The Calm Before the Storm?

Disclaimer: Your capital is at risk. This is not investment advice.

Week 8 2022

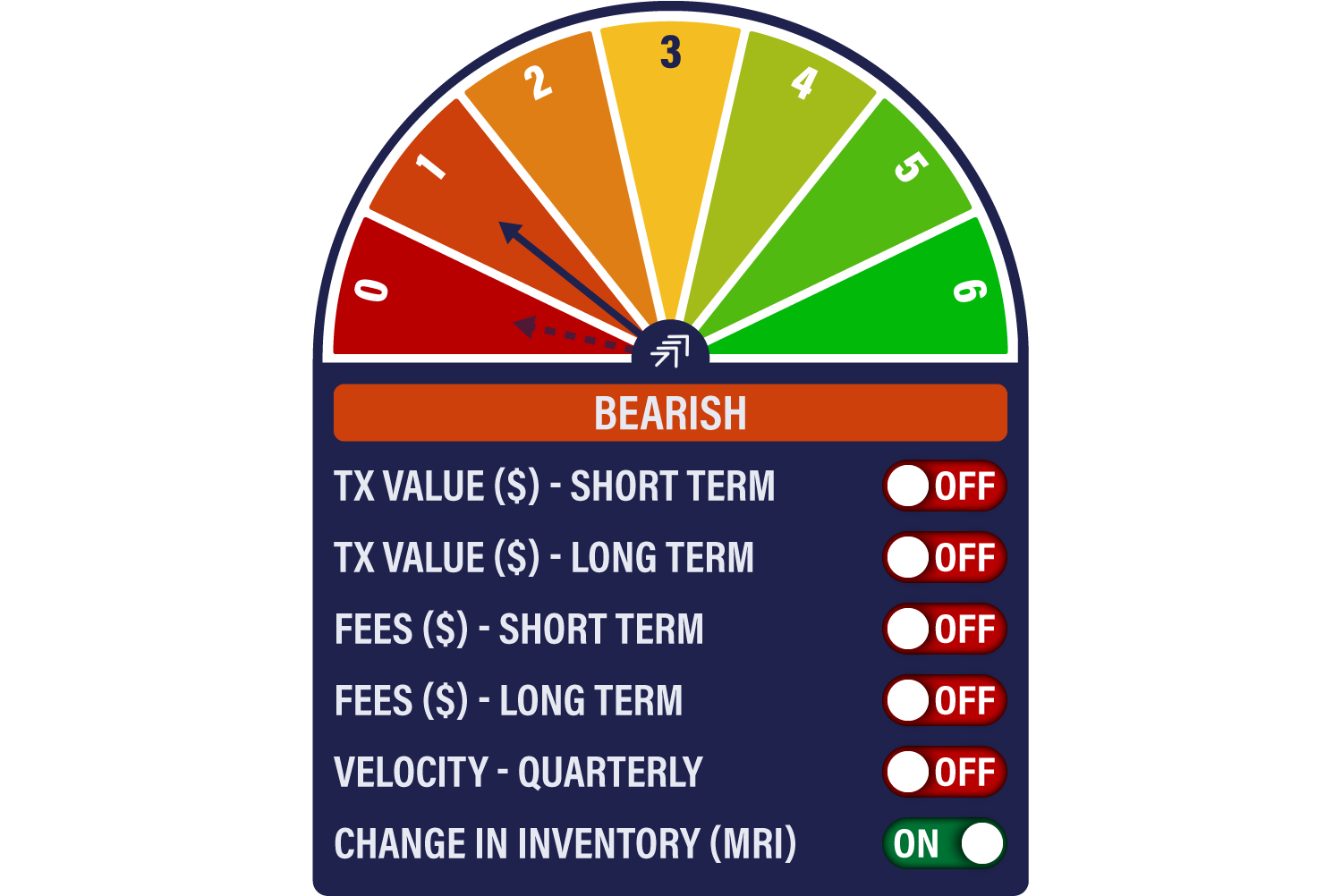

This week, there’s been a slight pick-up in the Network Demand Model as MRI turns back on. But that’s the only good news as all other network health indicators continue to deteriorate. With stories doing the rounds that President Biden will be issuing an executive order on crypto and CBDCs imminently, perhaps it’s of little surprise that investors are taking a wait-and-see approach.

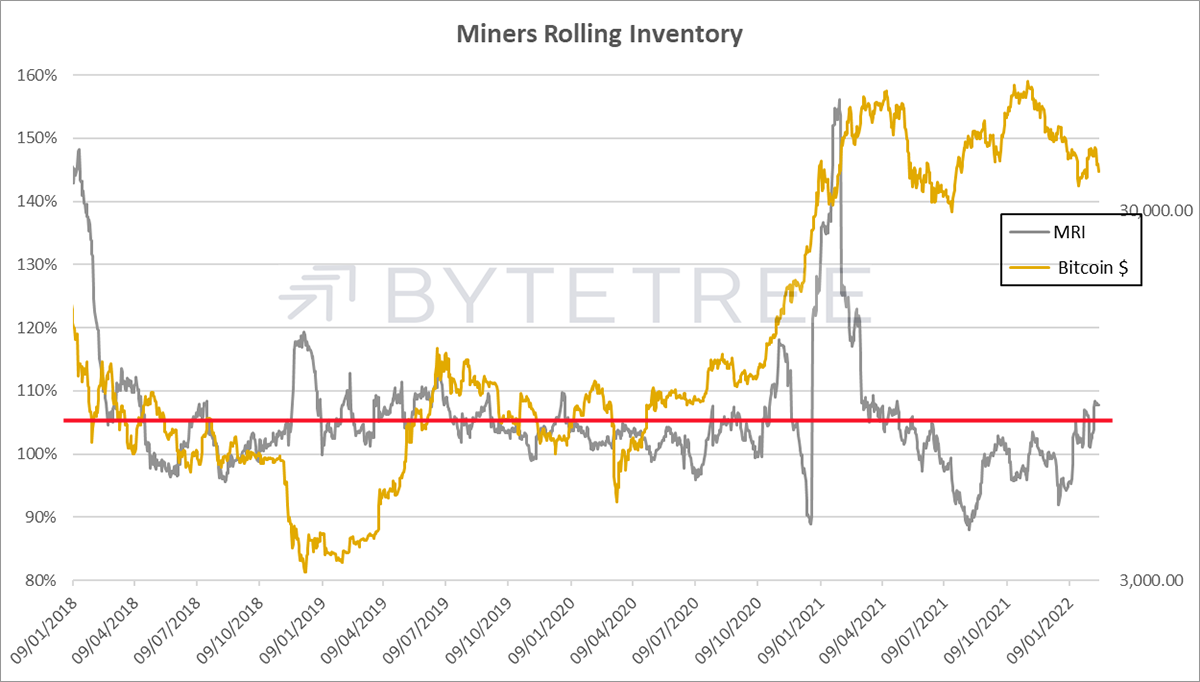

Miners have continued to sell into what has been a weak market. This is pragmatic. What we would be uncomfortable seeing is miners taking a strong view on the price and hoarding in a weak market because this simply creates an overhang and sets up a capitulation. This was the case in late 2018 when the price fell 40% or so, and the miners unloaded inventory into cycle-low prices. Also note that the miners took advantage of the late 2020 and early 2021 surge. They should be in pretty good health.

Elsewhere there’s not a great deal to write home about. As seen below, Fees have slumped again.

Meanwhile, the transaction count has gone into reverse.

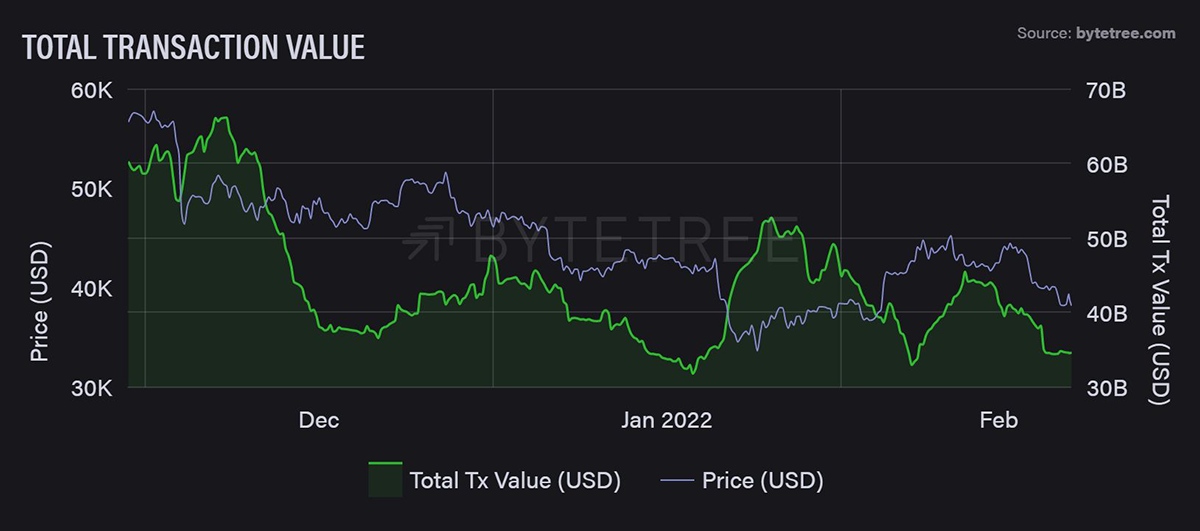

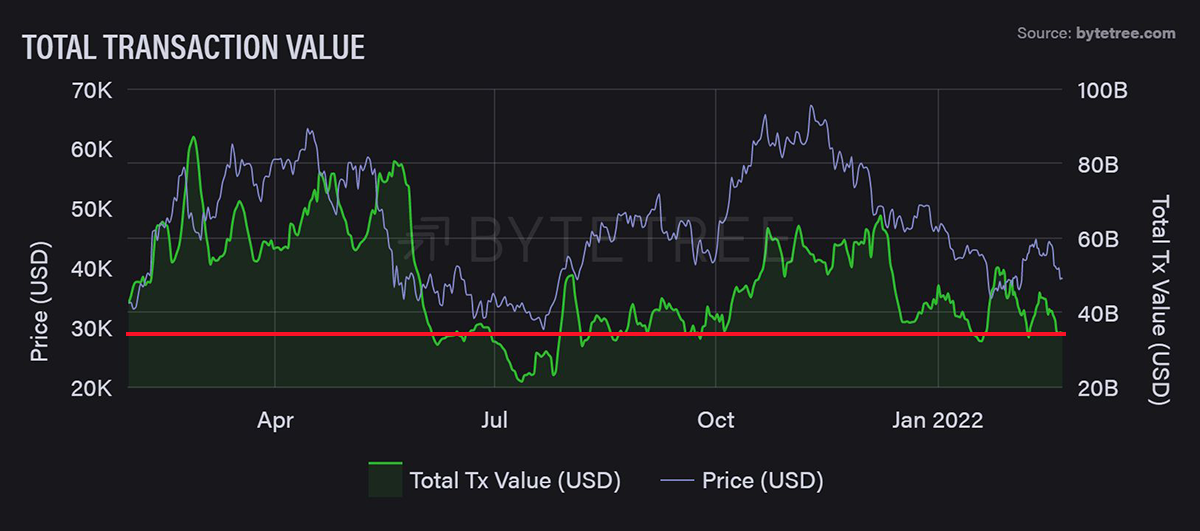

While the value of transactions has also dropped back to recent lows.

All a bit gloomy, although if we zoom out (see below) we can see that when we dipped below this level back in June/July 2021, it marked a good entry point.

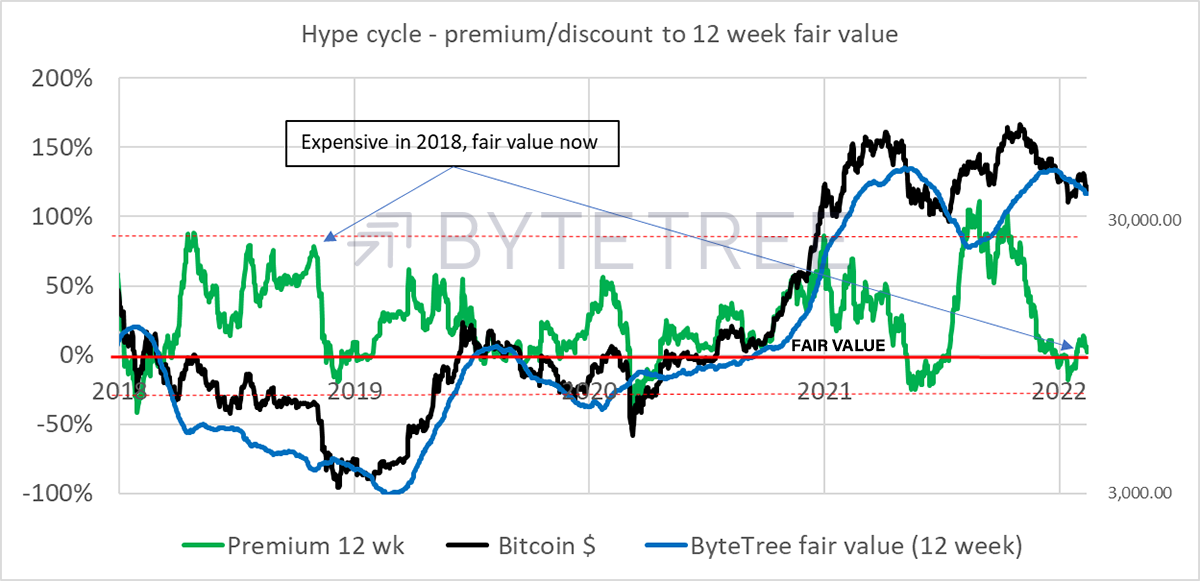

One thing that has changed since 2018 is that Bitcoin is no longer very expensive against its own trading history. If we look at the fair price, calculated as a multiple of transaction volumes averaged over the 12 weeks, bitcoin is bang on the Fair Value line, which was very much not the case in 2018.

Comments ()