Alpha Is Shifting to Bitcoin, but Stacks Is Going Against the Grain

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: STX;

In recent weeks, we have seen a faltering alt market. Bitcoin has risen from the ashes as the wider market falls and now stands close to the $60k price level. In our opinion, this shift has two underlying reasons.

Firstly, typically at the end of a cycle, alts falter when a bear market is near, as was the case in 2013 and 2017. So why not this year? Secondly, Bitcoin looks to be latching onto the inflation-hedge narrative.

As investors, we want to know how else we can benefit from a market rotation into BTC. This brings to the forefront smart contract blockchains, which has been the biggest trend of this cycle. The alts, which offer an alternative to Ethereum in most cases, have provided lucrative returns, typically without the utility to back them up. Furthermore, many assume smart contract blockchains must be alts because surely Bitcoin is too cumbersome to house the complex transactions that smart contracts produce?

Stacks, the Bitcoin Beneficiary

Not necessarily. Stacks says otherwise, and we think they might be onto something. Stacks 2.0 is a layer-1 blockchain that enables Bitcoin to settle a variety of decentralised apps (dApps) transactions and smart contracts. In other words, Stacks merges the utility of Ethereum and the settlement security of Bitcoin, bringing Ethereum functionality to the Bitcoin blockchain.

Stacks is a necessity should Bitcoin want to have associated dApps. Bitcoin’s “base” layer cannot support this scale of development due to two main factors. Firstly, the limited scalability of Bitcoin’s block capacity means the large number of transactions typically created by smart contracts is too much for the blockchain to handle. Secondly, Bitcoin’s constricted scripting language means complex smart contracts would not be supported.

History, Team, Partnerships and Funding

The team history behind Stacks is not the most straightforward. In 2013, the idea to build a better internet prompted the Princeton Computer Science Department to launch a project that evolved into Stacks. Muneeh Ali and Ryan Shea recruited more Princeton computer scientists in 2014 for research and development, leading to a PhD thesis publication in 2017. This, in turn, led to a 2017 initial coin offering (ICO), which raised nearly $50m.

The original company behind Stacks was Blockstacks, which in late 2020 split into two main entities. Muneeh and Shea rebranded into Hiro Systems, a company solely focused on building developer tools for Stacks. Secondly, the non-profit Stacks Foundation, Daemon Technologies, Freehold and New Internet Labs joined forces to further the development of the Stacks 2.0 network.

Overall, Stacks has raised $95m through several ICOs. The mere mention of ICOs can turn some investors’ stomachs, but in the case of Stacks, a value proposition has occurred in the face of the typical ICO bubbles. In 2019, Blockstacks PBC launched an SEC-qualified token offering, in which even retail investors were able to participate, raising a total of $23m.

This SEC-qualified ICO also brings another significant factor to the STX token. The SEC agreed that the token is not seen as a US security. This is massive news because there is uncertainty around whether many tokens will be considered a security or not, creating a major regulatory risk factor.

Determined not to have STX treated as a US security, Stacks (through Hiro) filed a U-1 report with the SEC. Furthermore, an SEC filing in December 2020 ruled that STX does not qualify as a security when the Howey test is applied. All-in-all, this cements Stacks’ regulatory position, which should carry significant value for investors.

Foundation Grants

With any smart contract blockchain, the deciding factor for success is based around their developer funding. This has become a more pertinent issue with the rise of Ethereum. In effect, Ethereum does not need to incentivise developers to build on its network due to how established it is. Ethereum has all the aspects that other smart contract blockchains fail to fully achieve, such as liquidity, a wide user base, and security.

In our previous Token Takeaway on Tezos, we highly praised its foundation and attributed a fair portion of our positive conviction score to its extensive grant program. In comparison, Stacks is nowhere near the levels of developer investment, even when looking relatively at both projects’ funding. Stacks has attributed just $600,000 to community grants in total, but bear in mind that these grants are for essential protocols to build on the Stacks blockchain.

A Lack of Visible Network Activity

With the launch of Stacks 2.0 in December 2020, the foundation decided to join the Flipside alliance. Flipside Crypto aims to promote transparent on-chain data by hosting accurate data for various protocols to provide the community with the tools for informed decision-making.

Although this announcement was made in January this year, the page has since been removed from the Flipside portal. I’m including this information because without Flipside’s coverage, there are very few data sources for Stacks. Although, it is dangerous to read too much into this, but it does beg the question: why wouldn’t you want a transparent representation of your network's activity available to the crypto-sphere?

“Stackers” are entities that stake their STX tokens to run full nodes on stacks. In essence, they are rewarded through token distribution, just like miners on Bitcoin.

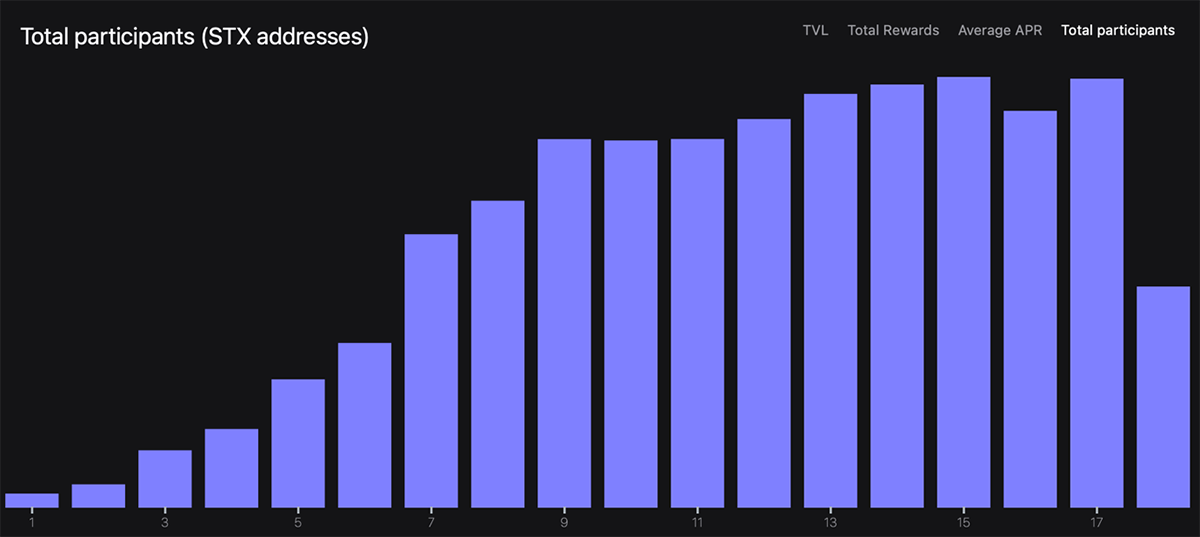

The chart above represents all the cycles since the launch of stacking rewards in February 2021. Each cycle spans around two weeks, with the first cycle ending in mid-February. We are currently halfway through cycle 18, hence the lagging bar. Bar 17 shows the latest available data, it states that around 3,500 Stackers are receiving “miner” rewards. We’ve seen a promising adoption curve in terms of growth, and while this is a small subset of data, we hope to see a continuation.

However, the available network data for Stacks is not up to par, which is a typical attribute of a blockchain that lacks maturity. A blockchain with no data sources is bad news as investors need to see the network activity, the growth, or even the failures. Stacks has minimal coverage, so we can’t gauge its network effect.

Technical Analysis

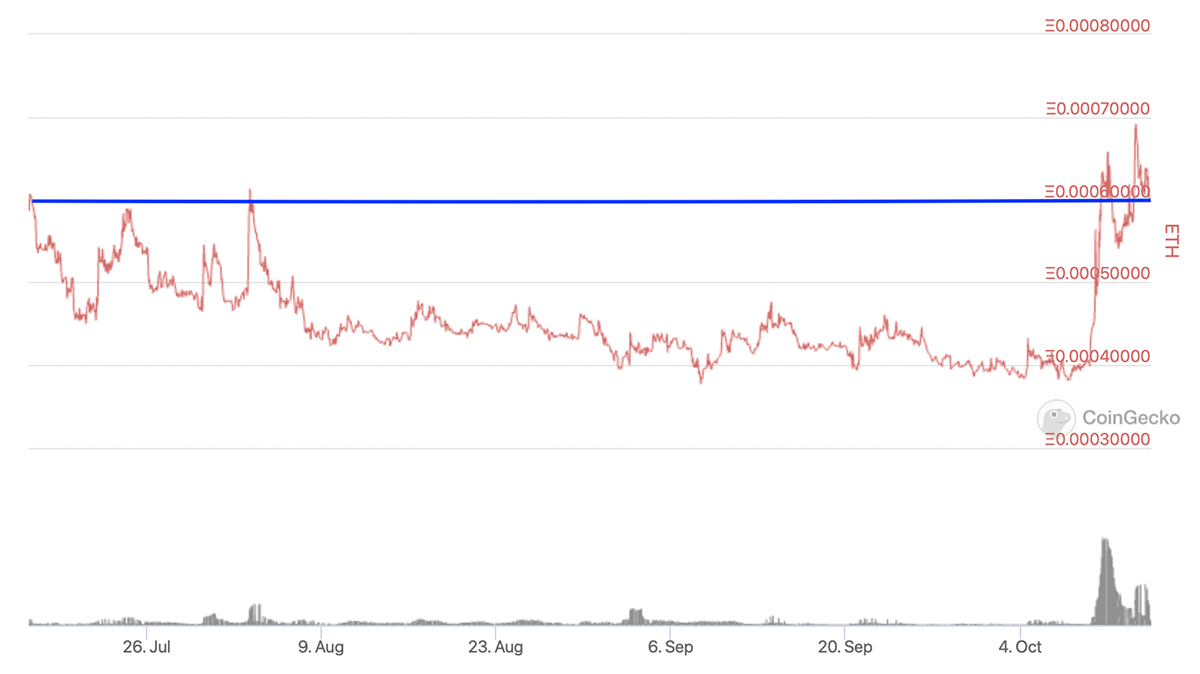

The interesting part about STX stems from its status as an altcoin. If the market classifies STX as an altcoin, but the token benefits from a rising bitcoin price, does it represent a dual value proposition? To explore this notion further, we’ve chosen to analyse both the ETH and BTC relative charts.

As seen in the chart above, STX has slumped relative to ETH over the past 90 days. However, STX has recently experienced significant growth and rocketed to a 3-month relative high against BTC. This is positive news, especially since it has been accompanied by an enormous spike in trading volume.

When looking at BTC relative to STX, the July to October slump is not as damaging as the ETH relative chart. This could signal that the market attributes a value more along the lines of BTC to STX. That said, STX’s growth has put it on the cusp of securing a 3-month relative high against BTC. Should a breakout relative to ETH and BTC happen in the coming weeks, we could expect a nice trade on STX.

Where To Buy

| Centralised Exchanges: | Gate.io, Binance, Crypto.com, OKEx |

Conclusion

Overall, Stacks presents a unique investment case through its aim to bring dApps and smart contracts to Bitcoin. It shows that Bitcoin can be used for applications, and there is no reason to assume Bitcoin could never have utility like Ethereum – a powerful notion for the most secure settlement layer in the space.

However, Stacks remains mostly a concept for now. Ultimately, with no accurate data analytics, it needs maturity to be a longer-term trend. Not to say it will continue along this path, investors should look for better grant programs and a prolonged BTC relative high.

STX CONVICTION SCORE

Digital Asset Market: Bitcoin’s on-chain activity is perking up with the recent run. Alpha remains with BTC, but altcoins are riding the wave as well.

Hype vs Reality: Near-Reality.

Trade or Trend: Without bigger developer grants and more transparent data, the trend is not there. A trade opportunity will occur should STX breakout against BTC and ETH.

Market Outperformance: STX just broke out of a 3-month slump against ETH, while a BTC breakout seems imminent.

Competitive Advantage: Respectable funding rounds and backed up with good technology. Completely unproven. There are no real competitors so it could have a moat situation, which is positive.

Token Takeaway Score: 3/5 (a 3-month breakout against BTC would push it to a 3.5/5)