Moving the Bitcoin Dial from Neutral to Bull

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 38

Bitcoin is very clearly showing strength against the 17 trillion-dollar NASDAQ, which is the most over-owned and over-blown allocation on the planet. It’s fading while bitcoin is proving resilient.

BYTETREE ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Stars and tech |

| On-chain | A $6bn mega block |

| Investment Flows | Still encouraging for bitcoin |

| Macro | Dollar disappoints |

| Crypto | An ethical dilemma |

ATOMIC has upgraded bitcoin to a bull market. This reflects an improvement in bitcoin’s relevance, credibility and sustainability more so than anticipating an impending surge. But given the former, the latter becomes more likely.

Technical

The ByteTrend star count for the top 15 has ballooned from 24 stars last week to 46 stars this week. If all 15 coins had a 5-star trend, that would be 75 stars. 46/75 (or 61%) isn’t bad considering the disruption to civil society.

This is a powerful measure of market breadth within crypto, and we are excited to be bringing these to the site soon. This space lacks decent technical measures, and ByteTree is taking the lead. More to come in ByteTrend and hopefully on the site this week.

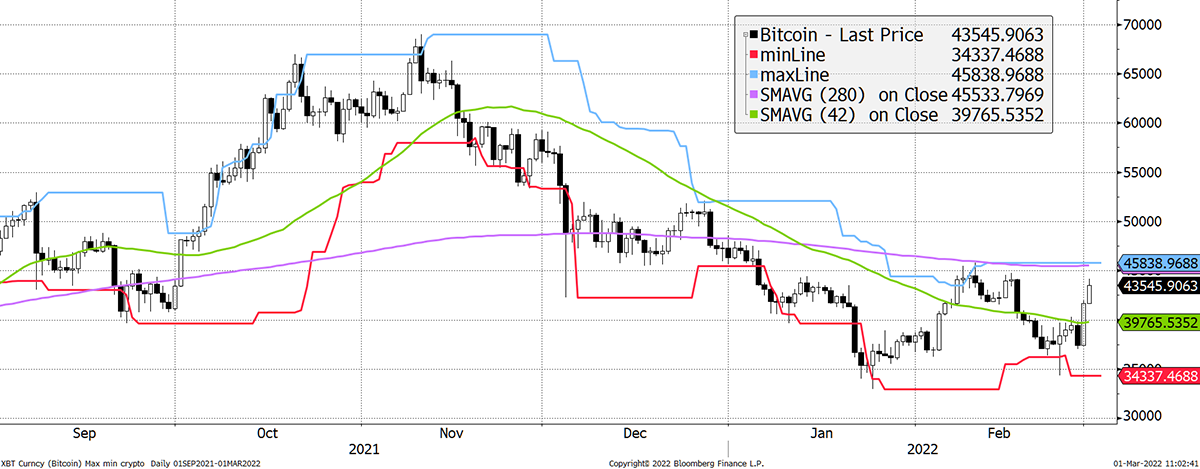

As of this morning, bitcoin scores 4/5, which is a remarkable recovery. For a 5/5 we just need to see a break above $45,000. It seems you can’t keep a good thing down.

Bitcoin 4/5

Source: Bloomberg. Bitcoin with 20-day max and min lines, 42-day and 280-day moving averages past six months.

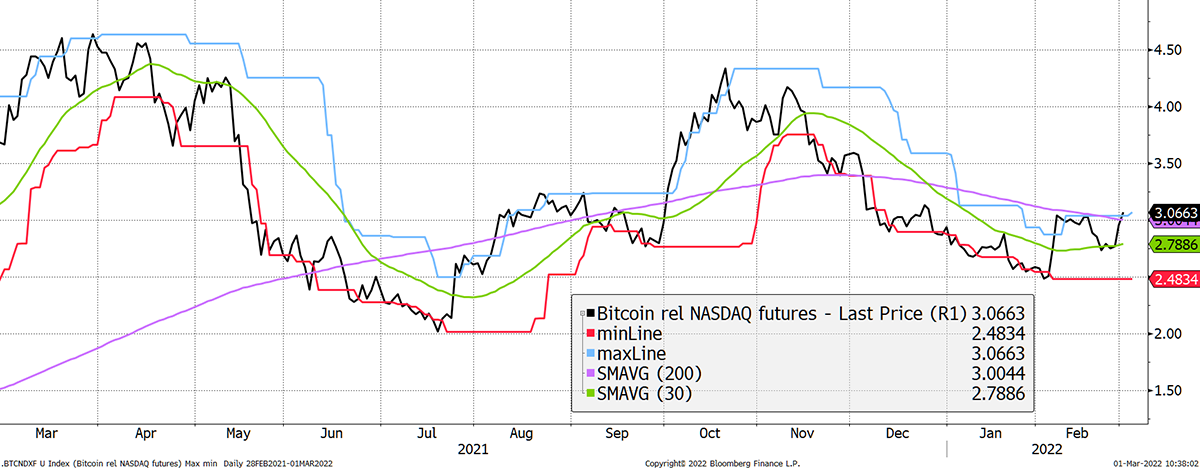

It is Bitcoin’s strength against the NASDAQ that is even more exciting. I go on about it because it is so important in driving asset allocation decisions - subconsciously or otherwise. The price of markets is hard to predict and very much in the hands of policy and events. Yet, where the money is flowing within markets is an easier task. To clarify, it’s not easy, just easier.

Bitcoin is very clearly showing strength against the 17 trillion-dollar NASDAQ, which is the most over-owned and over-blown allocation on the planet. It’s fading while bitcoin is proving resilient.

Bitcoin 4/5 versus NASDAQ

Source: Bloomberg. Bitcoin measured in NASDAQ with 20-day max and min lines, 30-day and 200-day moving averages past year.

The last time bitcoin was weak against the NASDAQ was in spring 2021. Back then, tech stocks were soaring, and bitcoin was weak. This time, tech is lagging, and bitcoin is resilient. An all-time high on the “Bitcoin in NASDAQ” chart, during these uncertain times, would turn heads. The upgrade to bull in ATOMIC is to be ahead of that.

In recent weeks, I have shown bitcoin overtaking ARKK. Now it’s the NASDAQ, and the next target is the S&P 500. Never underestimate the demand for a credible alternative asset when things change. When you look around at the options, bitcoin is basically the only alternative to gold.

I have long felt that mainstream asset allocators will eventually get their head around bitcoin. When they do, big money is coming.

Investment flows

For some time, I felt the $30,000 level would break. In part, that was a lack of external visible flow from funds, but also a reduction in network activity. This was unquestionably the way to think about blockchains pre-2021, but it is time to move forward.

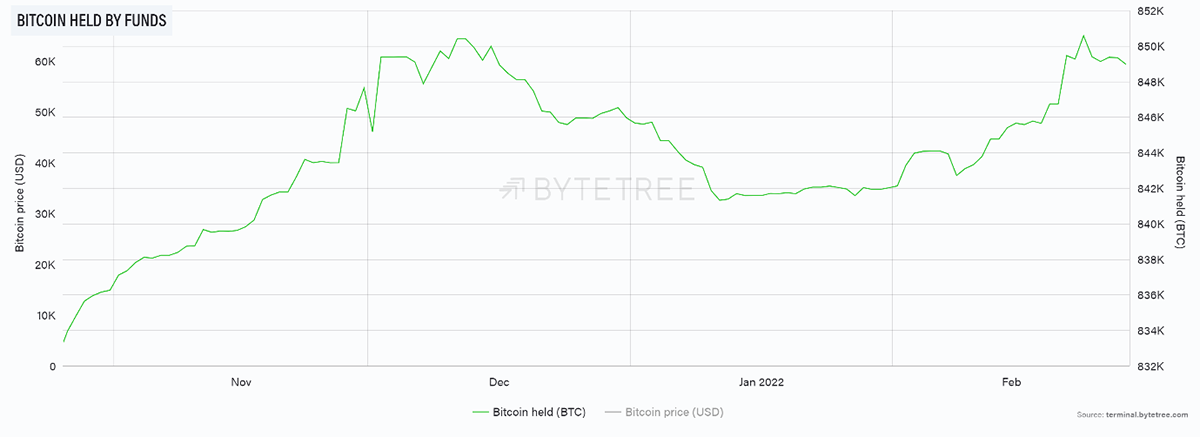

Just as people say bitcoin is failing as a hedge against conflict, there have been meaningful inflows.

Source: ByteTree. Bitcoin held by funds (BTC) since October 2021.

I would add that both Grayscale Bitcoin (GBTC) and Microstrategy (MSTR) have seen demand. GBTC’s discount is narrower, while MSTR’s premium is greater. Stablecoins held on Ethereum have also grown to over $120 billion.

Coinbase (COIN) also reported Q4 2021 results last week. Revenue was a record $2.49 billion for the quarter. Most of that is retail transactions of $2.29 billion, which again highlights how institutional involvement is still in the foothills.

One you have made up your mind that the institutions are coming, then the only way for bitcoin is up.

On-chain

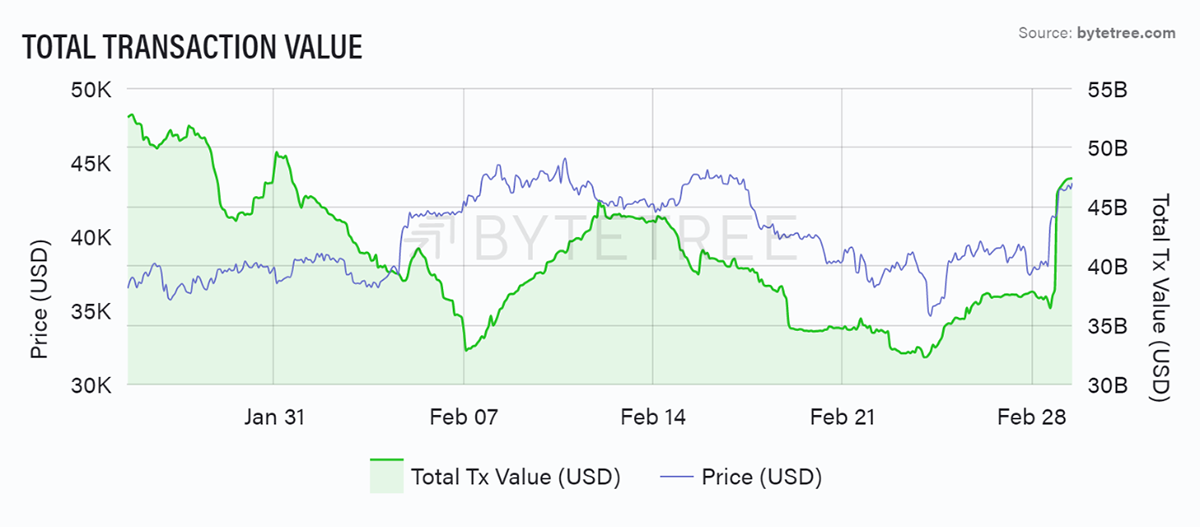

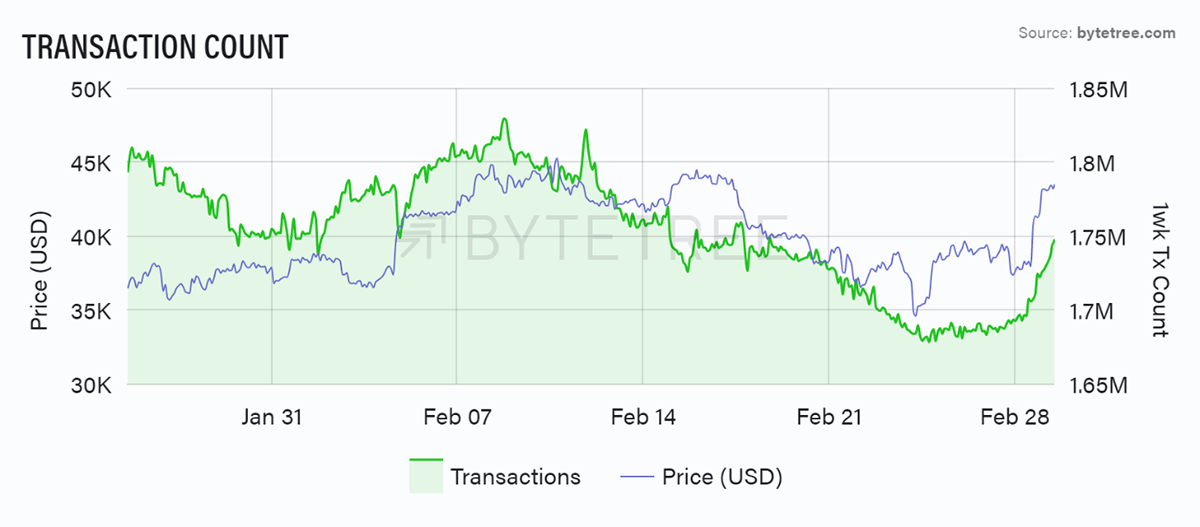

Last night, a blue whale shifted $6bn of bitcoin, which stirred things up. This was well received by the market but will flatter the network value stats for a week or so. I can’t help that as it happened.

Source: ByteTree. Bitcoin total transaction value and price (USD) over the past five weeks.

It was also pleasing to see more transactions in the network, which also tends to be bullish.

Source: ByteTree. Bitcoin total transactions and price (USD) over the past five weeks.

Macro

One reason that bitcoin has sprung to life in recent days is that the dollar rally has been restrained. The score of 5/5 is bullish, but you’d have expected more given events and the rush to safe-havens. Recall that in FX, if something goes down, something else must go up.

Dollar barely moves

Source: Bloomberg. US dollar Index year.

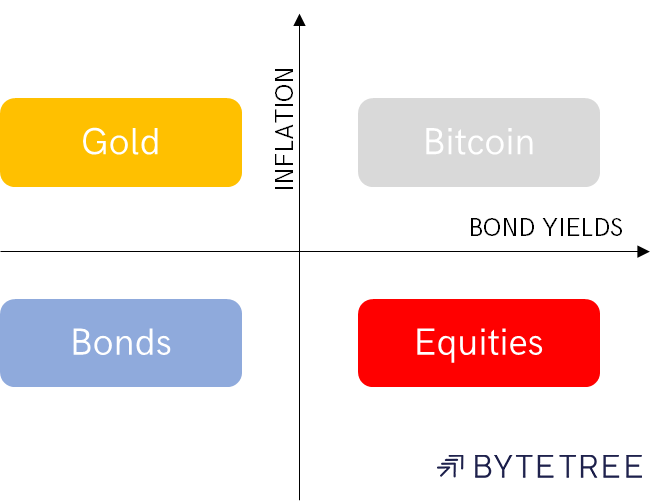

Bitcoin also sits firmly within the top right box in the Money Map. It likes bond yields and inflation to be rising.

Source: ByteTree. Money map.

And they are. The two-year yield has dipped slightly, but if this inflation keeps on coming, which it looks like it is, then bitcoin is the place to be.

Inflation rises in risk-off

Source: Bloomberg. US 2-year inflation expectations and bond yield past year.

Cryptonomy

It’s now been six days since Russia invaded Ukraine, and a lot has happened since. In terms of crypto’s role in the conflict, what has really stood out is the application of decentralised digital currency. The utility side has long been an argument from the sceptics to oppose digital assets. But following the invasion of Ukraine, the relevance of crypto has now become apparent to many.

Over the weekend, the European Commission issued a statement to remove Russian banks from the SWIFT messaging system, crippling their ability to operate globally. Furthermore, the statement also declared that they’d put restrictive measures against the Russian Central Bank, Russian officials, and elites close to the Russian government. Following these measures, the possibility that Russia will use cryptocurrency to bypass these sanctions is now being considered. Legal experts have stated that the use of digital assets would still be a violation of sanctions, while some believe that Russia’s recent draft bill to legalise the use of cryptocurrency was no coincidence.

Source: Twitter.

The Ukrainian Vice Prime Minister and Minister of Digital Transformation, Mykhailo Fedorov, issued a statement on Twitter requesting that all major crypto exchanges block addresses of Russian and Belarusian users. Exchanges Kraken and Binance, as well as many prominent crypto Twitter profiles, responded with a refusal to do so in line with arguments around decentralisation and the lack of legal requirement. Not everyone shared this opinion as it emerged that the NFT platform DMarket froze assets belonging to users based in Russia and Belarus. Following this refusal, Ukraine has announced their intentions to follow up with legal demands.

Nonetheless, Ukraine has benefitted from crypto in their crowdfunding effort to raise funds to combat the invasion. As of writing, $30.8 million in funds has been raised, with 26,000 cryptoasset donations. Research firm Elliptic confirms that the majority of donations were in BTC and Ether, including a single Bitcoin donation worth $3m, while other contributions came from stablecoins and NFTs. Ukraine is not the only war-torn nation that has benefitted from crypto, as people in Afghanistan have been using crypto for paymentsfollowing the Taliban offensive in August last year.

In the midst of the war and terror, it is easy to lose sight of other significant news. eBay has announced that they are considering adding crypto payments to their platform. The company, which aims to be the marketplace for Gen-Z and millennials, directly manages $86bn in volume and already allows for NFTs to be traded on their platform. Should eBay implement crypto payments, it would open the crypto space to a highly liquid and significant market.

For better or worse, Bitcoin and crypto have been circulating in the news over the past couple of weeks. The conflict in Ukraine has brought up an ethical dilemma on whether Bitcoin’s foundational decentralisation should be restricted for the greater good. On whichever side of the argument you stand, I feel the upcoming legal action from Ukraine may cause a rift in the cryptoverse.

Summary

Whatever madness there is in the world, financial markets carry on. They are looking ahead at the carnage and opportunities and constantly trying to get things right.

Bitcoin seems to be of its time. It can’t be a bubble because, as the Coinbase results show, the mainstream hasn’t yet bought it. The need for alternative stores of value, and ability to transfer wealth, has never been clearer. Recent events show that bitcoin is on the right side of history, and it is a prudent decision to own some.

Comments ()