Bitcoin Melt Up

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 23

This type of development is long-term bullish because it fuels the network growth. Much better to see millions of people using bitcoin rather than the few HODLing it.

Highlights

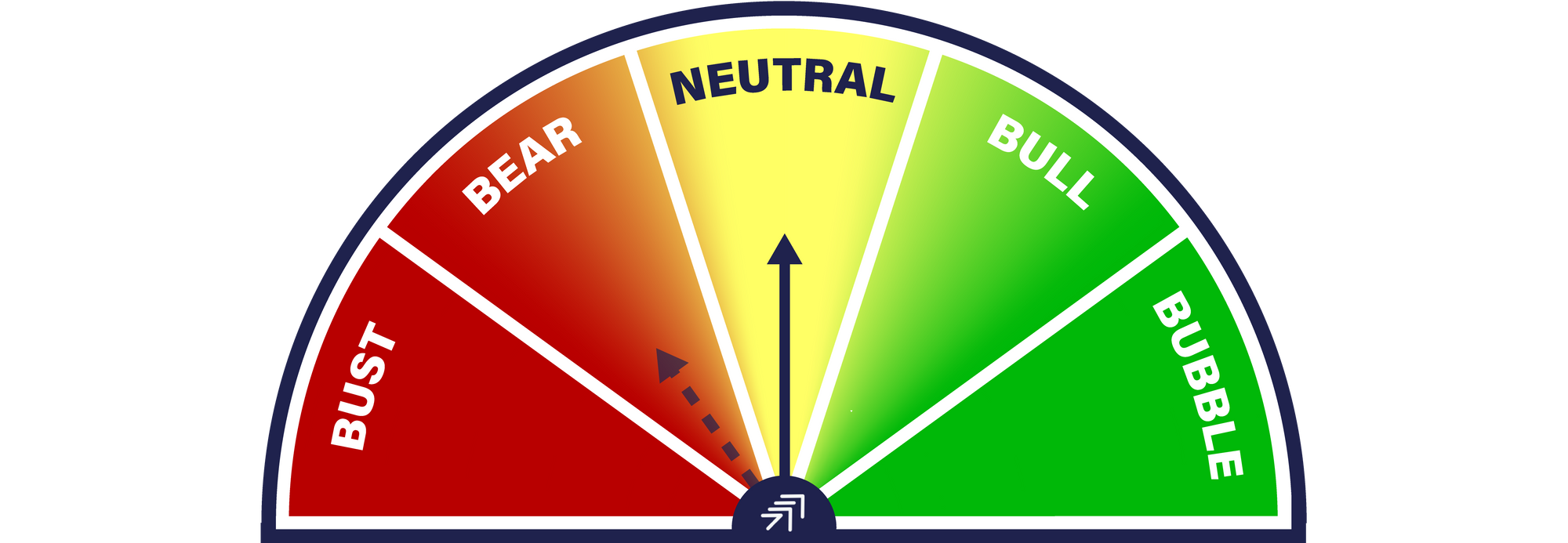

| Technicals | They say a new high is always a buy |

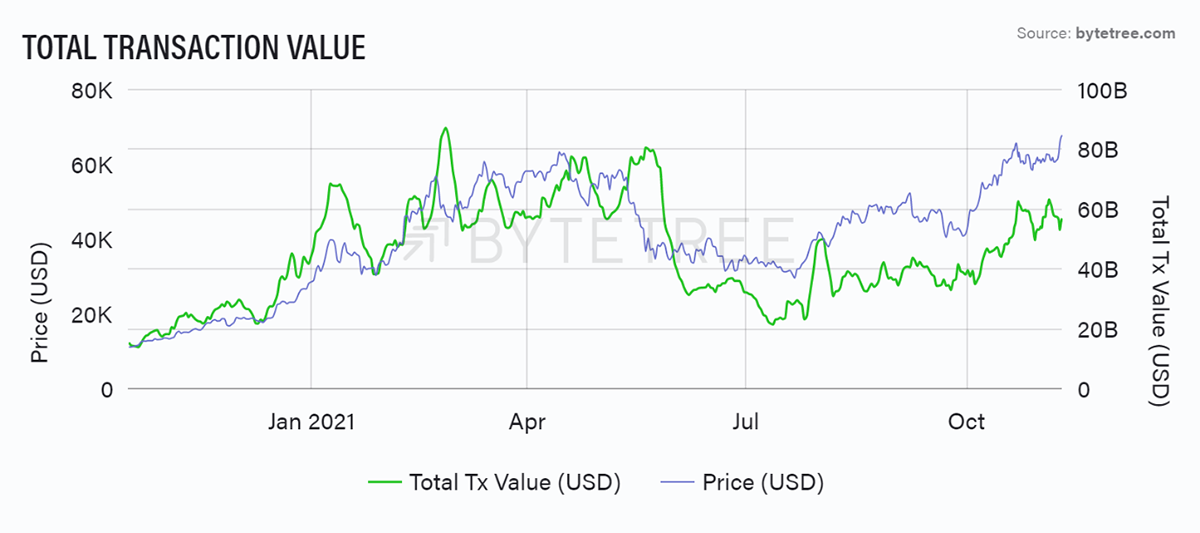

| On-chain | Price still leading the chain |

| Macro | Fighting off bonds and tech |

| Investment Flows | Australian ETF approval |

| Crypto | Ether College |

ByteTree ATOMIC

MasterCard has formed partnerships in Asiawith Amber Group, Bitkub and CoinJar to issue crypto-linked credit, debit and pre-paid cards.

Who said bitcoin isn’t money? It is now.

This type of development is long-term bullish because it fuels the network growth. Much better to see millions of people using bitcoin rather than the few HODLing it.

It’s logical that a widely distributed network maximises value. Consider if one person owned all of the bitcoin, there would be no network and therefore no value. Vibrancy and widespread adoption are key, not necessarily in reaching the highest possible price in the short-term but in creating lasting value.

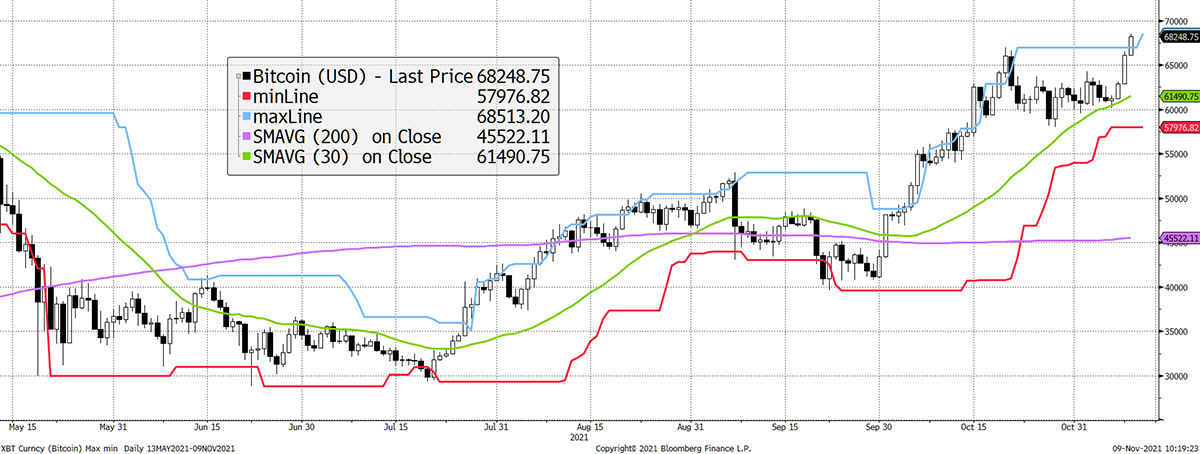

Technical

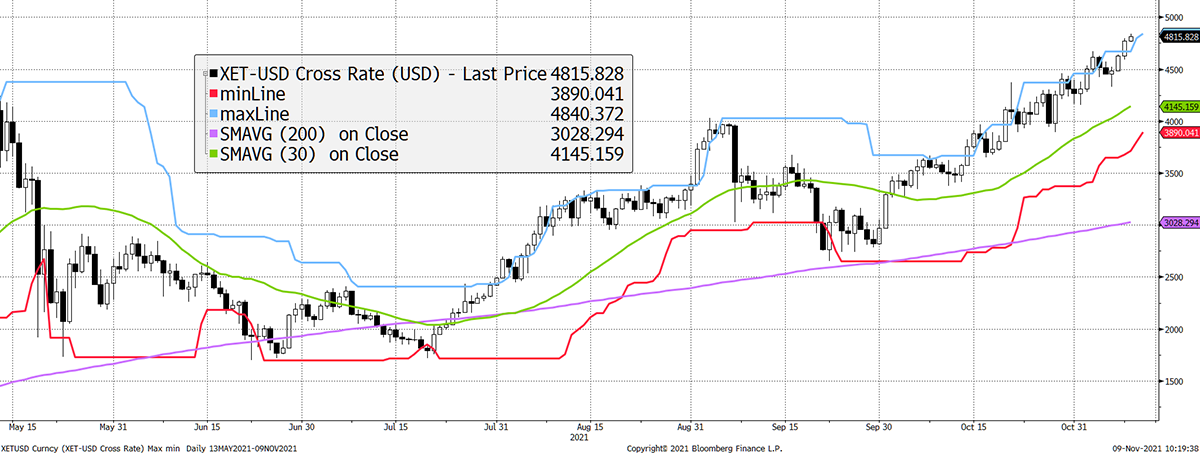

The BTC 200-day moving average has turned positive and is looking happier than it was over the summer.

BTC ByteTrend score 5/5

Source: Bloomberg. Bitcoin with 20-day max and min lines, 30-day and 200-day moving averages past six months.

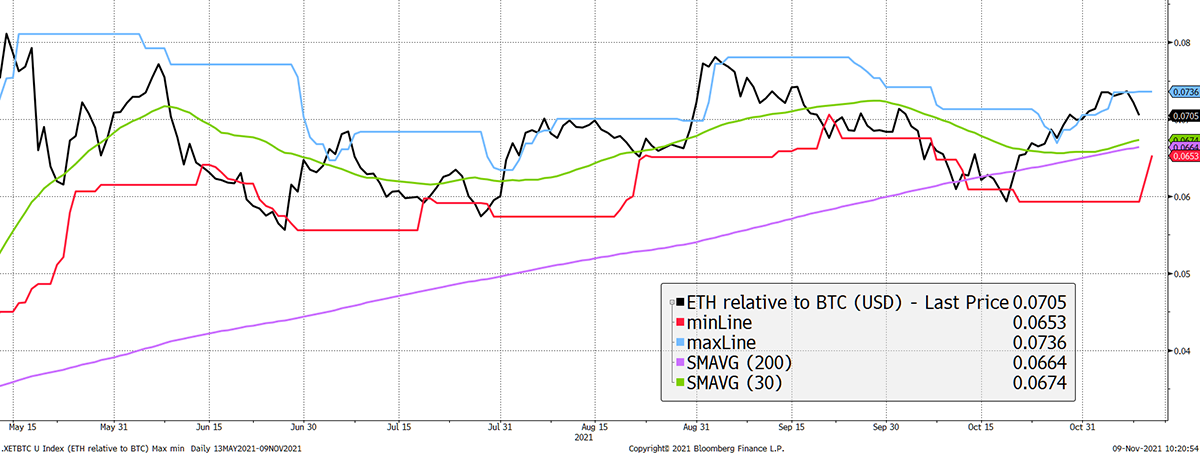

ETH ByteTrend score 5/5

Source: Bloomberg. Ethereum with 20-day max and min lines, 30-day and 200-day moving averages past six months.

ETH remains a stronger trend than BTC on a relative basis. The moving averages are rising, and the price is above both. Furthermore, the last touch was the blue 20-day high.

ETH (priced in BTC) score 5/5

Source: Bloomberg. ETH in BTC with 20-day max and min lines, 30-day and 200-day moving averages past six months.

ByteTrend explained:

We urge you to become familiar with the ByteTrend score concept because it will become a major feature in ByteTree technical research. Quite simply, it enables a trend to be quantified, which helps to remove emotion and provide a comparison across many charts for cross-market screening.

A ByteTrend score gets a point for each of the following criteria:

- Price is above the 200-day moving average

- Price is above the 30-day moving average

- 200-day moving average slope is rising

- 30-day moving average slope is rising

- The last touch of the max/min lines was blue

On-chain

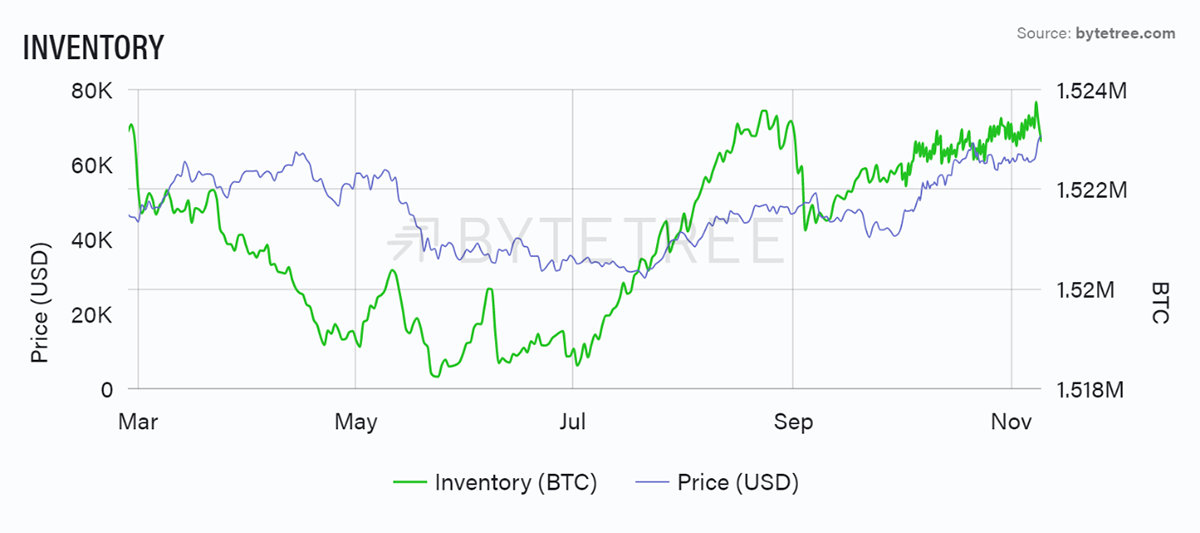

There’s one chart worth highlighting, and that’s the miner’s inventory. When it is rising, they aren’t selling as hard as they could. The accumulation of 5,000 BTC of inventory (a week’s supply) is not particularly significant, but investors mustn’t forget the miners have the capacity to sell. That remains unlikely while the price action remains strong. Let’s face it; the miners are bullish.

Source: ByteTree. Miner inventory (green) and the price of bitcoin (USD) since March 2021.

Investment flows

You can always depend on the Aussies. In 2003, they were the first country to launch a gold ETF, and now, the regulator has just approved spot Bitcoin and Ethereum ETFs.

You have to assume that other regulators are coming around, and this is bullish. As you saw above, MasterCard is operating in Thailand, which was previously crypto unfriendly. The US has approved a futures ETF, which is a good start, and now Australia has continued the trend.

The UK regulators - who were happy for citizens to buy bitcoin ETFs in 2015 (circa $200), only to ban them in 2020 (circa $10,500) - are starting to look lonely. They can’t ban them twice, but they can reverse their decision, as is the case for all countries that have put obstacles in bitcoin’s path.

While the network will always underpin bitcoin’s long-term value creation, investment flows have become by far the most important factor in influencing the price. We saw that in May when the funds sold, and the price collapsed. As soon as they stopped selling and turned buyers, the price recovered.

It isn’t essential that the money comes in each day because the ecosystem is getting ever more sophisticated. All the market needs to know is that more inward investment is coming over time, and ETF approvals seem to underpin that.

In this regard, any positive news surrounding ETFs is short- to medium-term bullish. Long-term, less so as this is only HODLing. The real heroes are out there using bitcoin.

BITO stalls

Source: ByteTree. Bitcoin fund inflows (net, 7-day cumulative) since March 2020.

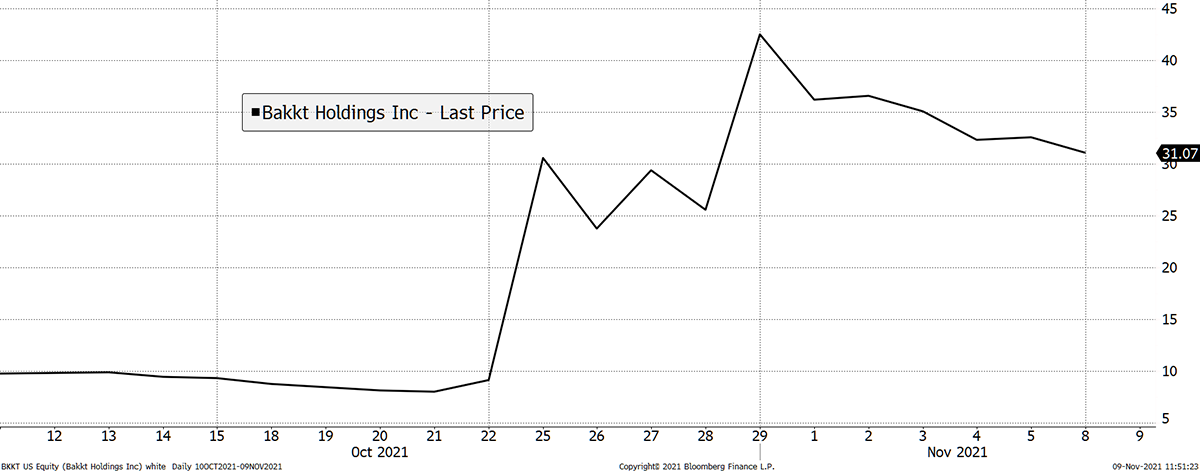

As predicted, a futures-based ETF didn’t quite cut it. There was a burst of activity around the IPO, but the issuance has waned, especially as they hit contract limits. But it’s all progress, and with many more products and stocks coming to market, digital asset exposure on Wall Street is growing. The latest company is Bakkt Holdings (BKKT), which came to market via a SPAC, VPC Impact Acquisition. A 4x run in a week.

Source: Bloomberg. Bakkt over the past month.

It bodes well for Concord Acquisition Corp (CND US), which is coming to market with Circle - the company behind the $34 billion stablecoin, USDC. Many of these companies will end up in the S&P 500, which means investors will have crypto exposure whether they like it or not.

Macro

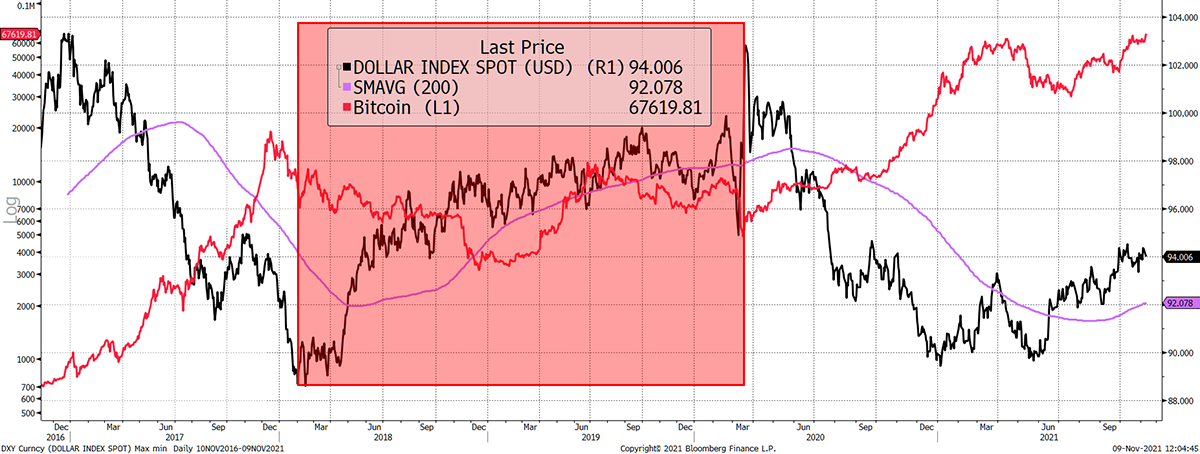

The US dollar is in a bull market, which will disappoint the hyperinflation camp. At least if there is hyperinflation, it will happen in the US last. This trend is gaining strength and will be a headwind for hard assets at some point. It is worth looking at the last dollar bull run in 2018/20.

Dollar bulls are no friends of bitcoin

Source: Bloomberg. US Dollar Index and bitcoin with dollar bull move highlighted since 2016.

Ether College

- by Tom Salter and Aun Abbas

This week’s Ether College will educate our readers on Ethereum’s utility.

Ethereum has set several new all-time highs in recent weeks, which may have led investors to wonder what Ethereum does or what utility it has. This answer splits in two:

The Utility of the Ethereum Platform

The vision of Ethereum is to be a globally decentralised, un-ownable digital computer for executing peer-to-peer contracts. This virtual machine houses sectors like decentralised finance (DeFi) and non-fungible tokens (NFTs); the former being the blockchain iteration of the traditional financial world as we know it, and the latter digitising ownership, be that in art or gaming.

The Ethereum platform is made of smart contracts that form the foundations of decentralised applications (dApps). Its utility relates to the data stored on Ethereum’s network and the balance between the accessibility of said data and the cost of access to all users.

To simplify this, consider Compound.Finance - a leading lending and borrowing protocol. This platform offers financial empowerment to users, but it comes at a cost. The data stored on the platform relates to yield generating opportunities it makes available. The accessibility and cost of access relate to the complexity of its smart contracts. A more complex transaction will cost the user a higher network fee, making it less accessible.

The Utility of the ETH token

The ETH token is the native token for the Ethereum platform. The utility of ETH is often likened to Ethereum’s lifeblood; i.e., ETH is required for transacting on the network. Like oil in an internal combustion engine, gas fees are the transaction costs required to run on the Ethereum Network. The more the Ethereum Network is used, the more ETH is demanded to finance this usage.

ETH can also be used to generate a yield for its users. This use case is available on DeFi within Ethereum, most DeFi protocols on other blockchains and even some centralised exchanges.

Summary

An all-time high is exciting stuff. All the problems surrounding China, the mining vacuum and regulatory uncertainty seem to be behind us. There is a temptation to reach for lofty price targets, but that is always difficult when the network lags the price to this extent. In that regard, we are yet to see a new high.