Ray Dalio Speaks on Bitcoin and Gold

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 98

“I would take the gold…I would like to sprinkle a little bit of bitcoin into that mix too.”

Speaking at the Future Investment Initiative Forum in Riyadh, when asked about what they would choose between dollars, some gold, or bitcoin to “put under your bed for a rainy day?” Ray Dalio replied:

“I can’t put a mix together, I guess. I would take the gold…I would like to sprinkle a little bit of bitcoin into that mix too. The biggest asset is human productivity and if you can tap that…so I’m looking at the new technologies and all of those [things] are very, very exciting. Gold is a dead asset, but the amount of printing of money and the devaluation of debt is a big force too. So I want that technology, a little bit of bitcoin, and I want to bet on those other industries.”

Dalio barely needs an introduction. He is the founder of Bridgewater Associates, which has become the largest hedge fund in the world with assets stated to be $140bn. Unlike normal hedge funds, which identify special situations such as a financial collapse, undervalued companies, frauds or high frequency trading strategies, to name a few, Bridgewater is the master of asset allocation.

So far as I understand it, they don’t claim to time the market or focus on stock picking but build “all-weather” portfolios. That is an optimized mix of assets that will perform well in different environments.

For example, a typical wealth manager will build you a 60/40 mix of equities and bonds. In normal times, when bonds paid a decent yield, the 60% in equities would make you money during bull markets, yet the 40% in bonds would act as a buffer during the bears. Bridgewater took this simple idea several stages further by leveraging exposure to bonds, meaning there was much higher protection when things went wrong.

They would also embrace inflation-linked bonds, international equities and international bonds, with a foreign exchange overlay. This wasn’t hunch investing but driven by world-class research and a deep understanding of data and financial modelling.

Bridgewater portfolios didn’t seemingly shoot the lights out yet ended up doing just that. Short-term, they seemed to be dull, but since they kept missing bear markets, their compound rates of return beat the street. It’s a reminder of how the best way to compound returns is to avoid stepping backwards in the first place.

The beauty of this strategy is that it is scalable. It’s all well and good picking interesting young companies, but that’s not a solution for $140bn of capital that needs to be deployed. Bridgewater has been successful because they focused on major asset classes where large amounts of capital could be deployed. At least, that is how I understand Bridgewater - in simple terms.

Bitcoin and gold

Dalio would “take the gold” and “sprinkle a little bit of bitcoin into that mix too.”

This was in the context of something to put under your bed for a rainy day, which basically means a long-term inflation hedge.

He’s written plenty on the coming inflation, so he wouldn’t choose bonds. And he knows equities are in a bubble, as is obvious to any student of financial history. He has written positively about gold, not because he’s a gold bug, but because it is both “risk-reducing” and “return enhancing”. He also sees it as a natural inflation hedge.

On bitcoin, he’s been diplomatic. He likes the idea but clearly doesn’t think it’s ready for an allocation to Bridgewater portfolios. I suspect he sees it as too volatile, yet the very fact it “gets a sprinkle” indicates he can see the long-term potential.

ByteTree BOLD

I first mentioned BOLD, the combination of Bitcoin and gold, in February 2021.

Combining bitcoin and gold is a good solution. Both assets are long-term stores of value, yet they both have their strengths and weaknesses. One is volatile; the other is calm. One is modern; the other is ancient. One requires energy; the other does not. One has utility, while the other has little outside of jewellery. Above all, one is an established monetary asset accepted all over the world, whereas the other hopes to one day catch up.

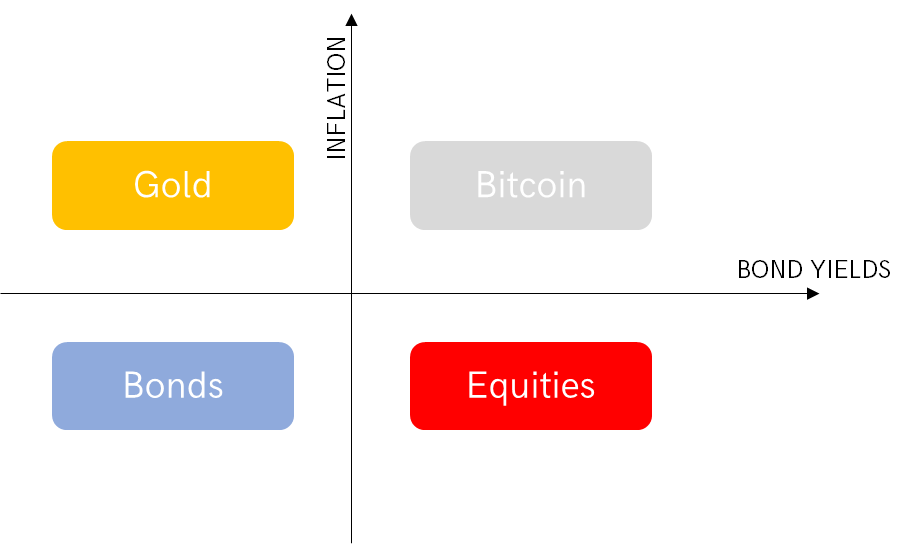

The bitcoin and gold combination exceeds all expectations as an inflation hedge because both assets are effective in different economic environments. Both assets prefer inflation to deflation, but gold is a risk-off trade that investors flock to when the world is going to hell. In contrast, bitcoin is a risk-on trade, which does best when the stockmarket is rising.

The bond yield broadly reflects the economic environment. When it has been rising, financial markets tend to be in risk-on mode, and when falling, risk-off. This can go too far as a high bond yield will eventually choke off economic growth. But while it is rising, financial markets have tended to respond well.

Inflation is the rate of future debasement of the currency. When it is low, that implies there is low demand for hard assets, as they serve no useful purpose during such conditions. Yet when inflation is rising, investors seek protection to maintain future purchasing power. Both bitcoin and gold prefer rising inflation to falling inflation.

The Money Map

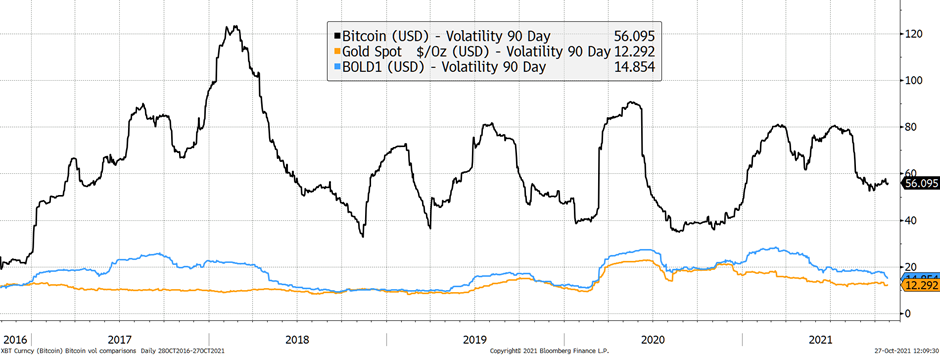

There are many different ways to combine bitcoin and gold. Having explored many, we settled on volatility as it effectively addresses risk. Volatility-weighed strategies are a tried and tested approach in portfolio construction and are no doubt an important input at Bridgewater.

Above all, a volatility-weighted strategy steers the portfolio away from risk. As long as bitcoin’s volatility is high, it gets a modest allocation within the portfolio. Yet, if bitcoin’s volatility was one day able to fall to gold’s levels, the allocation would be 50/50.

ByteTree uses the inverse 360-day volatility for both gold and bitcoin. Over the past year, gold has had volatility of 12.3% and bitcoin, 56.1%. Bitcoin is much more volatile and gets a smaller weight than gold. Some simple maths results in a portfolio that is approximately 82% gold and 18% bitcoin, hence Dalio’s sprinkling.

Bitcoin, gold and BOLD volatility

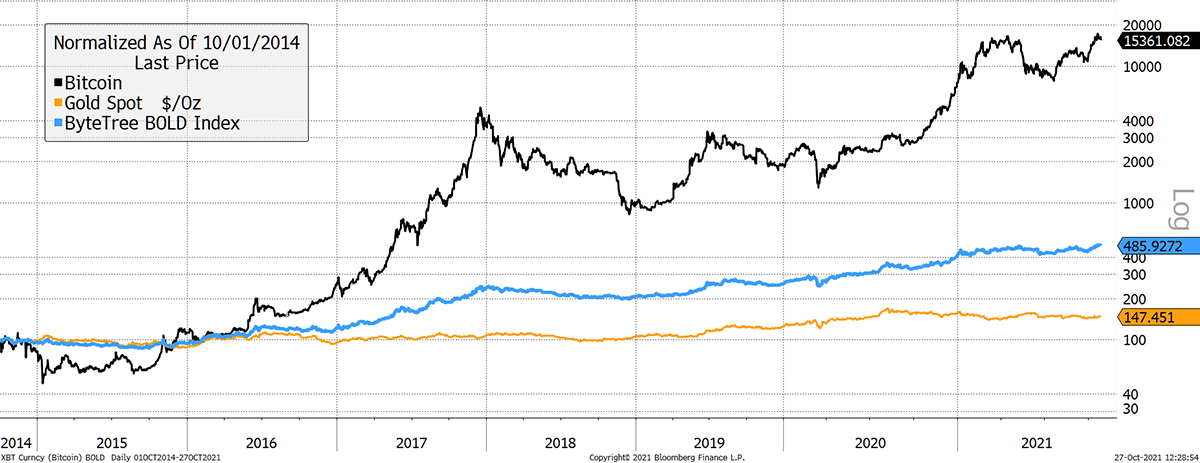

This approach is simple to understand and is based on proven portfolio techniques. The performance of the BOLD1 Index can be seen below against gold and bitcoin. Bear in mind, BOLD1 only holds a sprinkling of bitcoin, yet that was enough to treble gold’s return, while the level of risk has barely budged.

An optimized inflation hedge

Since 2013, bitcoin has beaten gold hands down, but that won’t always be the case. In 2014, 2018 and even 2020, bitcoin saw sharp drawdowns, which BOLD1 barely noticed.

One additional strength of the strategy comes from rebalancing transactions. Each month, the volatility calculation is made, setting a target weight. If prices have moved over the past month, the portfolio will have deviated from the target weights.

If bitcoin had risen, some would be sold and reinvested in gold. In contrast, if bitcoin had fallen, it would be bought, and some gold would be sold.

Rebalancing transactions are a powerful source of return over time, as they are a “value” based approach. You are always taking what the market is offering at lower prices and giving back at higher prices. Keep on doing this, and you’ll add value, especially if the underlying asset mix has sound long-term potential, as both bitcoin and gold do.

Indeed, the Yale University Endowment, a $42 billion fund, under the guidance of the legendary David Swenson, used to rave about rebalancing transactions around their target asset allocation. All experienced investors understand the power of this simple tool. The trouble is that people forget to do it (and get taxed in the process?) and lose an important source of return.

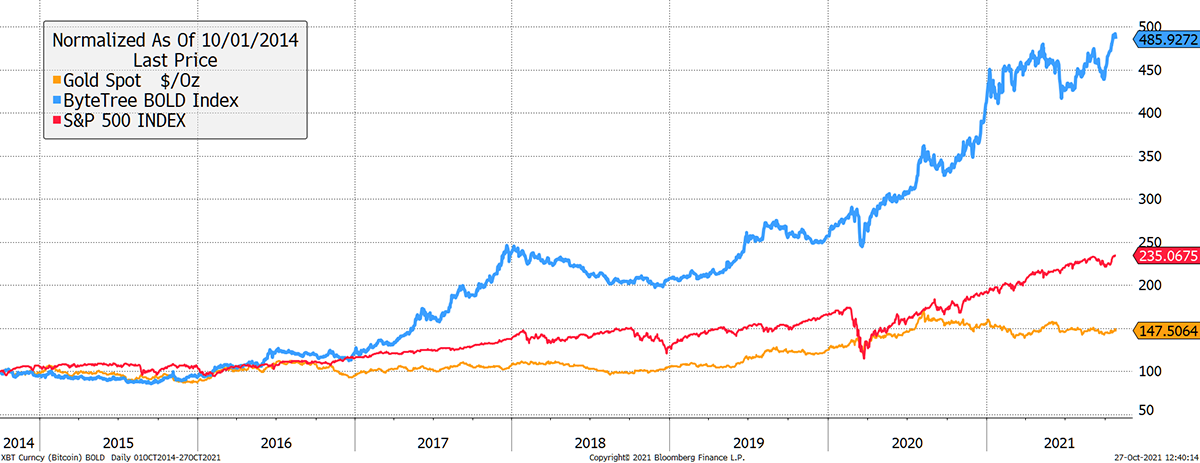

BOLD1 looks unimpressive compared to bitcoin in the chart above because, well, what doesn’t? The surge in bitcoin is a once in a lifetime event. Few would argue that the pace of future growth will be lower. Below I compare BOLD1 to gold and the S&P 500, which shows things from a different perspective.

Alpha from diversification and rebalancing

Recall this strategy is mainly based on gold, where most of the money is allocated. Looking ahead, this may become the interesting part. As this stockmarket boom comes to an end, we will sooner or later see a period of risk-off return. Assuming inflation remains a problem, gold will be the solution.

The BOLD1 Index is ideally placed because it holds the greatest commodity, gold, alongside the greatest crypto, bitcoin. They have the most liquidity and are the most resilient assets in their respective sectors. Whenever there is risk-on, bitcoin will pull the cart, and when it is time for risk-off, gold will take over.