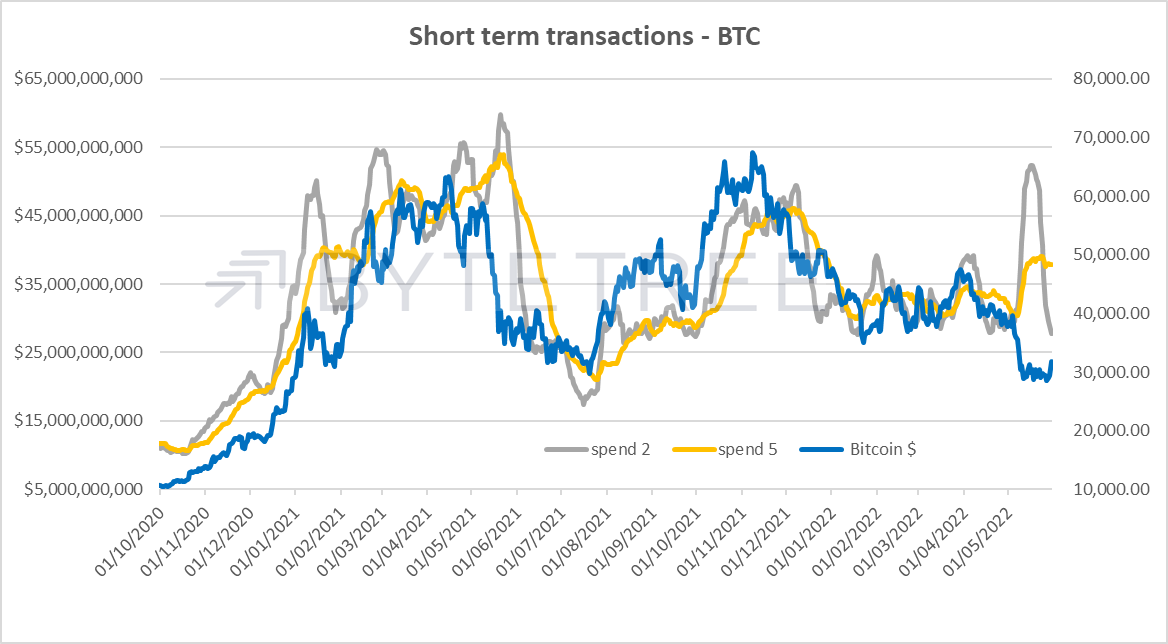

Short-term spend has corrected back to a range following the capitulation activity between 9th and 13th May, when on-chain transactions briefly averaged around US$12.8bn a day, versus a usual average of around US$4bn. This signal is likely to spend some time consolidating unless we see a sharp increase in the bitcoin price.

Source: ByteTree

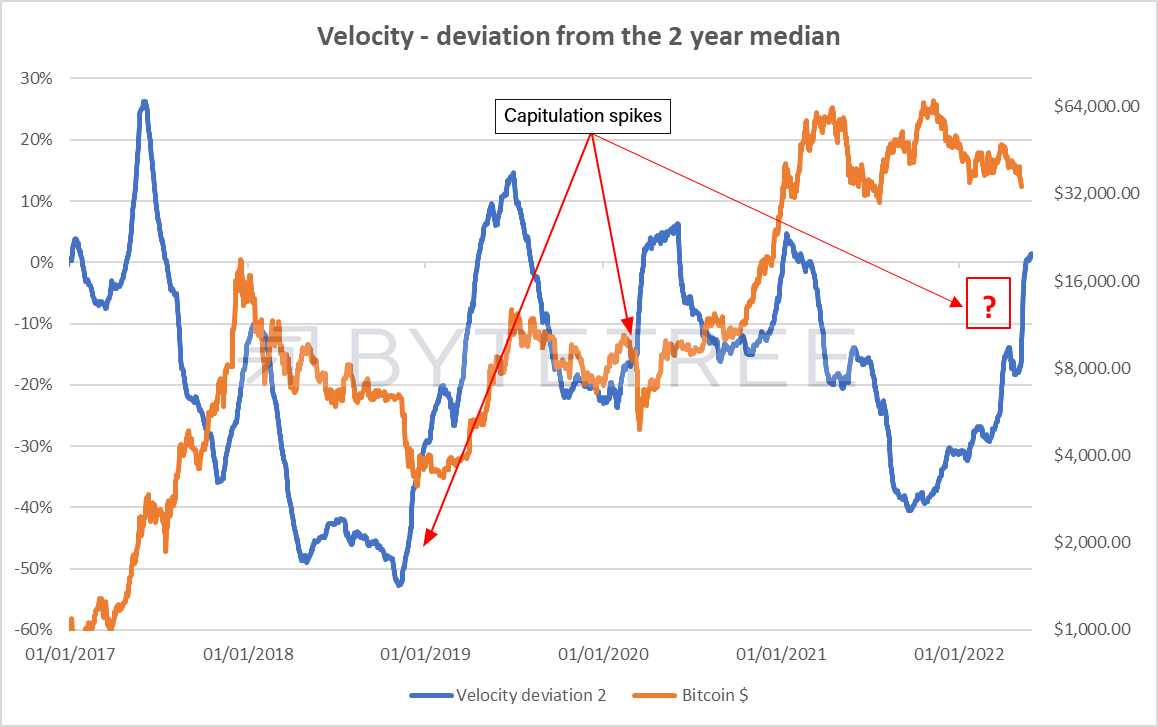

We also see signs of capitulation in the velocity series. Typically a velocity spike signals the bottom of a bear market or the top of a bull run. This is a classic pattern of money moving between weak and strong hands.

Source: ByteTree

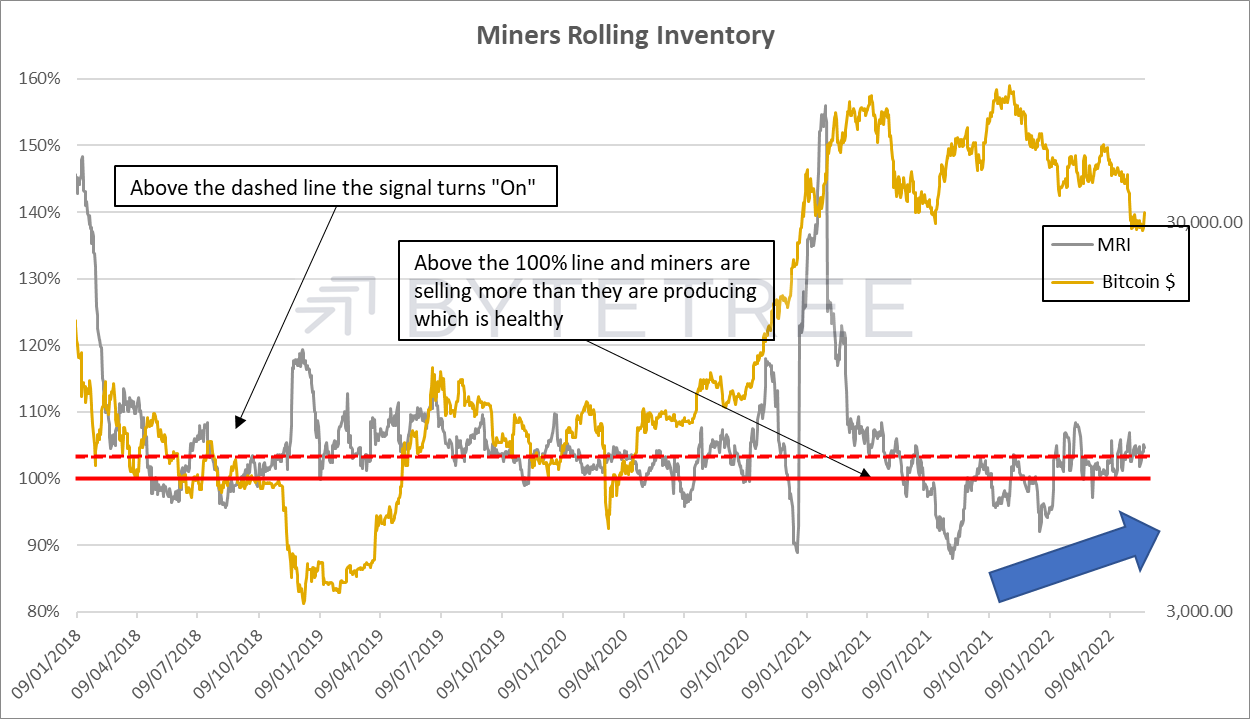

Meanwhile, the miners continue to find a healthy bid for their inventory. All-in-all, the network is much healthier than the mainstream media would have you believe.

Source: ByteTree

Investment Flows

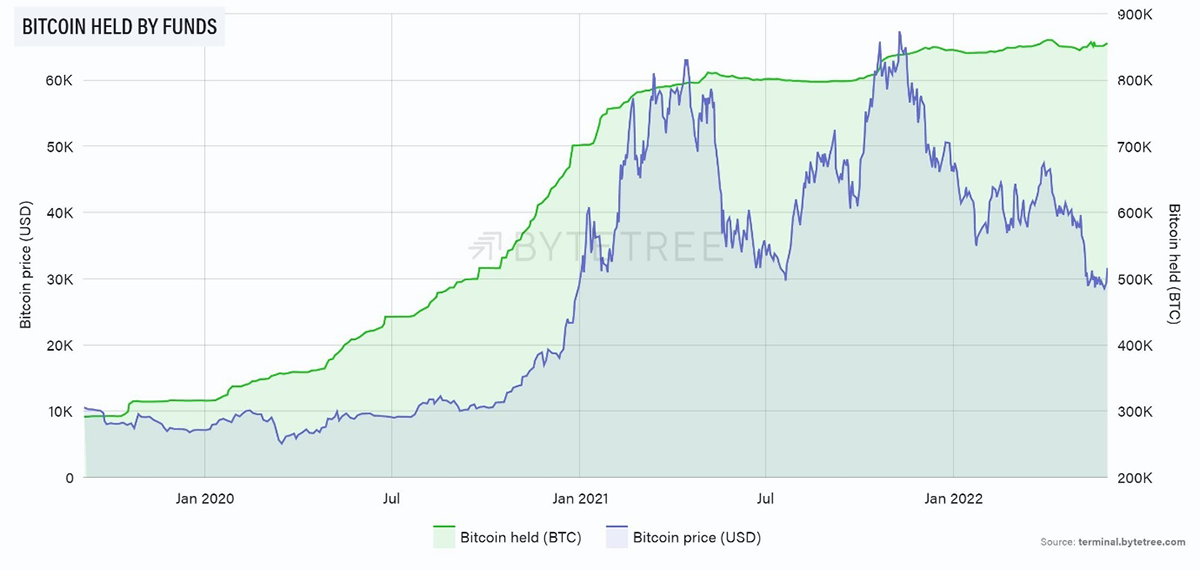

In a typical bear market, you would expect to see fund holdings decline as the price declines. The remarkable thing about this cycle is that fund flows have been agnostic to the price. Useful data for this series only goes back to September 2019, but look at what has happened since in the chart below.

Despite a roller-coaster ride for the bitcoin price, fund holdings have chugged higher. And this is in an environment where a) it has become much easier for people to buy bitcoin directly via an exchange, and b) there haven’t been a huge amount of new funds. Structurally this is bullish.

Source: ByteTree. Bitcoin held by funds (green) and the bitcoin price (blue), since September 2019.

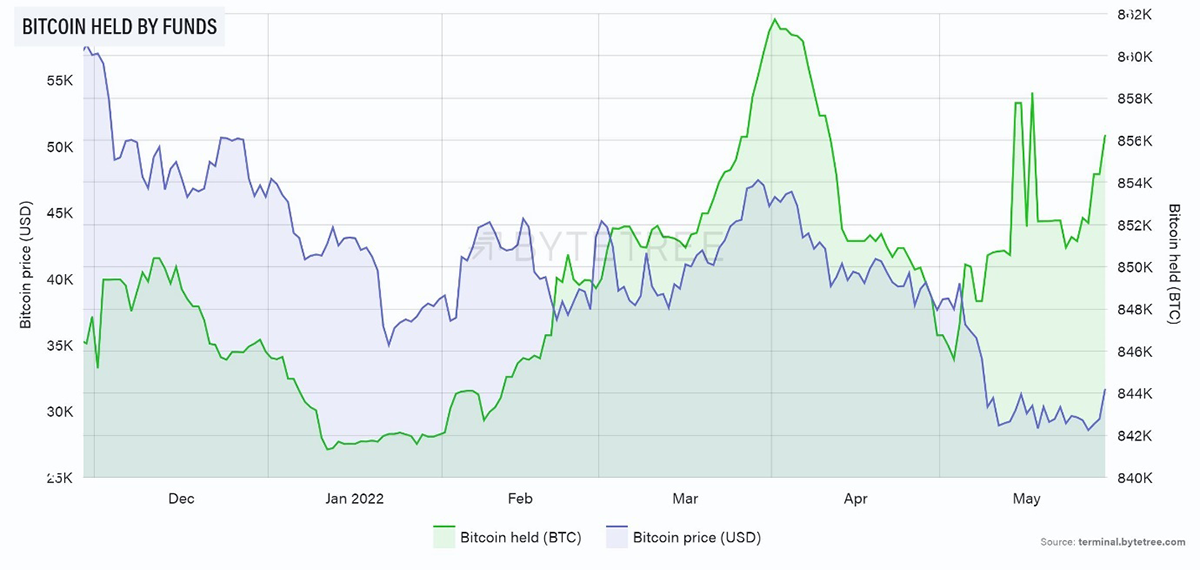

Zooming in, we can see a short-term pattern where positive flows are leading the price. Again, this looks constructive.

Source: ByteTree. Bitcoin held by funds (green) and the bitcoin price (blue), since December 2021.

Macro

Dollar strength has taken a breather, for the time being at least, and in so doing, the foot has come off the windpipe of risk assets. Strikingly, however, there has been no respite in the energy complex. Brent is humming back to US$120 a barrel, while gasoline and other products make new highs.

Higher interest rates are choking off growth but having little effect on the primary driver of inflation, which is energy. If grain can’t be extracted from Ukraine and sent to overseas markets, we have a real problem on our hands. Political unrest is the devil-child of inflation, as we saw back in the Arab Spring of 2010.

At the same time, politicians have fallen at the first hurdle, at least in the UK, and this has ramifications for bitcoin. The government has announced a £15 billion support package to address the cost-of-living crisis. Looked at dispassionately, this is the sort of policy that fans inflation rather than fights it because the government is subsiding consumption of the principal driver of price rises. Will they keep “finding” new money if oil prices continue to rise? If so, where from?

At the same time, the Chancellor has announced a “windfall” tax on energy firms, which aims to raise around £5 billion. Not only is this theft from pensioners and other investors who own shares in these companies, but it also disincentivises the discovery and production of new energy.

The pattern of short-term political expedience at the expense of long-term prudence continues. By avoiding near term problems, larger ones are created further down the line. It will be instructive to see how other central banks respond when they are faced with similar pressures.

It goes without saying that these are fertile grounds for bitcoin. Government largesse and continued political stress are the feedstock of hard assets.

Cryptonomy: Old [watch]dog, new tricks

By: Laura Johansson

In early April, British Chancellor Rishi Sunak announced plans for the UK to become a “global cryptoasset technology hub”. The announcement also included several practical moves to realise this ambition. Stablecoins are to be legalised and recognised as a form of payment, the Royal Mint is minting NFTs to memorialise the move to accept crypto, and the FCA, the UK financial watchdog, hosted a two-day crypto sprint a few weeks ago.

The FCA has been widely criticising crypto for years, which culminated with the banning of selling crypto-derivatives to retail consumersin October 2020. That ban is still in place, but the FCA’s approach to crypto seems to have changed somewhat, undoubtedly forced by the government’s announcement in April. At the recent FT Digital Asset Summit, David Raw, the FCA co-director of consumer and retail policy, even admitted that the FCA has been overly critical of crypto in the past, and is now looking to change their approach.

The crypto sprint in May marked the first time the FCA had actively gathered views from crypto experts in the private sector. Around 100 participants from various sectors and key representatives of the FCA and HM Treasury came together to collaborate on future regulation of cryptoassets. We will undoubtedly learn more about the outcome of the crypto sprint over the coming months, but a recent article from CoinDeskhints at it being a positive one.

Michael Johnson, the head of compliance at Zumo and an attendee at the sprint, said:

“I think the way that the FCA has engaged with the industry at this early stage is a great thing, because it's a sign that they're listening so hopefully we can actually get regulations that fit the industry”

A spokesperson from the FCA agreed:

“It was striking that the general view on future regulation for the crypto market matches ours, with consumer protection and market integrity key to providing confidence in this evolving sector.”

How much of the advice gathered from the private sector will actually result in policy is unclear, but at least the FCA is willing to listen. It’s an ongoing discussion but a very welcome one.

Summary

It's hard not to feel upbeat about bitcoin when looking at the resilience of the network and the steadfastness of fund holdings, let alone the perilous state of the macro environment. With plenty of evidence that we've had a capitulation event, and with sensible regulation no longer a pipedream, we remain bulls.

Comments ()