Small Signs of Optimism from Bitcoin Fees and Transactions

Disclaimer: Your capital is at risk. This is not investment advice.

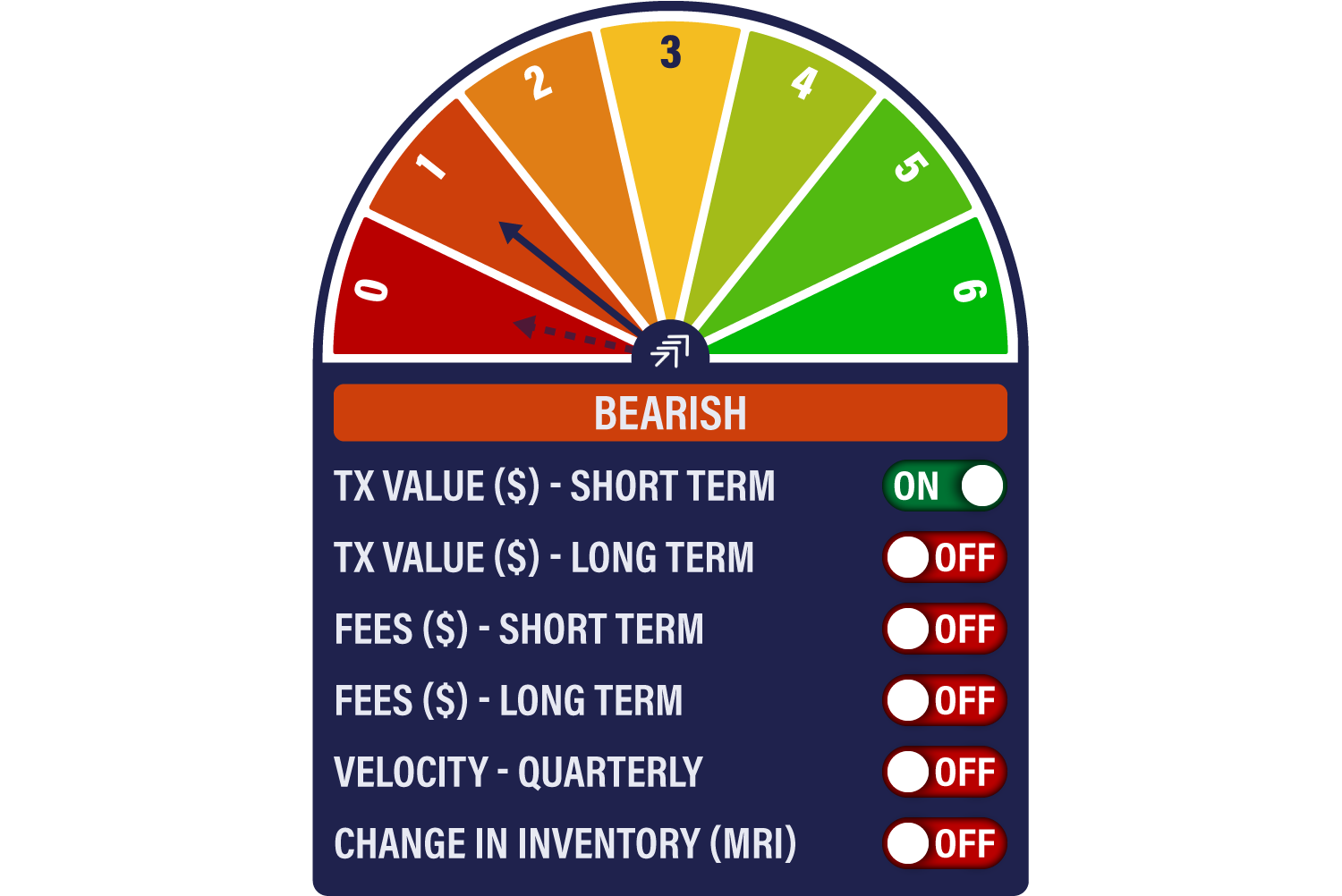

Bitcoin Network Demand Model

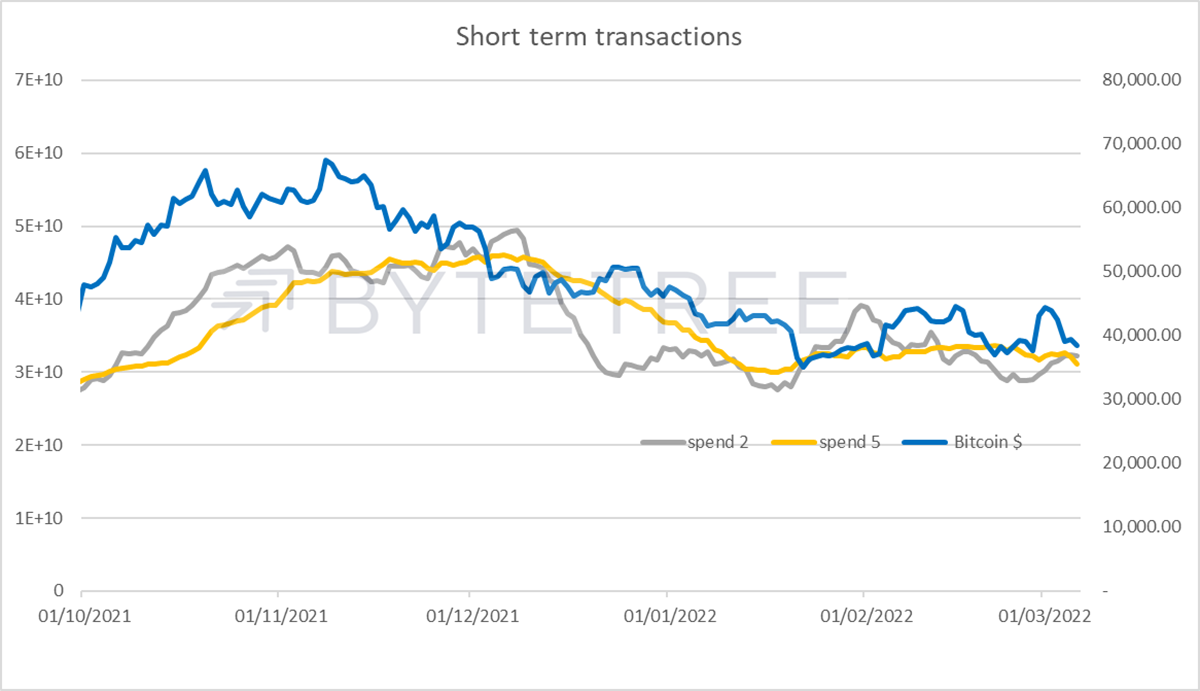

The short-term transaction signal turns on again this week, a result of a massive block that went through last weekend when the price surged from US$38k to US$45. The spike in volume turned out to be a bull trap. The signal is unlikely to stay on for long without a more sustainable recovery in on-chain activity.

Last weekend saw a massive block confirmed on the Bitcoin Network, measuring about US$8.3bn. Our understanding is that the series of transactions in the block were technical in nature (the reorganisation of addresses) rather than a massive buyer and therefore has zero significance as far as network expansion is concerned. This can be seen on the x-axis below as the incongruously large bar.

The upshot was to lure the market into a false sense of excitement. Still, there was no follow-through in terms of activity, and as the news from Ukraine continues to deteriorate, bitcoin succumbed to the broader sell-off in risk assets.

However, the short-term transaction series did turn on, although it would be more comforting if the 5-week spend line (yellow, chart below) was moving positively rather than negatively.

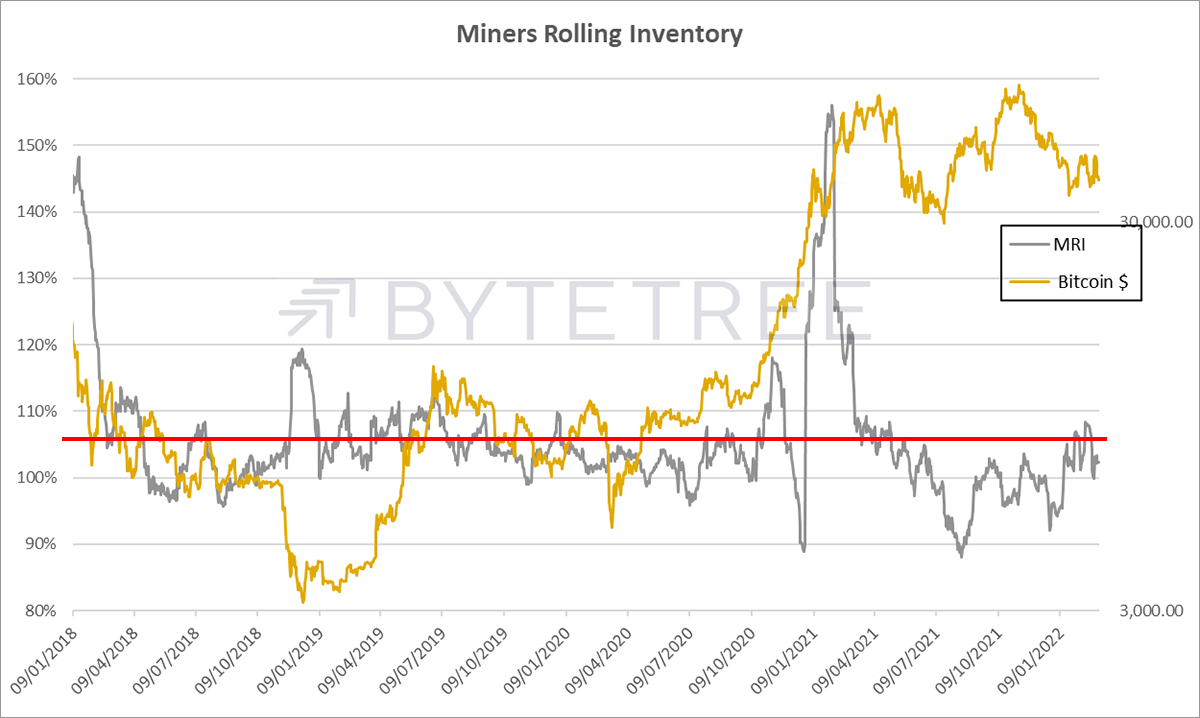

As predicted last week, we were due a big lump of miner selling and that duly came through, which can be seen in the first exhibit as a large anomaly, this time on the top bar chart (measuring around US$74m). Miner’s Rolling Inventory (MRI) briefly picked up as a result, but again this was short-lived, and the series remains below the level deemed bullish.

In better news, both transactions and fees have sharply bounced, as shown in the bottom two charts. This might be an early indicator that bitcoin’s usage as a monetary network has started to accelerate, perhaps as a result of the Ukraine conflict. If this continues and its use case as a genuine store of value is proven over this very traumatic period, it would be hugely positive for the long-term outlook.