Bitcoin Network Demand Model

Disclaimer: Your capital is at risk. This is not investment advice.

Week 51 2021

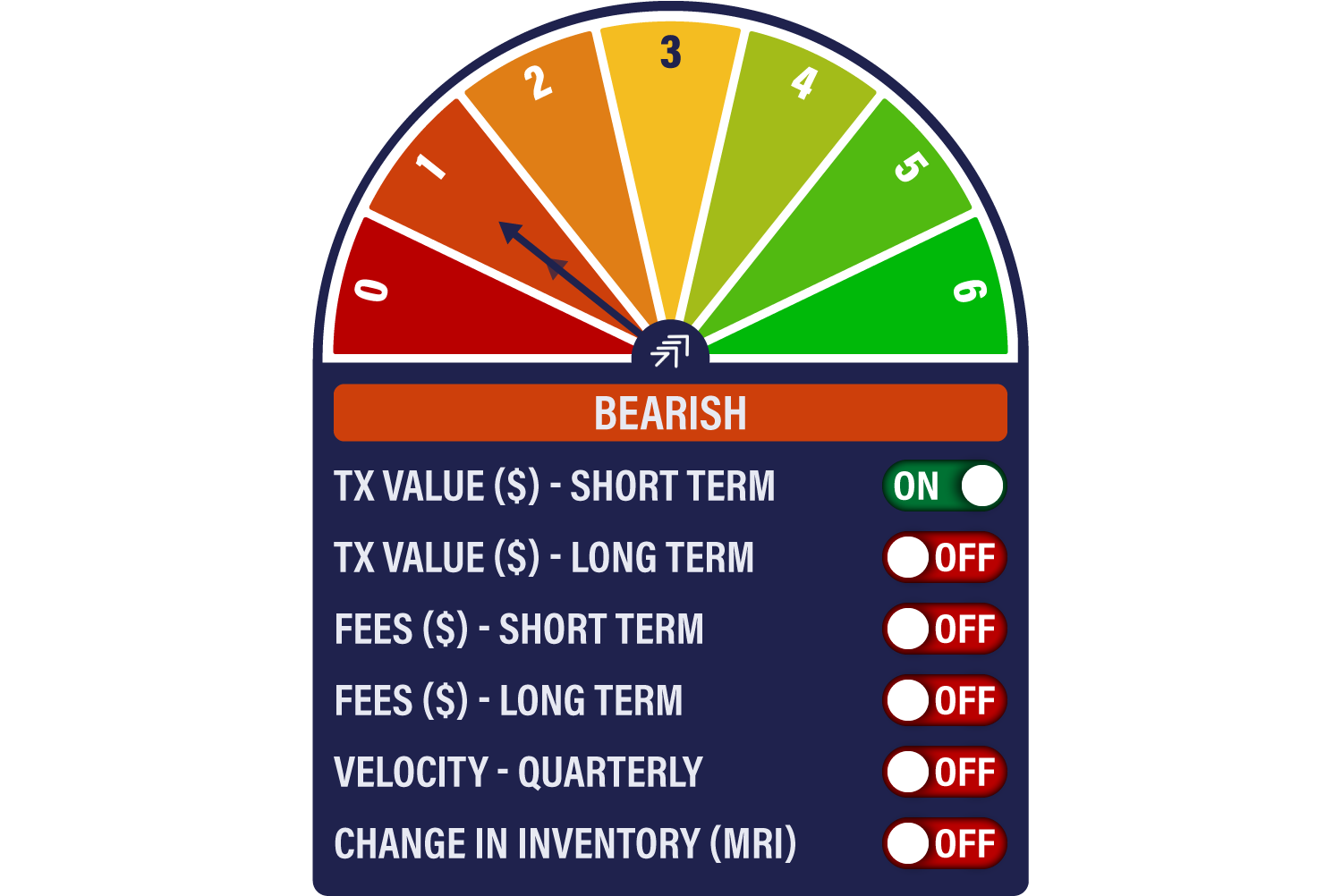

The Network Demand Model registers a score of 1/6 for the second week running, with only the short-term transaction indicator in positive territory. On-chain data is unmistakably soft, perhaps unsurprisingly so as investors shut up shop ahead of the year-end, not to mention the elevated levels of market uncertainty.

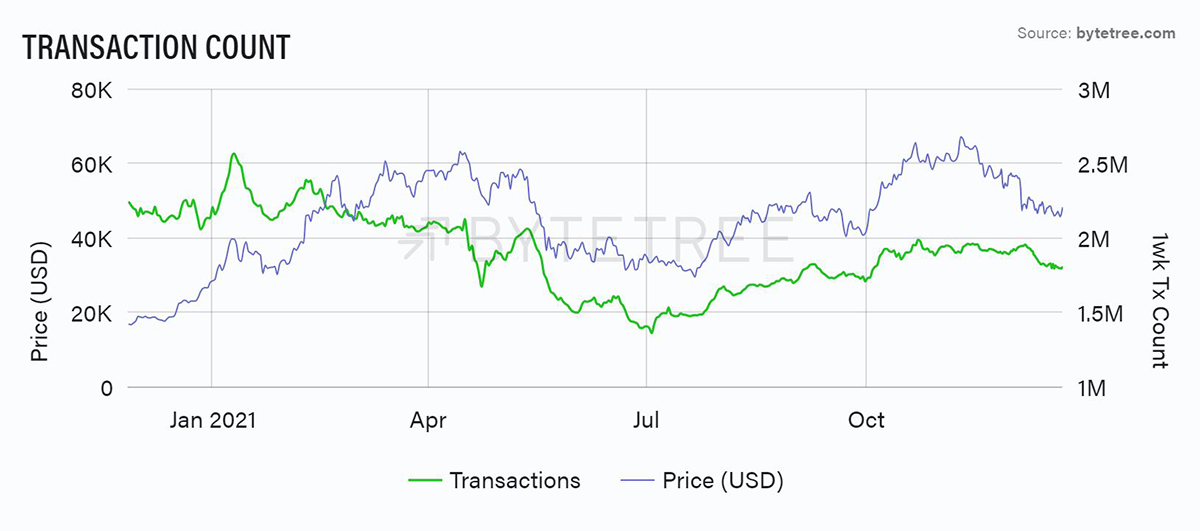

Bitcoin’s price resilience in the face of such poor activity is intriguing. Still, it perhaps reveals a feature that has become more apparent as the year has drawn on, namely that the price has been a leading indicator of transaction activity and not vice versa. Note how in the chart below the best buying opportunities generally happen during periods of low transaction activity.

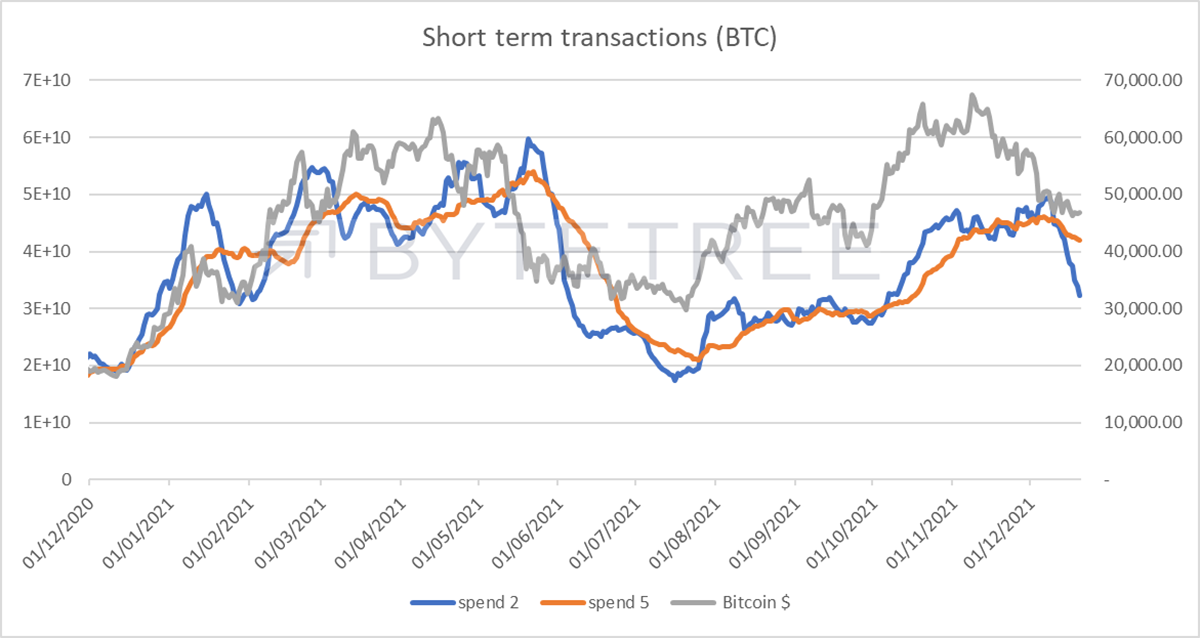

This is further demonstrated in the chart below, which shows a 2-week and 5-week moving average of transaction value against the bitcoin price. Eyeballing the recent behaviour suggests the time to be cautious is when transaction value is rising while the price is flat or falling. Conversely, the time to be adding is when transaction value is low, and the price is flat or rising.

This makes sense when thinking about the two fundamental drivers of the bitcoin price: adoption and speculation. Lower volumes give us a clue as to when the “value” buyer - someone who is more interested in the long-term potential and underlying adoption trends - is prepared to step in. High transaction activity tends to run hand-in-hand with elevated levels of FOMO and increases in system leverage. This also explains why the ByteTree Fair Value tends to lag rather than lead the price.

A higher price is not a foregone conclusion, but it’s encouraging to see bitcoin holding firm at current levels, regardless of the poor on-chain data. If activity fails to recover in the new year, however, the price will be vulnerable. At this point, a sense of pent-up institutional demand, combined with some unpleasant inflation numbers, are reasons to be cautiously optimistic. The price is now a long way from recent highs.

Wishing you a very Happy Christmas.

Comments ()