Crypto Stocks Continue to Strengthen

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 100

I always enjoy Coinbase (COIN US) results as they give a good insight into the digital asset space.

Q3 revenue came in at $1,234 million on customer assets of $255 billion. Not too shabby. They’ve hired 600 people in Q3 and now have a team of 2,781 employees. They are adding more assets to the platform and are introducing a peer-to-peer NFT marketplace. For those who are still confused by crypto, this is the point made in the earnings release:

“Social and mobile companies were the building blocks of Web 2.0; crypto and the blockchain will drive Web 3.0 which improves upon the past models to combine content, payments and identity, on one platform. We believe Web 3.0 represents a paradigm shift in how we all interact with the Internet which will unleash unprecedented innovation and economic freedom.”

Crypto is a growth story because the next generation of computing will not only securely exchange information but value too. This goes way beyond the noise of meme coins, which will inevitably prove to be painful investments. The excess within the crypto space often gets the most attention and crowds out the incredible innovation.

This is the message that isn’t well understood in the old world of finance or, indeed, among regulators. Crypto may be volatile, and probably deserves to be, but the long-term rewards are huge because true value creation is underway.

The best bit of COIN’s quarterly report is what their customers are up to. BTC trading volumes are a mere 19% of the total, presumably having once been 100%. That suggests a preference for HODLing bitcoin, while also reflecting the growing depth of trading in alternatives. ETH volumes were 22% of the total, with 59% attributed to other assets. No wonder they’re booming.

When you dig into the numbers, BTC had inflows of around $0.8bn, ETH had outflows of $1.3bn, and a whopping $26bn flowed into alts. These are estimates based on the data provided, where I suspect the average alt performed somewhere between BTC and ETH.

COIN is valued at $75 billion, and the crypto equity sector is becoming a growing force. Eighteen months ago, there was a small gang of tired names trading at pennies, struggling to survive. Now, there are giants.

Crypto is a growing equity sector

Alongside COIN, there is Galaxy (GLXY CN), Microstrategy (MSTR) the US 1.4x leveraged bitcoin ETF which trades at a 35% premium to BTC, CoinShares (CS SS), Argo Blockchain (ARB LN), RIOT, HUT 8 (HUT CN), Marathon Digital Holdings (MARA), Canaan (CAN), and Bitfarms (BITF), to name a few.

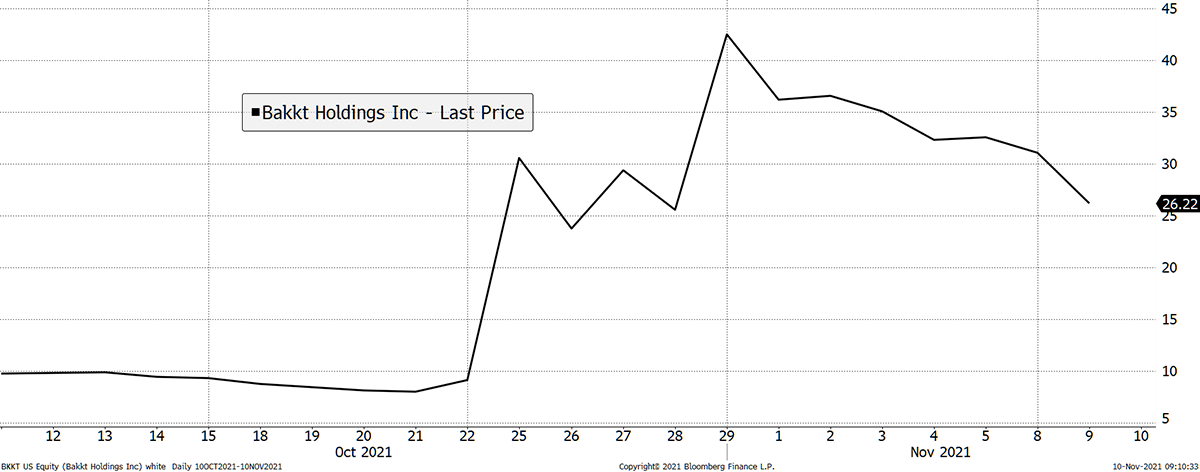

The latest addition is Bakkt Holdings (BKKT), which came to market via a SPAC, VPC Impact Acquisition. It ran up 4x in a week to a $6 billion valuation. Madness, perhaps, but they have just signed a deal with MasterCard. It is unclear who the winners will be, but it is clear there will be winners. That means equity investors should engage.

Bakkt IPO flew

It bodes well for Concord Acquisition Corp (CND US), which is coming to market with Circle, the company behind the $34 billion stablecoin, USDC. Many of these companies will end up in the S&P 500, which means investors will have crypto exposure whether they like it or not.

And if you like value, look no further than CoinShares (CS SS). I’ll disclose that their chairman, Danny Masters, sits on ByteTree’s board. Looking at their Q3 results, it’s trading on 5.4x next year’s earnings. Deep value in crypto? The CoinShares management team thinks so because they keep buying more shares in their own company.

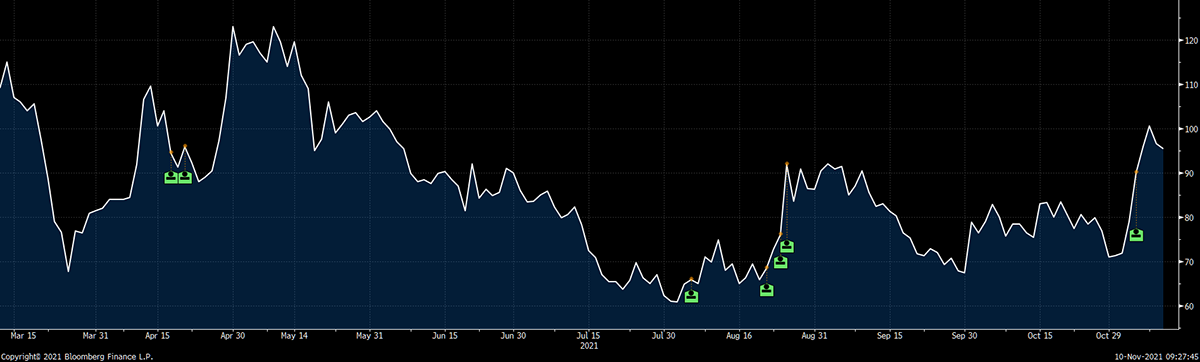

CoinShares insiders are buyers

Bitcoin Miners Outperform

- by Tom Salter

Bitcoin miners are a large part of crypto’s exposure on the stock market. MARA, RIOT, HUT, CAN, and BITF have a combined market cap of $17.1bn and offer investors a spicier entrance (albeit more accessible) to the already red-hot Bitcoin market.

Since February last year, 3/5 of the largest crypto mining stocks would have been more lucrative investments than holding BTC, with RIOT and Canaan underperforming the benchmark in the chart (BTC/USDT). Bitcoins are a large part of a crypto miner’s revenue, and as we have seen with companies like Microstrategy, stocks that hold Bitcoin tend to act as unnecessary leveraged BTC positions. Miners seem to be unaffected by this risky affliction on the downside.

Although potentially trivial, it looks like the Swedish regulators are asking the EU to consider banning PoW mining, according to Bitcoin.com. Considering these mining giants operate in the Americas and eastern hemispheres, we could see a higher growth potential as hash power from Europe leaves the market, ready to be lapped up by companies like MARA.

Bitcoin at an ATH

- by Tom Salter and Aun Abbas

We cannot ignore yet another BTC all-time high of $68,525, which is made just that little bit better by the supporting growth of the underlying Bitcoin Network.

Bitcoin is a trillion-dollar asset and has been for some time. From Coinbase allowing you to collateralise bitcoin to borrow fiat, to Mastercard resolving to create crypto-linked credit and debit cards in Asia, we now know that digital assets are not merely instruments of market speculation.

Bitcoin has real use-cases from which it derives its value, whether that be as a HODLed hedge against inflation, or via a growing network. Whereas the HODL use-case suggests that bitcoin’s utility comes from not being used, we at ByteTree sympathise with the view that the value of bitcoin is a function of a vibrant network. In line with Metcalfe’s law, a growing network equals a growing bitcoin.

Remember that, unlike gold, Bitcoin is a technology. This means the blockchain has a globally distributed team of developers and coders who constantly look to improve the settlement currency. The technical explanation is out of the scope of this letter, but readers should be made aware that the Taproot upgrade is being implemented this week. Read our take on the upgrade here.