Ukraine Buries the Really Bad News

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 36

Last week, a story broke in the crypto press about Russia recognising crypto as a form of currency. Given that the mainstream press hadn’t verified the story, I had my doubts, so I checked a secret source. I can confirm that story is true.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Impressive |

| On-chain | Stable |

| Investment Flows | Surprisingly bullish |

| Macro | Inflation surge |

| Crypto | Those Super Bowl ads |

Technical

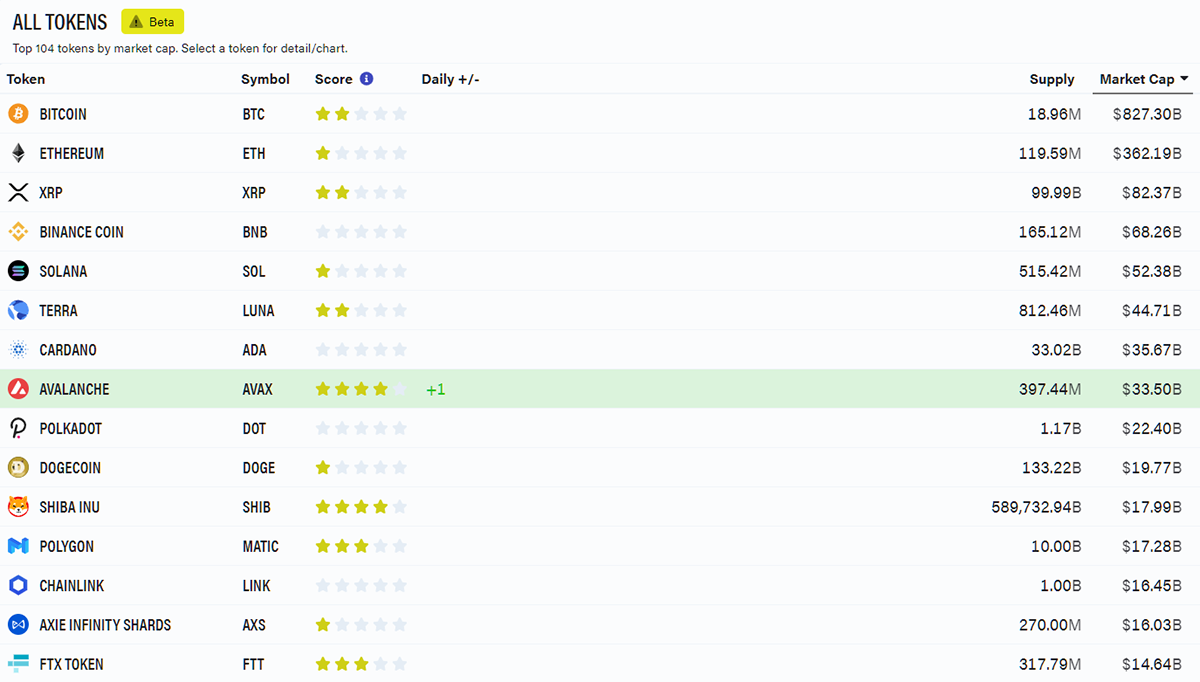

Last week, there were 27 stars in the top 15 crypto trends, out of a maximum of 75 (if they were all 5-star). This week, it has dropped to 24. That makes me bullish because it’s been a miserable week for asset prices, and the level of capital destruction in crypto has been surprisingly slight.

Source: ByteTrend

I do find it irritating that SHIB and DOGE have any stars at all because they make a mockery of this space. It would be reassuring to see the serious contenders show resilience while the rest quietly fade away.

In the meantime, bitcoin is a respectable 2/5. It wouldn’t take much for it to keep on building from here.

Source: ByteTrend. BTC ByteTrend over the past year.

I have recently shown the long-term trendlines bounce away from uncomfortable scenarios, which is good news, but there can be no doubt that this is a rough period for asset prices. That is why the current 2/5 is such a relief.

Investment flows

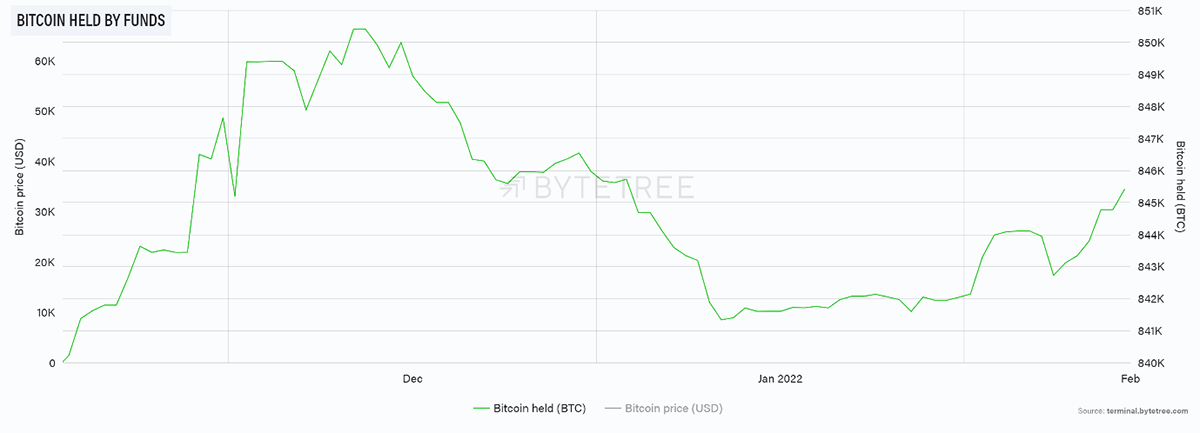

The flows into bitcoin have been impressive. With the media broadcasting live from Kyiv, it is reassuring to see money find its way into bitcoin.

Investors are buying bitcoin

Source: ByteTree. Bitcoin held by funds over the past three months.

This has been a week where money left equities and other risky assets for the likes of gold. For bitcoin to be on the right side of that is a game-changer. It helps to build the digital gold narrative that bitcoin is more lifeboat than Titanic. For bitcoin to appreciate another 10x, this continued build in credibility is imperative.

It is hard to underestimate how important these little things can be when added together. I have previously highlighted how bitcoin is beating the ARKK ETF. That has confirmed it is now more credible and resilient than a no-profit tech stock. That is great news because that wasn’t always the case.

As you’ll see below, it will soon take over from the FAANGs, and when it does, investors will wake up. Then you’ll see some serious flows into bitcoin!

On-chain

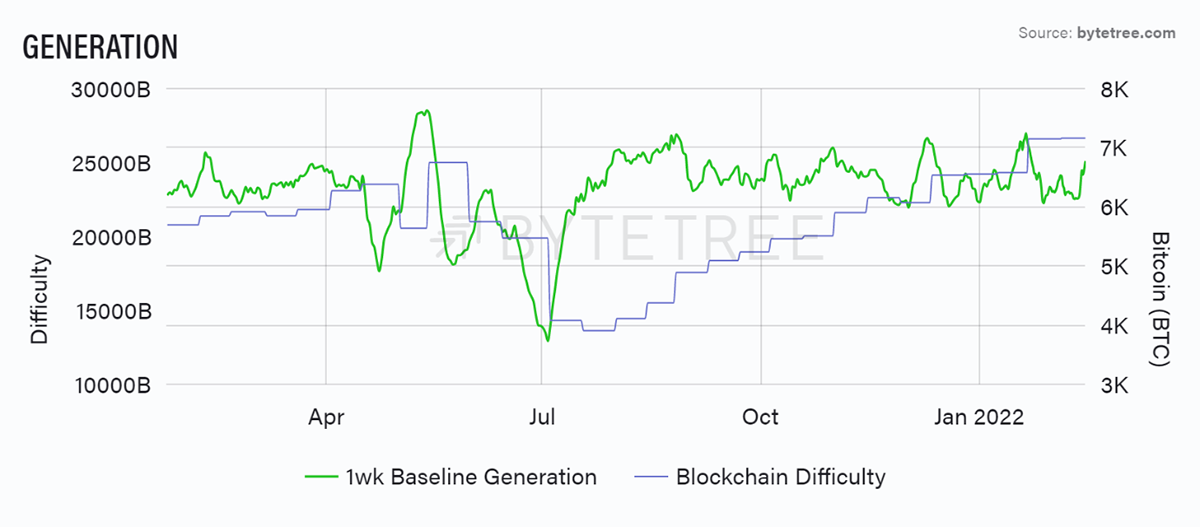

The chain is broadly stable, with no noticeable growth in recent weeks. But that doesn’t seem to matter much because the network isn’t contracting, and I’ll take that. The one piece of reassuring news is the continued growth in the hashrate, which means it has never before been more difficult to mine bitcoin. That in itself isn’t bullish but gives us confidence that there is continued investment in the network.

Source: ByteTree. Bitcoin 1-week Generation and blockchain difficulty over the past year.

It is largely the result of the easy monetary conditions seen in 2021, where the miners were able to raise large amounts of capital. That is now being deployed in new mining operations, which makes the process even more competitive. A higher hashrate isn’t necessarily bullish for price, but a lower hashrate is bearish, just as we saw when China left the network last April.

I suppose this is a long-term bullish signal but unlikely to sway the price in the short term.

Macro

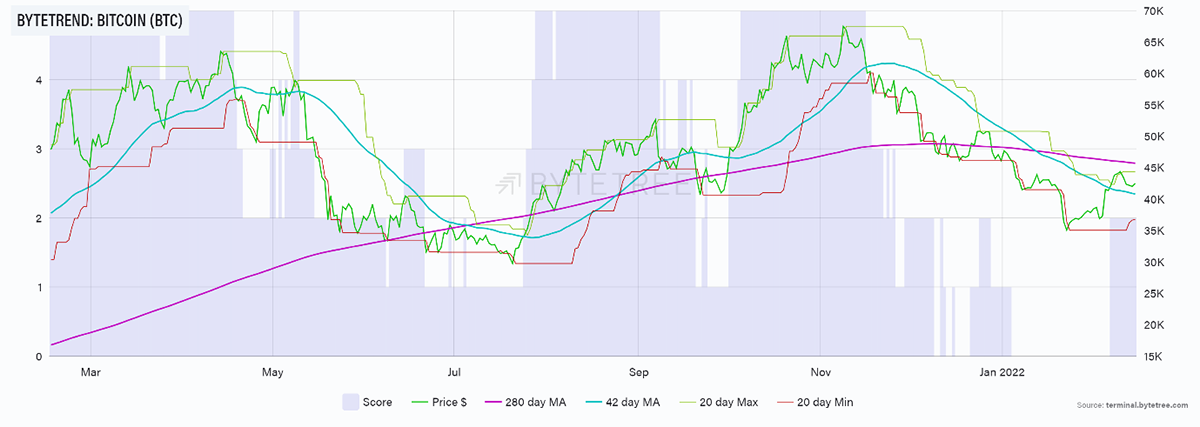

Could this be the real story? Inflation expectations in the US surged as the 7.5% year on year print confirmed last Thursday. The monthly print was 0.6% against 0.4% expected, and even when you exclude food and energy, it was 0.5%. Make no mistake - inflation is here.

Inflation heats up again

Source: Bloomberg. US inflation expectations over the past year.

This is a serious problem for the developed world. Higher inflation will crush both asset prices and standards of living. For those in doubt, ask why the Turkish stockmarket trades on a PE of 5x when the developed world trades in the teens. It’s not a coincidence as inflation destroys valuations.

Inflation drives interest rates, which drive asset prices. That is an inescapable truth, and ByteTree reaffirms the message that bitcoin is a lifeboat in a higher-rates and inflation world. Few get this.

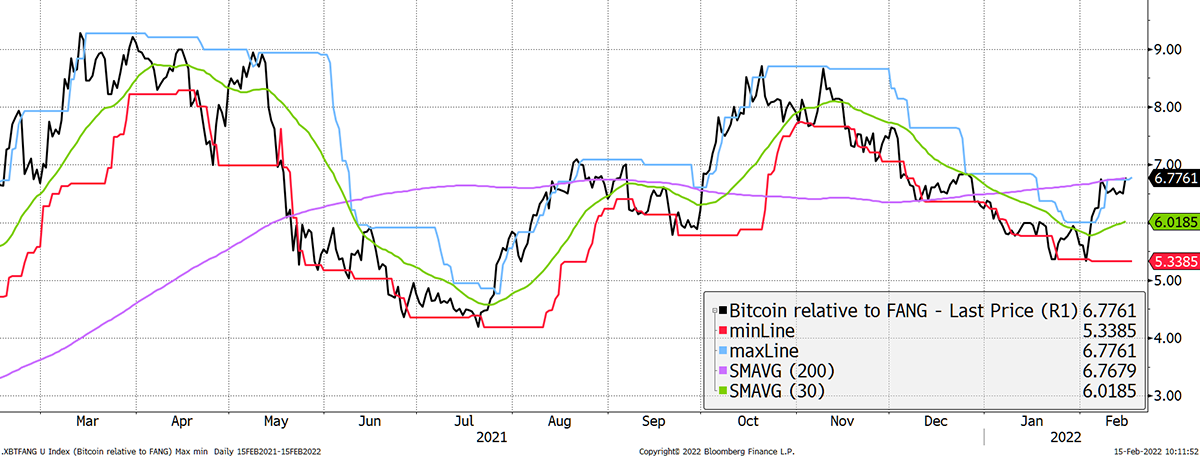

Last week I showed NASDAQ, this week, the FAANGs. This chart is on the verge of a perfect trend score of 5. FAANG stands for Facebook, Apple, Amazon, Netflix and Google – an acronym to highlight the old gang of leaders.

Bitcoin leads FAANGs 4/5

Source: Bloomberg. Bitcoin in FAANG over the past year.

There’s a new gang of leaders in town, and it’s crypto. I’m the first to admit that there are plenty of shitcoins that will join the 90% club (price fall of 90%+), but the crypto leadership has a serious role to play in the 21st century.

Look no further than the Ukraine crisis, where threats of sanctions will force Russia to build greater economic resilience. This means more workarounds and less reliance on the likes of the Swift payments system.

Last week, a story broke in the crypto pressabout Russia recognising crypto as a form of currency. Given the mainstream press hadn’t verified the story, I had my doubts, so I checked a secret source. I can confirm that story is true.

Cryptonomy

While the story of the US annual inflation headline rate hitting 7.5% in January and the developing situation between Russia and Ukraine are fighting for attention in the news, the cryptoverse found another topic to distract themselves with: Super Bowl.

The game, which determines the American NFL season champion, took place last Sunday, with crypto adverts making a historic debut. The crypto platforms that were competing for the ad space included Coinbase, FTX, and Crypto.com. With 30-second ads going for up to $7 million each, it’s safe to say a fair portion of their marketing budget was spent.

Their main advertising aim was to increase brand exposure to retail investors. Areport shows that 36 million US households (1 in 4 US homes) watched the game on Sunday - a monumental target audience. On Monday, The Block reported that crypto apps in the US app store had shot up in popularity, with the Coinbase app surging from 186th to 2nd place.

However, the “Crypto Bowl” was not without backlash. Although the ad by Crypto.com, which featured LeBron James talking to a younger version of himself, was amongst those more warmly received. Crypto.com’s native token CRO has held a score of 4/5 on ByteTrend since 5 February.

CRO is not the only crypto exchange coin currently doing well on ByteTrend. LEO, the utility token for the Bitfinex exchange, is currently the only token with a score of 5/5 on ByteTrend - a score it has held since 1 February.

LEO recently saw a new all-time high following the announcement from the US Department of Justice that they seized 94,000 of the bitcoins stolen in the 2016 Bitfinex hack. The LEO token white paper, published in 2019, states that if Bitfinex can recover any of the stolen bitcoin, it “will use an amount equal to at least 80% of the recovered net funds from the Bitfinex hack […] to repurchase and burn outstanding LEO tokens”.

Cryptocurrency burning takes tokens out of circulation, adding value to the remaining supply - a similar practice to corporate stock buy-backs. However, the stolen funds remain with the DOJ, and no LEO tokens will be burned in the foreseeable future.

Summary

Bitcoin gets inflows in a crisis. The trend score is 2/5 and rising, while no-profit tech is a firm 0/5. The FAANGs are next in line, and Russia is soon to vote yes to crypto. I feel that the institutional dollar is getting ever closer.

Comments ()