Bitcoin and the Financial Lifeboat Narrative

Disclaimer: Your capital is at risk. This is not investment advice.

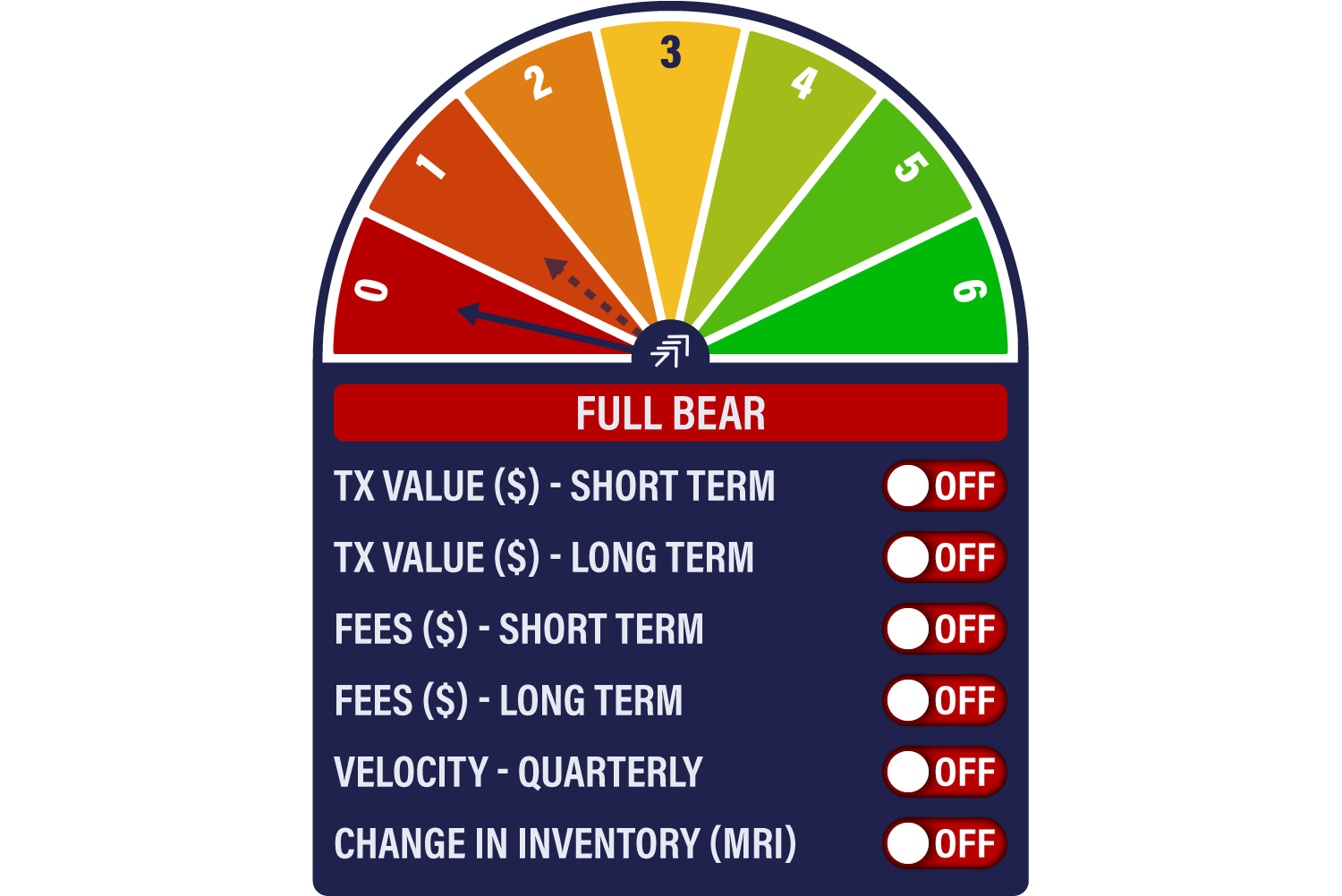

Bitcoin Network Demand Model

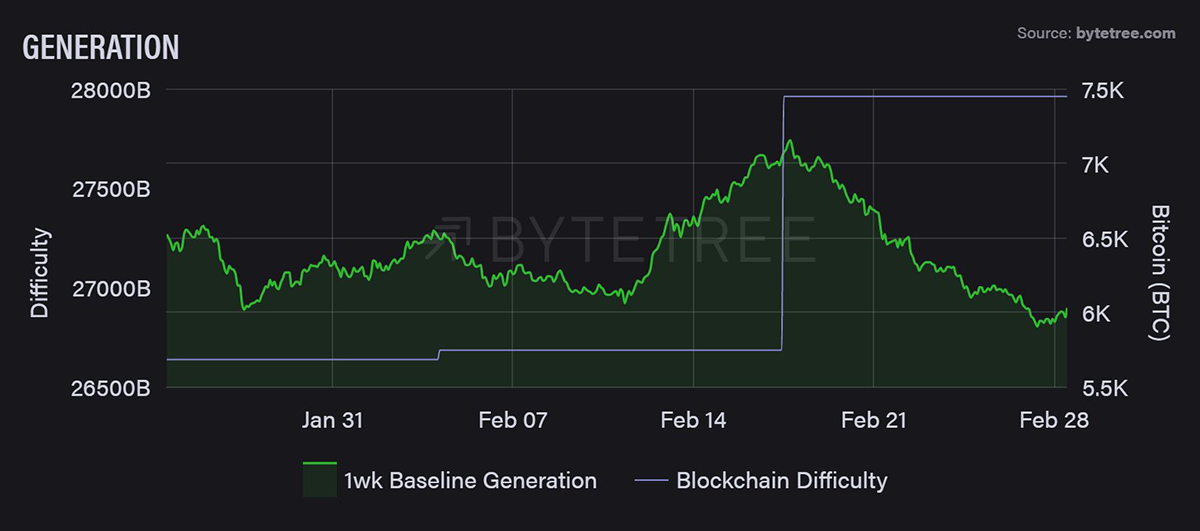

There is no positive news from the Network Demand Model again this week as bitcoin on-chain activity remains torpid. After a brief burst of selling, the miners have once again sat on their hands, and Miner’s Rolling Inventory (MRI) has adjusted sharply downwards. Similarly, fees remain subdued and transaction value stays in a range. Of interest is a sharp increase in block time over the last ten days and, with that, a decrease in generation.

Some semblance of pattern recognition suggests we might encounter another bout of miner selling soon - watch the First Spend chart on the Terminal. A big spike will tell you that MRI is about to climb again. How the market adjusts to this will be important, particularly given the Ukraine situation.

Since the last “difficulty adjustment” on the 16th February, coin generation has declined and block times have increased sharply.

The difficulty adjustment is designed to keep the Bitcoin Network operating at a pre-defined, codified tempo. An adjustment higher effectively makes it more expensive for the miners to extract value from the network, whether in the form of rewards (new bitcoin) or fees. Higher difficulty might have the effect of removing marginal production. Loss of income from regular mining activity might have the secondary effect of prompting greater inventory sales, although this is very hard to quantify.

The impact of the Russian invasion of Ukraine should not go unremarked in this regard. As of August 2021, Russia accounted for around 11.23% of the global hashrate (Cambridge Bitcoin Electricity Consumption Index). It seems unlikely that there will be much change in this dynamic in the short term, although it is interesting to see that Flexpool, an Ethereum mining operation, has halted services to Russia entirely.

It might be that over time, sanctions on equipment will downgrade Russian mining capabilities, but short term, there seems little reason to expect a shock like the one we experienced from China last year. Furthermore, it seems unlikely that exchanges will block individual accounts.

The danger in all of this is that crypto gets portrayed as an escape route for Putin’s cronies rather than an escape route for his victims. It is important that crypto’s role as a financial lifeboat for those who have been unlawfully dispossessed remains the dominant narrative; otherwise, there will be repeated calls for censure.

While the Ukraine situation demonstrates Bitcoin’s use case as a means of protecting wealth in the most extreme scenario, overall network activity remains a concern. It suggests other forces are at work outside Ukraine that are keeping investors cautious.