I Blame the Macro

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 44

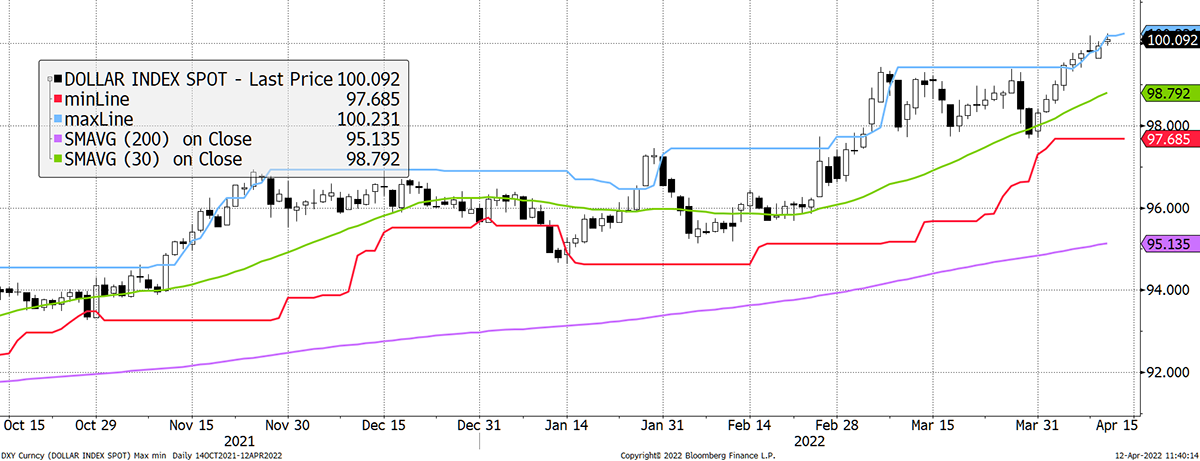

The dollar rally is the problem. It started at the beginning of April, which stalled the bitcoin rally. A 2% rise in the dollar index has translated into a 17% bitcoin correction. Ouch.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Slump |

| On-chain | Stable |

| Investment Flows | Damn tourists |

| Macro | NASDAQ crash |

| Crypto | The bigger picture |

Technical

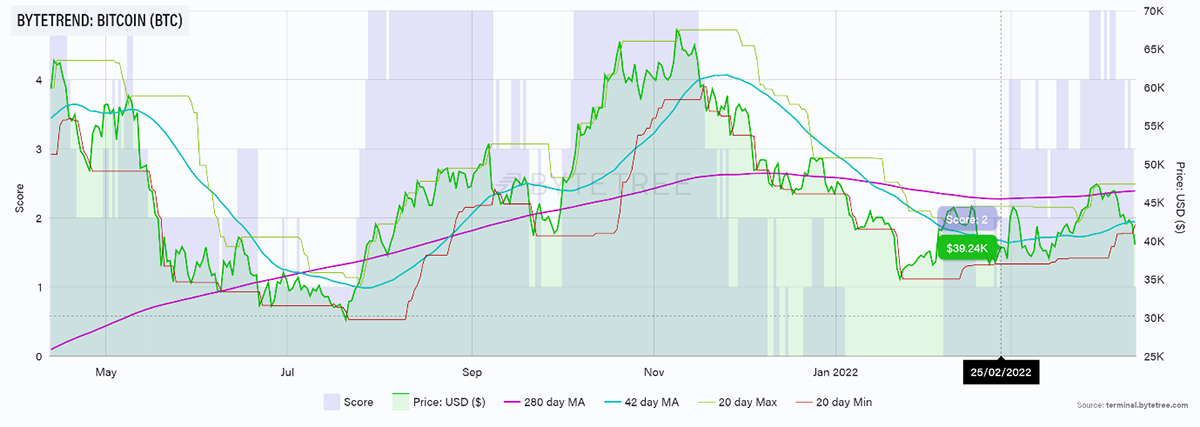

What a week. The ByteTrend star count for the top 15 tokens has collapsed from 66/75 to 21. This is savage and is warning us to be prepared for worse to come.

If all 15 coins had a 5-star trend, that would be 75 stars, which would reflect the max bullish technical conditions.

Bitcoin slumps to 1/5

Source: ByteTrend. BTC on ByteTrend, measured in USD, over the past year.

The market is the market. It is not right or wrong; simply the market. It has weakened, and we should listen to the message. I don’t like that one bit, but this downgrade of trends across the board cannot be ignored. I won’t show you lots of crypto charts because they are depressing, but we’ll head straight to the source of the problem.

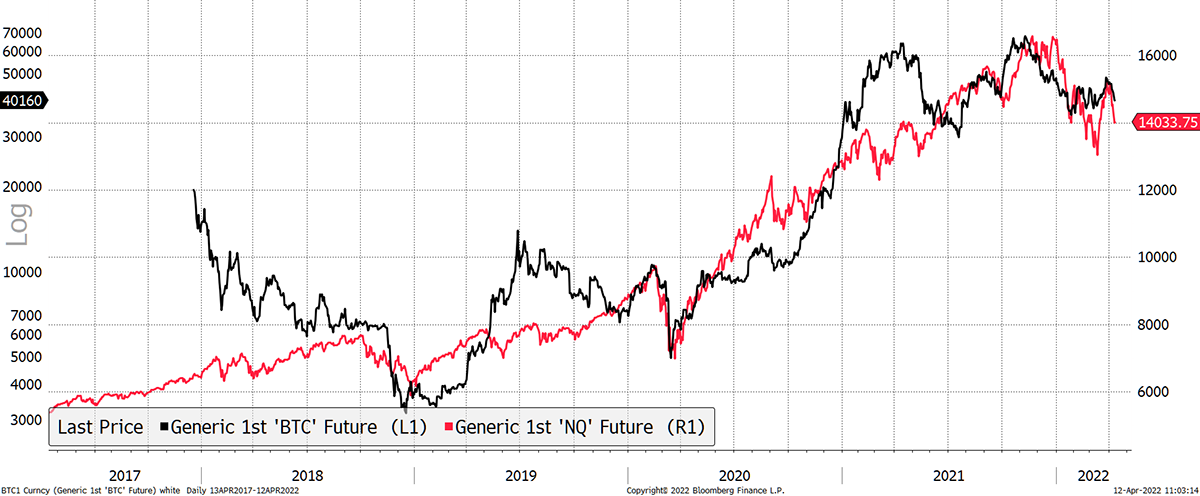

It all comes from the panic that is building up in financial assets. As you know, bitcoin has always been correlated to stocks, especially tech. This chart (minor chart crime, so be aware of the axes) shows you how much more aligned bitcoin has become to the NASDAQ in terms of asset maturity.

Blame the NASDAQ

Source: Bloomberg

To move on from chart crimes, this shows bitcoin relative to the NASDAQ (BTC in NASDAQ in crypto speak). I use futures to align timing (exchange hours etc.). Bitcoin traded in a range from mid-2018 to mid-2020. Then there was a revaluation in late 2020 before a new range resumed.

Waiting for a new Bitcoin and NASDAQ range

Source: Bloomberg

It is my thesis that as the NASDAQ disappoints over the next few years, bitcoin will climb to a new range, although we might have to wait until halving in 2024. In any event, it is unlikely that the bitcoin bear markets will be materially worse than the NASDAQ bear markets in the future.

Zooming in on the above chart and overlaying ByteTrend, our 5/5 didn’t last for long. It’s not over; just a setback. Should bitcoin show stability in the face of a NASDAQ decline, this chart will hold a higher score, and institutional investors will pile in. That’ll trigger an upgrade back to a bull market.

Bitcoin in NASDAQ slumps to 1/5

Source: Bloomberg

Finally, bitcoin is oversold relative to its 30-day moving average. Not massively so, but enough to realise the best chance to sell is already behind us, and a bounce becomes more likely.

Bitcoin is oversold

Source: Bloomberg

Overall, it’s not great, but the external macro factors are driving this.

On-chain

Given the circumstances, the chain is stable. While there are no horror stories on the bitcoin blockchain, the miners are selling, and that’s unhelpful. It means more supply, and so the stock to flow ratio just shrank a little.

Source: ByteTree. Miner inventory (BTC) over the past year.

Investment flows

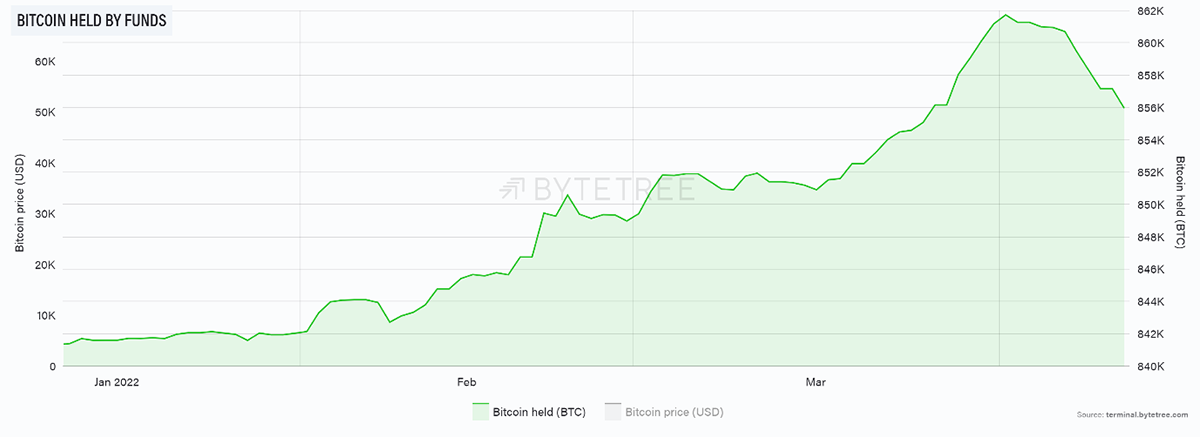

It pains me to see money leave the bitcoin funds, but it is. Of the 20,000 BTC acquired by funds since February, 6,000 BTC have subsequently left. Let’s hope this eases.

Source: ByteTree. Bitcoin ETF flows, year to date.

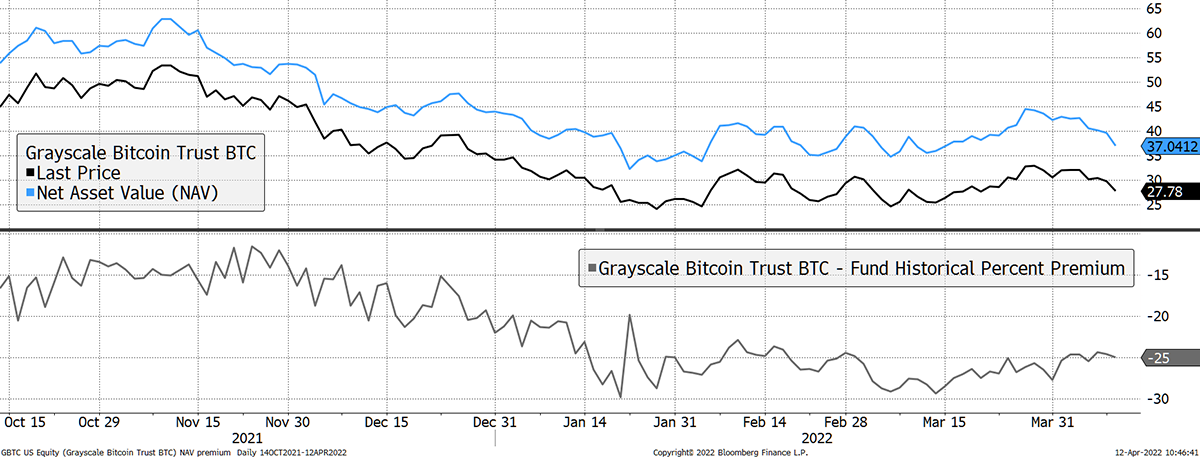

It is encouraging to see Grayscale’s (GBTC) discount holding around 25%. See the late 2021 slump from 15% to 30%? It’s not yet happening, which is nice.

Source: Bloomberg

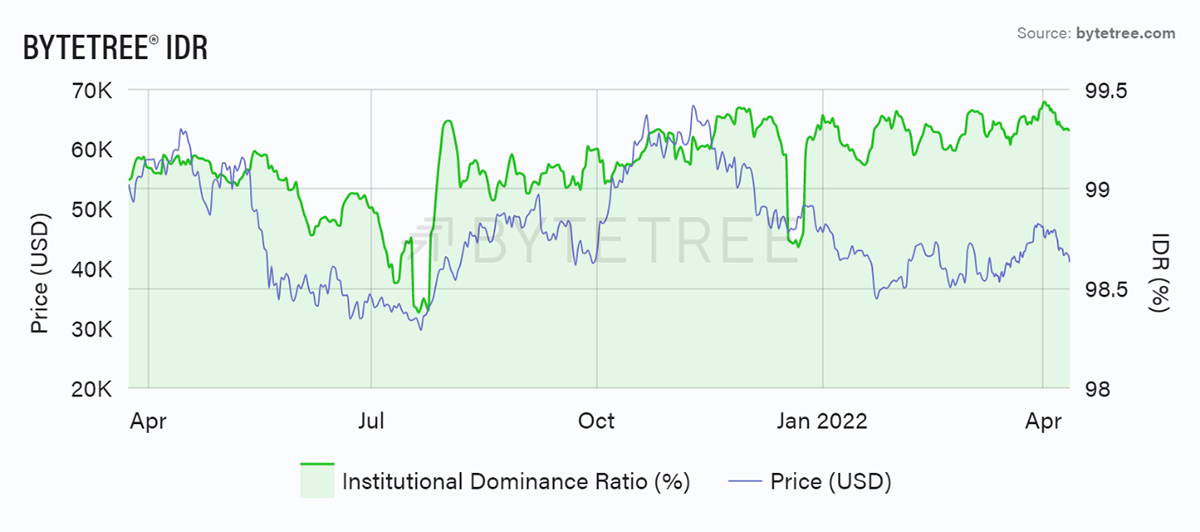

Back to the chain, this is mirrored by our IDR, which measures the dominance of high-value transactions that we deem to be institutional traffic. It holds a healthy level above 99%. Once again, blame the macro, not the chain.

Source: ByteTree. The Institutional Dominance Ratio (%) and BTC price (USD) over the past year.

Macro

The dollar rally is the problem. It started at the beginning of April, which stalled the bitcoin rally. A 2% rise in the dollar index has translated into a 17% bitcoin correction. Ouch.

Blame the dollar

Source: Bloomberg

This is macro. It’s Fed tightening, risk-off and so on.

But thinking about where the dollar is on a longer-term basis, it’s quite overbought compared to its 200-day moving average. Admittedly it’s not 2008 or 2015, but we’ll probably end up there as this risk-off period ends with a shock.

The dollar is overbought

Source: Bloomberg

Historically, these dollar rallies have quickly reversed with intervention from the authorities. That will happen at some point, and that 17% decline will reverse in a heartbeat.

Cryptonomy

The bigger picture - by Laura Johansson

It was this time a year ago when Bitcoin was building up to that new high on 16 April. Coinbase had just revealed that their Q1 2021 earnings ($1.8bn) exceeded their total 2020 revenue ($1.3bn), and, of course, we had the highly anticipated Coinbase IPO on the NASDAQ to look forward to a few days later. Undeniably, there was a new energy in the market that not even Turkey banning crypto could quench. And no, I don’t have an amazing memory; I just never clear out my inbox.

The markets look somewhat different this year, and so do the headlines. On the latter, I am not just referring to the price analysis articles but also these from the past week:

• Two New Territories Are Adopting Bitcoin

• New York Senate Authorizes NYDFS to 'Assess' Crypto Companies

• Roman Coppola's Decentralized Pictures Is Shaking Up the Film Industry with Crypto

It’s easy to lose sight of the bigger picture during market corrections. Still, the truth is that the narrative around crypto, and Bitcoin in particular, has dramatically changed over the past year. It’s less hype and more tangible. With the UK’s adoption of stablecoins, Biden’s executive order on crypto, and the EU’s (somewhat controversial) draft proposals to legalise crypto, the wheels have been set in motion for the next phase in the crypto [r]evolution.

Last week, Politico reported that the FTX Digital Markets Co-CEO Ryan Salame had launched a new political action committee (PAC) to support “forward-looking Republican candidates who want to protect America’s long-term economic and national security”. The Democrats also have crypto-linked PACs, including support from FTX Co-Founder and CEO Sam Bankman-Fried. However, in a recent newsletter from Decrypt, a democrat candidate and former Yearn Finance developer Matt West confessed that he couldn’t use crypto as the primary talking point for his campaign at the risk of getting branded as “crypto crazy”.

Clearly, there is still some work to be done, but crypto firmly entering the global political scene is definite progress. I look forward to scrolling through my inbox again in a year’s time.

Summary

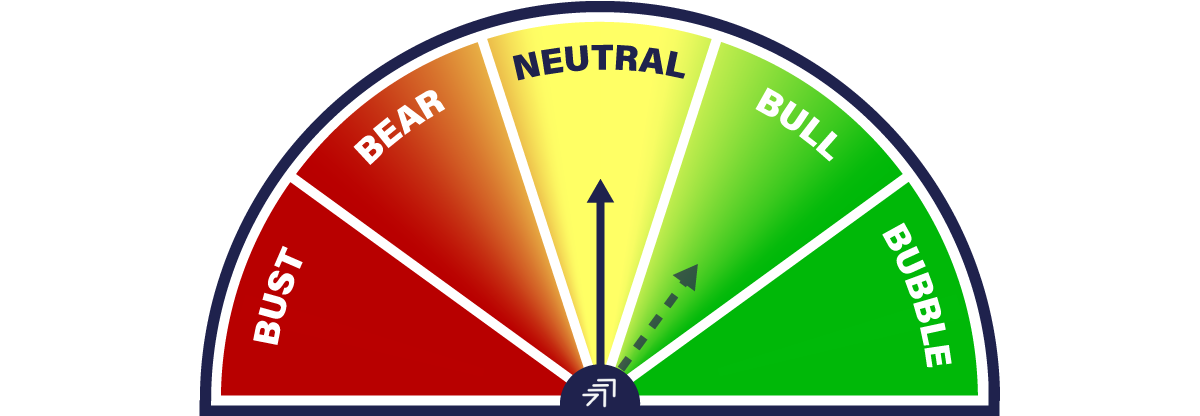

On this occasion, I am uncomfortable downgrading the dial from bull to neutral, but given I believe the NASDAQ will collapse and bitcoin is seemingly related, it is the right thing to do. It means to carry on HODLing, but rein in the leverage.

Tomorrow I’ll cover ByteFolio. NEAR held up well!