Why Ukrainians Own Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 109

With tensions rising between Kyiv and Moscow, the world waits to see whether Russia invades. Their motivation has been to contain NATO, which has been closing in on their borders for decades. This is an opportune time for the Russians to attack while they are practically unopposed.

Since the annexation of Crimea in 2014, Russia has spent eight years preparing itself to withstand harsh sanctions, which would be the inevitable consequence of an invasion. Today, it has a huge foreign exchange and gold reserves, low debt and holds the cards in Europe’s energy supply. Russia is more self-sufficient than it has been for years.

These days, what is good for Russia is bad for Ukraine. The political uncertainty and threat of invasion have turned Ukraine into a Bitcoin hub as people have sought to protect themselves financially. Ukraine punches far above its weight in crypto, ranking 20th in hosting Bitcoin nodes despite being the 60th largest economy. Better yet, according to the Chainalysis 2021 Global Crypto Adoption Index, Ukraine ranked fourth. Institutional and B2B activity were so-so, but activity from retail investors was off the scale.

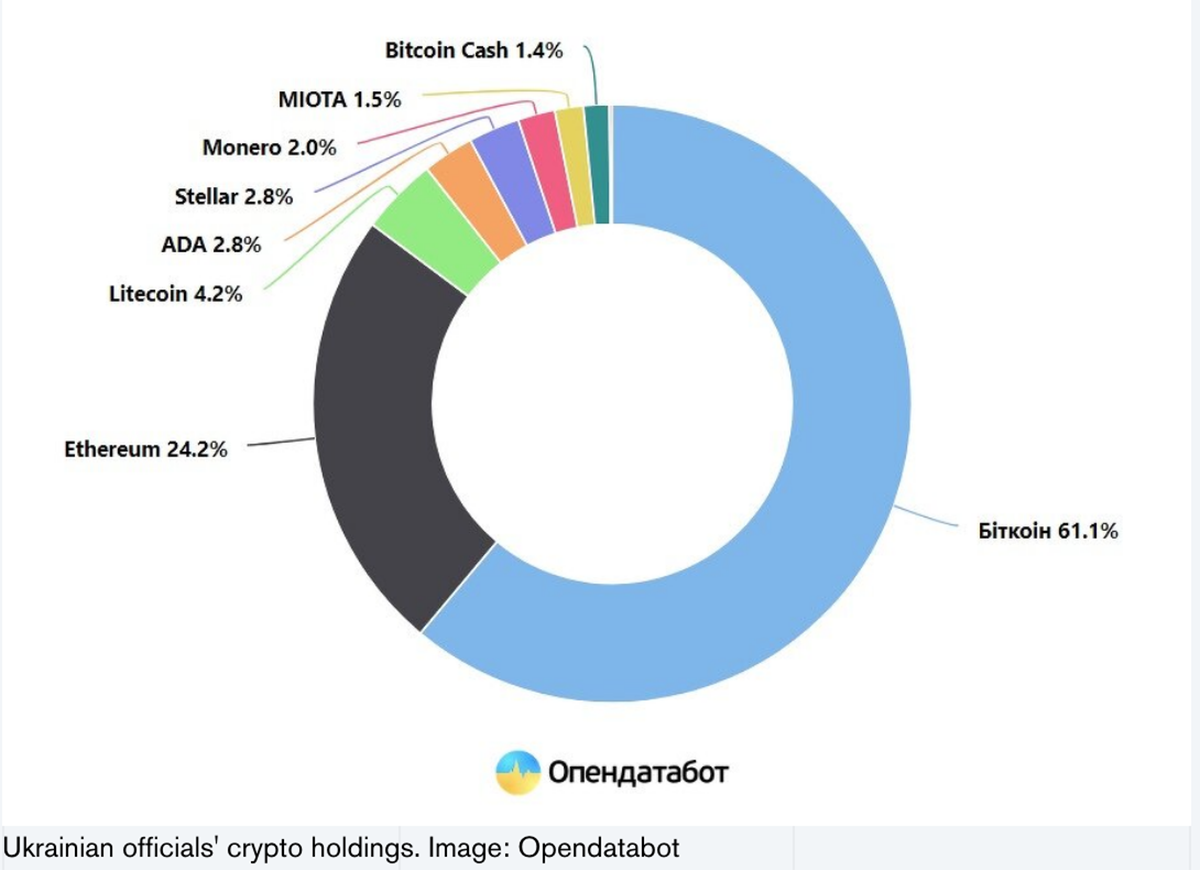

Crypto is so popular in Ukraine that in September 2021, the Parliament adopted a law that legalises and regulates cryptocurrency, removing uncertainty for investors. That was a long time coming, given that Ukrainian public officials have declared owning 46,351 BTC, which is worth around $2 billion.

It is unsurprising that crypto became popular as Ukrainians are well educated, particularly in mathematics and computing, and live under a cloud of political uncertainty. That means they understand how to use it while having a powerful motive as a hedge against political turmoil.

Beyond political and military risk, other macroeconomic events have put pressure on the economy, even before bitcoin was released in 2009. As a result of corruption and political uncertainty, the Ukrainian Hryvnia (UAH) has been consistently weak in recent history. Naturally, the experience of high inflation and currency debasement incentivises holding assets outside of the system.

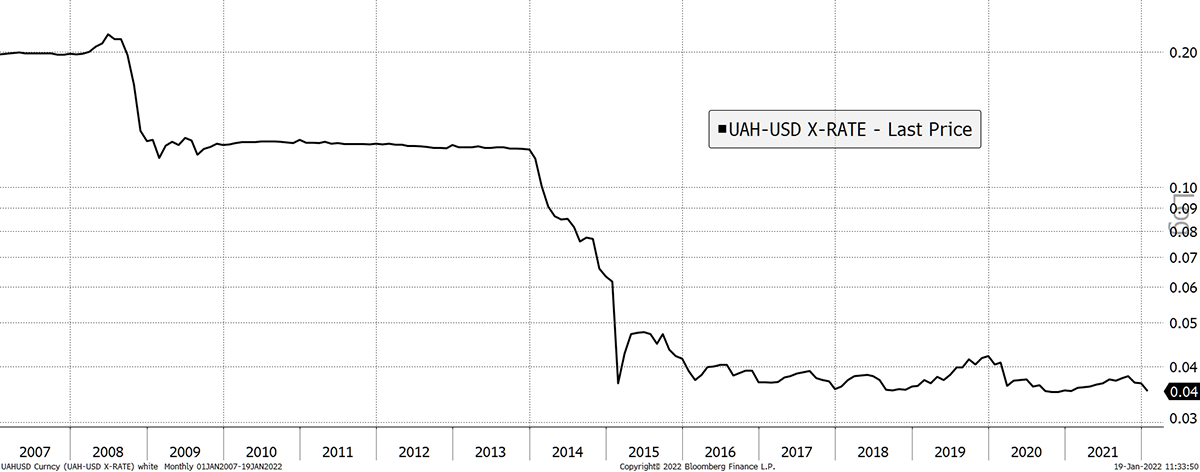

Ukrainians’ enthusiasm for crypto has paid off as the hryvnia has depreciated against the US dollar by 9.3% p.a. since 2000 and 13% p.a. since 2008. This makes saving in local financial assets all but impossible.

The Hryvnia loses money quickly

Pre-bitcoin, gold was the natural way to store wealth - something that is commonplace in countries with depreciating currencies and political uncertainty. While gold is still very much the go-to store of value for central banks and old school institutional investors, it is easy to see the advantage of holding wealth in a digital form in the 21st century.

Perhaps it matters less whether that wealth is bitcoin, gold, shares or dollars, provided it is held digitally. If it is, it doesn’t even matter if your phones and computers are confiscated, provided you can remember a short phrase. Once you reach safety in another country, just log on, and your ownership is recovered. There’s some technical knowhow, but not much, and after all, necessity is the mother of all innovation. Such self-custodianship is exclusive to digital assets, and it transcends intermediaries, be that your government, your neighbouring country’s government, or even an inaccessible bank in times of war.

When it comes to digital assets, bitcoin is by far the most established and has the benefit of being truly decentralised. That is an advantage over traditional assets, which could ultimately be confiscated through legal channels. In contrast, bitcoin cannot simply be confiscated, demonstrating the actual value proposition of decentralisation.

When you see criticism of bitcoin’s energy use, it comes courtesy of that decentralisation. Without it, some actor could play with the code and make changes, but with it, they can’t. Escaping with digital wealth, only to find it confiscated through the courts would defeat the purpose.

In that sense, bitcoin’s volatility is something to embrace rather than fear. It’s hardly going to be a calm ride when many investors are motivated by chaos. If you were facing the threat of a Russian invasion, it stands to reason that the price volatility is less of a concern when the alternatives are so much worse.

What is happening in Ukraine marks a turning point. The US and their allies have left Afghanistan, demonstrating that the world’s police force has signed off. This gives the likes of Russia the green light to do what they wish.

Then there’s the monetary threat that stems from decades of easy monetary policy and debt accumulation. Inflation will stay high, meaning that not just people living in places like Ukraine seek safe-havens, but much of the developed world too.

The more uncertainty spreads, whether macroeconomic or geopolitical, the more people will start to come to the same conclusion. They will accumulate assets such as gold and bitcoin. Those who are happy to sit tight can opt for gold, but those who feel they are likely to move will opt for bitcoin. Don’t lose sight of the big picture; the trust in institutions, be they financial or political, is waning. Decentralised digital assets are the expression of this mistrust, and their adoption will sharply increase in line with institutional interference, incompetence and insipidness.