The Efficient Inflation Hedge Combines Gold and Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree BOLD

The world is sinking in debt, and the most gracious exit is to see it inflated away. Inflation is something we had better get used to because financial repression, which keeps interest rates low despite inflation, has become a policy choice. This will disrupt markets, and investors need to protect themselves.

Gold and bitcoin are an ideal asset combination to combat the dangers associated with higher inflation and currency debasement. Gold has been tried and tested in this role over centuries, while bitcoin is a relative newcomer. Yet bitcoin’s design was based upon gold’s scarcity, and its internet presence gives it widespread distribution, making it well-placed to fulfil a monetary role.

These assets complement each other. Both are effective in combating inflation, yet gold outperforms when the economy is contracting, while bitcoin outperforms when it is expanding. By holding both, the portfolio is efficiently balanced to combat all inflationary scenarios.

The next decade will likely see interest rates held down while inflation is allowed to run wild. On the face of it, the economy appears to be growing while the debt inflates away, yet much of that growth is an illusion.

Inflation disrupts

This new era will require more government control, and that means misallocated capital to a new round of state-sponsored projects. The benefits will prove to be temporary because repression cannot last forever as “one day you run out of other peoples’ money”.

Investors will have to foot the bill as they face a prolonged period of negative real yields combined with higher taxes. The antidote will be to embrace the likes of gold, bitcoin, commodities, and industrial cyclicals while treating traditional stocks and bonds with caution.

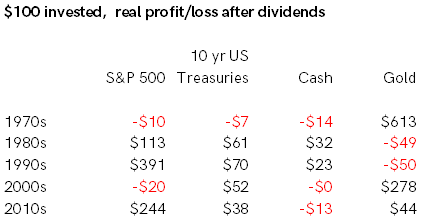

The last time the developed world experienced a prolonged period of inflation was in the 1970s. From the nifty-fifty stockmarket bubble peak in late 1972, $100 invested in equities had purchasing power of $72 by the end of the decade. Over the same period, $100 invested in 10-year Treasuries became $63. These numbers from Stern NYU are quoted in real terms and include dividends but not taxes. It is a reminder of how painful inflation can be for investors.

The table looks at real asset returns by decades.

The asset that stands out as a true diversifier is gold. It saved the day in the 1970s and the 2000s when financial assets struggled. Investors always flock for a safe haven under similar conditions. Once gold was unshackled from the fixed price courtesy of the gold standard, it ran wild, rising from $35 in 1971 to $800 by the decade end.

So long as financial repression was policy, the price of gold rose, and a small allocation made the difference by protecting investors’ capital in real terms. Investors who held some gold in 1970s protected their portfolio from capital erosion.

Inflation hedges

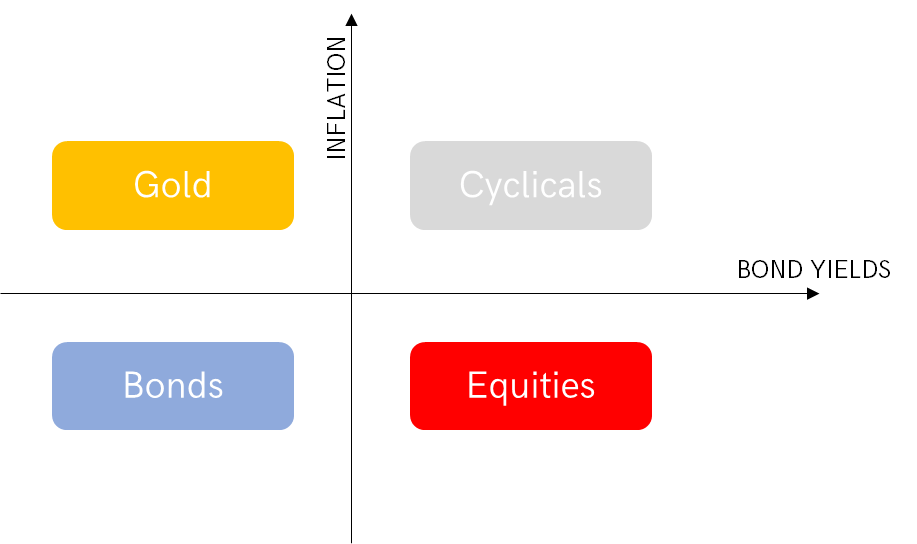

Not all equities performed poorly in the 1970s, as natural resources and industrials did well too. These tend to be capital intensive industries, with significant plant and equipment, and the ability to raise prices. Unsurprisingly, these companies, which are generally referred to as cyclicals or value stocks, tend to perform best when the economy is doing well and when inflation is rising. As you’ll see, this is how we see Bitcoin today.

That contrasts with financial assets, bonds and general equities, which prefer inflation to be stable. A rising bond yield tends to indicate risk-on market conditions, and a falling yield, risk-off. Gold likes inflationary, risk-off conditions.

The ByteTree Money Map

When inflation remains elevated, a blend of gold and cyclicals is a winning strategy. During the good times when the economy has expanded, the cyclicals have pulled their weight. During the recessions, gold has done the heavy lifting. This blend of assets with different drivers is a powerful inflation hedge.

Bitcoin behaves like a cyclical asset

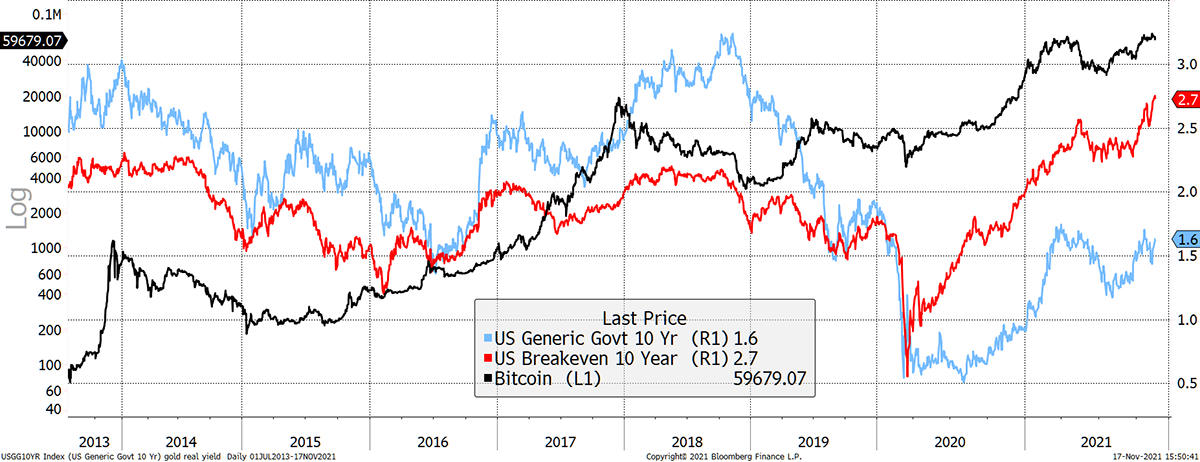

Bitcoin didn’t exist in the 1970s, so there is no live test of its sensitivity to periods of high inflation outside of the present. But the last decade of data strongly suggests that bitcoin behaves like a cyclical asset. Approximately 95% of its historical return has coincided with rising rates and inflation, with the famous corrections occurring when inflation and rates have been falling. That is, bitcoin performs best in an inflationary, risk-on environment.

Bitcoin has performed best when inflation has been rising and the economy expanding

That contrasts to gold which prefers falling real rates, which you’d normally associate with an inflationary, risk-off environment. By blending gold and bitcoin, you end up with an optimal outcome, as one asset performs during the good times while the other performs during the bad. This inverse correlation has been particularly striking over the past two years.

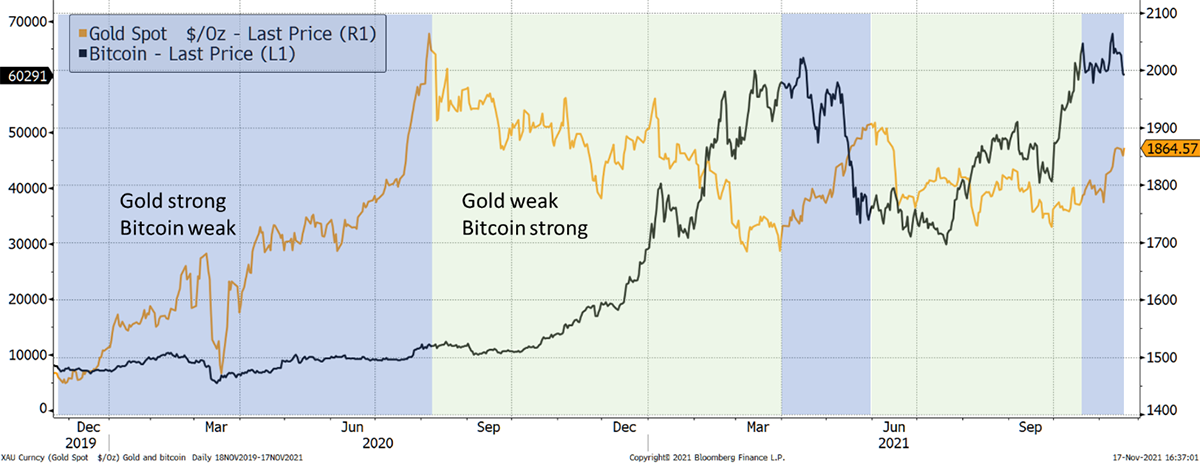

Gold and bitcoin have low correlation

Gold was strong into the summer of 2020 when there were widespread lockdowns and fears the economy would collapse. Following the Covid-19 government stimulus measures to support the economy, inflation expectations rose quickly. Gold surged, yet bitcoin remained at $10,000. It wasn’t until lockdowns began to ease, and bond yields rose from near or below zero in October 2020, that bitcoin took off. In other words, bitcoin didn’t move until the economy was clearly in recovery mode.

Then in May 2021, bitcoin peaked just as gold troughed. There were other reasons for the moves, but the Federal Reserve was telling the market that inflation was transitory. Inflation expectations eased slightly, while bond yields fell significantly. This period saw gold rally while bitcoin faltered.

Gold then peaked at $1,900 in May while bitcoin fully recovered to make an all-time high at $67,000 in November.

These repeated inverse correlations are highly attractive for a portfolio as different economic scenarios are covered. But be in no doubt that the environment both assets fear is risk-off accompanied by deflation. We saw this in the 2008 financial crisis (pre-bitcoin) and March 2020. On both occasions, the monetary authorities were quick to respond with stimulus packages.

Efficient diversification

A 20% rally for gold is a large move. It is estimated to be a $12 trillion asset class, and so a 20% move creates $2.4 trillion of value. In contrast, bitcoin is a $1 trillion asset class, and would need to rise to $150,000 to create the equivalent amount of dollar value. This explains why bitcoin is likely to calm in the future because 10x or 100x rallies become difficult as an asset faces the laws of large numbers.

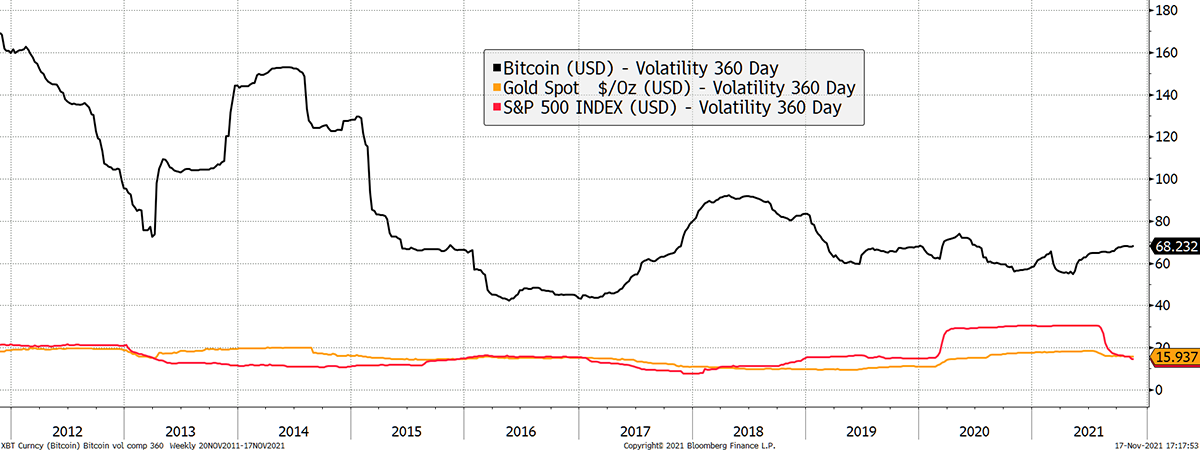

Another way to think about that is through price volatility. This does not forecast future returns but helps to gauge risk. Bitcoin used to have annual volatility of 160%, which is extraordinary. Today that has eased to 68%, which is still high. In contrast, gold’s volatility over the past year has been 15.9% which is similar to the S&P 500, added for reference.

The volatility gap between gold and bitcoin

A portfolio can be weighted inversely to its volatility so that the least volatile assets have a higher weight and vice versa. In the case of bitcoin and gold, that is a simple mathematical task. The target weight in bitcoin is given by:

`"Weight" = (1/"𝜎_B") / (1/"𝜎_𝐵" + 1/"𝜎_𝐺")`

where 𝜎_𝐵 and 𝜎_𝐺 is the 360-day volatility of bitcoin and gold, respectively. The target weight in gold is one minus the target weight in bitcoin. At current volatility levels of 𝜎_𝐵=0.68 and 𝜎_𝐺=0.16 the weight in bitcoin is 19% resulting in a gold allocation of 81%.

As bitcoin matures as an asset class, its volatility is expected to fall further. If it ever came down to gold’s level, then the weights for each asset would be the same.

ByteTree BOLD Index

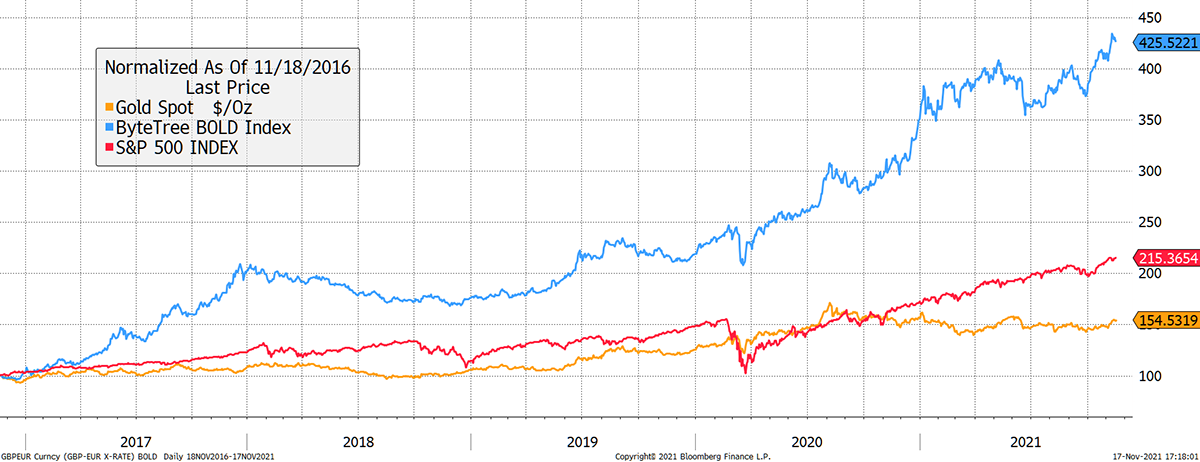

ByteTree has been fascinated by the blend of gold and bitcoin and believes the combination of these assets creates an efficient inflation hedge. Having two inflation-sensitive assets that work at different points in the cycle is a highly attractive proposition. This strategy has been wrapped into an index that combines bitcoin and gold, known as BOLD.

The risk is managed by the inverse volatility method described and results in the BOLD portfolio holding volatility at 21%, which is lower than 8 of the top 10 S&P 500 constituents. Only Berkshire Hathaway and Johnson & Johnson have lower readings.

The final detail is the frequency of rebalancing. This is important because the longer you leave it, the more prices can drift from the target weight. That would have been a good thing when bitcoin rallied strongly in 2013 or 2017, but now the expectation for more mature asset behaviour means that more frequent rebalancing adds value rather than detracts.

Each time the portfolio is rebalanced, you are buying more of the asset that has lagged at a low price, and selling some of the asset that has done well at a high price. As this is repeated over time, the portfolio has a source of excess return over and above the combined asset returns.

BOLD has performed well while remaining stable

Beating financial repression with BOLD

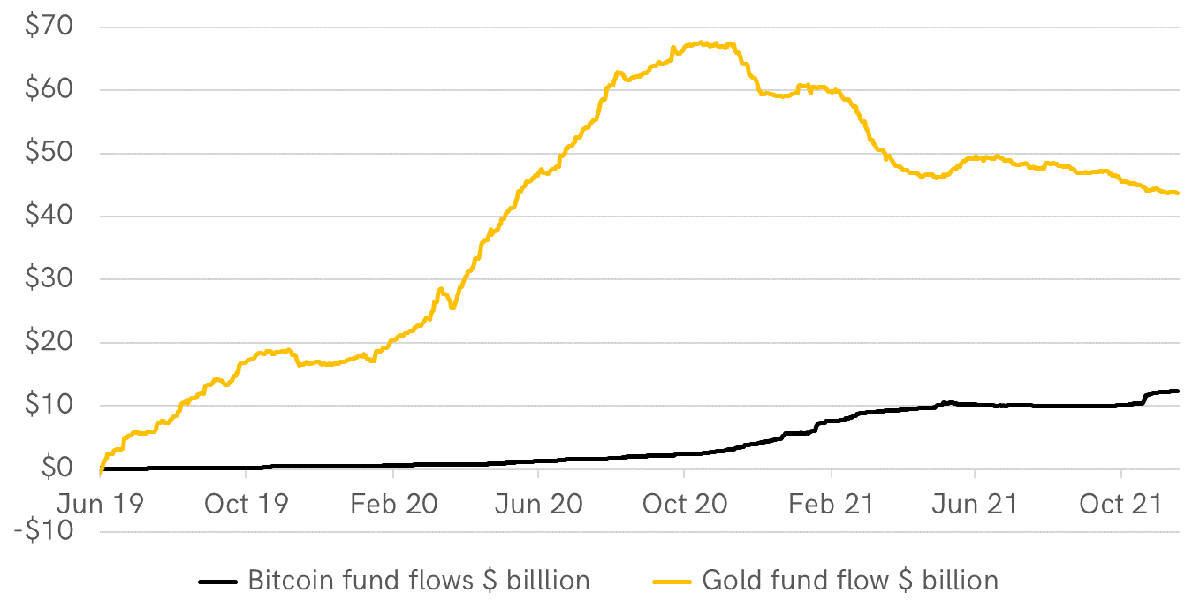

Institutional investor behaviour understands this, as is evidenced by the fund flows. From June to October 2019, investors injected $65 billion into gold funds and $12.4 billion into bitcoin funds.

In October 2020, when the economic recovery was underway, investors reduced their allocation to gold and increased bitcoin. We can’t be sure it was a switch within the same group, just that it happened.

Gold and bitcoin fund and ETF investment flows

The gold ETFs alone hold assets worth $182 billion, while the bitcoin ETFs and closed-ended funds hold $50 billion, much of which was capital appreciation. In contrast, the silver ETFs hold $22 billion, meaning bitcoin is 2.2x more widely held in institutional portfolios than silver. Bitcoin has not challenged gold, but it may well have taken share from silver.

Bitcoin is not the new gold

When people suggest bitcoin is disrupting gold, they miss the quantitative and qualitative differences between these assets. Bitcoin may be lighter and faster in terms of its transactional ability, but gold is already established. Each asset has a different role.

Gold is stable (low volatility) because it has a value buyer. Bitcoin is less stable because it does not. When the price of gold falls, there is a dependable buyer from either jewellery or the central banks. In that regard, gold is unique as there is always a bid, even during times of crisis.

In contrast, bitcoin is cyclical as there is no value buyer on the same scale. This is not a bad thing, as it applies to most growth stocks too. Successful investors accept that bear markets are part of the journey and know to ride them out.

Bitcoin investors who have heeded this advice have been richly rewarded, and there is no reason this will not continue, albeit at a more moderate pace.

Better together

It is surprising that many bitcoin bulls feel the need to challenge gold when bitcoin’s code was based upon it – at least on the supply side. With different macroeconomic sensitivities, bitcoin and gold are well-suited partners in serving different roles.

It is better to understand the common threat of financial repression, a severe headwind for financial assets. At ByteTree, we believe gold has found a high-tech friend, which has become the monetary asset of the internet and compliments gold’s role as the monetary asset for the real world.

The ByteTree BOLD Index is an ideal way to harness this strategy that blends gold and bitcoin in an efficient manner to protect investors from financial repression.