Bitcoin Network Demand Model

Disclaimer: Your capital is at risk. This is not investment advice.

Week 47 2021

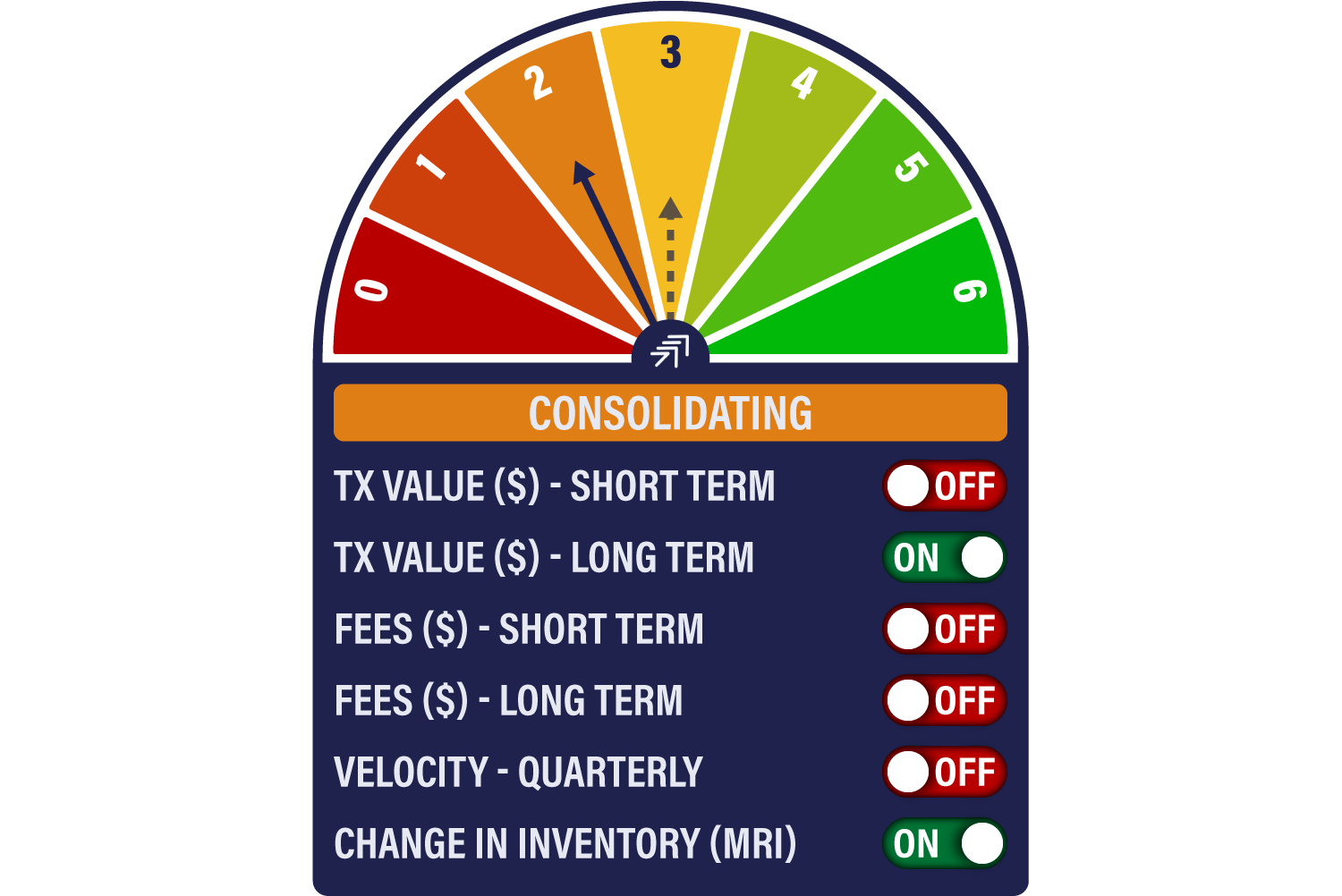

The Network Demand Model slides from 3/6 to 2/6 this week, but it’s a noisy rather than a worrying change at this point. A sign of consolidation rather than collapse. The decline comes as short-term transactions turn negative. Miner’s Rolling Inventory remains on after last week’s surge in miner selling, while long-term transactions also remain on. A positive change in the fee series is also getting closer - this might also be telling us something about the quality of investors now driving the bitcoin price.

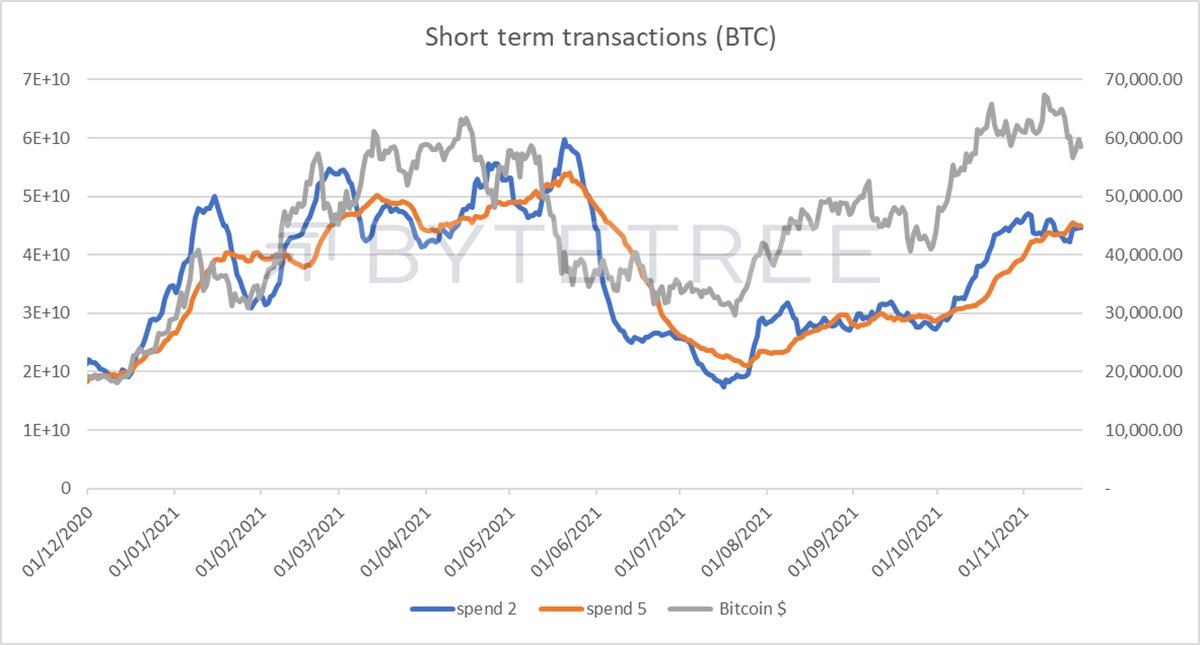

The behaviour of the short-term transaction series, shown below, is consistent with a period of consolidation for the bitcoin price. At this point, the break of trend is somewhat noisy, similar to the period a couple of months ago when the price traded between US$40-50,000. A significant price move is normally accompanied by a major divergence in the 2 series, which is currently not apparent.

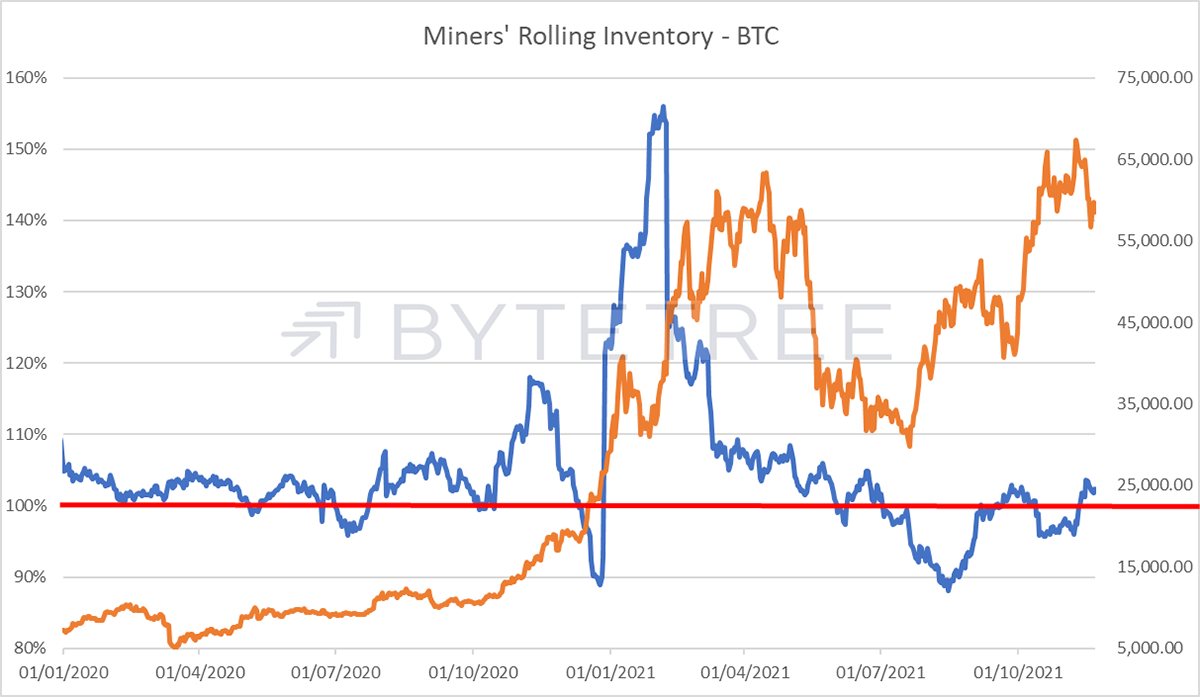

Miner behaviour has markedly changed as we have progressed through this latest bull run. Note how enthusiastically they sold (as shown on the blue line in the chart below) into the spike in the first quarter of this year. They correctly considered that the price was heading to unsustainable levels. By contrast, they have been diligently hodling through the recent weakness. While there has been a pickup in miner selling of late, it is nowhere near a scale that should alarm investors.

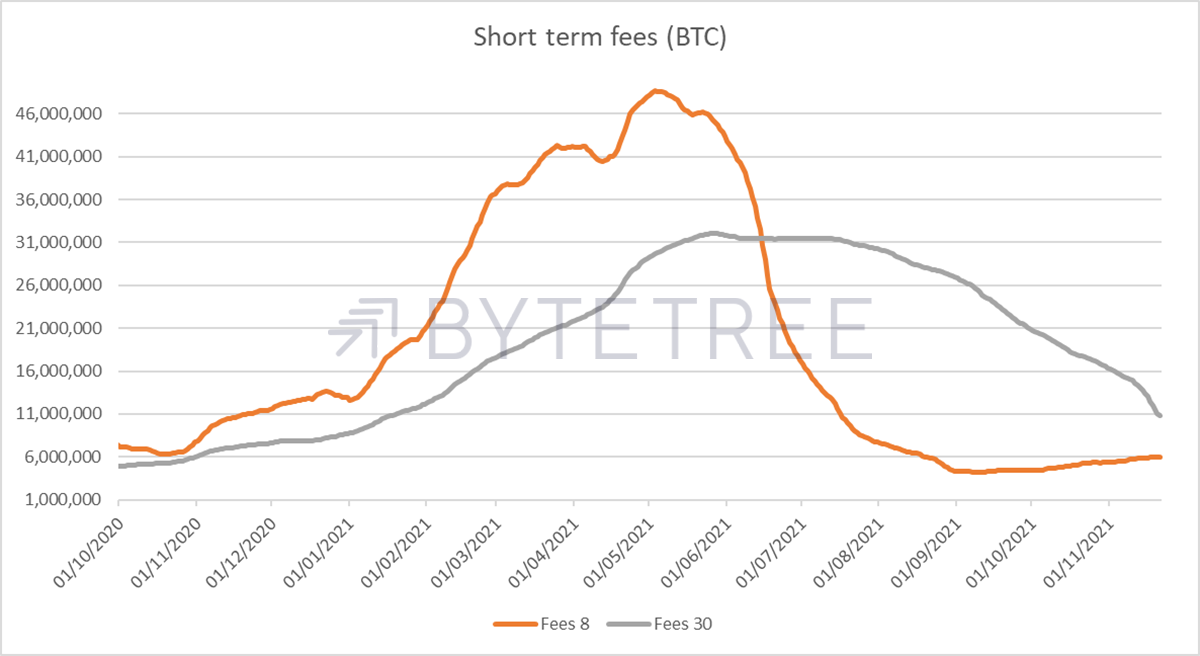

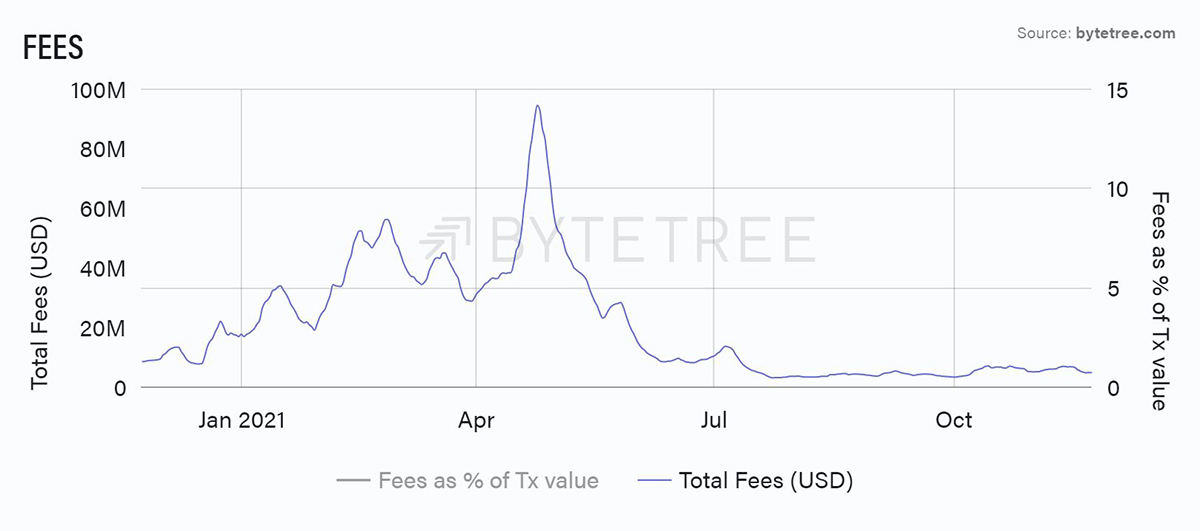

The shorter-term fee series is, as expected, getting close to a positive signal. The excesses around the price spike earlier in the year are now being eliminated from the data. This again paints a picture of a network in good health and far from frothy.

Fees generated for the miners remain subdued. This is a series slightly at odds with the bullish narrative accompanying bitcoin’s recent rise. The fall may be due to technology improvements on the blockchain (Segwit/Taproot), but even so, it is strange that the absolute level of fees is tracking at around US$5.2m on a rolling 7-day basis. That compares to around US$8.8m a year ago. Another theory for the change is that small scale speculative activity has moved away from bitcoin towards the alt-space, with bitcoin trading increasingly dominated by large scale institutional investors.

Comments ()