21Shares Launches the World's First Bitcoin and Gold ETP

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree BOLD

Today, Wednesday 27th April 2022, 21Shares is launching the 21Shares ByteTree BOLD ETP, which tracks the Vinter ByteTree BOLD Index. The ETP, which combines bitcoin and gold, will trade on the SIX Exchange in Switzerland.

“I would take the gold…I would like to sprinkle a little bit of bitcoin into that mix too.”

Ray Dalio, Bridgewater Associates

In a world of elevated inflation and heightened political risk, investors are actively looking for portfolio protection and diversification. Gold and bitcoin both have these qualities. Extensive research at ByteTree has led to the conclusion that investors are better off thinking about bitcoin AND gold, rather than bitcoin OR gold.

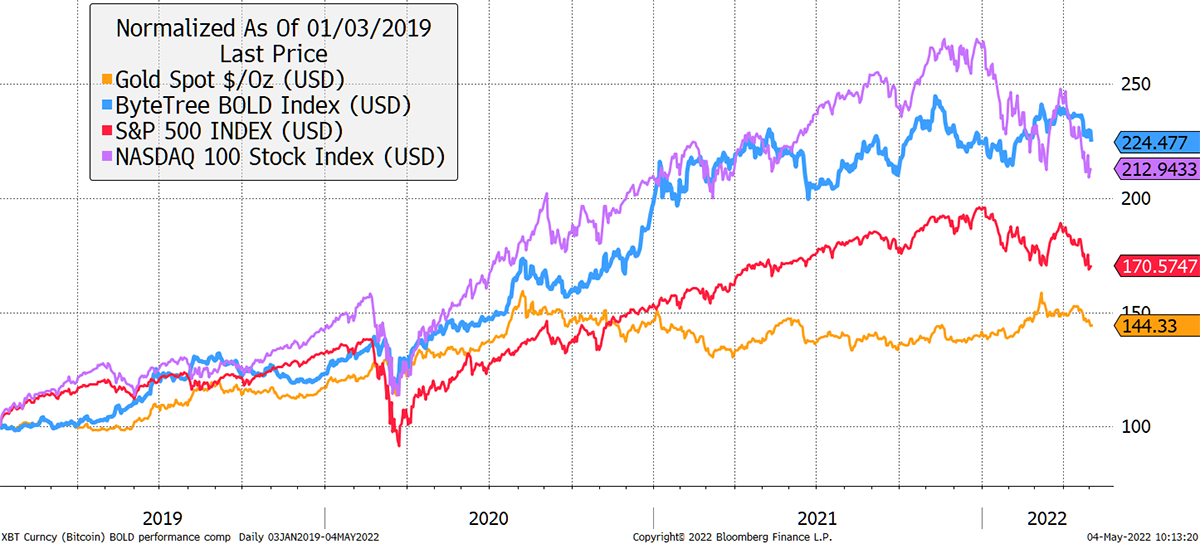

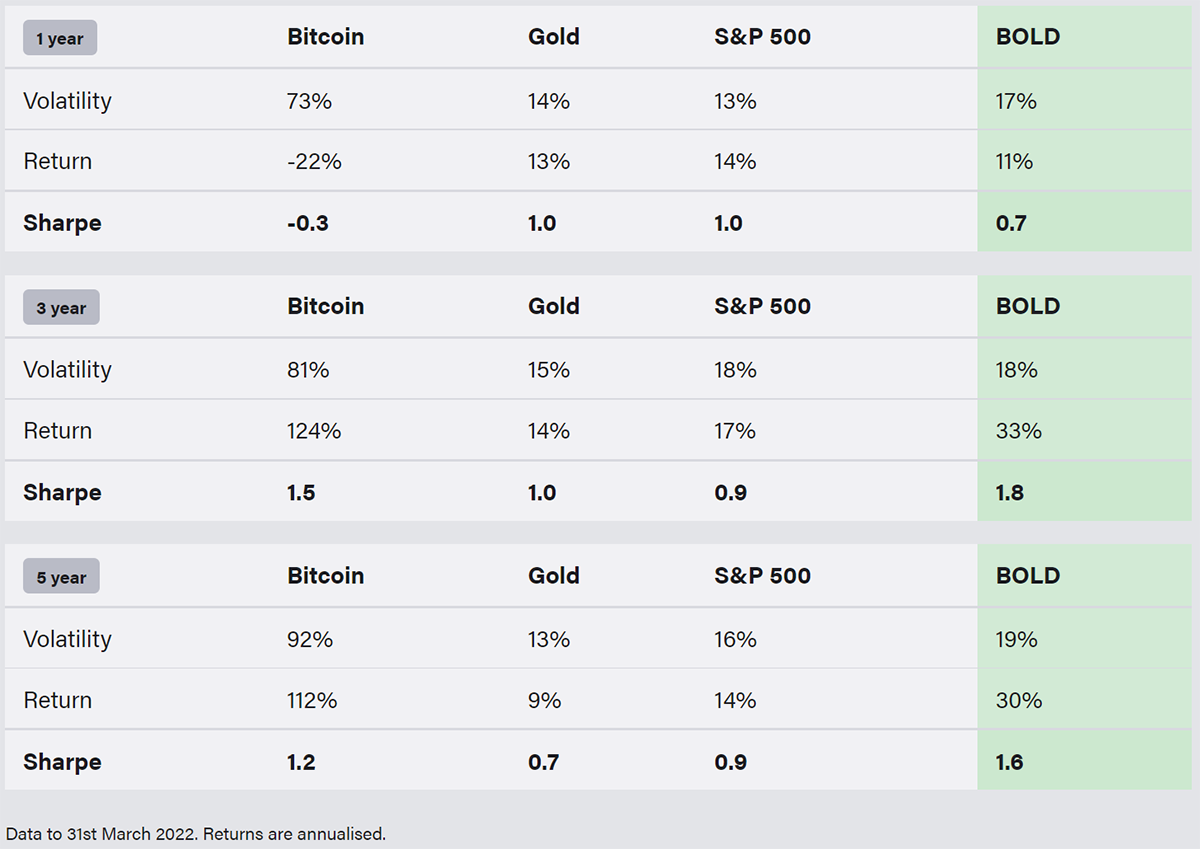

ByteTree’s BOLD index (“BOLD”) has been designed for this purpose. BOLD allocates exclusively to bitcoin and gold, using a risk-weighted approach. The performance of the index has been remarkable, as these two assets perform at different times. BOLD has delivered annualised returns of 33% and 30% over three and five years respectively. This is approximately twice that of the S&P500, yet with only slightly higher volatility (see chart and table below).

Consistent risk-adjusted returns

What makes BOLD so special?

- It is the world’s first and only Exchange Traded Product to blend gold, the world’s oldest store of value, with its new digital companion, bitcoin.

- Monthly rebalancing of the two assets - by reducing the outperformer and adding to the underperformer - both manages risk and captures additional return from rebalancing transactions.

- BOLD will be physically backed with leading custodians: gold (JP Morgan), bitcoin (Copper).

How does BOLD work?

- The weights are calculated by the inverse of the 360-day historic volatility (“inverse volatility”) of each asset. The lower the volatility, the higher the weight. This is recalculated monthly.

- At launch BOLD will be approximately 82% gold and 18% bitcoin.

- Once a month, BOLD will rebalance back to the target weightings, reducing the stronger asset and adding to the weaker asset, which is a value-driven approach.

Past performance of the BOLD Index

- Historically, gold has performed well during risk-off periods, whereas bitcoin has performed strongly in risk-on markets.

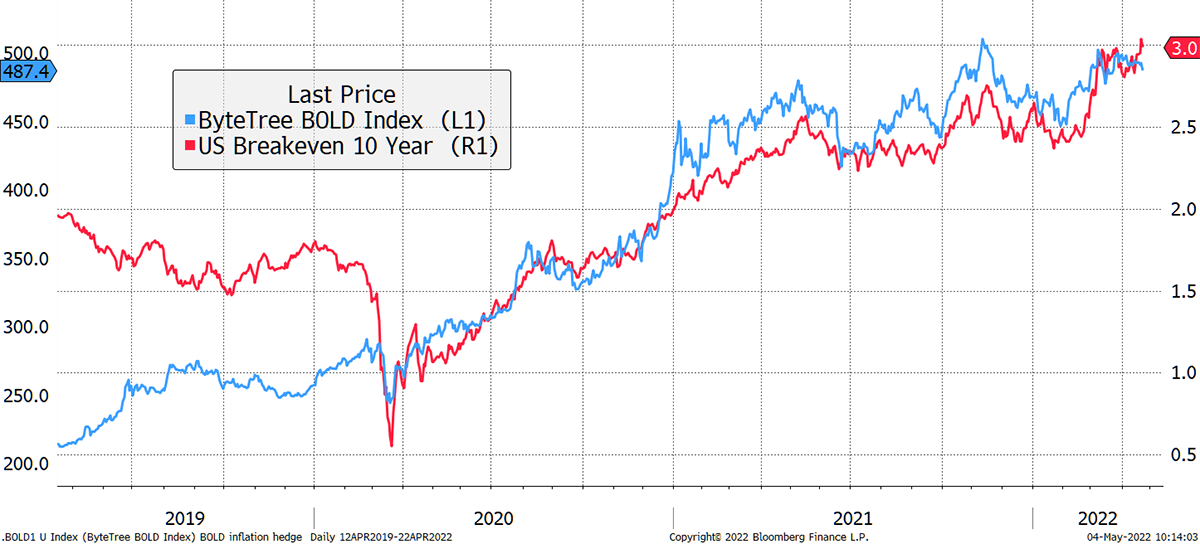

- Since 2020, the year that bitcoin became increasingly viewed as an institutional-quality asset class due to its market size, distribution and liquidity, the BOLD index has been a remarkably accurate inflation hedge. It closely follows the 10-year breakeven rate, a measure of inflation expectations (see chart at bottom of page).

- The BOLD index has demonstrated a much lower drawdown risk profile than pure bitcoin. “BOLD barely registered the sharp drawdowns experienced by bitcoin in 2014, 2018 and 2020. BOLD’s maximum drawdown over that period (Nov 2014-Nov 2021) was 16% - around 20% of that experienced by bitcoin. (ByteTree AM research)”

More details about the BOLD Index can be found on our website. The BOLD Index aims to deliver high-quality portfolio protection in an inflationary and politically uncertain world. We believe this simple and innovative strategy plays to the strengths of both assets, which often show negative correlation.

The BOLD Index is now investable via the 21Shares ByteTree BOLD ETP, which trades on the SIX Exchange in Zurich from today. This is an exciting time for ByteTree and ByteTree Asset Management and we hope you share our enthusiasm for what is an extraordinary partnership between these two great assets, combining as they do to help protect wealth in these inflationary and politically volatile times.

Effective inflation hedge – BOLD performance since Bitcoin has become an institutional asset in early 2020