Sandbox: The Matrix Meets the Metaverse

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: SAND;

The idea of a metaverse is by no means new and pre-dates Bitcoin by decades. The term was first mentioned in the science-fiction novel Snow Crash (1992) by Neal Stephenson. While the modern-day view likens the metaverse to a fairyland, the original was dystopian.

The metaverse is a virtual reality universe where conventional bounds don’t constrain the environment. Just like Neo in the Matrix, it allows one to escape from the destroyed and derelict real world. With the rebranding of Facebook to Meta, Agent Smith’s quote seems appropriate for the metaverse’s future:

“You hear that Mr. Anderson? That is the sound of inevitability!”

While the metaverse is inevitable, we don’t know the form it will take. Virtual reality tech is trivial and too distant from an investment perspective. So, how can an investor find alpha in a movement which has significant growth potential? This is what we’re looking at this week.

The Metaverse

So, what is a metaverse? The truth is everyone has their vision - that’s the point. You oversee your metaverse, empowered by the boundless virtual and computer-generated quasi-reality. The internet was the first step towards the metaverse, and since then, it has evolved beyond our imagination.

The digital asset ecosystem has improved upon this vision, especially with advancements in the non-fungible token (NFT) space. Protocols like Decentraland and The Sandbox are leading the charge, with other players like Axie Infinity and Aavegotchi providing a more gamified approach.

Investments into the Metaverse

Investors should be looking at the potential of the metaverse with dollar-symbol eyes. Some of the pioneers of the internet and social media crazes certainly are. Over the past few months, metaverse-centric crypto-companies, protocols, and tokens have raised over $600m from the likes of Softbank’s Vision 2 Fund, Animoca Brands, Galaxy Interactive and Samsung Next.

Digital assets are perfectly positioned to become the financial arm of the metaverse, which is an opportunity far greater than disrupting traditional finance. Bear in mind that these decentralised apps (dApps) and associated tokens present an investment opportunity that only early-stage VCs would dream of in the traditional world. In crypto, everyone gets to buy at the start.

Why NFTs?

The non-fungible space has exceeded many people’s adoption expectations. In November 2020, only 6,000 unique wallets were buying or selling a non-fungible asset weekly. As of October 2021, this hit a peak of 100,000 unique wallets weekly. That’s a growth of nearly 1,700% in one year.

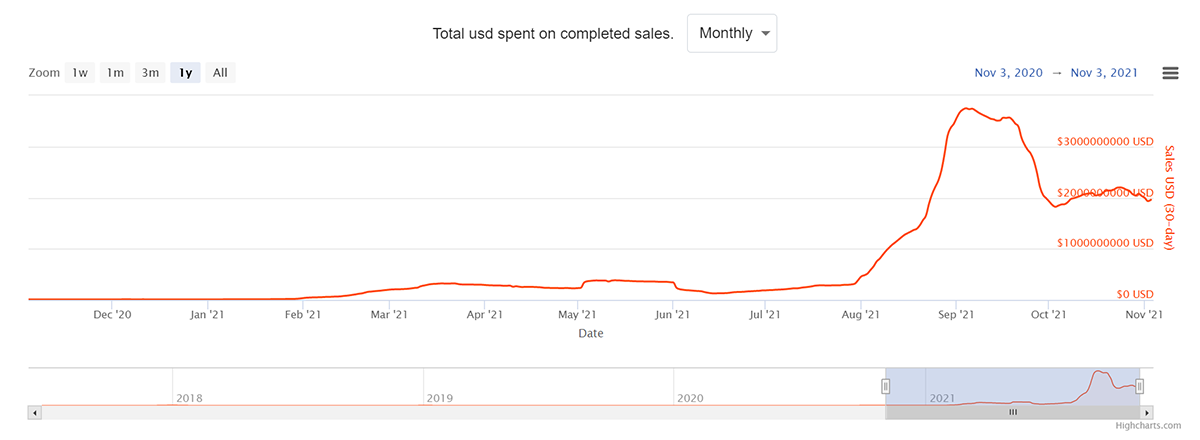

The monthly sales stats are equally as impressive.

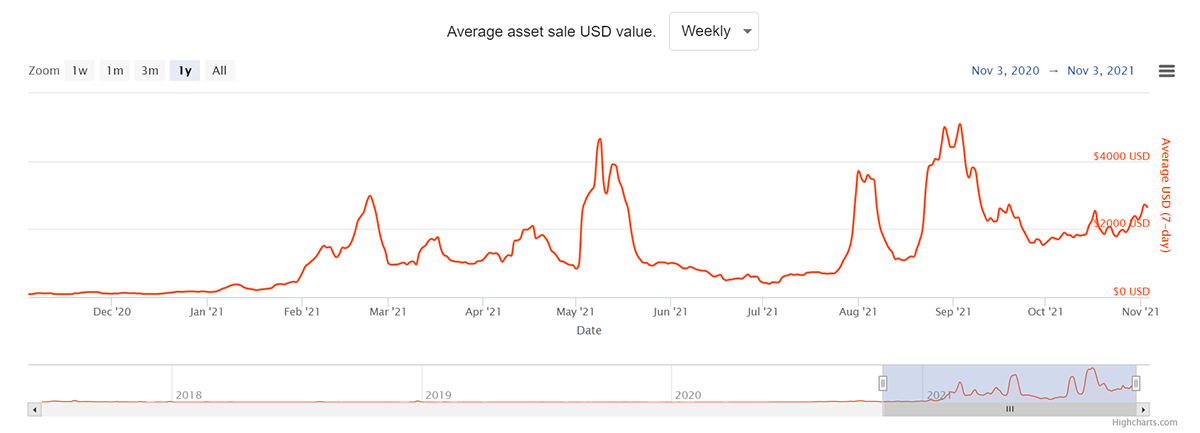

While the average price per NFT shows us that it is not just inexperienced retail participants.

The growth of NFTs and the metaverse are naturally correlated. NFTs provide digitally unique and indivisible assets that grant holders absolute ownership rights. It is only right that the ownership of digital assets come in a digital form.

How To Invest in the Metaverse

An investor has several different plays to consider when investing in the metaverse. One option is to choose a particular token such as Decentraland’s MANA or The Sandbox’s SAND. Alternatively, one can choose to invest in blockchains that look poised to dominate the metaverse/NFT space. The latter is a safer option due to them being more established. Finally, an investor can take the equity route and allocate capital to an ETF like Roundhill’s META, or back the social media and tech stocks that are entering the space, such as Facebook.

Over the past few weeks, Sandbox’s SAND token has stood out in our quant models. The Sandbox is a unique type of metaverse, akin to Roblox and Minecraft, which generated over $1.3bn in cumulative sales last year, according to Business of Apps. Bear in mind that there are many more sales and revenue-generating avenues in the crypto-verse, due somewhat to the secondary sales avenues available through marketplaces like OpenSea and Rarible.

The Sandbox

Released in 2012, The Sandbox is an established game developed by Animoca Brands. The backing should be seen as a stamp of approval as Animoca is behind the most successful metaverse and NFT projects. Animoca have recently raised $65m at a $2bn valuation from the likes of Ubisoft. Yesterday, they helped The Sandbox raise $93m from Softbank’s second Vision Fund to continue expanding their creator economy.

Sandbox users can generate value through several unique techniques. Firstly, they can use the in-game VoxEditor to create their own NFTs/Assets, which they can sell on the Marketplace. These assets can be used in The Sandbox’s “landverse”, which users purchase to create unique and gamified experiences.

Content creators such as Snoop Dogg can monetise an experience for willing customers. He called it his “private party”, which he hosted in his estate within the Sandbox. Truly the start of a metaverse.

The ownership of The Sandbox is not constrained to unknown entities and anonymous hackers. Some of the biggest names are getting involved. Atari, Binance, Galaxy Digital, The Smurfs and The Walking Dead are all looking to have a stake in the future of the metaverse, and they’ve chosen to start their journey in The Sandbox.

The Sandbox is developing at a staggering rate. The release of their Foundation saw over 50 game projects and 180 NFT artists gain grants and 165+ partnerships. Finally, they have the competence to start the process of Polygon* migration, which will reduce fees by 99% and increase the development capacity of the virtual world. When Polygon is fully integrated, investors should expect to see an uptick in active users and perhaps a correlated increase in the SAND token’s market price.

*Polygon is a layer-2 scalability solution for Ethereum. It enables quick and cheap network fees.

The SAND Token

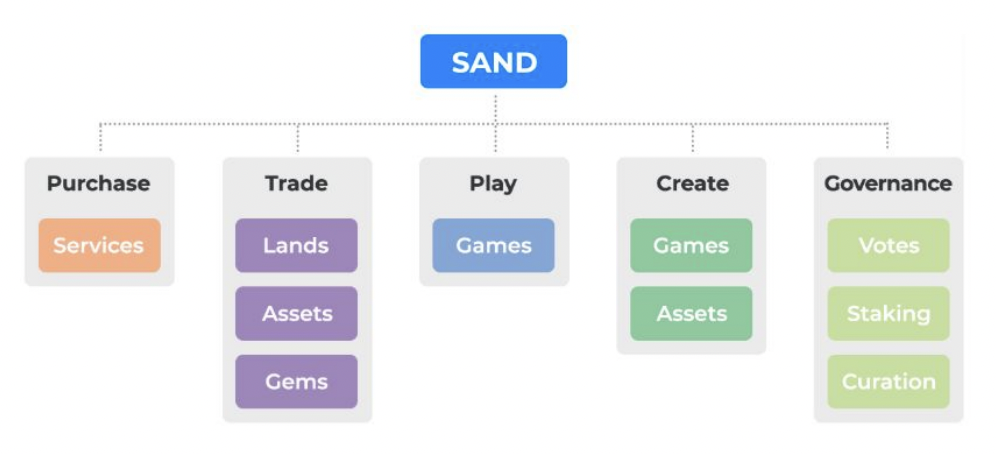

The protocol’s utility token, SAND, enables users to monetise their land and content creators to monetise their work within The Sandbox. Further yield can be generated through staking utilities and in-game reward systems.

Content creators also pay SAND to upload assets to the Marketplace and pay for ‘crystals’ to define the rarity of their assets, which essentially gives the asset a price floor.

Furthermore, all in-game assets and Land are bought and sold with SAND tokens, so naturally, the growth of the protocol will attribute value to its utility token. Investors should take SAND seriously due to another unique factor, its fee capture model, which takes 5% of transaction fees and redistributes them to staking rewards (tokenholders) and the Foundation’s money pot.

Technicals

The announcement of Meta by Facebook, catalysed by the nearly $100m investment by Softbank, has caused Sandbox to skyrocket in comparison to Bitcoin (i.e. the market). This signals a very strong move.

However, investors should be aware of the air beneath both SAND and MANA. Consolidation is needed, although cost-averaging could be a play here. MANA has $1bn more in market cap, which could signal SAND has more growth potential.

Where To Buy

| Centralised | Upbit, Binance, Huobi, OKEx |

| Decentralised | Uniswap, Sushiswap |

Conclusion

The metaverse currently offers investors the chance to be the first buyers for the only world which knows no bounds. Opportunities like these don’t come often. The Sandbox offering is unlikely to remain this attractive for long, and like everything in crypto, it will be gone like a flash. Nevertheless, it is not the only opportunity out there. With its recent re-price, investors should consider all possible options. Diversification could be a play.

CONVICTION SCORE

Digital Asset Market: The Alts look to be strengthening against Bitcoin. A continuation of this trend would benefit metaverse-based tokens.

Hype vs Reality: Reality.

Trade or Trend: Long-term trend. The metaverse has the potential to outgrow our physical world, and there is no reason why it wouldn’t. In terms of trade, I would advise caution. The token market price has risen 270% in the last 30 days. Just make sure to keep this gem on your watchlist.

Market Outperformance: All-time high relative to Bitcoin, pioneering new levels. Very bullish.

Competitive Advantage: In terms of metaverse market outperformance, Decentraland is in-line with The Sandbox. Both use the first-mover advantage.

Token Takeaway Score: 3.5/5