Bitcoin Beats ARKK

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 32

The crypto market remains soft, but the macro environment is very much on side. This is not 2014 or 2018 when bitcoin collapses. Tech is already much worse, and the market has noticed. Any strength will eventually be amplified.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Weak |

| On-chain | Weak |

| Investment Flows | Stable |

| Macro | Bullish |

| Crypto | Opportunities |

If you were living in Ukraine or Russia, would you care if the Bitcoin chart looked a little grim? Probably not, but you’d certainly be grateful that the price was a little lower.

For many, there is no luxury of market timing as the time is now. What matters is the longer-term belief of where an asset will end up. In tomorrow’s piece, we will be covering this with events in Ukraine at the forefront of our minds. In the meantime, ATOMIC focuses on the present.

Technical

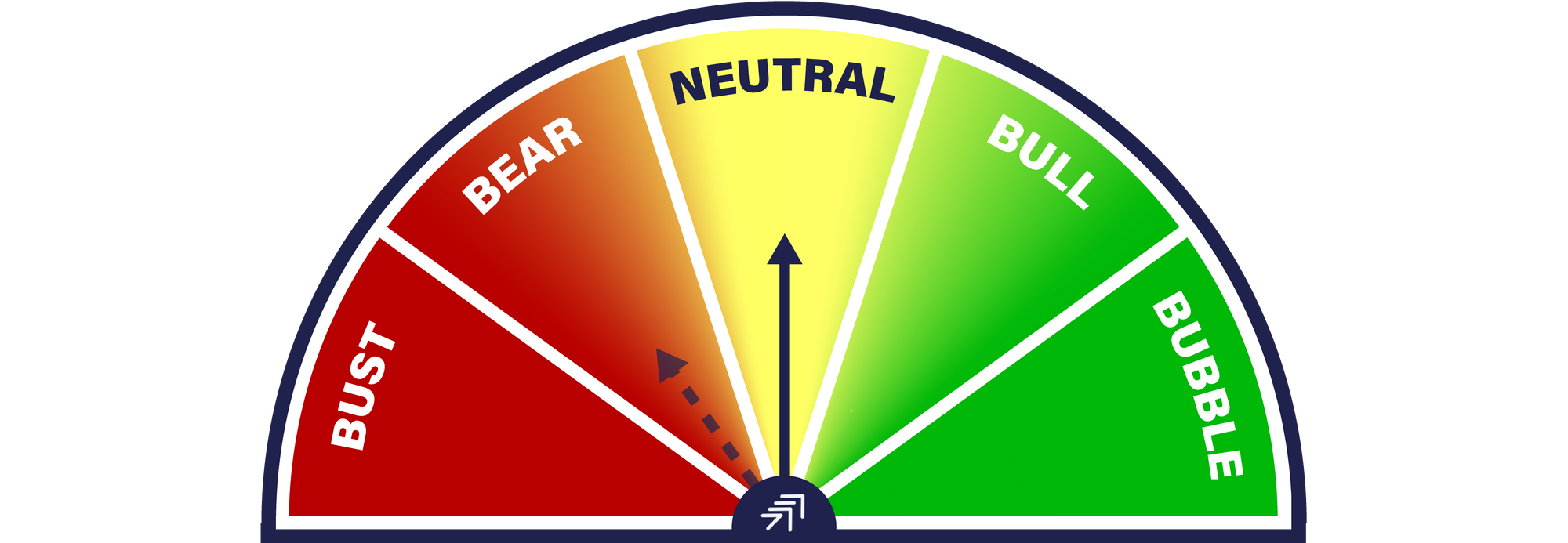

The price action remains weak, with the notable exception of Cardano, which is bucking the trend. More on that in the Cryptonomy section later in this piece.

Overall, breadth is still deteriorating. Bitcoin, Ripple and Polkadot are in downtrends with ByteTrend scores of zero. Over the past week, downgrades have exceeded upgrades.

Source: ByteTree. Daily score changes, 18 January 2022.

I’ll take this opportunity to update you on the long-term bitcoin chart.

The post-March 2020 uptrend of 283% per annum is decisively broken, which should come as no surprise as that is too good to be sustained. More recently, the price has dipped below the -39% green downtrend line since the April 2021 peak. The lower trendline seems a long way down but catches up with current prices in 2024/5, so not as bad as it sounds.

The likelihood is that bitcoin finds a home above the $30k purple line, which was the low tested in January and July last year.

Bitcoin trend

Source: Bloomberg. Bitcoin trend since 2018.

As for ETH, it holds the range pattern versus bitcoin, thus averting a relative selloff. This in itself is good news because last time, ETH collapsed on a relative basis. This is not last time!

ETH (priced in BTC) score 2/5

Source: Bloomberg. ETH in BTC with ByteTrend moving averages past year.

Investment flows

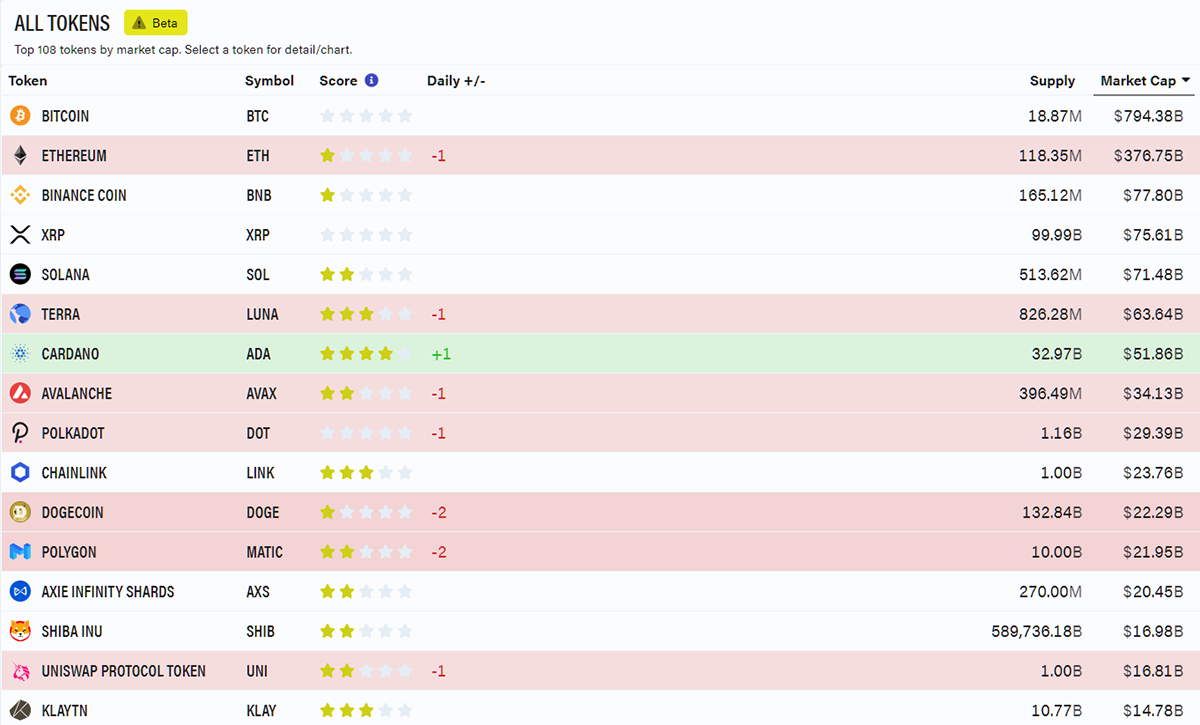

Both the BTC and ETH flows have stabilised over the past week, which at the very least implies there is no panic selling.

Source: ByteTree. Bitcoin held by funds over the past month.

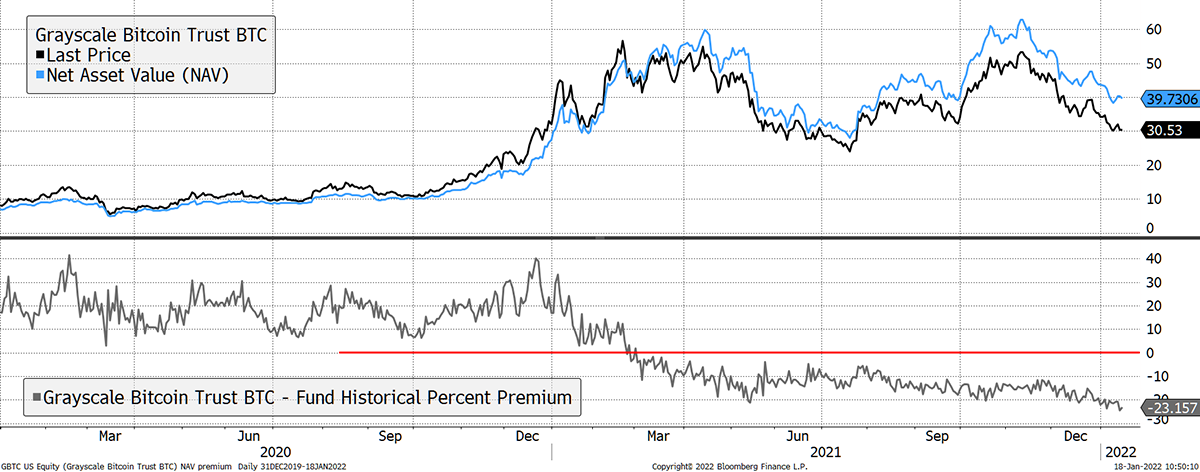

Yet there can be little doubt that demand from institutional investors has waned as the Grayscale discount hit a record low at 23%.

GBTC discount widest on record

Source: Bloomberg. GBTC discount/premium to net asset value past two years.

In part, this reflects the poor structure of GBTC, which is a lobster pot. Bitcoin can get in but can’t get out. Yet a similar pattern is seen in Osprey (OBTC), which also trades on a wide discount. The bottom line is that closed-ended funds are a sub-optimal way to hold BTC and the market knows it.

On-chain

Ever since the July low, the miners have been growing their inventory, which has been supportive. In recent days, that changed with an attempt to sell into the market. That brought downward pressure on the price, which will warn other miners to hold the line. The problem comes when they lose faith and scramble for the exit. Bitcoin miners need an OPEC.

Source: ByteTree. Bitcoin miner inventory level over the past year.

A new low in inventory would warn of a stampede, which is not happening. Meanwhile, other measures of network activity remain weak.

Macro

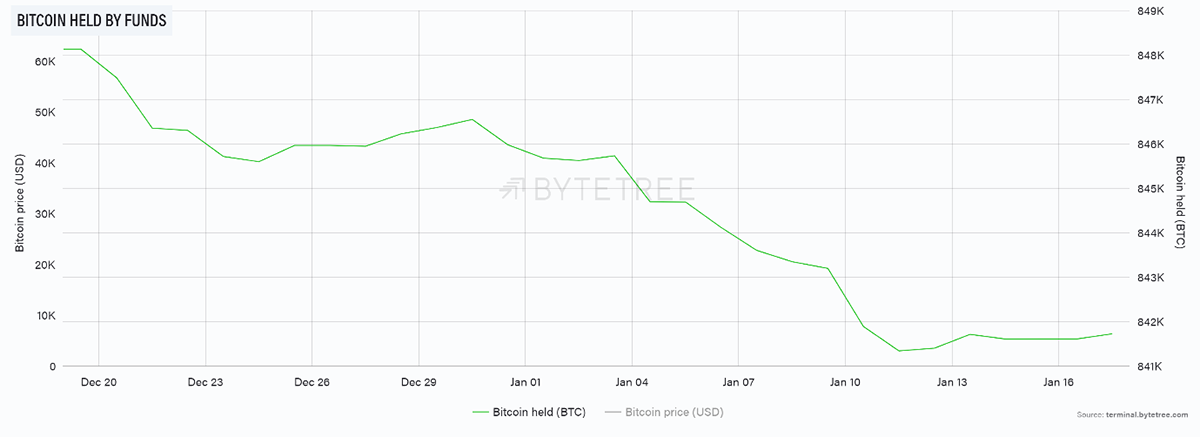

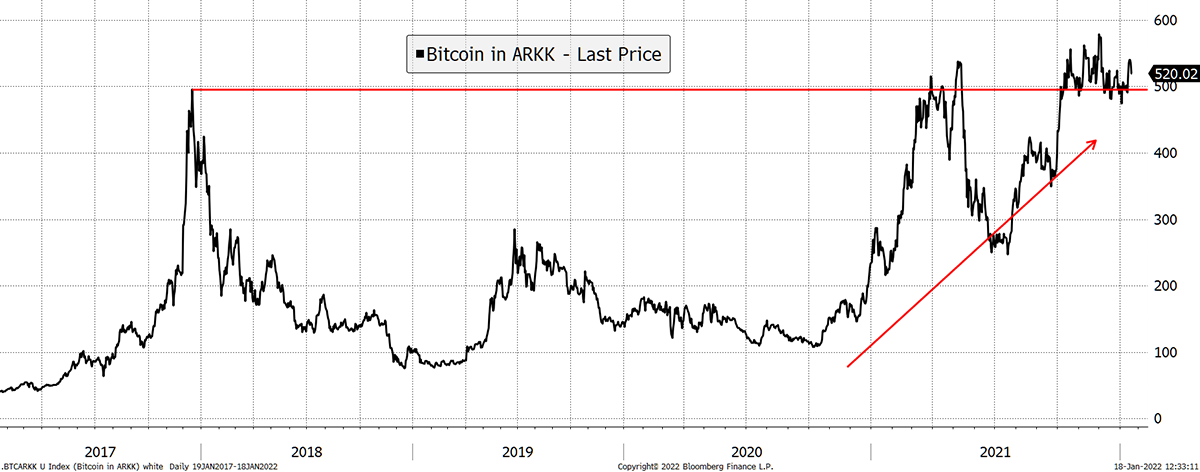

2022 has gotten off to one hell of a start. Bitcoin is down 10%, the NASDAQ is down 6%, while the more speculative ARKK ETF (tech stocks) are already down 15%. While this is happening, gold is flat, and oil is up 12%. Expect mayhem in 2022.

Bitcoin in ARKK

Source: Bloomberg. BTC divided by ARKK ETF since 2017.

Bitcoin is a speculative asset, but it has purpose and global appeal. I am pleased to see that Bitcoin is no longer in the centre of the storm like it was in 2014 and 2018. This is an important development.

2022 is the down year of the four-year cycle, which is a waning concept but not over yet. The very fact that bitcoin has a friend in the stockmarket that is faring worse is already a sign of progress. Fight one battle at a time. This time Bitcoin beats speculative tech in a downturn. Next time the S&P500 perhaps, and maybe one day, gold.

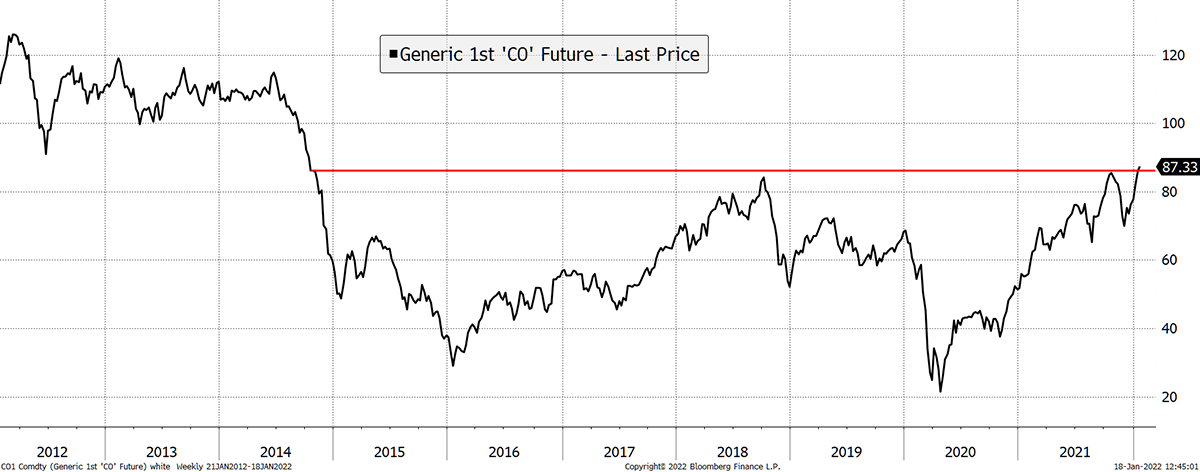

As stated last week, the macro conditions remain favourable as the bond yield is rising. Inflation expectations, as told by the bond market, are still in doubt. I can only presume bitcoin hasn’t noticed the rise in the price of oil.

Oil at a seven-year high

Source: Bloomberg. Brent Crude since 2012.

The Cryptonomy

The Cryptonomy has seen many protocols oscillate between their respective price ranges, resulting in volatile ByteTrend scores. Three particular tokens have demonstrated stability and significant strength that contradicts this overall market trend: Fantom (FTM), NEAR and Cosmos (ATOM).

Both Fantom and NEAR are layer-1 ETH-killers, promising to tackle issues relating to the throughput, affordability and usability of the Ethereum Network. The outperformance of NEAR and Fantom somewhat indicates why a layer-0, or an enabler of interoperability, like Cosmos is needed. Imagine if our laptops could not frictionlessly connect to one another, each unit would become less valuable. As a result of our shared internet, our laptops are invaluable. In this sense, Cosmos intends to become the internet of blockchains. The outperformance of these tokens is a clear indication that capital is shifting towards protocols addressing scalability, interoperability and usability issues. We look forward to covering these protocols in upcoming Token Takeaways!

In other news, Cardano (ADA) - yet another ETH-killer - has been gaining traction with a current ByteTrend score of 4/5, a change of +3 in three days. This is likely down to the incoming launch of the first DEX on Cardano, Sundaeswap, and the launch of the first Cardano metaverse, Pavia.io. In light of Cardano’s very loyal community, it will be interesting to see the rate at which the projects slowly deployed on it are adopted. With that said, this may also just be a classic case of “buy the rumour, sell the news”.

Summary

2022 is off to an extraordinary start, which has so far unwound everything seen over the past 18 months. The crypto market remains soft, but the macro environment is very much on side. This is not 2014 or 2018 when bitcoin collapses. Tech is already much worse, and the market has noticed. Any strength will eventually be amplified.

Comments ()