Silver Special

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report - Issue 64;

Many say silver is gold on crack, but that’s not the whole story.

Highlights

| Regime | What is palladium telling us? |

| Macro | US inflation expectations taking off |

| Valuation | 10% cheap |

| Flows and Sentiment | Modest outflows |

| Technical | Consolidation period coming to an end |

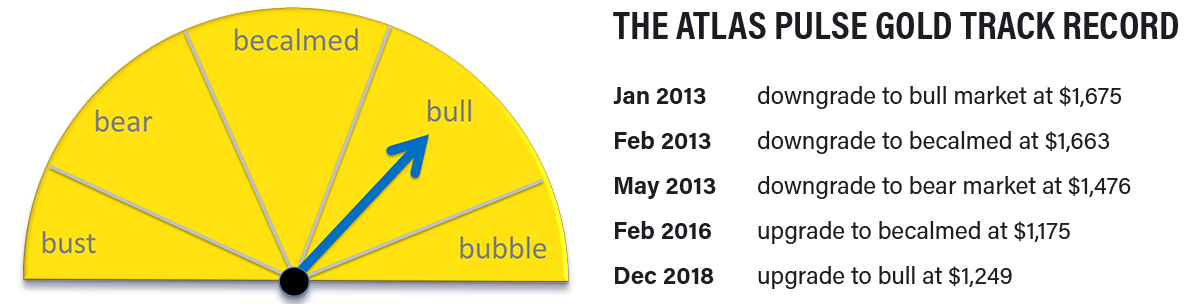

Regime

Out of the three criteria of the gold regime model, two remain bullish and have been most of the time for two decades. The third criteria, the ability for gold to beat the S&P 500, still remains elusive:

- Short-term real interest rates are below 1.8%. They are -5%. TRUE

- The gold price, measured in a basket of currencies, is rising, measured by a 35-month exponential moving average. Long-term uptrend. TRUE

- The gold price relative to the S&P 500, measured by a 35-month exponential moving average. FALSE – but what if US tech tanks?

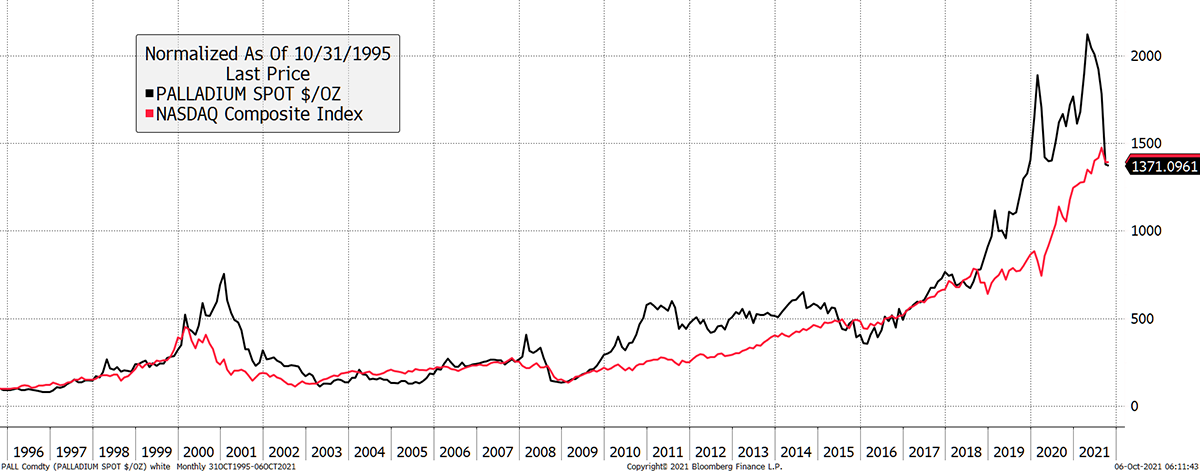

What Is Palladium Telling Us?

Not only has palladium closely mirrored the fortunes of the NASDAQ in terms of correlation, but returns have been similar too. This post 1996 relationship between US tech and palladium has been an extraordinary fit.

Palladium and Tech

When we talk about palladium, most point to catalytic converters in petrol cars, but there must be something else going on, such as demand from electronics. The fit is too tight.

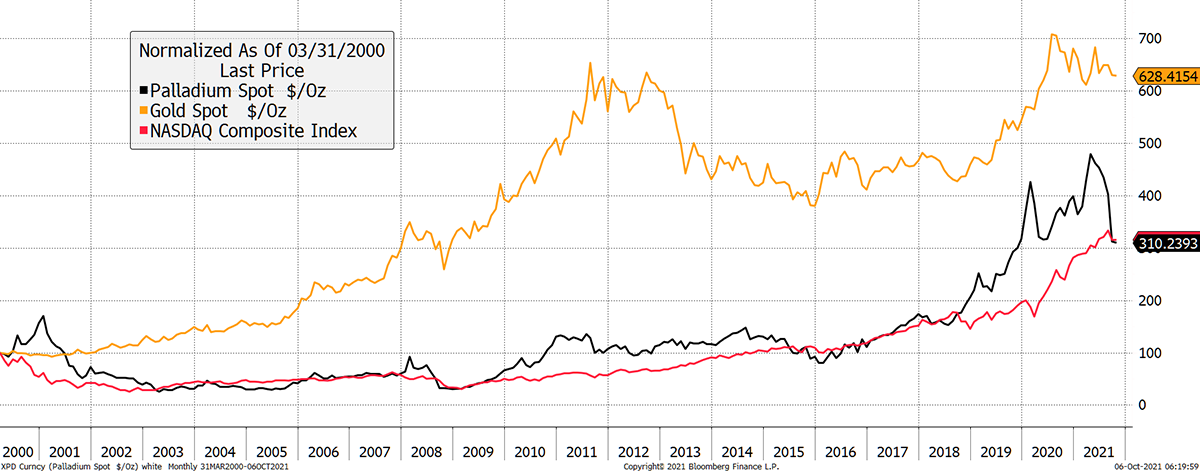

General perception would have you believe the tech has made fortunes for investors. However, an 80% loss is so devastating that gold proved to be the tortoise. Investors sometimes forget this.

Gold Avoided the Drawdown Since the Tech Peak

Gold future returns may turn out to be pedestrian, or they may be spectacular, either with or without a monetary collapse, but they won’t be down by 80%. In contrast, plenty of stuff out there can and will be.

I mention this because gold needs to outperform the S&P 500 in order to get investors’ attention. In recent years, and with equities so strong, that’s been tough. But when equities finally cool, it will be inevitable.

Macro

Maybe we don’t have to wait for an equity bear because gold could be revalued by the Federal Reserve. Wow, go Luke.

The crazier this world gets, the more these things make sense. All the major events since I started in this business in the late 1990s have been unprecedented, unparalleled and outright ridiculous. Yet they keep on happening.

Last year alone, the masters increased the money supply by a third. Bonds yield less than zero after inflation, and in some cases, less than zero. Equities are at nosebleed valuations, and that’s not just tech. McDonald’s is on 9x sales. People think paper masks stop viruses. The ESG movement believes the energy transition will work seamlessly because someone like Elon Musk will invent something.

I have long said that food is energy. That the lights have gone off in the glasshouses in the Netherlands is a case in point. Without diesel tractors and complex logistics, or your own piece of land, we’re going hungry - even vegans. The world depends on ever increasing amounts of cheap energy that is no longer cheap.

This is the link between the real economy and the financial system that remains outside of our masters’ control. There may well be long-term structural deflationary forces from tech, demographics and globalisation, but rising energy prices impact everything and will counter that.

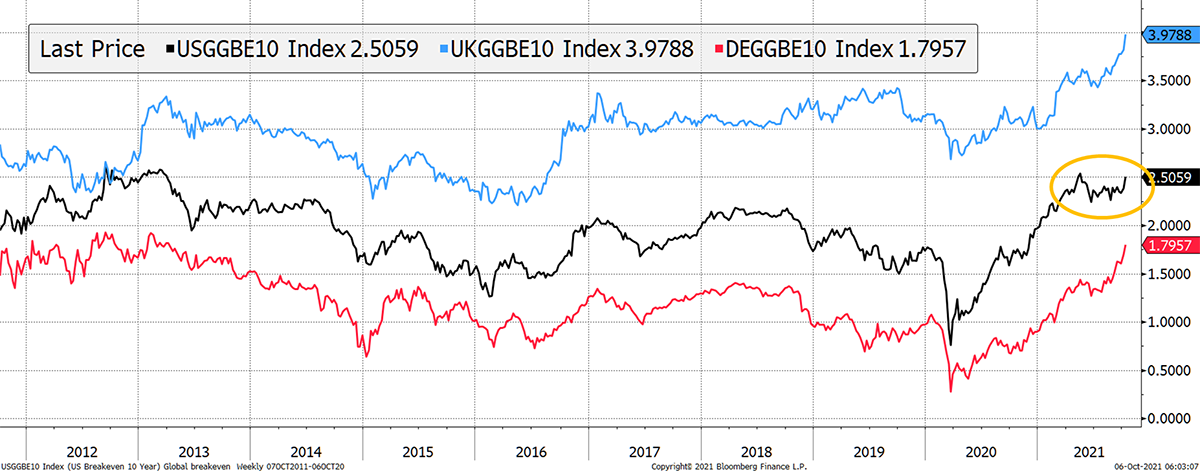

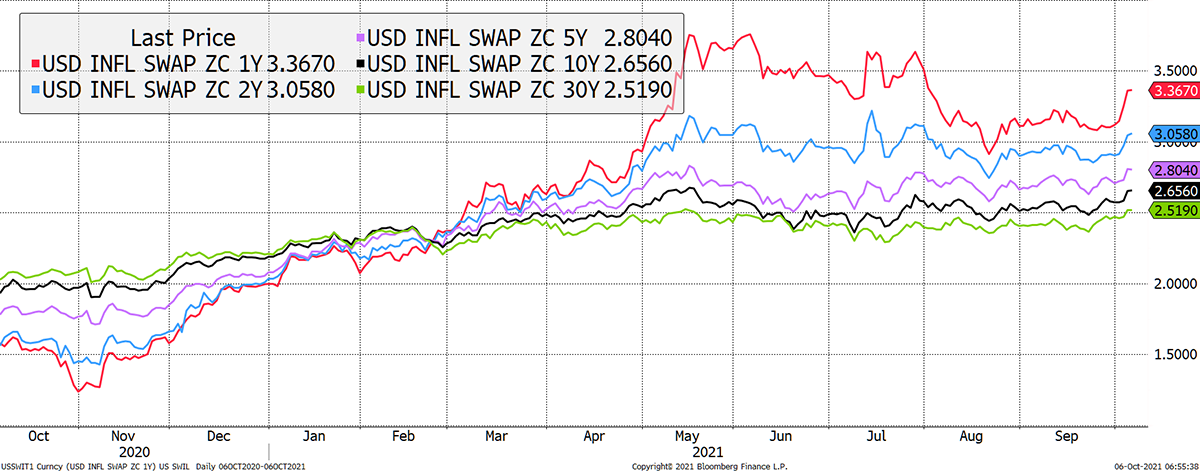

There’s an energy shortage, and it’s real. The charts are all over the papers, so I’ll spare you. This has been building in the UK and Europe for some time, but finally it is being recognised via US TIPS prices. US inflation expectations have started rising again and are about to take out the 2013 high. This could drive gold higher.

Long-term Inflation Expectations Break

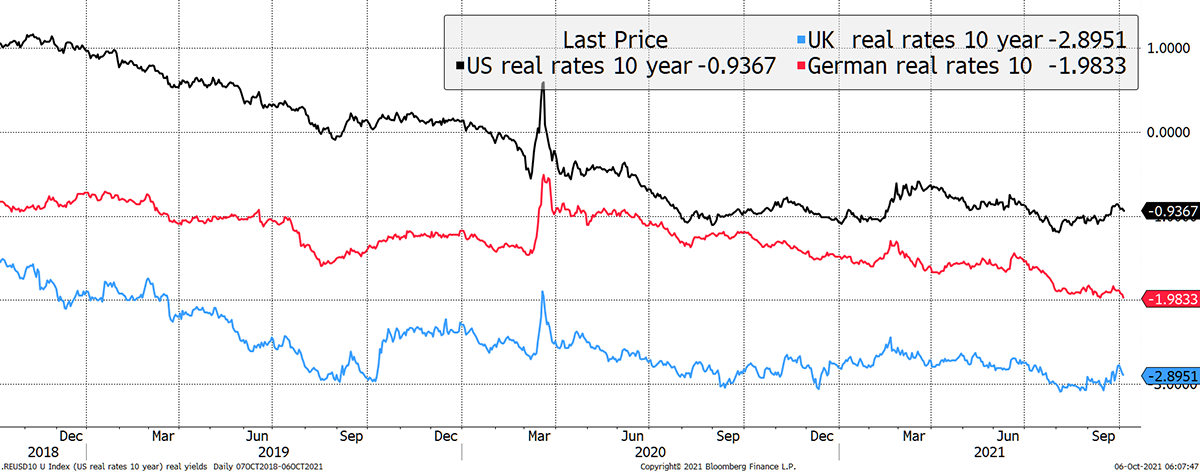

Yet bond yields are rising too. Gold’s best scenario is that inflation expectations rise faster than yields. When that happens, real yields fall, and gold loves it. After a year’s pause (remember how strong gold was from summer 2018 to 2020?), lower real rates are looking more likely, especially as the masters will want to cap bond yields.

Real Rates Ready to Fall

Transitory

Yet, there’s still a feeling that this inflation will pass. Maybe someone actually does invent something, and the energy crisis goes away. That is what the bond market has been thinking, but less so this week than last.

See how one year US inflation swaps seem to be pulling up the longer-term readings. In April and May, they didn’t. The bond market is beginning to smell inflation above and beyond the bounce you’d expect from the post-Covid economic recovery.

Not So Transitory

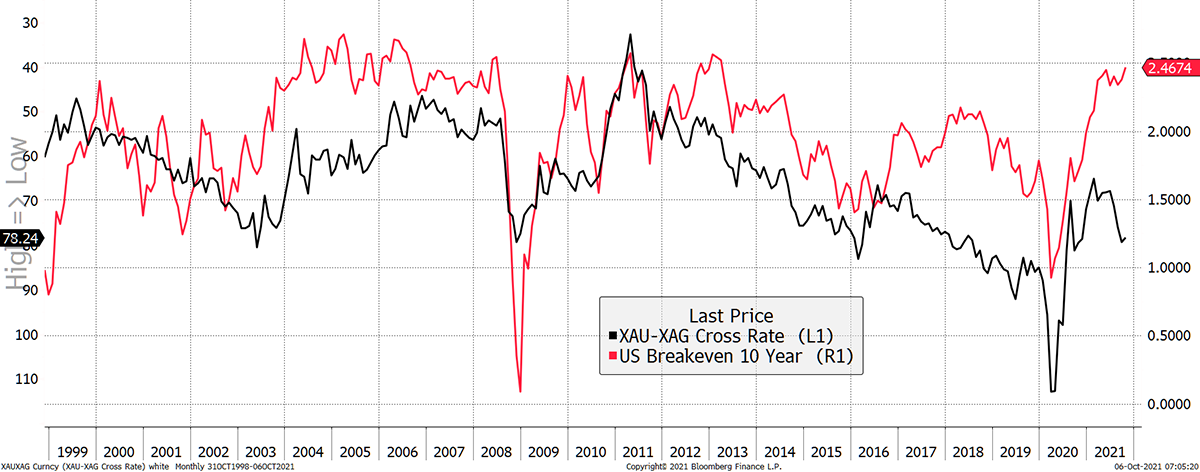

This is where silver comes in. Many say silver is gold on crack, but that’s not the whole story. Gold responds to lower interest rates like the long bond, whereas silver lags gold in that scenario. Silver only responds when inflation expectations are rising, and that’s when it really outperforms gold.

Silver Loves Inflation Even More Than Gold

There’s logic. Gold is a high-quality asset, whereas silver isn’t. Quality loves lower rates, and so gold gets to dress up and join the upper ranks of the bond market during the rallies. When that happens, silver lags gold, the gold-silver ratio (GSR) rises, making silver relatively cheap. This typically happens in a deflationary risk-off scenario.

When inflation finally turns up again, silver offers relative value because the GSR is high (the chart shows it inverted) and risk-on conditions return. Hence silver outperforms gold – at least for a while.

If the spike move in inflation expectations continues, I would reasonably expect silver to outperform gold from here. But remember, silver is riskier and more volatile but does the same job as gold over the long-term.

Valuation

Gold’s fair value keeps on rising, and my fair value model is updated daily on ByteTree. Gold is currently trading 10% below fair value.

Flows and Sentiment

The gold ETF flows are also on ByteTree. They are lacklustre but could be much worse. Let’s not forget how strong they were between 2018 and 2020, when they were the strongest ever.

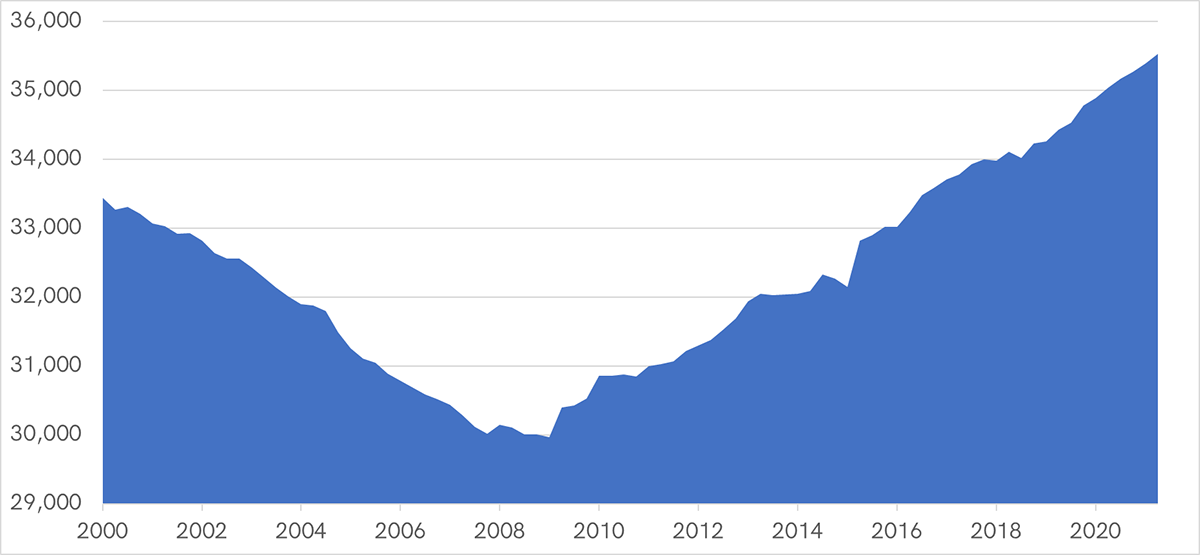

The Power of a Value Buyer

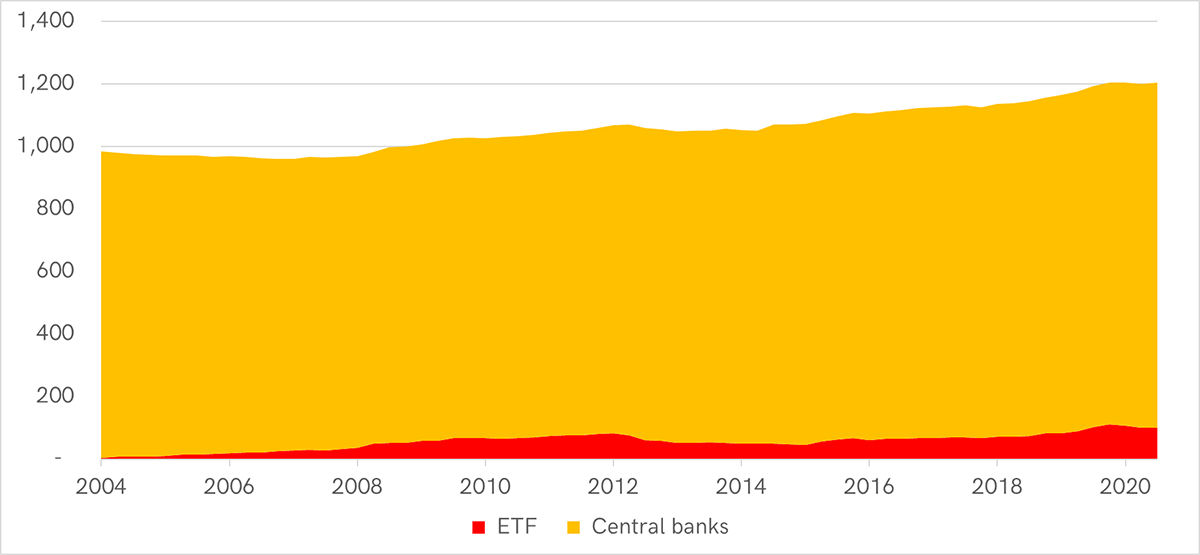

Gold isn’t just bought by investors over the stockmarket via ETFs and other funds. It has high demand from jewellery, some industrial demand, and central banks. Look how the central banks were sellers into 2009 and have turned buyers since, adding 5,500 tonnes to their stockpile. I estimate that cost them $244 billion.

Central Banks Support the Bid

Comparing that to the ETFs, their holdings are 11 times larger than the combined ETFs. That gives you a sense of scale.

ETFs Are Minnows Compared to Central Banks

To show total investment stock, you’d need to add coins and bars that are held neither by central banks nor the ETFs. That would be significant. Ideas on how to measure that would be welcome. At some point, I’ll be adding gold crypto tokens too.

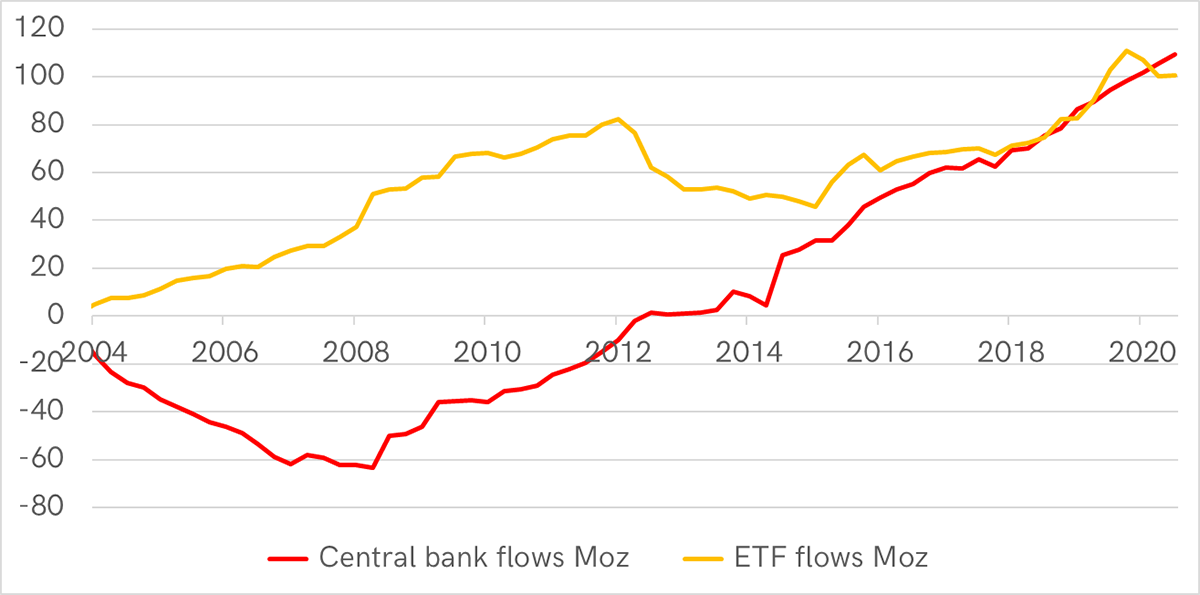

Since the 2008 financial crisis, central banks have become reliable value buyers, especially when investment demand has been lacklustre. Here are the changes in holdings for central banks and ETFs. Since 2009, the banks have been consistent.

The Value Buyer

They never buy too little, or too much, just the right amount, so there is plenty to go around for the wise countries building their reserves. According to the World Gold Council, the biggest accumulators over the past year were Turkey, India, UAE, Russia and Qatar.

This consistent source of demand from the central banks (and jewellery) helps reduce price volatility, because there is always someone cheering when the price falls. In contrast, the ETF investors are momentum players as they accumulate into a rising market and sell when it’s falling. Without the value buyer, gold would behave more like bitcoin. Or, at the very least, silver.

Why the Silver Squeeze Failed

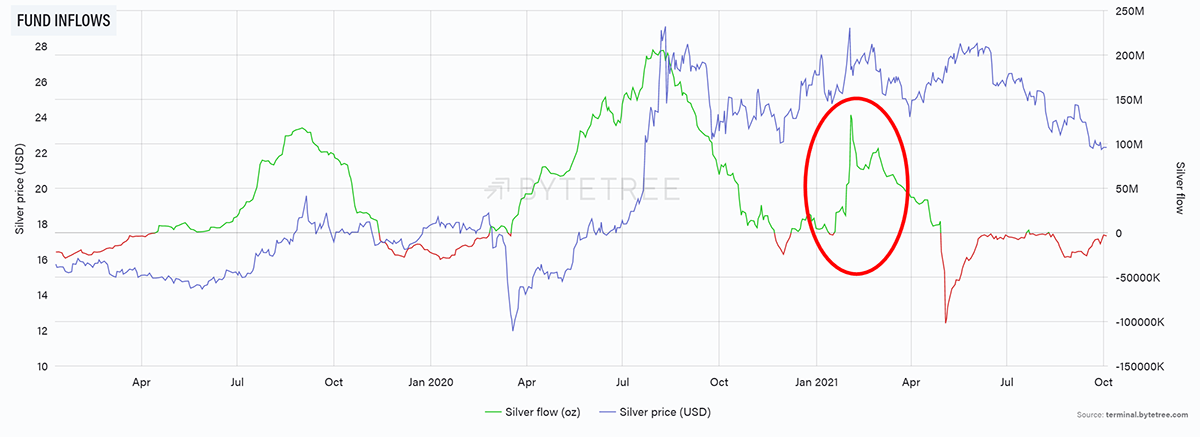

The link between ETF flows and the silver price is not as strong as it is for gold, but like everything, the price goes up when lots of people buy it. I was reliably informed on Twitter that the last January attempt to squeeze the silver market failed because they bought SLV (BlackRock) rather than PSLV (Sprott). Apparently, the latter actually buys silver, whereas the former just pretends to. Mmm.

The attempt to squeeze silver failed because the timing was off. In February, gold sold off as real rates rose, just as short-term inflation expectations started to cool. That’s not great for silver. I don’t know how much difference buying PSLV would have made, but you can’t fight the macro.

Or maybe they just didn’t buy enough.

If You Want to Squeeze Silver, Buy More

If they tried again today, I would think they’d have more luck as conditions are looking up.

Summary

The dollar is rising, which is never much fun for markets. That tends to put downward pressure on most things, including precious metals.

You get a sense that after all these years of stimulus and bailout, things are coming to a head. It would be truly remarkable if an allocation to gold wasn’t at least part of the answer.

I remain bullish. Thank you for reading Atlas Pulse.

Thank you for reading Atlas Pulse. The Gold Dial Remains on Bull Market.

Charlie Morris is the Founder and Editor of the Atlas Pulse Gold Report, established in 2012. His pioneering gold valuation model, developed in 2012, was published by the London Mastels Bullion Association (LBMA) and the World Gold Council (WGC). It is widely regarded as a major contribution to understanding the behaviour of the gold price.

Please email charlie.morris@bytetree.com with your thoughts.

Comments ()