Polygon: Shaping the Future of Ethereum?

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: MATIC;

Recently, we have heavily focused on the metaverse and highlighted how boundless non-fungible tokens can be. Both Sandbox (SAND) and Aavegotchi (GHST) have outperformed the market by some distance. This week, we are covering layer-2 scalability solutions and introducing Polygon (Ticker: MATIC).

Layers 1 and 2

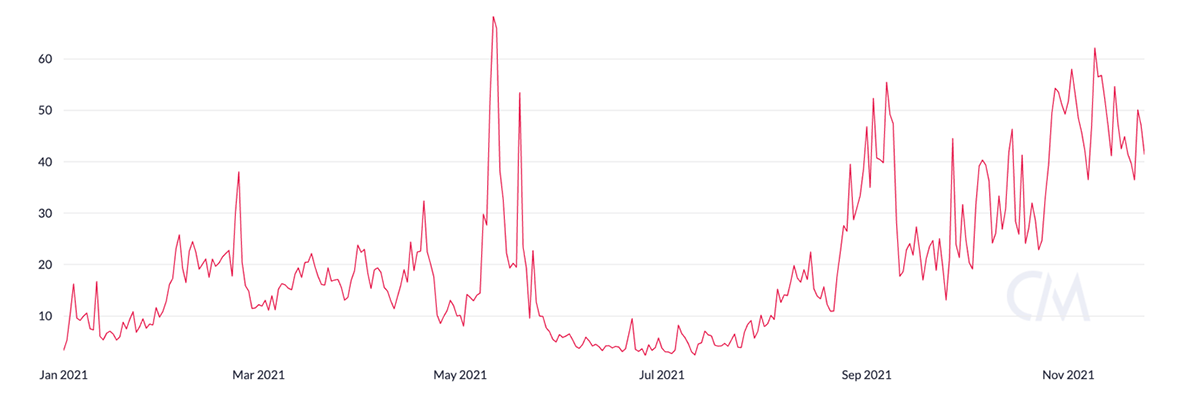

The scalability of a blockchain is an important consideration when determining whether to gain investment exposure to a network. Bitcoin was the first chain to experience issues with scalability, mostly due to its small block capacity. Indeed, Bitcoin’s small block capacity means that it struggles to handle large amounts of transaction data efficiently and quickly. Ethereum’s recent gas prices represent similar inefficiency and lack of scalability, with some transactions costing users over $150.

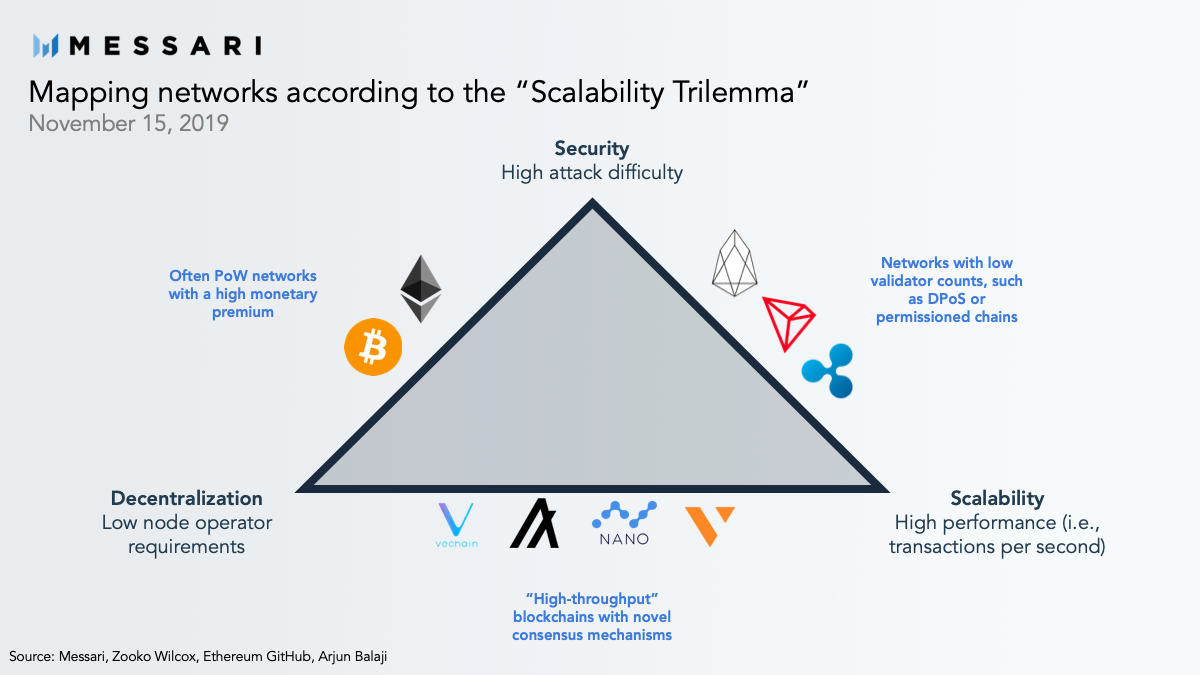

A layer-1 blockchain is the ‘main’ chain and foundation of a given network. The first layer determines key properties, ranging from its scalability and security to the extent of its decentralisation. These three factors form the infamous blockchain trilemma.

The trilemma refers to a blockchain’s inability to perfectly maximise every component while highlighting the need for compromise on aspects (typically security and decentralisation) to fit individual needs. A layer-2 solution is a protocol that integrates with a layer-1 blockchain to solve for scalability and transactional throughput.

To describe the difference between layer-1 and 2, consider the following scenario. You’re at the pub, and every time you want to buy a drink, you’ll have to queue and pay repeatedly; cumbersome and inefficient. Alternatively, you sit at a table, open up a bar tab, and execute one final transaction at the end of your session; quick and easy. To put it simply, layer-2 is the blockchain equivalent of batching your transactions away from the congested zone yet finalising them at your favourite, reliable pub.

Polygon

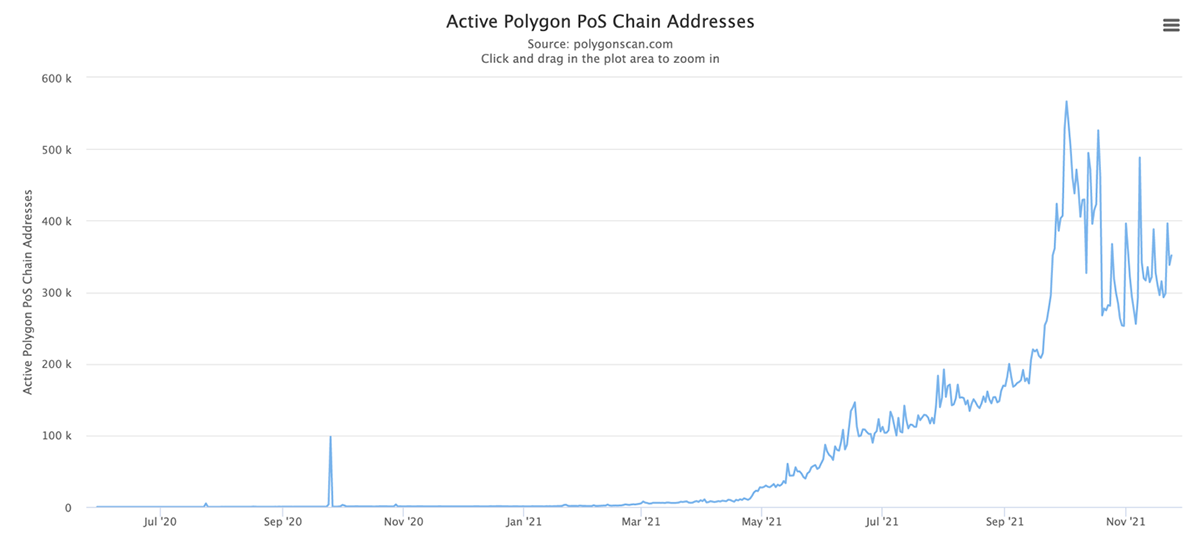

Polygon is a layer-2 solution built on and for the Ethereum Network. Ethereum is the industry’s highest value smart contract project and controls a higher TVL than all the ‘ETH-killers’ combined. A symbiotic relationship with the Ethereum Network promises serious adoption and traction, as evidenced by the 350,000 active addresses on the Polygon network.

Not only has Polygon derived significant value from Ethereum, but it has also overtaken it in terms of transactions per day. Additionally, more dApps are migrating to Polygon from Ethereum, from leading protocols such as Aave and the Kyber Network to more embryonic applications like Aavegotchi. There seems to be a growing consensus within the digital assets space that while Ethereum is the greatest smart contract network available, it is too expensive to operate on. Polygon is the main method by which users and developers can benefit from Ethereum’s excellence while avoiding its expense.

How Does Polygon work?

Polygon is the first protocol to aggregate several scalability solutions, such as layer-2s and sidechains. Simply put, Polygon develops an ‘Internet of Blockchains’ wherein developers create their stand-alone Ethereum-compatible sidechains to power their dApps. Without getting too technical, Polygon can batch transactions off-chain and generate cryptographic proofs that are only settled on-chain. This alleviates congestion on the Ethereum Network, promotes low-cost accessibility to dApps while maintaining access to the world’s largest digital asset money market, Ethereum.

Another of Polygon’s successes is the natural demand the network creates for its MATIC token. Indeed, users need to own the native token to pay gas and platform fees and transact on the network, not dissimilar to that of layer-1 native tokens. Given the rate and extent of adoption of the network, this natural demand is likely to persist and may present a rewarding long-term investment opportunity.

Conclusion

As things stand, readers should note that Polygon is the dominant force in the Ethereum scaling space. It has consistently attracted popular Ethereum-based projects to its network while simultaneously incentivising user adoption.

Polygon has made good use of its first-mover advantage, with front-running protocols like Arbitrum and Optimism. This trailblazing is compounded by the diversity of its offering, while its general-purpose scaling solution also supports the scaling solutions offered by its competitors. Polygon has successfully incentivised projects to build on its network. Still, more significantly, it gives these projects no reason to leave, as they can adapt their mode of scaling on one network alone.

Next week, we will further dive into the investment opportunity associated with Polygon and its competition (or lack thereof) with the ‘ETH-killers’.