A Strong Dollar, but Even Stronger Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 43

The only time we have seen net positive flows was around the launch of the Proshares Bitcoin Futures ETF (BITO). This rally was rational, as had the SEC allowed bitcoin ETFs, we might have seen a period of sustained net demand. We didn’t, and so the green blob was short-lived.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Strong |

| On-chain | Difficulty rises |

| Investment Flows | No green blob yet |

| Macro | A strong dollar by default |

| Crypto | Not your keys, not your coins |

Technical

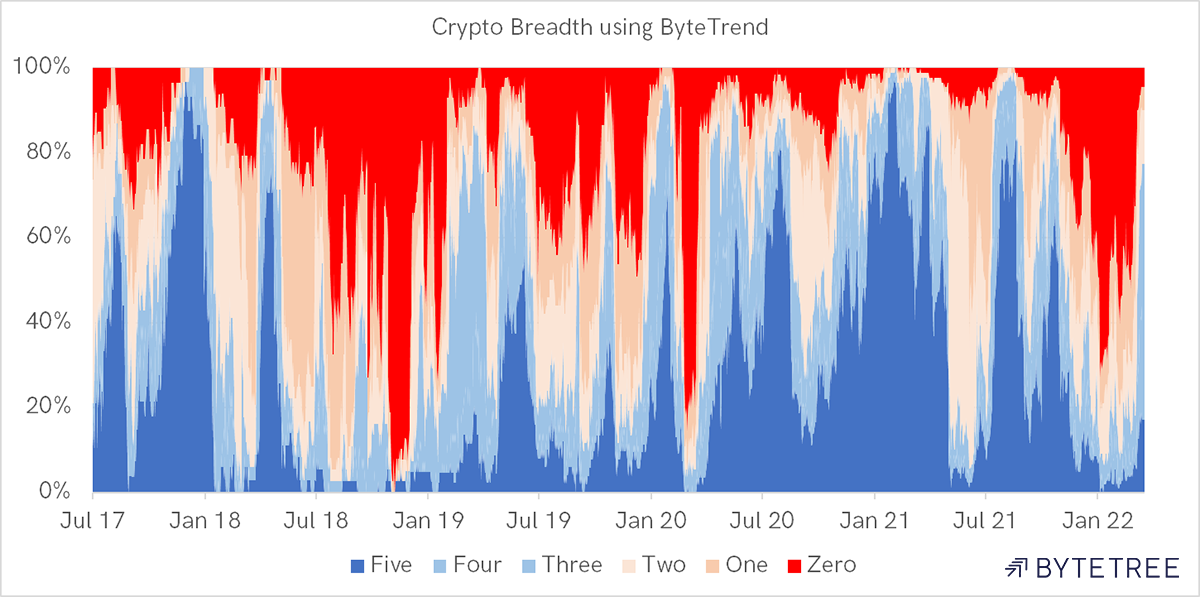

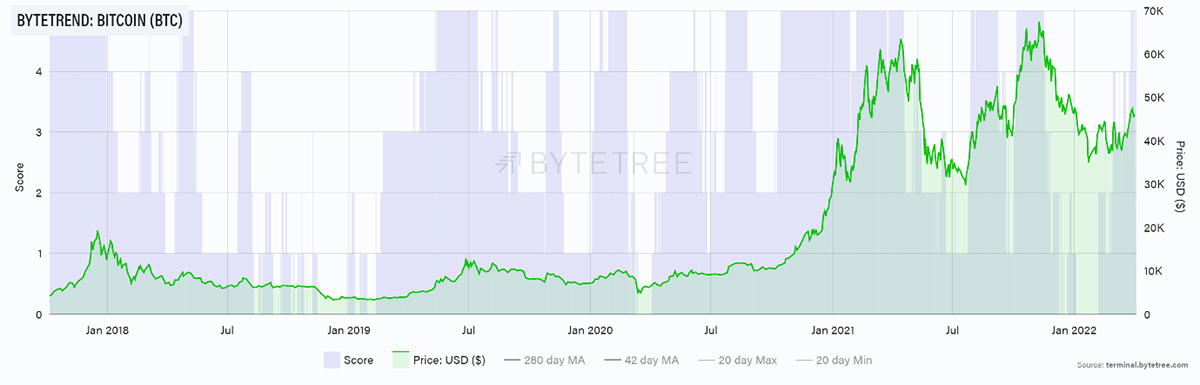

The ByteTrend star count for the top 15 tokens is now 66/75, and the early version of the historical chart is ready.

If all 15 coins had a 5-star trend, that would be 75 stars, which would reflect the max bullish technical conditions.

Source: ByteTree.

In the breadth chart, blue is strength and red danger. Starting in mid-2017, the bull market showed blue, which ebbed away in early 2018. The spring 2018 bear rally came through strongly, as most 280-day moving averages were still upwards sloping. Yet as they ebb, the sky turns red in the second half of 2018.

This red sky retreats in early 2019 in time for the rally, only to return in the autumn. Then comes the covid crash in March 2020, which is followed by a year of blue skies. The China mining ban in April 2021 didn’t even look that bad, as like in 2018, many 280-day moving averages were typically still positive. Strength came quickly in July last year, followed by the third darkest red sky in five years, which has recently retreated.

Source: ByteTree. ByteTrend for Bitcoin (BTC) since January 2016.

This is a complex and fast-moving space, and we are building things that make sense of it. The colourful chart above is a visualisation of a complex system. To my mind, it helps to separate the signal from the noise.

Crypto will always see harsh down days. But when the breadth is strong, it is rational to worry about price declines much less than when it is red. I tend to think of breadth as the prevailing winds that will return when there’s breadth and won’t when there isn’t.

You all know how obsessed I am with this chart: BTC in S&P. In the past, I have used NASDAQ, but you can tell I’m getting cocky by upgrading the challenge to the S&P. Quite simply, if bitcoin can beat the S&P, especially during choppy markets, then expect a flood of money to flow into the network. My bull case is bitcoin resilience in the face of an equity bear.

Bitcoin relative to the S&P 500 holds 5/5

Source: Bloomberg.

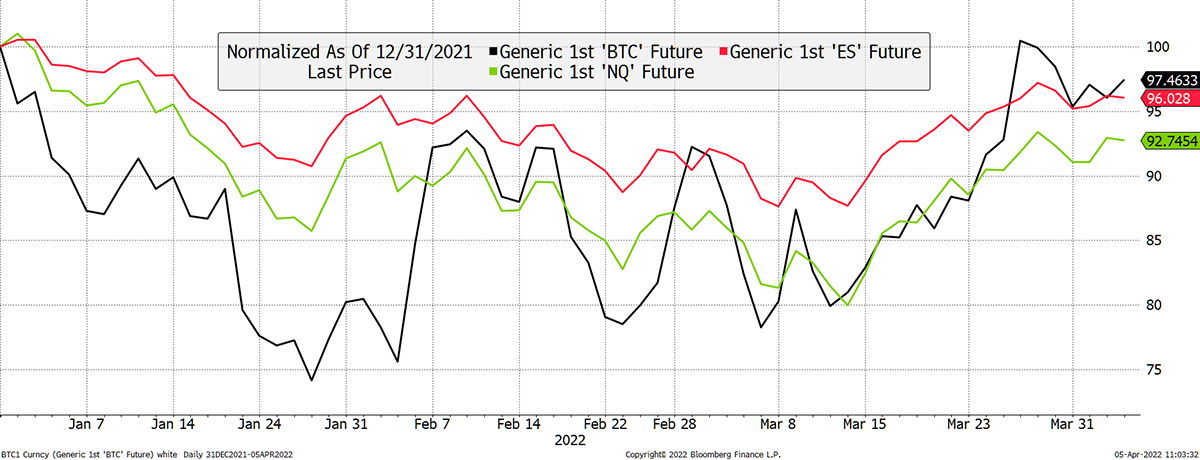

Just to remind you what bitcoin (BTC future) looks like against the S&P 500 (ES future) and the NASDAQ (NQ future) this year. They have more in common than ever before.

Source: Bloomberg.

On-chain

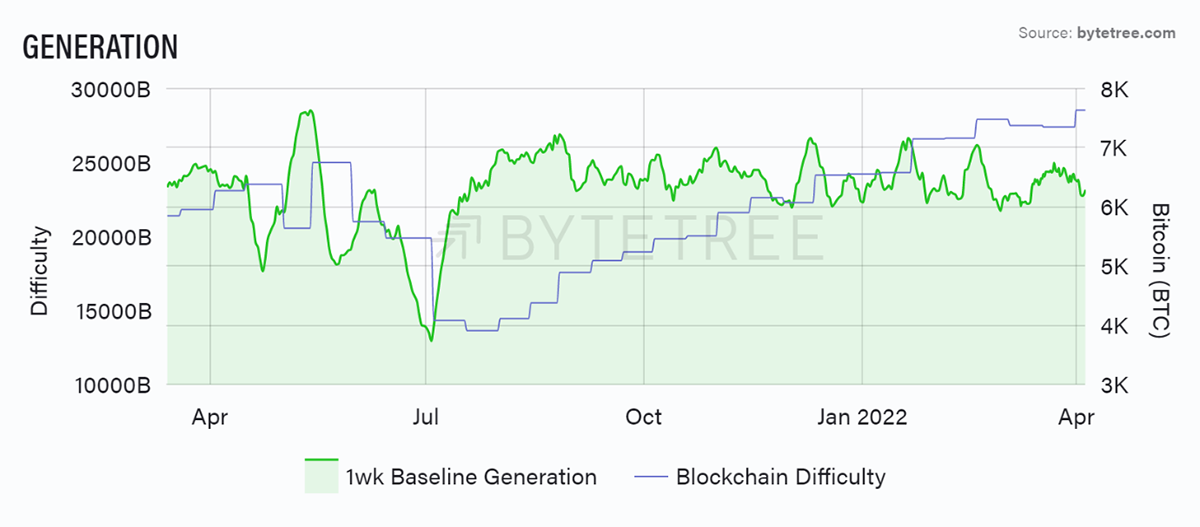

While not shooting the lights out, the blockchain is performing well, and is stable.

Of note has been the increase in mining difficulty to another all-time high. This makes bitcoin increasingly energy-intensive. Some will tell you that it enhances value as the energy is “embedded” in bitcoin’s value. Others see it as a total waste and make bitcoin a target for criticism.

Source: ByteTree. Bitcoin Generation and Blockchain Difficulty over the past year.

I don’t believe bitcoin stores energy and turns it into intrinsic value (Michael Saylor’s view). But I do buy into the idea that it is a useful way of storing the financial value from excess energy production. If we are talking about burn-off gas or excess wind production, then what else can you do with it? You may as well mine some bitcoin and keep the money rather than let it go to waste.

Furthermore, bitcoin is highly mobile, so provided a surplus opportunity exists somewhere, the network chugs on, and the energy companies have a means of return during periods of surplus. That increases their returns which is a win all round. There’s merit in this.

This is important because it’s topical, and every time bitcoin can win these sorts of arguments, its future strengthens.

Investment flows

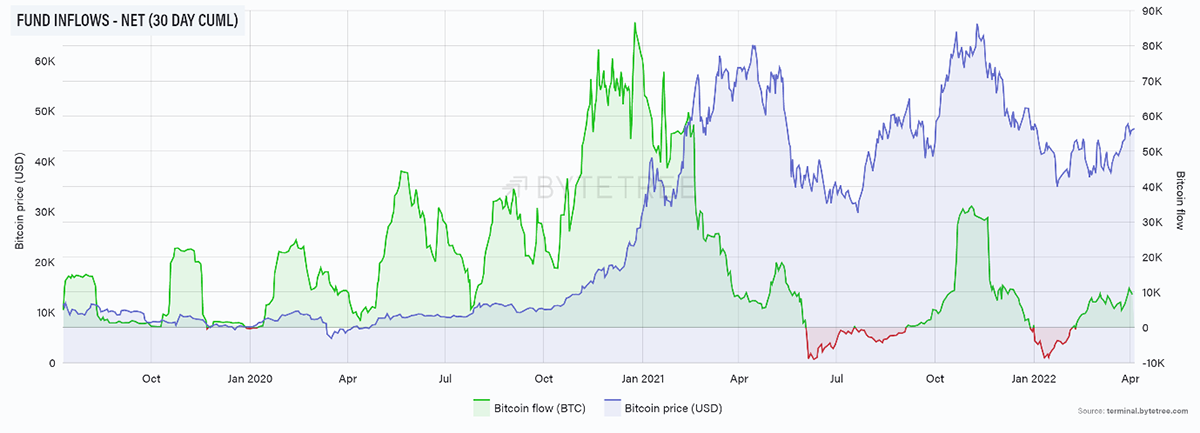

I started tracking bitcoin flows in late 2020. Soon after ByteTree’s product was ready, they had already ebbed, along with the market. It’s a harsh truth that as soon as you build something brilliant that explains so much, you have to wait months for a new signal. Such is life.

The second half of 2020 was fabulous as the funds queued up to buy 383,000 BTC. This was extraordinary to watch and explains so much of what happened to the bitcoin price in 2020.

Fund flows influence price

Source: ByteTree. Bitcoin net fund inflows (30-day cumulative) and price, since July 2019.

The fund buying slowed down in 2021, and I had become concerned that high prices would be difficult to sustain with the miners producing 27,000 BTC each month. At $46k, that’s $1.2 billion of cash required, whereas at $10k, it’s a “mere” $270 million. These are big numbers.

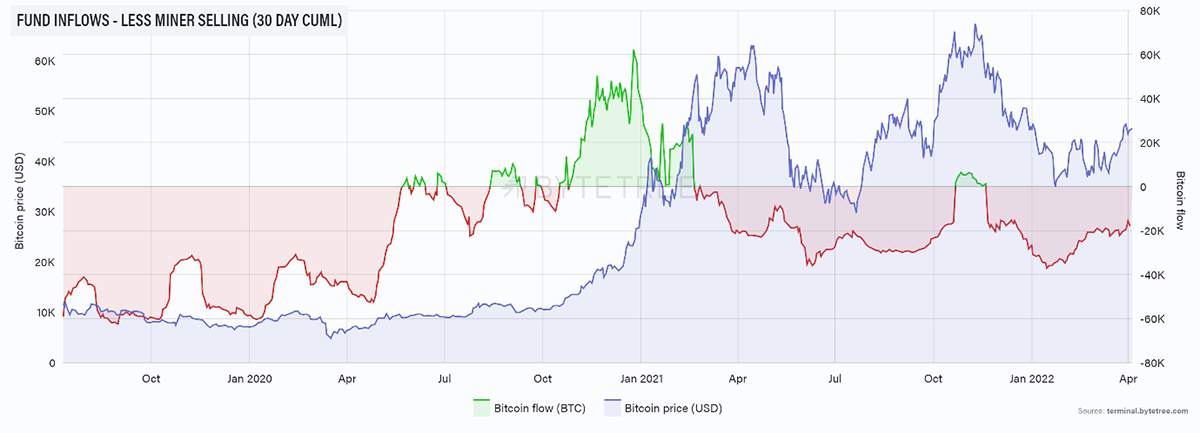

The chart below nets off the miner selling using ByteTree data, and it’s clear to the eye that the $10k to $50k rally coincided with the high net inflows. The final high came soon after the flows turned negative. Don’t forget; this does not measure retail flows, which can, at times, be vast.

The only time we have seen net positive flows was around the launch of the Proshares Bitcoin Futures ETF (BITO). This rally was rational, as had the SEC allowed bitcoin ETFs, we might have seen a period of sustained net demand. We didn’t, and so the green blob was short-lived.

Source: ByteTree. Bitcoin net fund inflows (30-day cumulative), less miner selling, and price, since July 2019.

The recent BTC accumulation has been a positive force, but not enough to turn our chart green just yet. But it is the start of something and without an excuse. The funds are simply accumulating an asset that they didn’t use to own but want to in the future. This has the potential to go on for years.

Macro

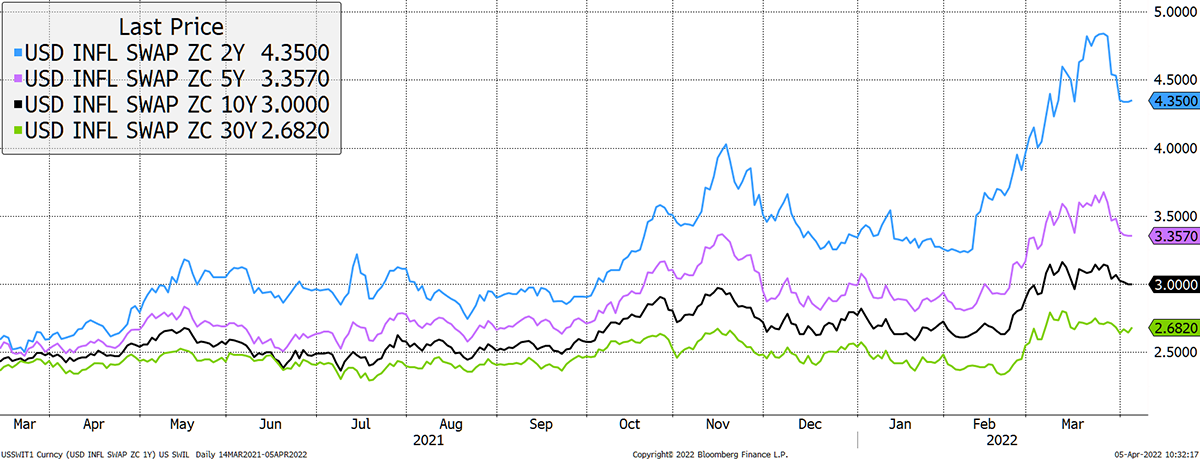

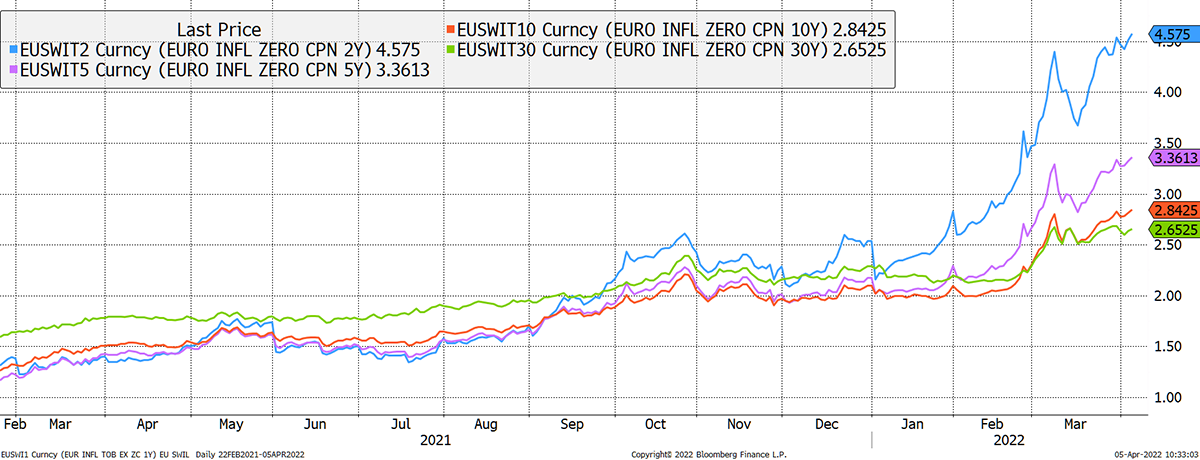

Inflation in the US is starting to cool slightly as the commodity bottleneck sorts itself out. It’ll keep popping up through wages and the like, so I still think we’ll see sustained higher inflation.

US inflation starts to cool

Source: Bloomberg.

However, in Europe, it is still rising. Germany, in particular, is in a tough position as it loses access to Russian gas. This comes through in the regional inflation differentials with the US and explains dollar strength.

Eurozone inflation is still rising

Source: Bloomberg.

When inflation is higher in one country than another, then expect capital flight from the weaker to the stronger, hence a rise in the dollar and a fall in the euro. To stop this, Europe needs to hike rates at a faster pace, and there is no chance of that.

We have already seen this in Japan, where they will keep rates low and ignore inflation. With the euro and the yen having no reason to rally, it is clear that the path of least resistance for the dollar is up. The bottom line is that we can’t have it all, as bitcoin would prefer a weak dollar over a strong one.

The dollar index remains 5/5.

Cryptonomy

Not your keys, not your coins - by Laura Johansson

Remember that controversial EU “travel rule” for crypto that I mentioneda few weeks back? Well, it re-emerged in the news last Friday as the proposal passed the vote in the European Parliament.

The proposal applies tough anti-money laundering requirements to crypto, requiring that each sender and recipient would have to be identified to legally complete the transaction from both hosted and self-hosted wallets. While it would be imposed on fiat payments to crypto exceeding EUR 1,000, the limit is scrapped for native crypto payments.

Additional discussions are directed around new measures against “unregulated exchanges”. This would ensure that exchanges would need to be fully regulated and apply the required AML and KYC steps to operate legally. By extension, this would effectively ban any self-hosted wallets. For security reasons, self-hosted wallets are popular within the crypto community, where the phrase “not your keys, not your coins” often makes the rounds.

Criticism for the proposal has come from both the crypto industry and inside the European Parliament. A member of the European People’s Party (EPP), Markus Ferber, said that “Such proposals are neither warranted nor proportionate. With this approach of regulating new technologies, the European Union will fall further behind other, more open-minded jurisdictions”. Following the vote on Friday, the proposal would have to be agreed upon by the EU Council to pass into law.

Meanwhile, in the UK, the government officially announcedthat stablecoins will be recognised as a valid form of payment. To “make Britain a global hub for cryptoasset technology and investment”, the UK government will legislate a financial market infrastructure (FMI) that will promote crypto innovation. The Financial Conduct Authority (FCA), which previously prohibited the sale of crypto investment products to retail clients, is hosting a two-day “Crypto Sprint” in May 2022. In collaboration with innovators, academics, regulators, and other experts, the sprint seeks to “help inform future policy decisions in a safe and inclusive way”. For an added seal of approval, the UK Chancellor, Rishi Sunak, has commissioned the Royal Mint to create an NFT.

Summary

Tomorrow ByteTree launches ByteFolio. It will start slowly and add new tokens over time, with the aim to outperform bitcoin by embracing the wider crypto space.

We are excited to be kicking off and feel this is a good time to be doing it.