Is Polygon Ethereum's Get Out of Jail Free Card?

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: MATIC;

Last week, we introduced readers to how layer-2s can help alleviate a basechain’s transaction congestion, meaning users can have the same benefits without being out of pocket. This angle is not too different from how ETH-killers present their use cases. The main difference is layer-2s are connected to established money markets, whereas ETH-killers (i.e., smart contract blockchains) have to create them. Building on last week’s introduction, this week, we will be evaluating how investable Polygon and its utility token $MATIC are.

History

Released in 2017, the Matic Network stood to focus on a complex solution combining multiple scalability solutions to help Ethereum with its consistent issue: an exorbitantly high-cost network. After several development shortcomings with Plasma scaling solutions, due to its unsolvable security and data availability issues, a rebrand and launch of Polygon in 2020 saw the release of two components:

- A Proof-of-Stake (PoS) sidechain, which they coined as a “commit chain”. The sidechain can support smart contracts and plasma tech to harbour MATIC to Ethereum transactions.

- The use of independent validators that do not share the security of Ethereum, although they do push transactions to Ethereum as its settlement layer. While it is not as secure as Ethereum, investors must understand the risks of independent validators (single point of failure).

Team, Partnerships and Funding

The largest layer-2 solution has a smart core team, but not any particularly big names. The real value lies with the advisory board: Ryan Sean Adams of Bankless, Pete Kim from Coinbase, and others from big names in crypto, including Consensys, ETHHub and the Ethereum Foundation. It is a decent company, but not world breaking.

The funding of Polygon seems to be a little light. According to Crunchbase, they have raised $3.6m in just two seeding rounds. However, their partnerships more than make up for it, which include EY (Wintermute’s $20m dev fund), Shopify, Venly, Draft Kings, Nexo, Akash, Arweave, Chainlink, Gitcoin, Infura, Enegra and many others. These partnerships constitute a well-connected and credible selection of backers.

Polygon’s Success

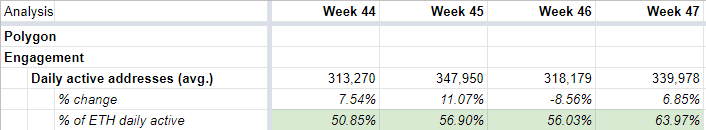

Daily active users are a good indicator of a blockchain’s growth, where a positive gradient will typically correlate with how a market attributes value to a network, i.e. the network effect. In Polygon’s case, there were nearly 350k users per day last week, which is a 10% increase on the previous week.

Furthermore, Polygon currently houses 65% of DAU relative to Ethereum, bringing Polygon close behind Ethereum. Although, if we consider them to be one, then Ethereum’s DAU is much higher than reported.

Polygon may have deficient funding, but it is a revenue-generating business. Polygon uses a ‘bridge’ to migrate investors from Ethereum to Polygon, and the bridge inflows over the past week were a staggering $212m. According to RaphaelSignal, Polygon generated nearly $100k/day over the last week, an increase of 12% on the previous week.

The Investment Case for Polygon

Investors have three main investment angles to play when looking to generate alpha from $MATIC. Firstly, a developer angle transpires when looking at Polygon. Ethereum is increasingly more expensive to use, and investors often neglect that this expense is not just on their shoulders, but also on developers.

Developers want to create applications on Ethereum because it is the top secure platform, with the biggest money market, and where the most valuable tokens and dApps reside. The logical step for developers is to move to Polygon from Ethereum, and if this happens, it can only be good for Polygon’s network effect.

Secondly, Ethereum’s future is worrisome for maximalists. The London Hard Fork (EIP-1559) has not (yet) worked as hoped, and ETH 2.0 could be a long way away. Polygon is the life raft that Ethereum needs to pass the time before Ethereum’s PoS migration.

Thirdly, a more interactive investor might see an alpha-generating opportunity investing in the Polygon ecosystem. There are distinct sectors within a smart contract blockchain, most notably decentralised finance, non-fungible tokens, and decentralised exchanges. Polygon offers a fantastic opportunity; it has a fresher ecosystem than Ethereum and with that comes higher potential alpha, especially if Polygon will fulfil its potential.

$MATIC Token

The $MATIC token is the utility token for the Polygon Network, similar to ETH for Ethereum. The token creates a link between the activity and the development of the network. That, in turn, creates a positive correlation between the $MATIC market price and network effect.

$MATIC has performed very well since creating a range in mid-October.

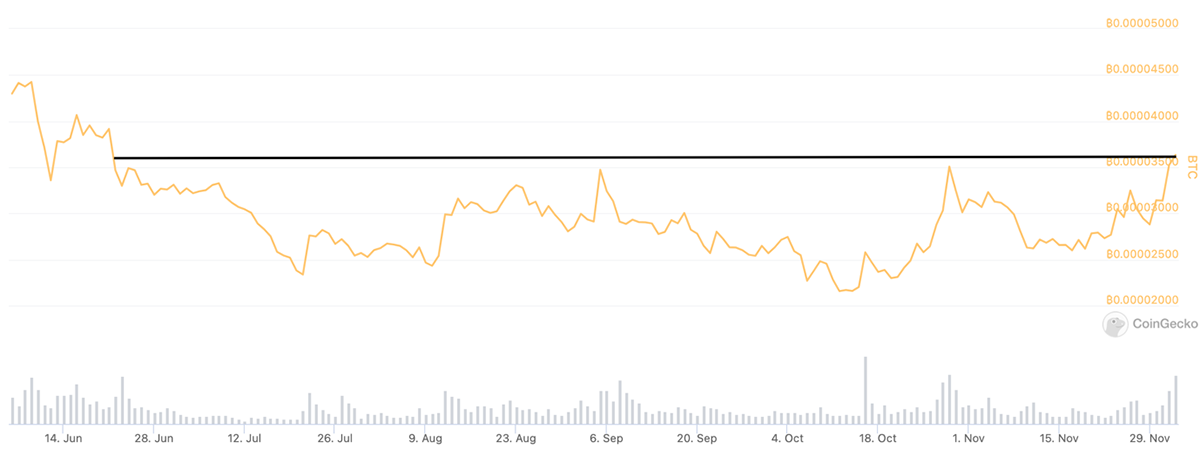

The picture gets more positive when looking at $MATIC relative to BTC, where a four-month relative high signals momentum and favours an upwards move.

Investors should look for a promising catalyst, which might propel $MATIC into the all-time high territory.

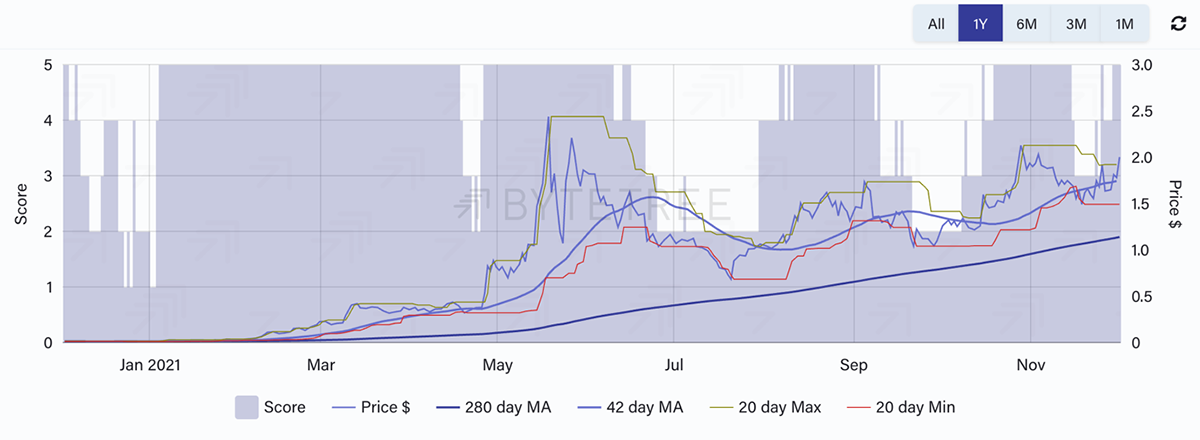

ByteTrend: MATIC

Finally, I would like to introduce you to ByteTrend, which is a score concept that will become a major feature in our technical research. Simply put, it enables a trend to be quantified, which helps to remove emotion and provide a comparison across many charts for cross-market screening. ByteTrends will be published on the Terminal soon, but for now I would like to highlight that MATIC stands at 5/5 score, which is very positive for its momentum.

Conclusion

Ethereum has systemic issues with its gas fees, and it needs a proxy while it future proofs itself; Polygon is the answer to this. Most importantly, investors have multiple investment angles, all of which have the potential to generate alpha.

While Ethereum is still very much the king, Polygon is positioned to be the smart prince and investors should remember that it has a direct access line with the most valuable money market in the digital asset ecosystem.

Where To Buy

| Centralised | Binance, Coinbase, OKEx, Crypto.com |

| Decentralised | Quickswap, Matic Network |

Conviction Score:

Digital Asset Market: In a weakening market, certain tokens seem to be excelling against all odds, MATIC included.

Hype vs Reality: Reality. It looks to be an essential part of Ethereum’s future

Trade or Trend: Trend. In-line with Ethereum’s timeline for fixing its scalability issues.

Market Outperformance: A four-month relative high against Bitcoin shows market strength.

Competitive Advantage: Polygon is dominating the layer-2 space in terms of Ethereum.

Token Takeaway Score: 4/5