Bitcoin Has Plenty Left in the Tank

Disclaimer: Your capital is at risk. This is not investment advice.

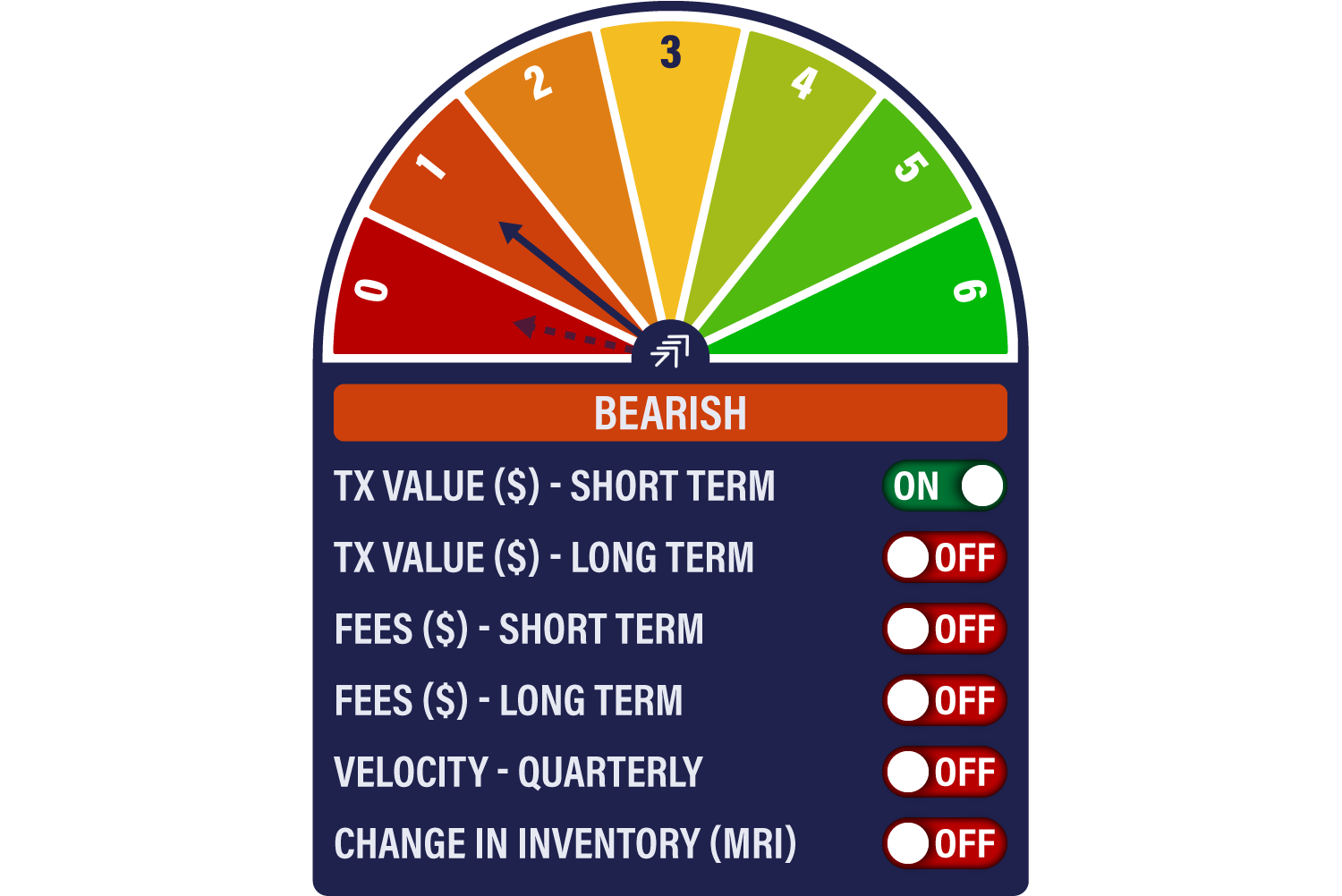

Bitcoin Network Demand Model

This week, the Network Demand Model moves from zero to 1/6 as “short-term transactions” switches back on. Over the last few weeks, we’ve consistently pointed out that downside risk is low. This is because the data has been steady rather than deteriorating, indicating that the next big shift in the model is likely to be positive.

Furthermore, the valuation has been fair. The absence of downside risk is obviously a necessary pre-condition for a move to the upside, which is what we have just seen. To sustain this, we would like to see on-chain activity improve, but is this happening?

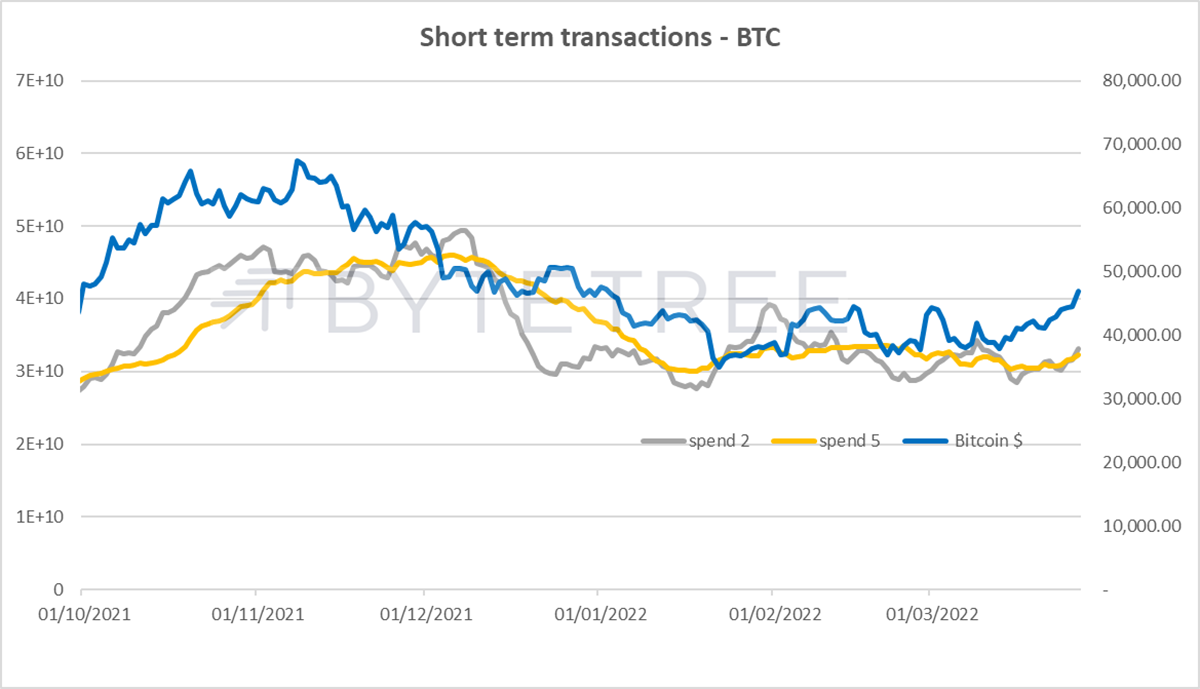

The short-term transactions indicator turns positive again as the bitcoin price breaks above recent resistance at US$45,000.

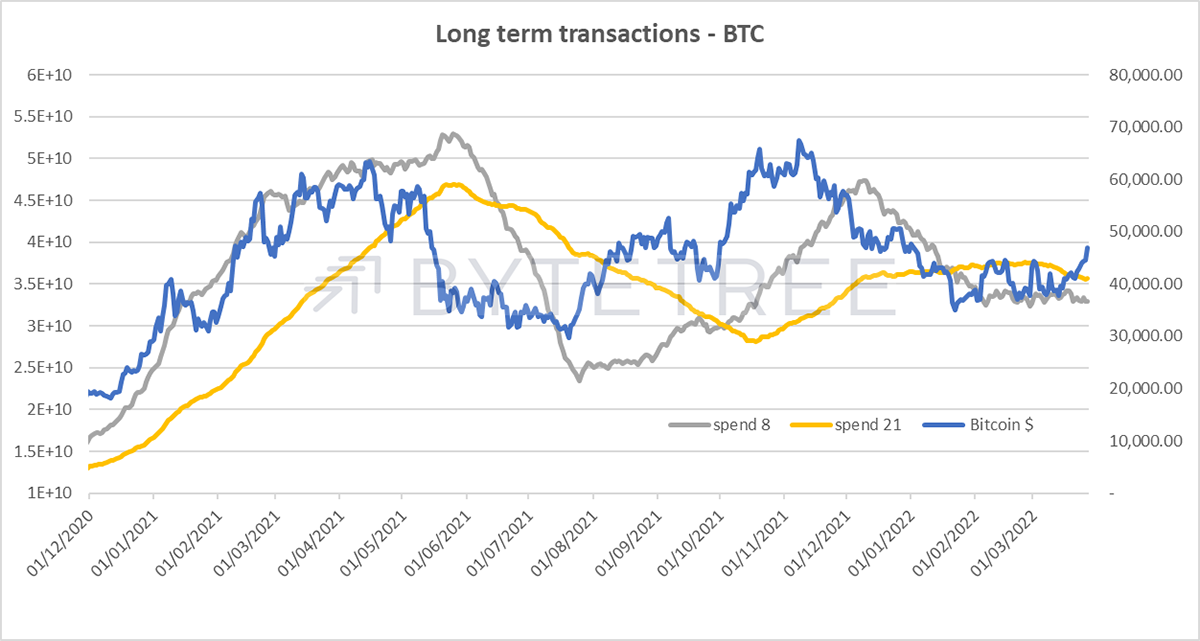

The longer-term transaction series remains off, but the gap is narrowing and look how both the 8 and 21 lines are no longer sloping downwards.

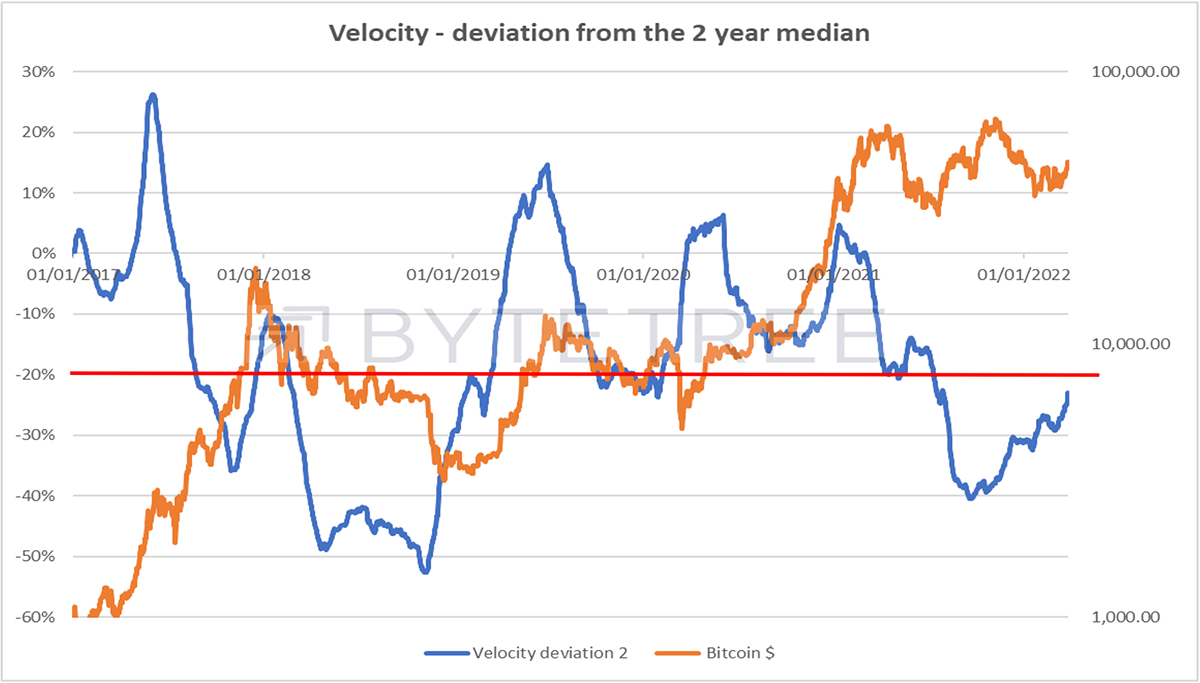

Velocity is also moving towards the level (red line) in the chart below that typically characterises a bull market.

From the Terminal, we also see an encouraging move in Transaction Count. This series has peaked out at around these levels since the start of 2022. Any move up and out of the range would be good to see. Worth noting that transaction count is one of the better data fits with the price, reinforcing the notion of bitcoin as a network effect asset.

Source: ByteTree. Bitcoin transactions and price (USD) over the past year.

I will keep you posted with the BTAM fair value chart over the next weeks and months. What we’d really like to see is a quiet bull market where the price rises alongside fair value, because that tells us that bitcoin is becoming more valuable because it is being used more. History suggests that this is an unlikely outcome because of its speculative nature, although perhaps growing institutionalisation will add more price discipline.

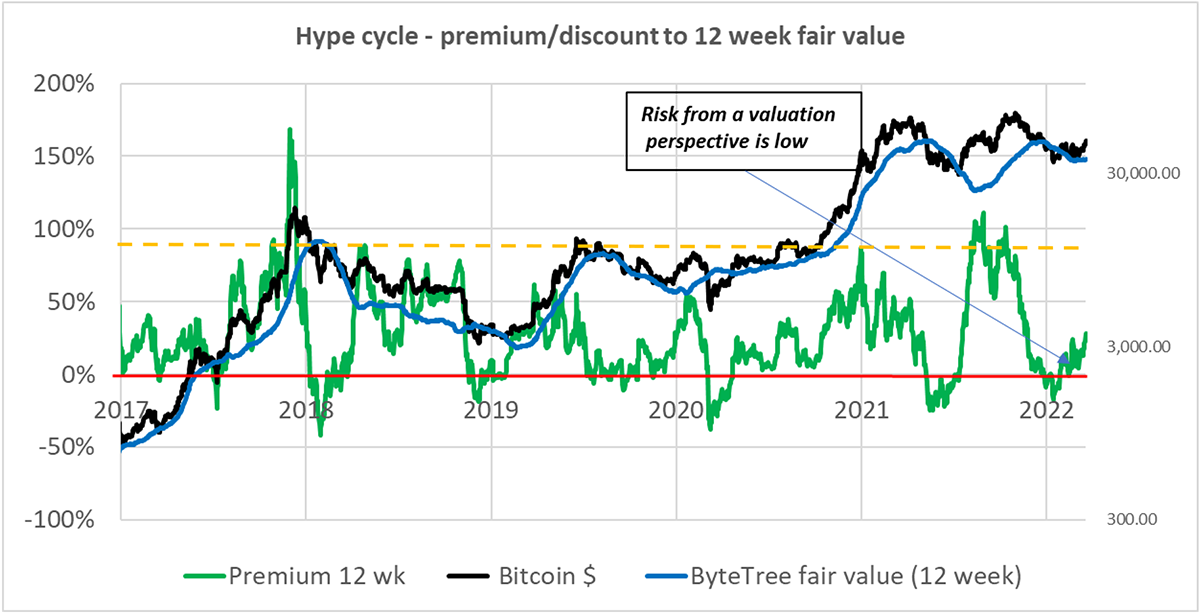

Going back over the last few years, a premium to fair value of around 90% (orange dotted line, below) is when the alarm bells start going off, and investors should start locking in some gains. At today’s valuation that would be around US$69,000, so there is plenty of room from here.

Comments ()