On-Chain Echoes from 2018

Disclaimer: Your capital is at risk. This is not investment advice.

Week 7 2022

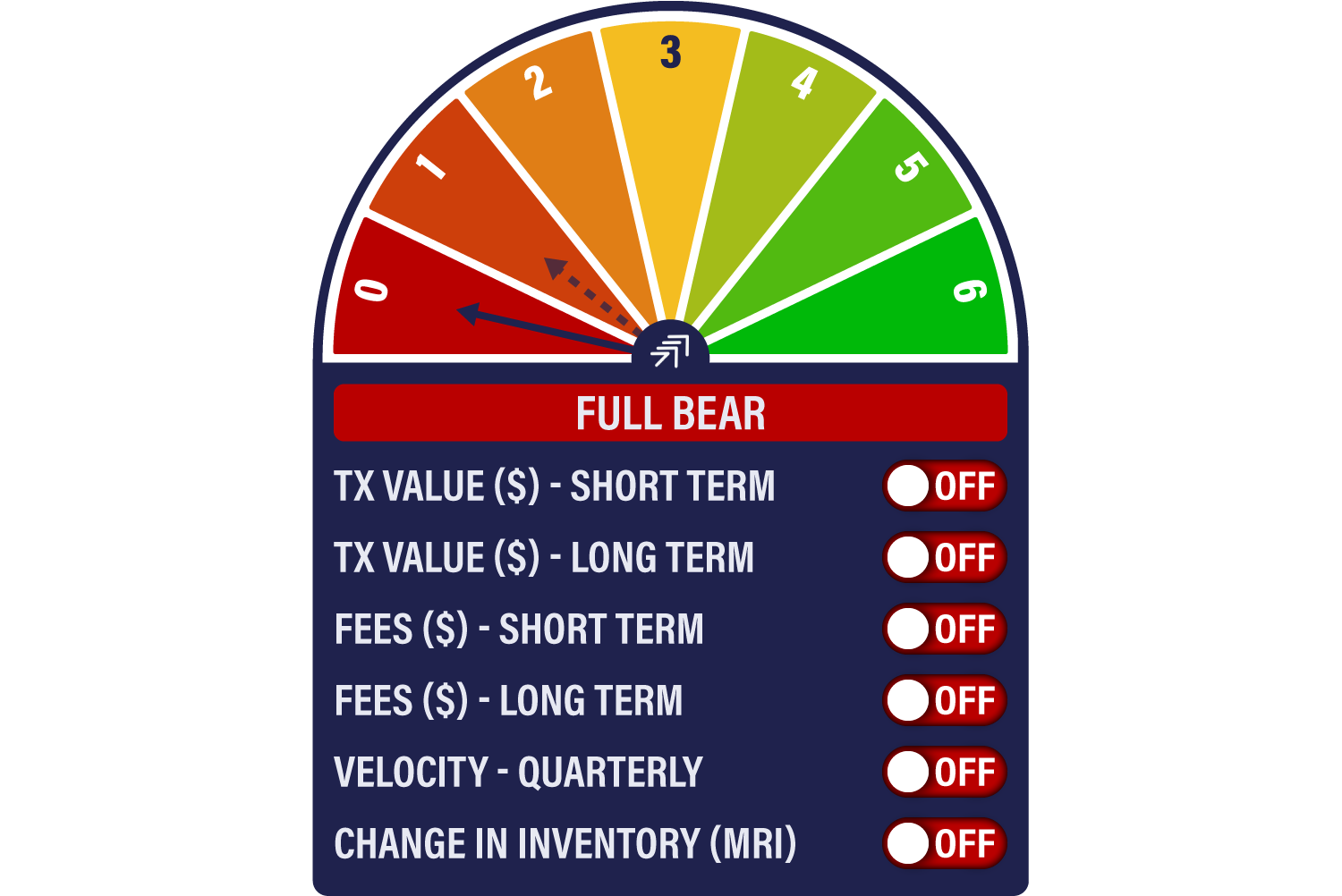

We can’t escape the fact that network demand continues to falter. Last week we were left with only the short-term transaction action signal in positive territory, but once again, there has been no uptick in transaction value to provide follow-through from the recent bounce.

This week the model once again turns back down to zero, a full bear.

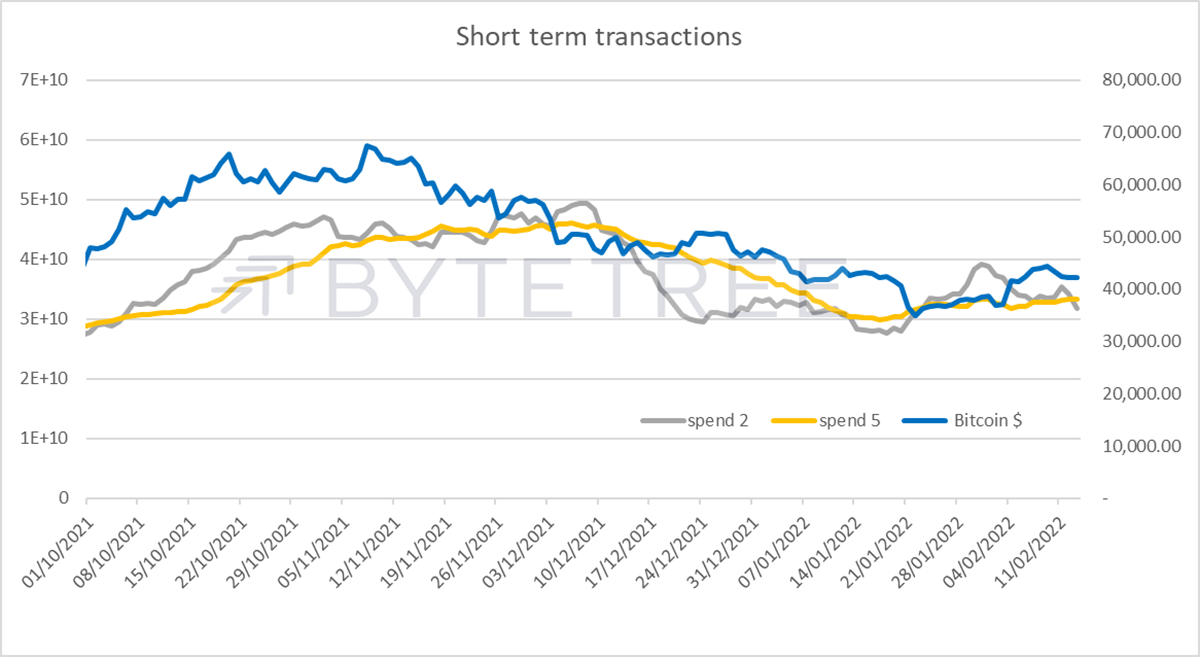

Zooming in on the short-term transaction series above, it’s clear that post the price recovery, from the recent low of around US$33k, transaction activity has once again tailed off (grey line). It seems like there are traders around who are willing to buy into selling climaxes, but appetite peters out at higher levels.

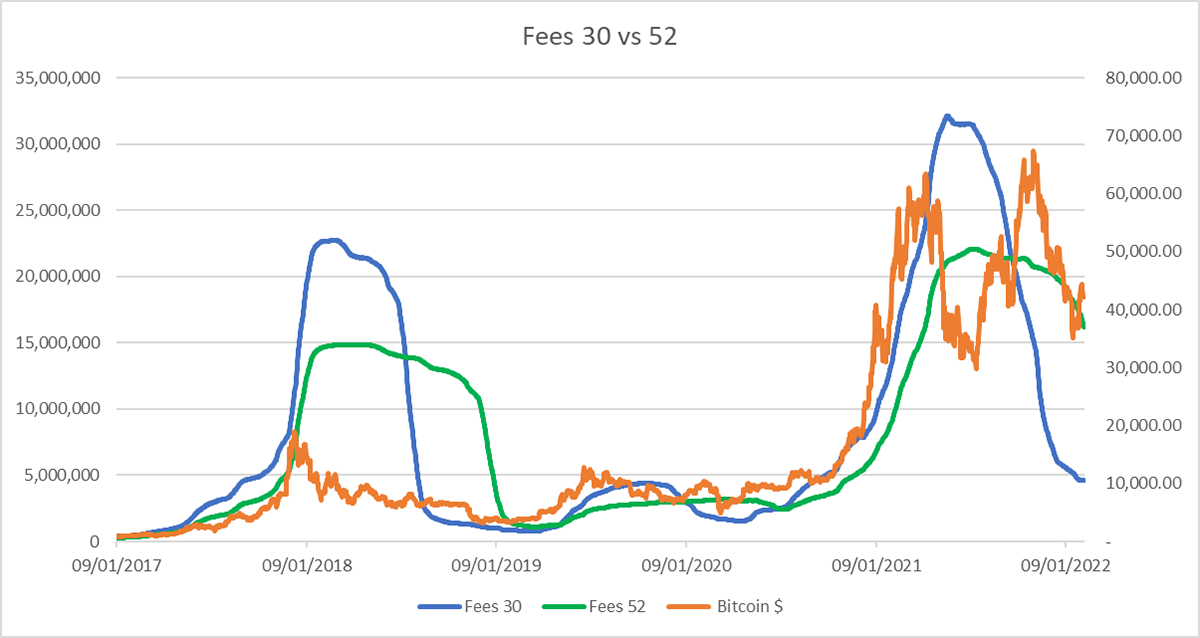

The collapse of bitcoin fees is pretty mind-blowing, but not without precedent, as shown below, where we look at the 30 and 52-rolling averages.

It would be nice to assert that history tells us that the worst is in the price, but the 2018 analogue doesn’t make happy viewing. Network activity tailed off through the first half of 2018 when it looked like the price had found a bottom, very similar to what we see now. What followed was a sudden and unexpected 40% drop in November, which really marked the bottom of that cycle.

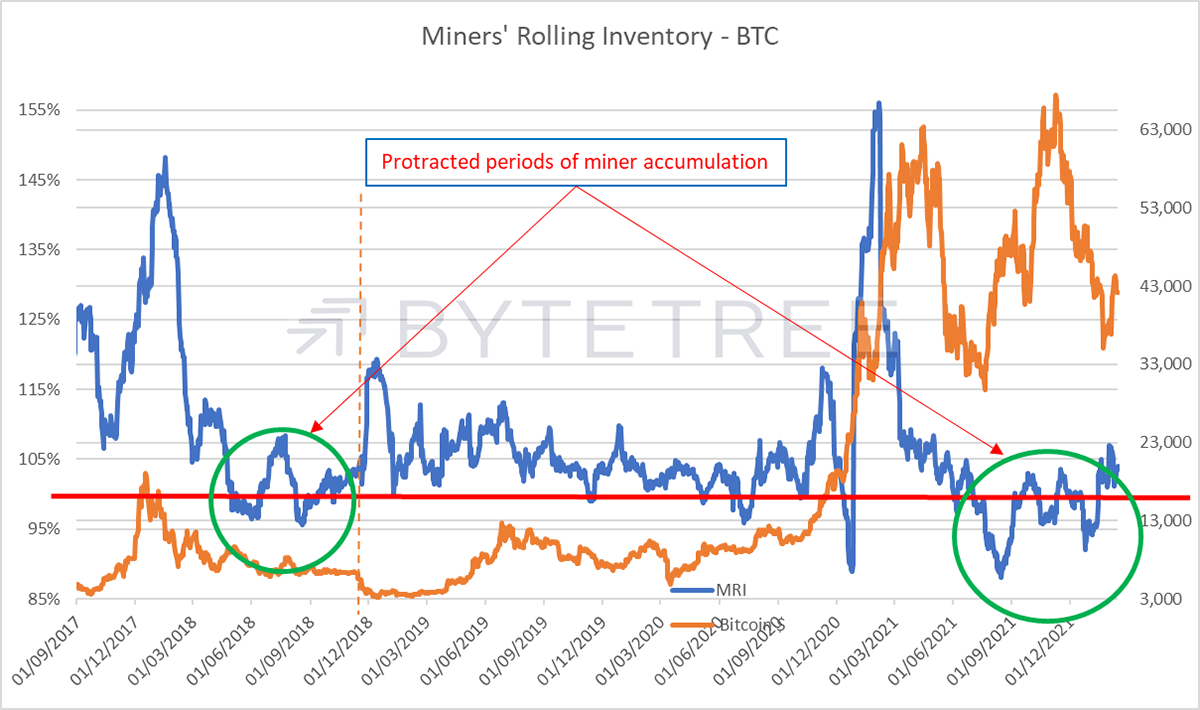

The November 2018 dump was marked by a massive spike in Miner’s Rolling Inventory (MRI). It seems like the miners were reluctant to unwind inventory until they had no choice. In our view, it is unwise for miners to hoard inventory - they are in the business of mining, not speculating, two very separate things.

As mining has moved out of China and into the west, mining companies have been able to avail themselves of fiat capital. This has enabled them to finance operating and capital expenditure from shareholders and not from the business itself. This is fine in a bull market but backfires badly in a bear market. If the bitcoin price remains low. there is a risk that miners will be forced to reduce inventory into a market that has little appetite for renewed supply.

The above scenario clearly played out in 2018, when miners accumulated inventory from the second quarter onwards, presumably thinking that they were cleverly timing the cycle lows. However, the price collapse seems to have triggered a panic sale and a flight to fiat safety.

We aren’t seeing miner panic by any stretch of the imagination, but some sizeable lumps have appeared. To give an idea of this, we witnessed a big chunk earlier today (top bars), substantially larger than the usual first spend. Something to keep an eye on, particularly if transaction activity remains subdued.