Not in the Dog House This Time

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 45

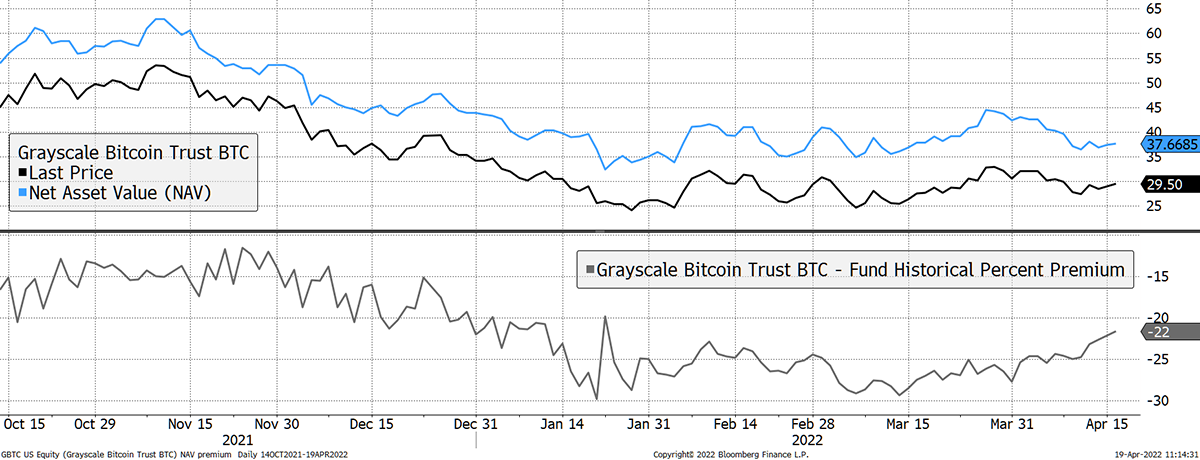

I showed GBTC last week with the discount narrowing to 25%. Well, it’s now 22%, which is notable. For whatever reason, GBTC has found a bid.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Avoided the worst |

| On-chain | Contracting |

| Investment Flows | GBTC narrows |

| Macro | Dollar strength persists |

| Crypto | MacD goes NFT |

Technical

Having collapsed from 66/75 two weeks ago, the ByteTrend star count for the top 15 tokens recovered to 39/75. This comes as a relief, but we should be aware that this is going to be a rocky ride.

If all 15 coins had a 5-star trend, that would be 75 stars, which would reflect the max bullish technical conditions.

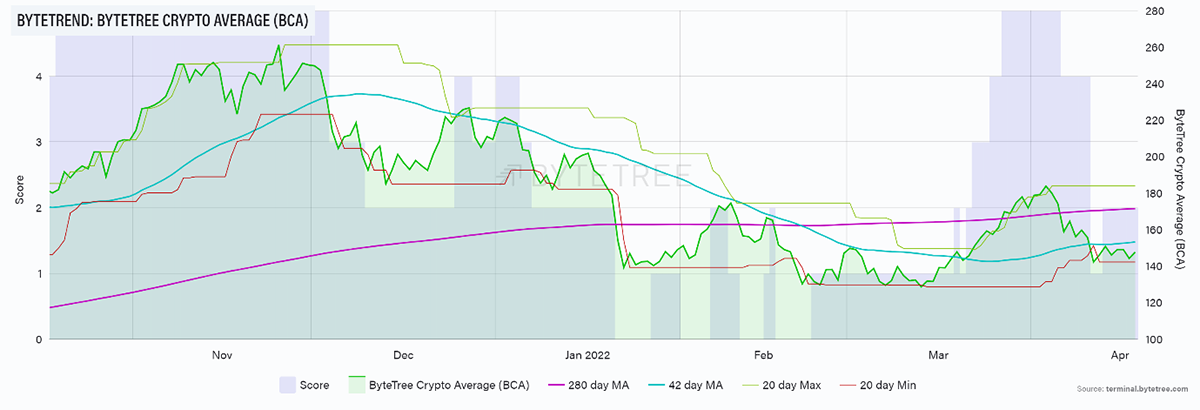

The rally in March was looking so promising – and it may return. We should be grateful that the long-term moving average is still rising.

ByteTree Crypto Average (BCA) holds 2/5

Source: ByteTrend. ByteTree Crypto Average (BCA) over the past 6 months.

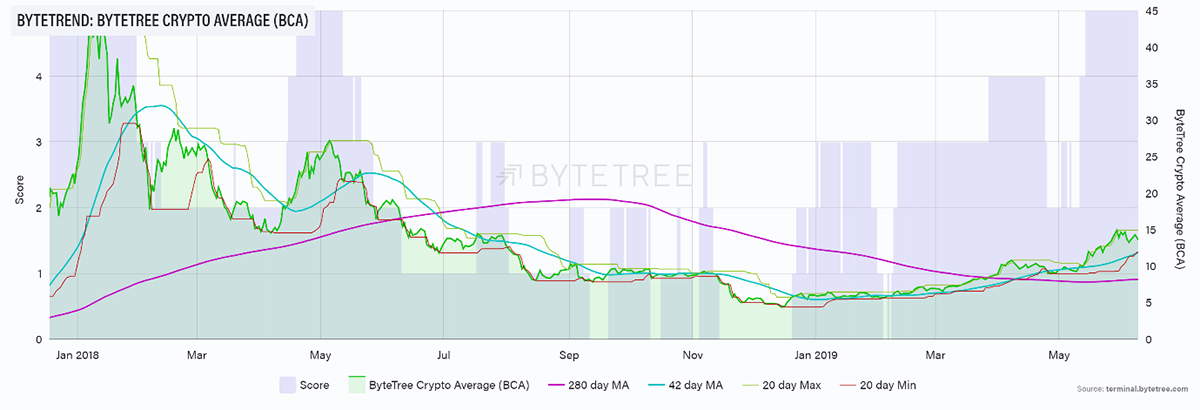

The situation today is stronger than it was back in 2018, shown below. When the BCA fell below the long-term trend back then, it quickly collapsed, making a low around six months later. This time, things are moving more slowly, which is a positive sign.

BCA in the 2018 bear market

Source: ByteTrend. ByteTree Crypto Average (BCA) since January 2018.

The BCA held a low score from June 2018 until the year-end. It was right to wait as the intermittent destruction was brutal, while the opportunities at the end were fantastical.

I believe that in this cycle, crypto proves to be more resilient than in times past, but seeing stocks like Tesla (TSLA) still trade above $1,000 scares the living daylights out of me, as it reminds us how much downside financial markets still have.

Crypto and Tesla are both tech bets, which is great. The difference is that TSLA is the fourth-largest constituent in the S&P 500, which means all traditional investors already own it. As stock markets come under pressure, they will more likely be sellers than buyers.

Yet, they have no crypto to sell as mainstream institutions still don’t own much, if any at all. With bitcoin showing less volatility and more liquidity this cycle than ever before, and with rapidly evolving use cases, you’d think having fewer flaky sellers will prove to be an advantage.

ByteTree believes that crypto > stocks in the next down cycle, but we will allow the evidence to shape our thoughts.

On-chain

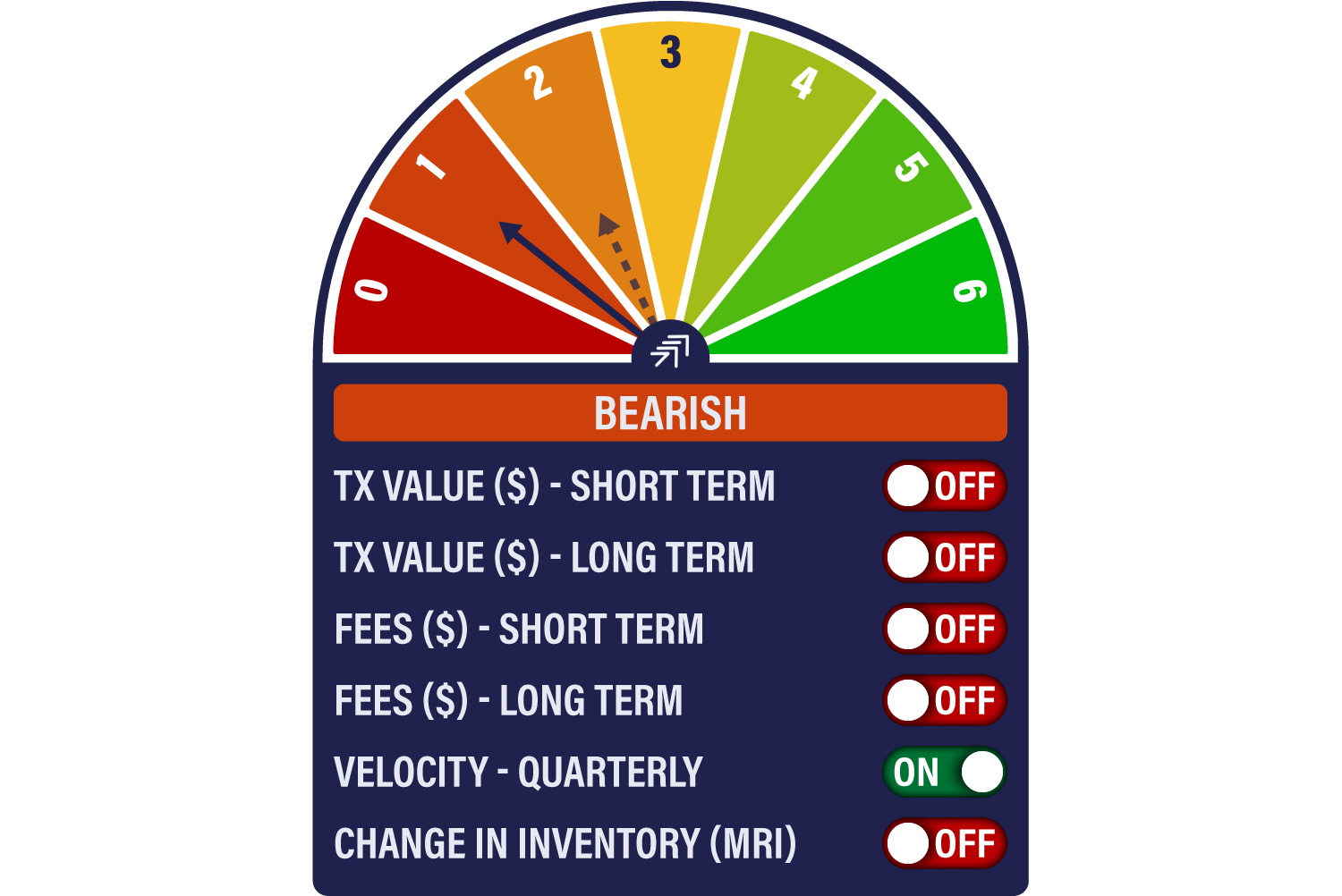

The Network Demand Model score declines to 1/6 as the short-term transaction signal once again turns off. The other 5 signals have been mainly off since June 2021.

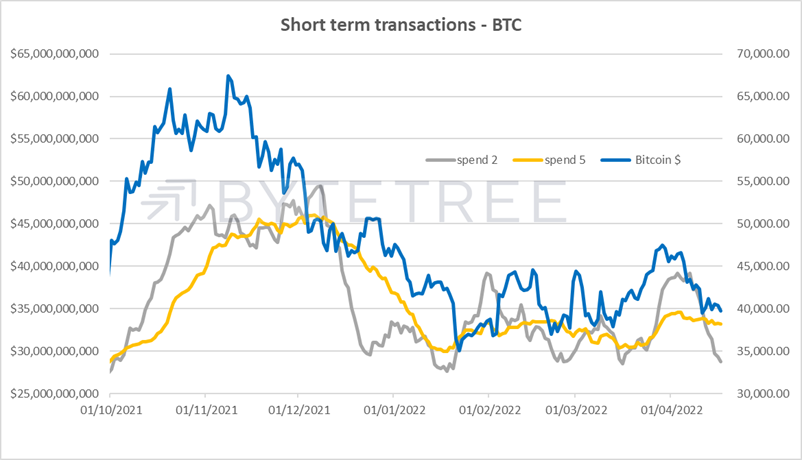

Short-term transactions have fallen sharply, as shown on the grey line below.

Source: ByteTree

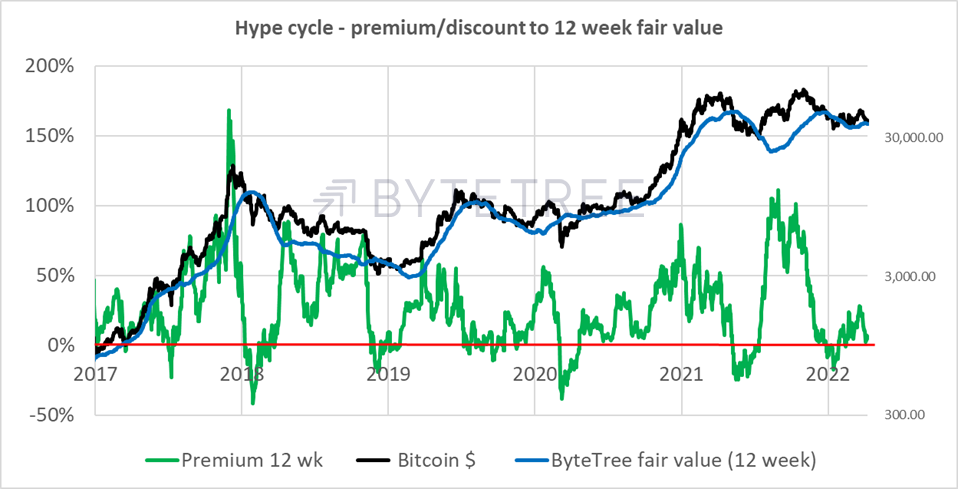

The ByteTree fair value shows the price is now trading at around fair value. Two weeks ago, it was at a 28% premium before correcting.

Source: ByteTree

Investment flows

The ETFs were reasonably stable last week, but there were two bank holidays in Europe which would have reduced activity.

I showed GBTC last week with the discount narrowing to 25%. Well, it’s now 22%, which is notable. For whatever reason, GBTC has found a bid.

Grayscale Bitcoin Trust (GBTC) finds a bid

Source: Bloomberg

Macro

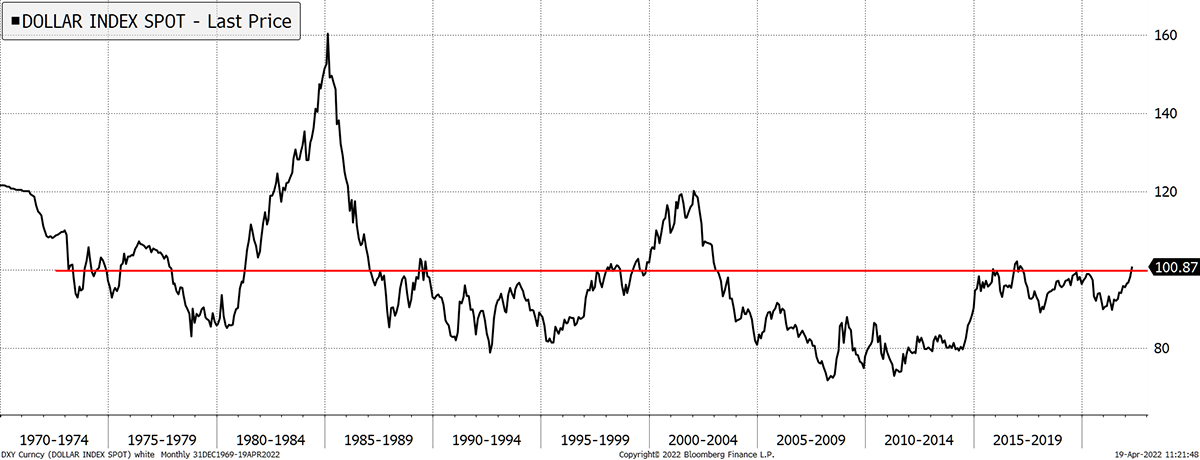

The dollar keeps on strengthening. I show it here since 1970 with the 100 level in red. These strong dollar periods have always been painful for financial markets, so we all look forward to this rally coming to an end.

Dollar wants to stay above 100

Source: Bloomberg

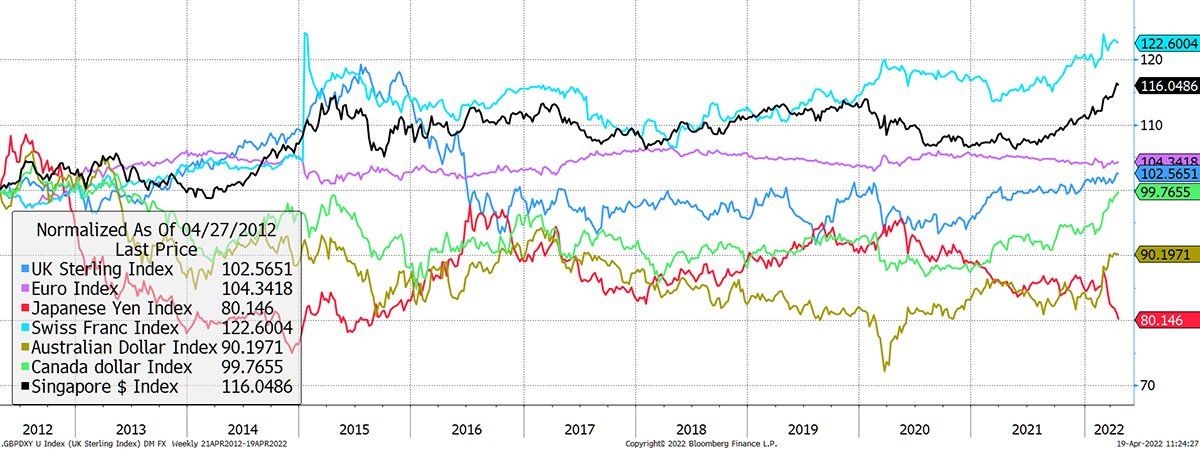

What makes the dollar so strong? US rates are expected to rise quickly compared to others, but some currencies give way faster than others. I show the major currencies against the DXY over the past decade. The Swiss Franc and Singapore Dollars have been the strongest, with the Yen and Aussie the weakest.

Strong Swissie, weak Yen

Source: Bloomberg

The pound, euro and Canadian dollar are all neutral over the past decade. Reality can be very different from perception!

Cryptonomy: MacD goes NFT

- by Laura Johansson

Big names are catching on to the prospects of the Metaverse, NFTs and Web3, and it’s no secret that the race for the future of business is on. Viewed as the next version of the internet, the metaverse market reached 38.85bn USD in 2021 and is predicted to reach a staggering 678.8bn USD by 2030.

We already have technology-focused names like Meta, Microsoft, Google and Apple (unsurprisingly) on board, but other industries are also seeing the potential. In February, McDonalds filed for ten US trademark applications that would cover virtual restaurants, goods, concerts, and events. As this Inc article quite helpfully pointed out, to register new trademarks in the US, the business must evidence the use of them within four years of the application. So, could it be that we will be enjoying a Happy Meal™ in the metaverse by 2024?

There was another win for the metaverse last week as Epic Games secured an additional $2 billionin funding from Sony and KIRKBI, the investment company behind The LEGO Group. Epic Games is the developer behind Fortnite, one of the most popular online multiplayer games, which already has an in-game currency that can be used to buy skins and other player upgrades. In essence, they have an ideal setup for decentralised tokens and NFTs, which the new injection of funding will help realise in the near future.

The development of the metaverse is advancing at the speed of light, which is exciting for crypto and blockchain technology on many fronts. We reached over 300 million crypto users globally in 2021, and I can only see that number go one way.

Summary

Crypto is neither in the limelight nor the doghouse. For the time being, other events have become more important, and so crypto simply has to wait for its moment to return.