Halving Fiat, Doubling Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 30

A 1% rise in inflation causes the purchasing power of money to halve every 70 years, so bitcoin doubling in anticipation is an entirely rational outcome. In my opinion, 4.5% inflation expectations seem inevitable, meaning the next double is just a matter of time.

Highlights

| Technicals | Major coins remain soft |

| On-chain | Miners hoard |

| Investment Flows | Flows Record outflows in ETH |

| Macro | Inflation goes where oil leads |

ByteTree ATOMIC

Analysis of Technical. On-chain, Macro, Investment Flows and Crypto.

In 2022, people will lose interest in viruses, and we will likely see a return to normality for the real world. As people start moving again, the price of oil will rise, and this will drive inflation even as disruption in the supply chain eases.

Hard assets, such as bitcoin, prefer rising inflation. Yet the big question for bitcoin is how much rising inflation matters? If inflation rose by another 1% and the price was $100k, would it have the same impact as if the price was $10k? We examine this question.

Markets are seeing rising inflation and outflows from BTC and ETH simultaneously. Perhaps that is telling us that the market overcompensated in 2021. In any event, ETF investors have been selling, especially ETH.

Technical

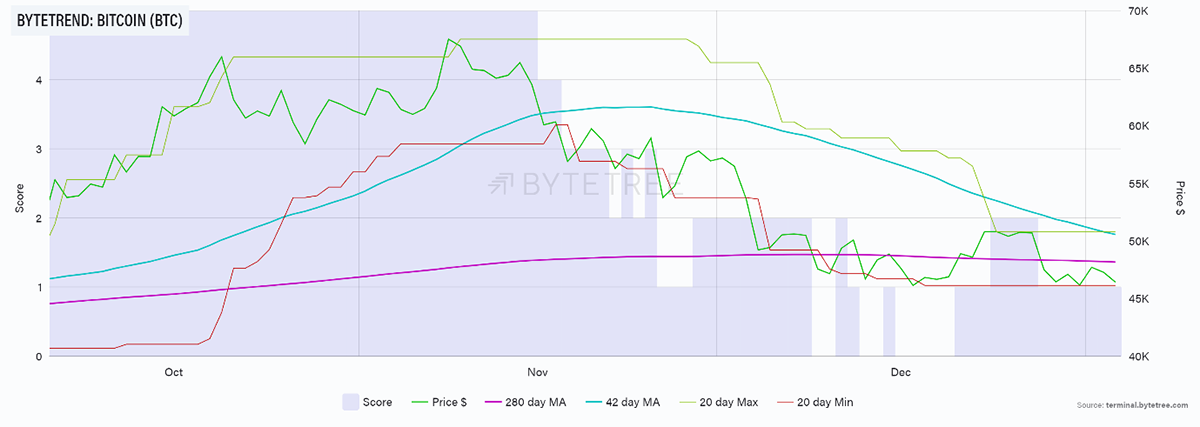

The BTC score is 1 out of 5 as the last touched the max line over Christmas. The price is currently hovering around the recent min but has not yet dragged it lower. The trend is weak and urges caution.

Read the introduction to ByteTrend.

BTC ByteTrend score 1/5

Source: ByteTrend. ByteTrend score for BTC over the past 12 weeks.

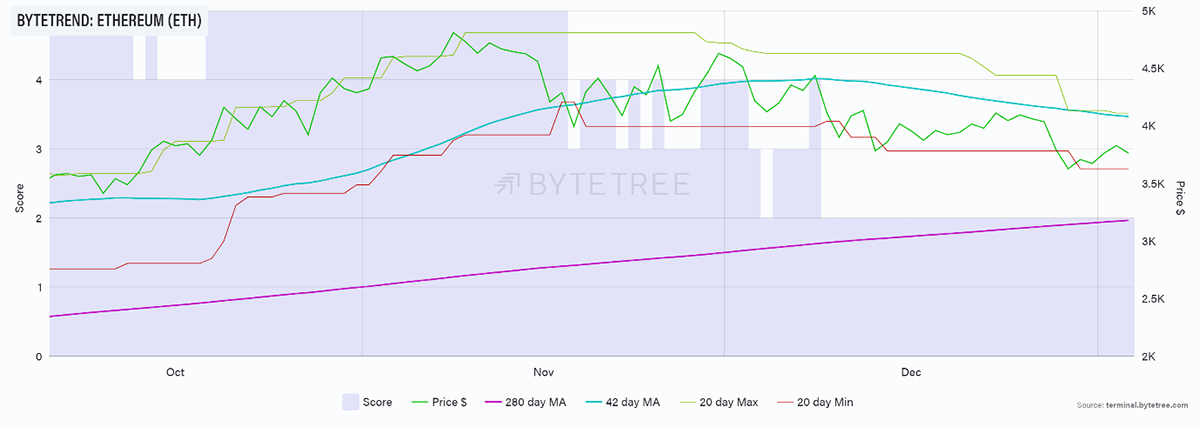

ETH scores 2 as the 280-day moving average is still powering ahead. Without renewed strength, the longer-term trend will level out in mid-February.

ETH ByteTrend score 2/5

Source: ByteTrend. ByteTrend score for ETH over the past 12 weeks.

With the scores of both ETH and BTC softer, the relative chart has less credence, yet it still favours ETH.

ETH (priced in BTC) score 4/5

Source: Bloomberg. ETH in BTC with ByteTrend moving averages past 6 months.

Investment flows

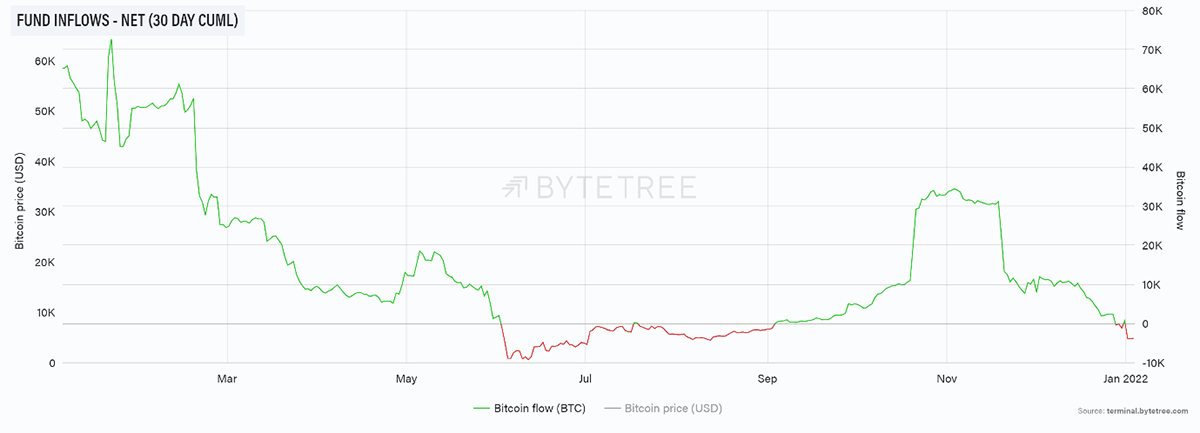

The greatest disappointment as we enter 2022 is the reversal of the ETF flows. The last time they went negative was in May 2021, and that saw the price retest $30k.

BTC

Source: ByteTree. Bitcoin net fund inflows, 30-day cumulative, over the past year.

One fund has a track record of seeing investment flows correlate with price. In December, there were heavy outflows in BTCE just as there were last May.

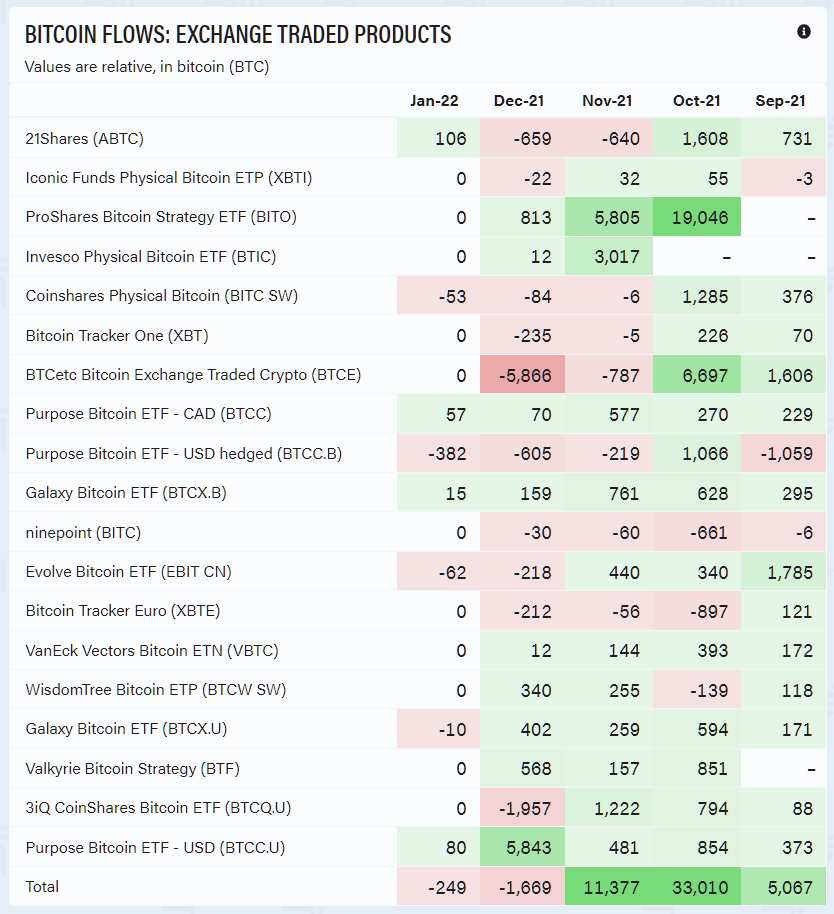

Source: ByteTree.

We know that BTCE receives BTC from the miners in Kazakhstan, so the inflows are not always in cash as expected, but rather in mined bitcoin. The coins tend to stay in the fund until the price trend turns down, at which point the BTCE ETF shares are sold. That is what happened in April and appears to be happening again now.

BTCE see outflows

Source: Bloomberg. BTCE GR shares outstanding and bitcoin price since June 2021.

No doubt some of the inflows into BTCE have been in cash, but with higher fees than the competitors, it seems unlikely to be a lasting trend. What seems clear is that these miners adopt a trend following strategy as they transfer BTC to BTCE when the price is rising, then sell BTCE shares when the trend turns down.

This doesn’t answer the many questions but at least helps to explain events.

ETH Outflows

In December, Ethereum (ETH) suffered its worst ever month of outflows, with redemptions of 39,296 ETH worth approximately $150 million. This could just be yearend profit taking or perhaps a shift into other areas of crypto.

There were two brief negative readings in January and July, but these were just speed bumps. The trouble with this time is the outflows are much more severe.

ETH

Source: ByteTree. Ethereum fund inflows, since April 2019.

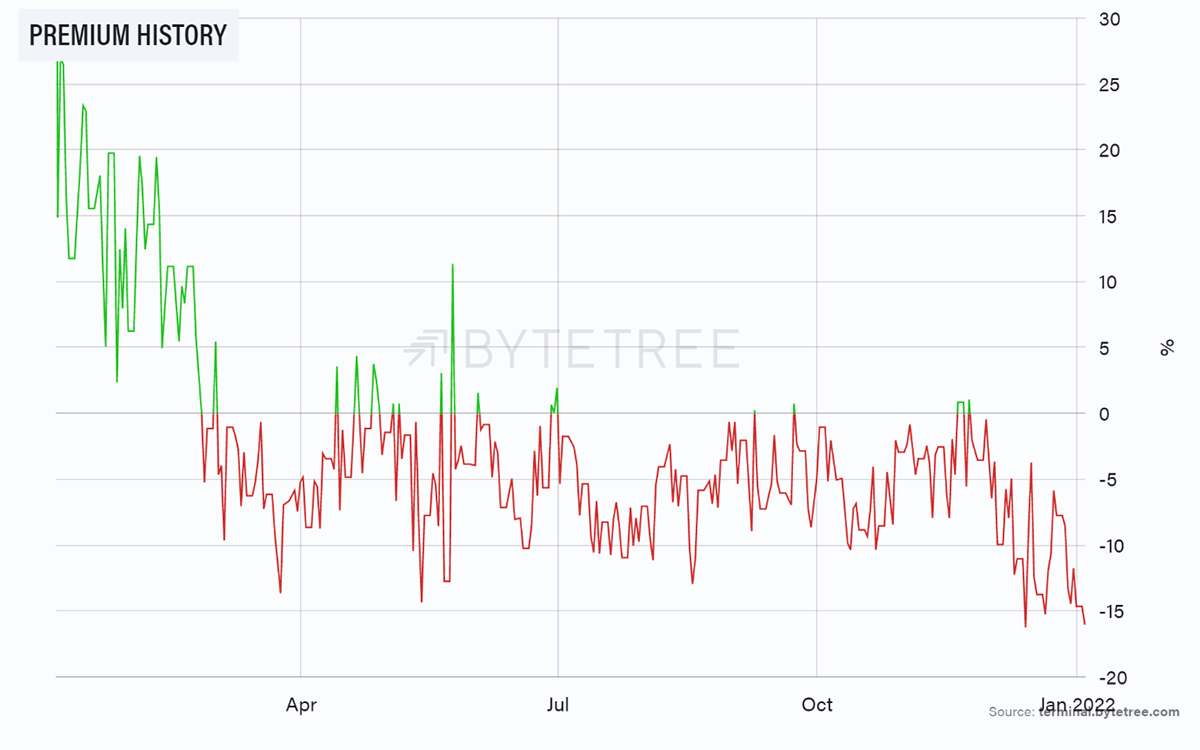

The Grayscale Bitcoin (GBTC) and Ethereum (ETHE) trusts are also seeing continued wide discounts. ETHE is highlighted. This means demand for both BTC and ETH over the stockmarket remains soft.

Source: ByteTree. Grayscale Ethereum trusts (ETHE) premium history over the past year.

On-chain

The weaker on-chain activity witnessed before the holidays continues into 2022. This can be seen through declining transactions.

Source: ByteTree. Bitcoin transaction count over the past year.

More important perhaps is the reduction in First Spend. This is the newly mined BTC that joins the network for the first time. Since this likely means the transfer of ownership from the miner’s address to another address, this is generally deemed to have been sold.

ByteTree’s observation a couple of years ago was that the network is healthy when the miners are selling more than they mine. Lots of selling pressure is normally considered to be bearish, as it would weigh on the price. But if the impact on price is minimal, then that must be bullish as it shows how strong the market must be.

It stands to reason that if the miners are not selling, yet the price is still weak, then the market must be weak. First Spend is at a six-month low. The miners are worried to sell into this market because they fear they will negatively impact price.

Source: ByteTree. Bitcoin miner First Spend over the past year.

Hoarding BTC means inventories are rising, which also means the miners have more BTC to sell in the future.

Source: ByteTree. Bitcoin miner inventory (BTC) over the past 12 weeks.

Macro

The weak price, flows, and network all appear to be related and feed off each other. However, they all fail to miss the big picture, which is the macro is once again bullish.

The price of oil is the proxy for energy – the single most important input into the economy. With oil’s ByteTrend score jumping from a 1 to a 4 over the past month, the energy squeeze is back.

Oil rallies

Source: Bloomberg. Brent crude in the past year.

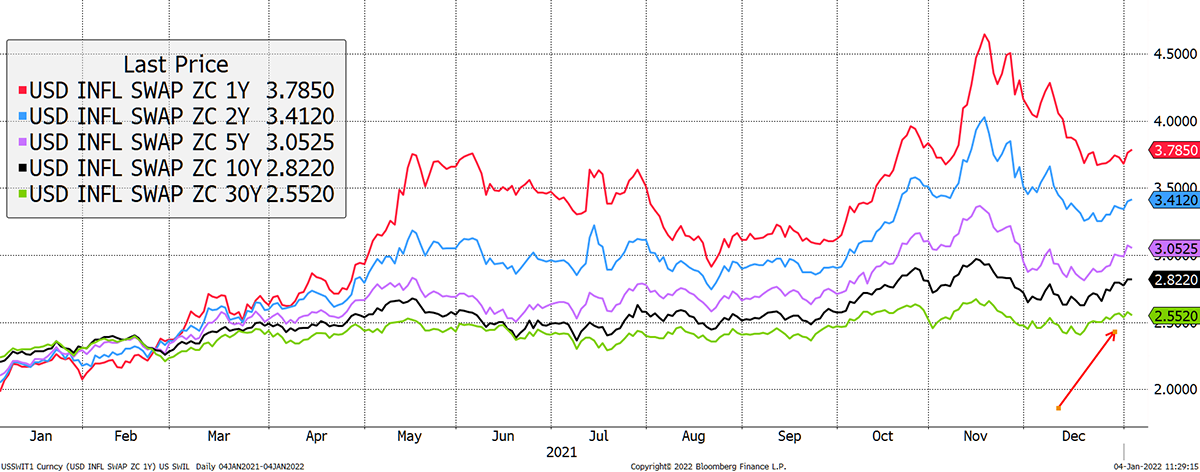

Oil, or energy in general, has always had a significant influence on inflation. Having seen inflation expectations cool since mid-November, they have started to rise behind oil, albeit with a lag.

Inflation cools but trend is still upward

Source: Bloomberg. US inflation swaps (expectations) 1, 2, 5,10, 30-year in the past year.

The point is that inflation is back on the rise, but bitcoin can still take a break if the time has come. Just as gold did little in 2021, because it had already delivered its inflation protection surge in 2020, bitcoin could disappoint as an inflation hedge in 2022.

If that happens, many will write off bitcoin’s inflation-proof credentials, but they will be wrong to do so. It is perfectly reasonable for an asset to take a break even as its fundamentals improve.

Double your money for every 1% hike in inflation

In March 2020, Bitcoin collapsed as inflation declined, only to recover as the stimulus prevented a return to normality. As inflation returned to 1.5% in the autumn, Bitcoin rallied to $17k. Then 2.5% and BTC touched $32k. Then 3.5% while BTC touched $66k. Could it be that every percent rise in inflation expectations double the price of BTC? If so, then the next jump to 4.5% from 3.5% will be key. When that happens, expect a break from $100k to around $135k.

Not all the inflation jumps are the same

Source: Bloomberg. US 2-year inflation expectations and bitcoin over the past two years.

It is logical as a 1% rise in inflation causes the purchasing power of money to halve every 70 years, so bitcoin doubling in anticipation is an entirely rational outcome. In my opinion, 4.5% inflation expectations seem inevitable, meaning the next double is just a matter of time.

As 2021 showed us in the gold market, prices are not always entirely rational. Bitcoin could see good news, but it won’t necessarily respond before the market is ready. This all bodes well for 2024 when the mined supply halves and First Spend is able to fall without creating an overhang.

Summary

What we do know is that the network is fickle. It comes and goes with ETF flows, price, and network all feeding off each other. Then there is the macro, which is improving in bitcoin’s favour. This means that any price weakness is fundamentally supported, which is bullish.