Gold Surges in Q1 While Bitcoin Struggles

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree BOLD

Price cycles and seasonality sometimes appear to be one of the great market mysteries, but there’s often a simple explanation. It is easy to understand why the demand for fireworks peaks at New Year, but other cycles can be harder to explain.

I’ll get to gold and show you why it often does well early in the year, but perhaps more confusing is bitcoin. With the notable exception of 2021, bitcoin has generally seen low returns in the first quarter. Some attribute that to selling pressure ahead of the end of the US tax year, but who knows?

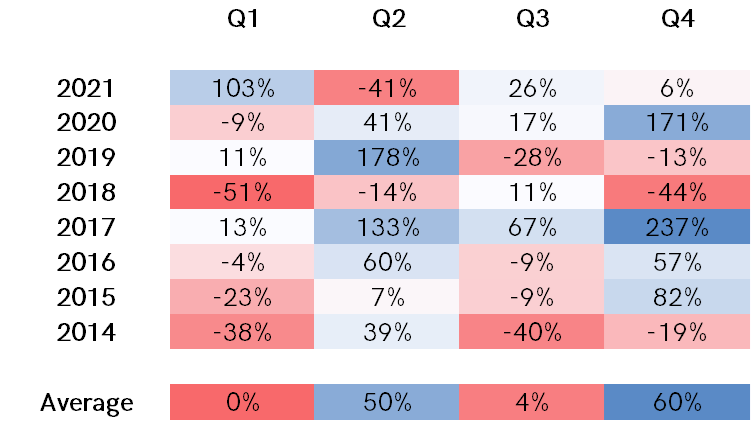

Bitcoin returns by quarter

Although the consistency of the quarterly data is far from perfect, there are some clear seasonal patterns around the price of bitcoin.

- Q1 is generally weak.

- Q2 is generally strong.

- Q3 is generally weak.

- Q4 is generally strong.

Musk broke the cycle

The Q1 2021 exception can be attributed to Elon Musk’s first bitcoin tweet. In fact, he didn’t even tweet. He just added “bitcoin” to his handle. Before that, the price had been softening, and had it remained soft, perhaps the rally would have been delayed until Q2, which would have been stronger as a result. But if something is going to break the cycle, it may as well be Musk with his 60 million followers.

The Bitcoin return from 2014 to present has been around 60x, yet if you only held it during the first and third quarters, you didn’t even manage to see 2x gains. For some reason, the price of bitcoin has seen the heavy lifting during the second and fourth quarters.

That caught my attention because I came up with a similar observation about gold a few years ago. It was similar in that it observed quarterly returns, yet opposite because it was the first and third quarters that saw the strongest returns, while the second and fourth quarters were the weakest.

BOSEQ and BESOQ

I came up with an acronym “BOSEQ”, which stood for “buy odd, sell even quarters”. I never expected it to catch on, and you’ll be pleased to see that it didn’t. In any event, if gold is BOSEQ then bitcoin is BESOQ.

Since 1990, 87% of gold’s return was generated in the first and third quarters, in contrast to just 13% in the second and fourth. Some might write this off as a coincidence, but there’s more to it.

Gold is sensitive to bond prices, and it turns out that the long bond has followed the same pattern. For whatever reason(s), bonds have performed best in Q1 and Q3, and worst in Q2 and Q4. Furthermore, during Q4, bonds have generally lost money, and materially so if you exclude the truly exceptional 2008.

Risk-on, risk-off

It is reasonable to say that gold follows BOSEQ because gold follows bonds. But it’s harder to say why bond seasonality is what it is, other than it is different from equities, which follows BESOQ. Bitcoin performs best when the economy is doing well, and it comes as little surprise that its seasonality has more in common with equities than bonds or gold.

Bitcoin and gold

Seasonality shows us that while not every year fits a perfect pattern, there is an underlying cycle that repeats. Bitcoin is a risk-on asset, while gold is risk-off. By having different behaviour, they have low correlation, which is why they are such a good fit when brought together.

To diversify between bitcoin and gold is not dissimilar to diversifying between bonds and equities - something investors have been doing for decades. Equities are risk-on, while bonds are risk-off, so at any given time, one tends to be in the sweet spot, helping to drive portfolio stability and return.

Following the almighty bull market since 2008, driven by low interest rates and government stimulus, large parts of the bond and equity market trade at record prices. High valuations are risky, and asset prices are vulnerable. Even if the next decade doesn’t see a crash in prices, at best, we’ll see an era of low returns from traditional assets.

Inflation

With so much monetary and fiscal stimulus from governments, supply shocks and a squeeze in the energy system, inflation is poised to rise. Inflation has a history of putting downward pressure on valuations, meaning bonds and equities will come under pressure.

BOLD in 2022

In contrast, both bitcoin and gold are hard assets deemed to be inflation sensitive. That means an era of higher inflation is likely to attract capital to these asset classes, sending prices higher. Naturally, you’d expect bitcoin to perform best during the risk-on times, and gold during the risk-off. The point is, while the inflation holds firm, one of them will be in the sweet spot. Bitcoin + gold = BOLD.

Comments ()