Terra: To the Moon or Down to Earth?

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: Luna

The digital assets space is currently taking a beating. The Federal Reserve is expressing an intention to increase interest rates sooner than anticipated. Kazakhstan, the jurisdiction which accounts for 18% of all bitcoin mining, has shut down its internet connectivityfor an indefinite period as a result of political turmoil. It is moments like these where long-term investors and crypto-enthusiasts alike must turn their backs on the noise and look for the music; that is, the protocols that can create real value.

In my view, real value exists in the overlap between the crypto-world and the real world. Digital assets have often had an ‘in-to-out’ approach, where the value of crypto protocols is often derived only from other crypto protocols, used only by crypto-fanatics. For example, a protocol that enables users to trade digital assets derives its value from other digital assets and represents a mentality testament to a circular economy. Here, digital asset market actors expect adoption to occur automatically, without reaching out a helping hand to the outside world.

This is where Terra is different. Terra employs an ‘out-to-in’ approach and deviates from this mode of thought, answering questions such as ‘What can digital assets do for real people in the real world?’ and ‘How do we create demand from those external to the digital assets space?’.

So, what is Terra (LUNA)?

Founded in January 2018 by the co-founders of Terraform Labs, Daniel Shin and Do Kwon, the Terra blockchain is an ecosystem of decentralised stablecoins. Stablecoins are essentially money market funds that utilise crypto infrastructure for global payments, and they are contrary to the volatile nature of most digital assets. They also turn the old money on old payment rails to tokens, or standardised packets of software, which can be transferred at the speed of an email or text message. There are more than a dozen stablecoins on the Terra blockchain, the first being the KRT (Korean won) and the most popular being UST (US dollar).

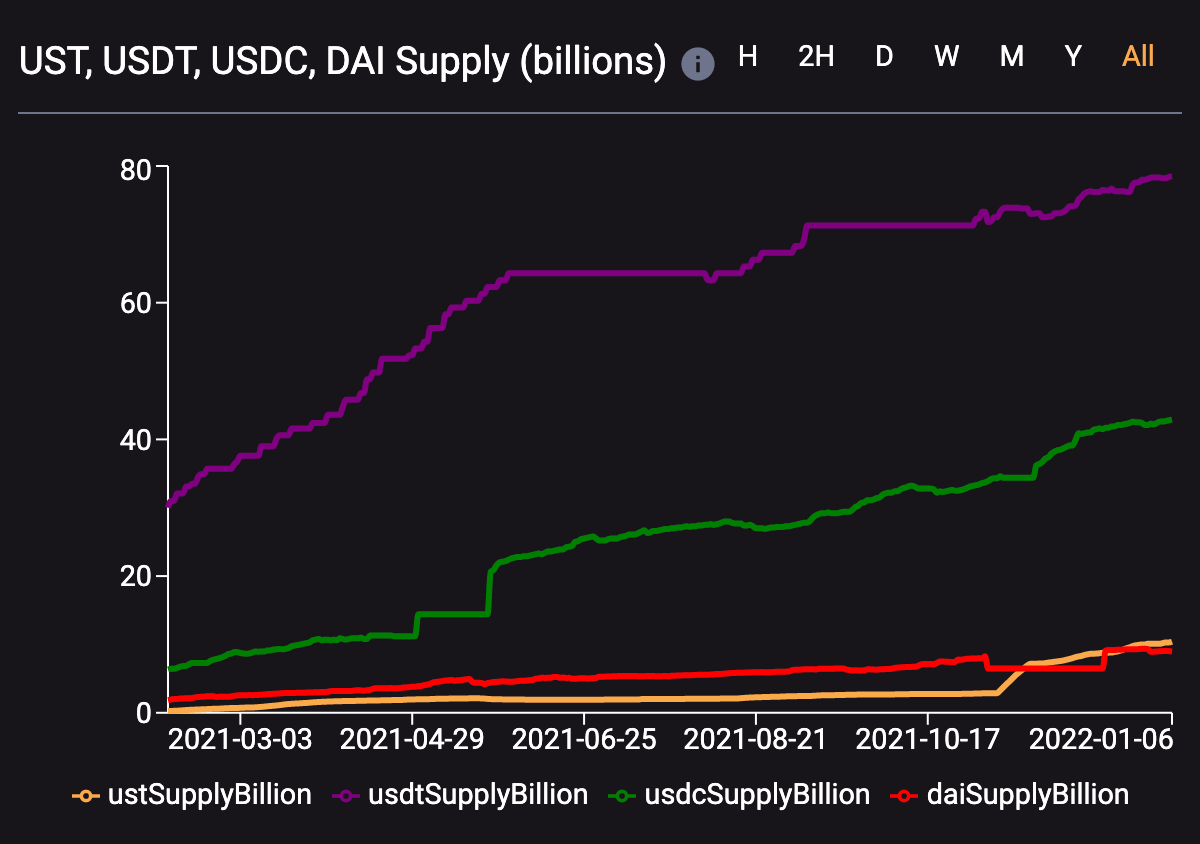

Whereas the market-leading stablecoins Circle (USDC) and Tether (USDT) maintain their fiat-peg by holding equivalent dollar reserves to the amount of USDC/USDT in circulation, Terra stablecoins algorithmically maintain their peg through an interrelationship with LUNA, the platform’s governance token. To mint UST, an equivalent dollar amount of LUNA must be burnt.

When UST exceeds its $1 peg, an arbitrage opportunity is created for network participants to mint UST by burning LUNA. This increases the supply of UST and restores its $1 peg. The opposite occurs when UST’s peg falls below $1.

The innovation of stablecoins disrupted the banks that consistently interrupted digital asset transactions. However, if stablecoins are as centralised as Circle and Tether are, don’t they simply mimic the single points of failure the banks are notorious for having? Surely, stablecoins ought to resemble the decentralised industry they seek to further?

This begs the question of what the advantage of UST is over Dai. Dai is another algorithmic, decentralised stablecoin that is issued through over-collateralised loans. The problem with Dai is that it depends on a constant demand for leverage. Terra separates itself from needing a constant demand for leverage by implementing a zero-sum mechanism between LUNA and Terra stablecoins. Moreover, Dai’s dependency on over-collateralisation in conjunction with its supply dynamics – on which there are hard limits subject to lengthy voting processes – means that its scalability is stunted. With over $10 billion UST issued, Terra has shown an impressive ability to scale its stablecoins.

LUNA is the stability mechanism for Terra’s stablecoins. With a maximum supply of 1 billion LUNA since genesis, the asset is a de facto deflationary currency system. As the demand for UST grows, the circulating supply of LUNA will fall. The elegance of this tokenomics means that the adoption of UST almost has a linear relationship to the value of LUNA. However, this works both ways: if there is insufficient demand for UST, LUNA becomes effectively worthless. So, where and how is this demand captured?

Terra Applications

It is first important to note that Terra is a Proof-of-Stake blockchain built using Cosmos’s Software Development Kit (SDK). Cosmos can be seen as a layer-0, or an internet of blockchains, which facilitates transactions at lower costs and higher speeds when compared to, say, Ethereum. The benefit of building on Cosmos also extends to developers not needing to subscribe to the rules of the underlying blockchain, as would be the case on Solana, Ethereum or Avalanche. This grants Terra the autonomy to create a sovereign, separate blockchain, and design it in accordance with its specific use-cases in mind.

Chai

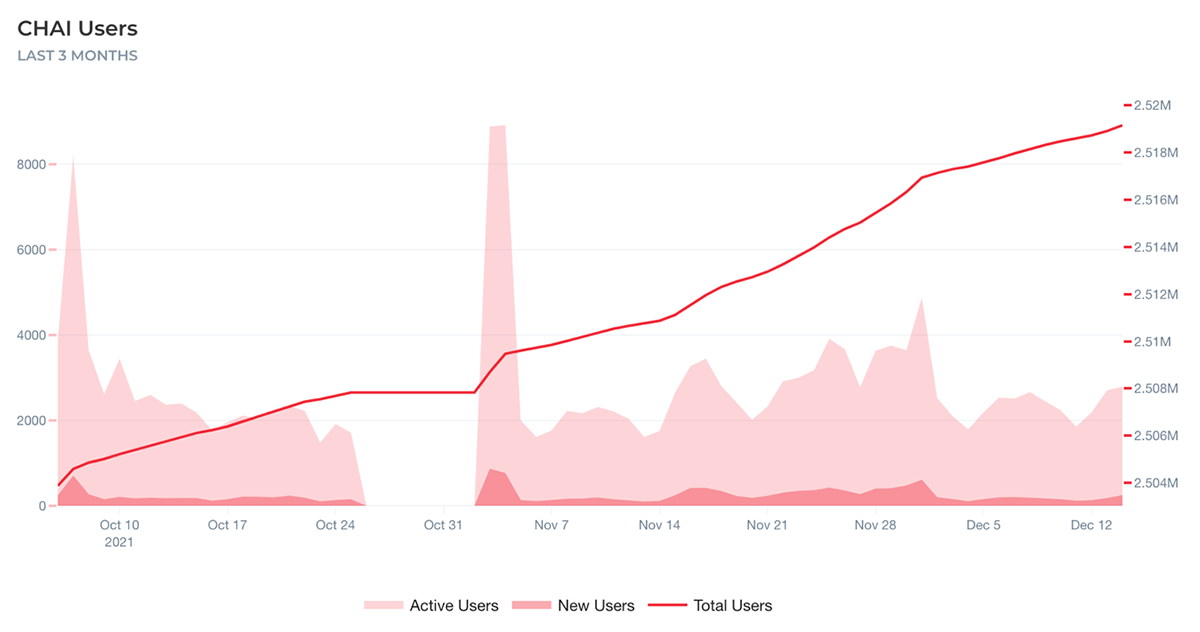

Chai is one of the fastest-growing e-wallet platforms and payments processors in Korea. Chai is the front-end application, whereas Terra is the back-end technology enabling the application.

Unlike in the US or UK, merchants in south-east Asia are more sensitive to their available working capital; indeed, many Singaporean taxi drivers still only accept cash. The 2-3% transaction fee charged by payment services with settlement times spanning a few days is less than ideal. Chai streamlined this settlement process by using Terra stablecoins, specifically KRT, reducing transaction costs from an average of 2.7% to approximately 1.1%. It is no surprise that CU, Korea’s largest convenience store chain, put up banners across 19,000 of its outlets encouraging the use of Chai.

Chai is part Visa/Mastercard and part Square/CashApp. Its adoption does not require any understanding of blockchain technology, and its merchant-centric approach has gained serious traction.

Anchor

Anchor is a savings product that offers users a fixed APY of up to 20%; yes, 20%. Its innovation is tied to two factors:

- It eliminates needing to rely on volatile digital assets for high APY by using stablecoins instead.

- The 20% APY is made possible as deposits on this protocol are put to work (i.e. staked themselves).

For example, if a user tries to take out a loan on Compound.Finance and posts collateral in ETH, this ETH is locked and remains dormant on the protocol. Since Anchor supports Proof-of-Stake digital assets that have very positive staking rewards, the protocol puts collateralised tokens to work by staking them into different blockchains and earning a staking yield on them. That staking yield is then conferred to the lender in the form of a stable deposit yield. Neat.

Chai and Anchor are merely two depictions of Terra’s growth potential and ingenuity. The Terra roadmap is exciting, its community funds are vast, and innovation is rife.

Conclusion

Stablecoins are one of the most powerful inventions in the digital assets sector. Should they maintain a single point of failure as a result of their centralisation, they become a tad oxymoronic.

Perhaps a good way of testing decentralisation, or lack thereof, of a digital asset is by imagining who Congress would call upon to question in the event of trouble. With USDT, they would call upon Tether. With USDC, they would call upon Circle. With Diem, they would call upon Mark Zuckerberg. The hope with UST is that Congress would have nobody to call.