The NEAR Protocol: A Faraway Competitor?

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: NEAR;

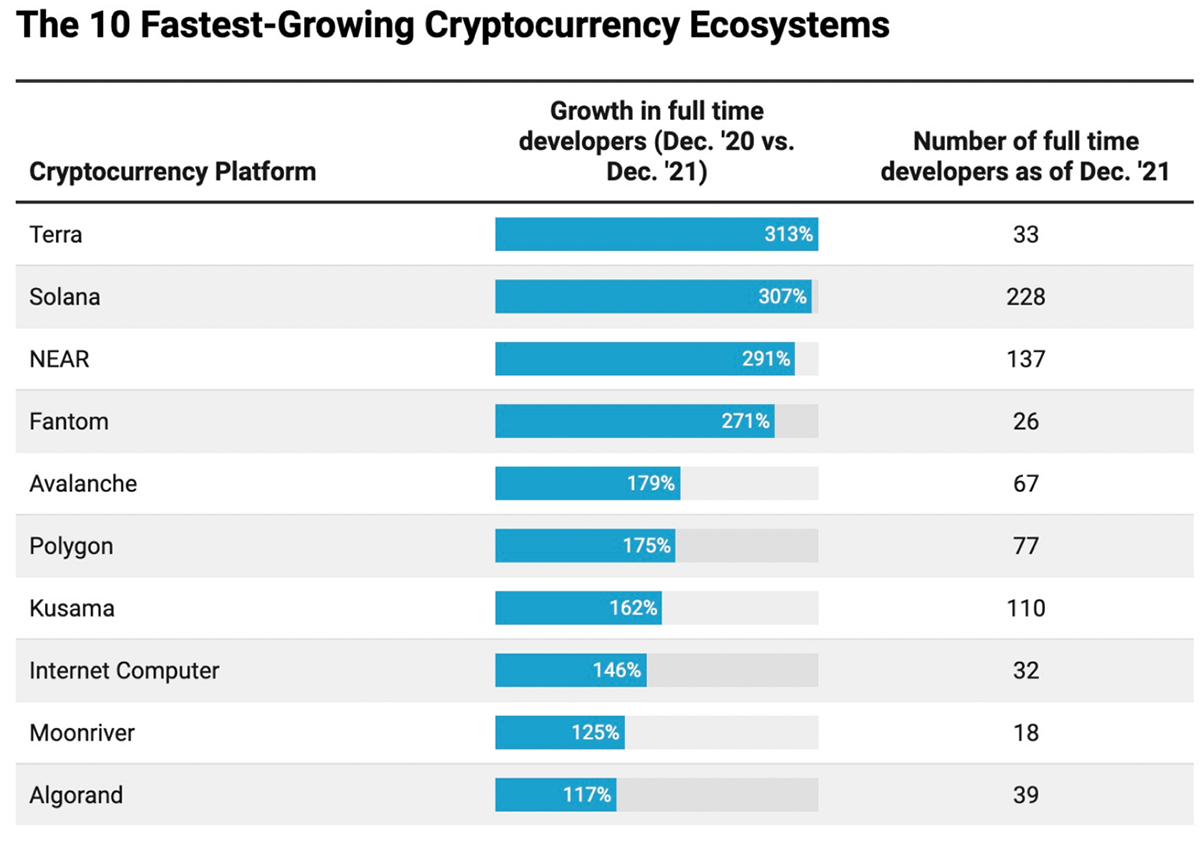

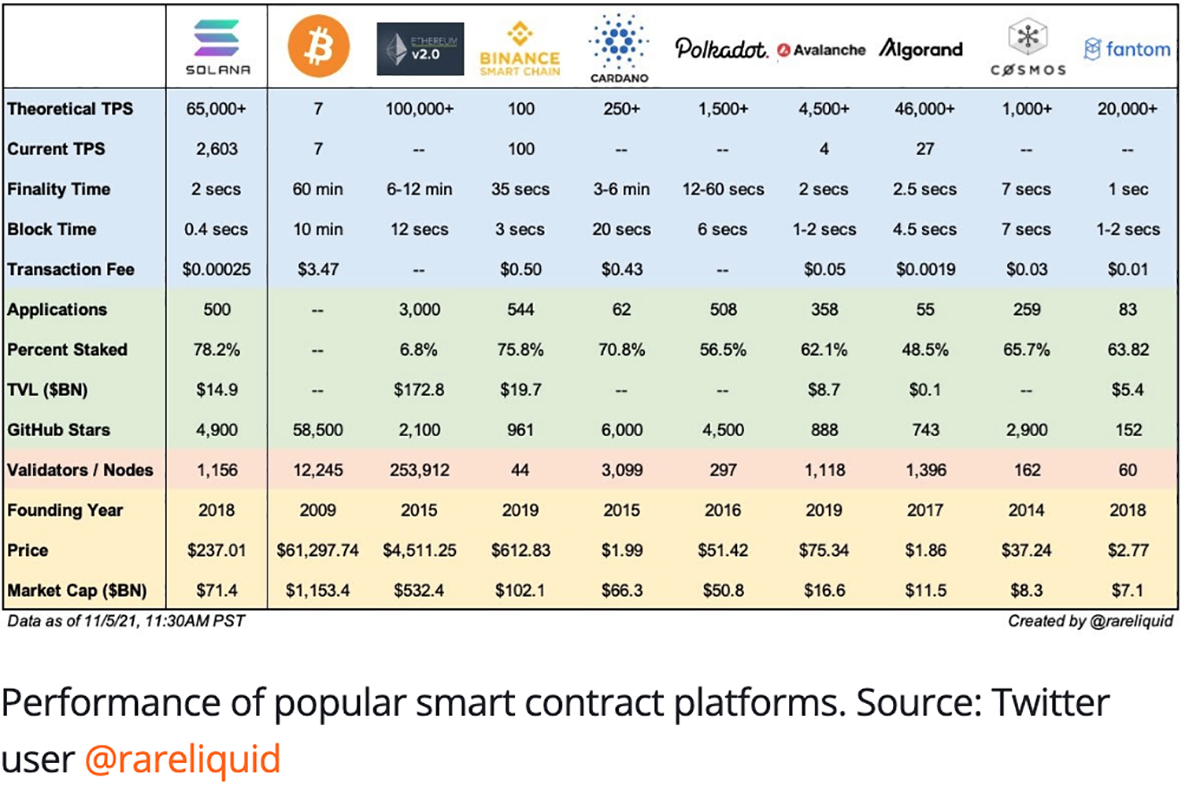

Three principal themes are directing the flow of capital in the smart contracts space: scalability, interoperability and usability. Scalability refers to a blockchain’s ability to be quick without costing an obscene amount of money. A lack of interoperability refers to the current compartmentalisation of dApps and the resultant loss in synergies, while usability relates to the simplicity of a user interface and the capacity to attract developers.

The current reference point we have is the king of the alts, Ethereum. The gas fees are too high, the transactions per second are limited, and your grandmother is more likely to win the lottery than successfully transfer an ERC-20 token to your MetaMask wallet. It is no wonder that Ethereum competitors continue to gain traction. A few months ago, we saw competition from Solana (SOL) and Avalanche (AVAX). Now, it is NEAR (NEAR) and Fantom (FTM) in the spotlight.

This begs the question of whether there is a significant enough difference among the smart contract platforms? Does each token have its moment in the sunshine, a mere phase of speculative glory, or is there an underlying utility behind the upside?

What makes NEAR different?

As alluded to already, NEAR is a delegated proof-of-stake smart contract platform that promises to be a cheaper, quicker, developer- and user-friendly version of Ethereum. The NEAR protocol was founded by Alexander Skidanov and Illia Polosukhin, former Microsoft and Google engineers respectively. On top of recently raising a mammoth $150m in a round led by Three Arrows Capital (3AC), NEAR has been financially backed by the best in the business since its very inception, including a16z, Alameda Research, Electric Capital, Dragonfly Capital, Coinbase Ventures, and Pantera Capital. Few protocols can boast this pedigree of funding quality and quantity.

NEAR implements its solutions to scalability, interoperability and usability in three main ways.

1. Scalability: Dynamic Sharding

NEAR’s solution to scalability is sharding via a mechanism called Nightshade. Sharding divides the computational load of a blockchain network into ‘shards’ that operate parallel to each other. On the NEAR blockchain, tasks are split, so individual nodes need not carry the entire network’s code, as is the case with Ethereum and Bitcoin, but only the code of their individual shards. As the shards work in parallel to each other, they diversify the burden of transaction activity, computation and storage.

NEAR’s sharding solution is dissimilar to Ethereum 2.0, as its shards scale ‘dynamically’, or in response to demand. In simple terms, ‘dynamic’ comes from shards being added and removed ad hoc, depending on transaction loads. The end benefit of dynamic sharding is that the network only has to pay for the infrastructure and scale exactly demanded, without requiring to pay for unneeded throughput.

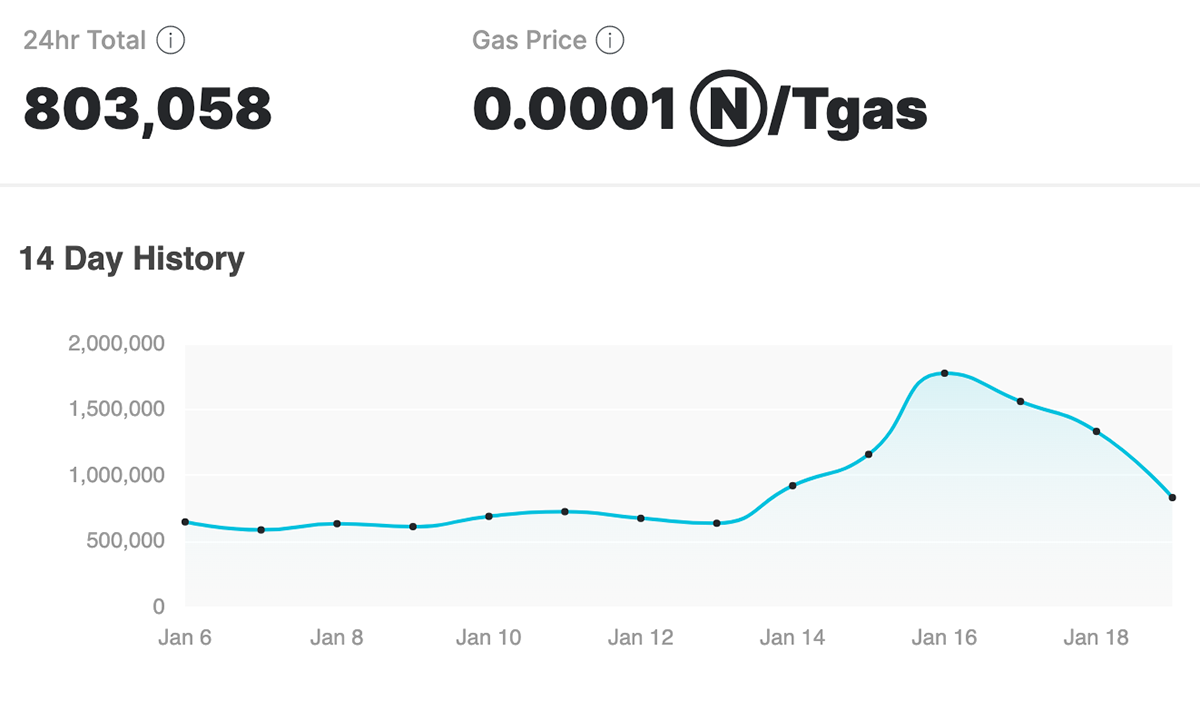

Theoretically, NEAR can reach a throughput of 100,000 TPS while keeping fees low. While 100,000 TPS is still ambitious, low fees, despite more transactions occurring on the network, is a reality.

2. Interoperability: Rainbow, Aurora, and Octopus

The Rainbow Bridge is compatible with the Ethereum Virtual Machine (EVM) and connects NEAR to Ethereum without the extortionate gas fees. This enables NEAR and its users to cheaply access the greatest capital pool within the ecosystem.

Aurora is essentially an EVM layer-2 on NEAR that can benefit from the cost and speed efficiency of the NEAR protocol. This improves externalinteroperability, i.e. applications or blockchains outside of the NEAR protocol.

The Octopus Network runs on the NEAR protocol and furthers interoperability by enabling Inter-Blockchain Communication-compatibility. Put simply, the Octopus Network can cheaply lease out-of-the-box security and interoperability to new application chains. This reduces the cost of setting up applications on the network while increasing accessibility to other applications and capital pools. This improves internal interoperability, i.e. applications or blockchains within the NEAR protocol.

3. Usability: User Interface and Developer Incentives

Applications on NEAR can be built in both Rust and AssemblyScript. These coding languages are a way to onboard existing Web2 developers and are testament to a developer-friendly approach as Web2 developers can quickly and easily code in both languages. The number of mechanisms used to attract future development on a blockchain is a great metric for analysing its long-term durability.

All transaction fees on the protocol are paid in NEAR, and are burnt unless they involve a smart contract, in which case a portion of the total fees goes to the creator of that smart contract, as stated in their whitepaper:

“Contracts are rewarded with 30% of the gas fees they generate, giving developers an immediate business model for apps and infrastructure.”

Moreover, fees on NEAR are priced in a predictable manner, with limited inflation occurring in events of increased usage. NEAR’s developer-friendly approach is unique and encourages new developers to build on it, while incentivising developers based on other blockchains to migrate to it.

Finally, NEAR is one of the best when it comes to user interface. One could almost guess that the founders are former Microsoft and Google engineers. Also, the human-readable wallet addresses give your grandmother a fighting chance of transacting on this network.

Is NEAR Different Enough?

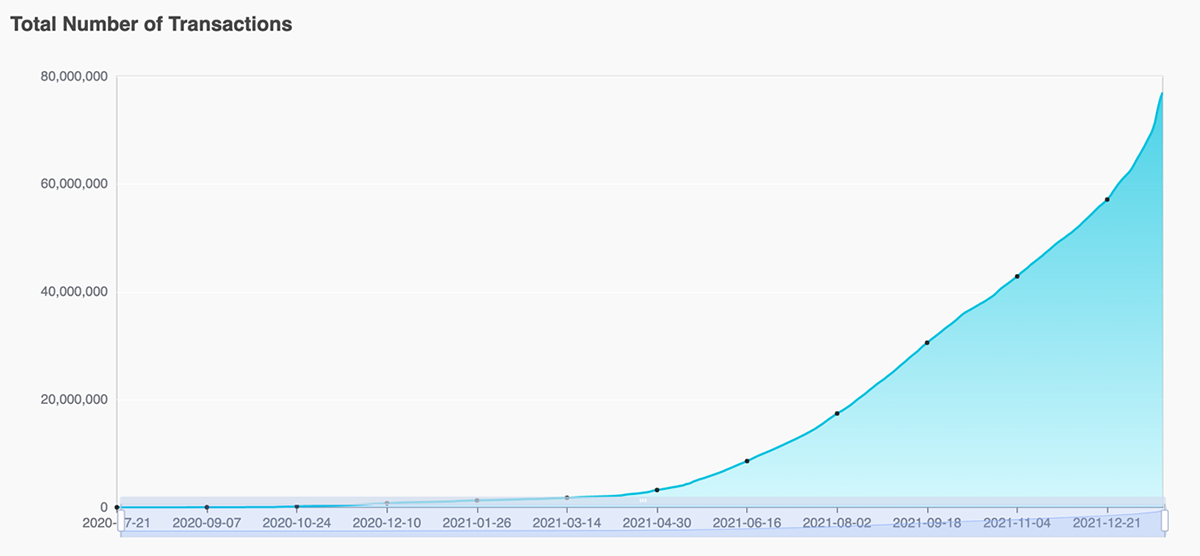

The crypto industry is heavily reliant on network effects. NEAR scores full marks for its technology, team and funding. NEAR settles transactions quickly, but so do AVAX, Solana and Ethereum layer-2s. The latter protocols are leading the way.

While NEAR isn’t in the table above, it would fit in it like a glove; Solana is quick, its coding language is also Rust, and its fees are equally low. The point is that the smart contracts space is the most competitive segment within crypto. Perhaps we are at a point of saturation, where the technological innovation of any given new entrant must be considerable for it to gain a sustained share of the market. Or maybe, NEAR has just proved to us that there is still appetite for layer-1s. Whereas Bitcoin and Ether have collapsed 25% and 28%, respectively, NEAR is up 102% from the beginning of December.

Yet, if we consider a timeframe longer than the last two months, NEAR has underperformed competitors such as Solana and AVAX by some margin. This can be partly attributed to the NEAR token’s vesting schedule or selling pressure, with the circulating supply increasing threefold since October 2020.

In terms of the issues that NEAR aims to tackle, this protocol hits the bullseye. It is one of the most technologically advanced protocols out there, its roadmap is exciting and the funding behind it cannot be ignored. Nevertheless, it is too early to say whether its promises will be fulfilled and whether there is enough demand on the consumer-side, as there is innovation on the creator-side. Time will tell.

Comments ()