dYdX: Using Leverage Isn't the Play

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: DYDX;

Since the decentralised finance (DeFi) summer of 2020, both centralised (CEXs) and decentralised (DEXs) exchanges have experienced increases in growth. dYdX, a non-custodial exchange based on Ethereum, has recently caught attention in the space. But has it got what it takes to become a future leader?

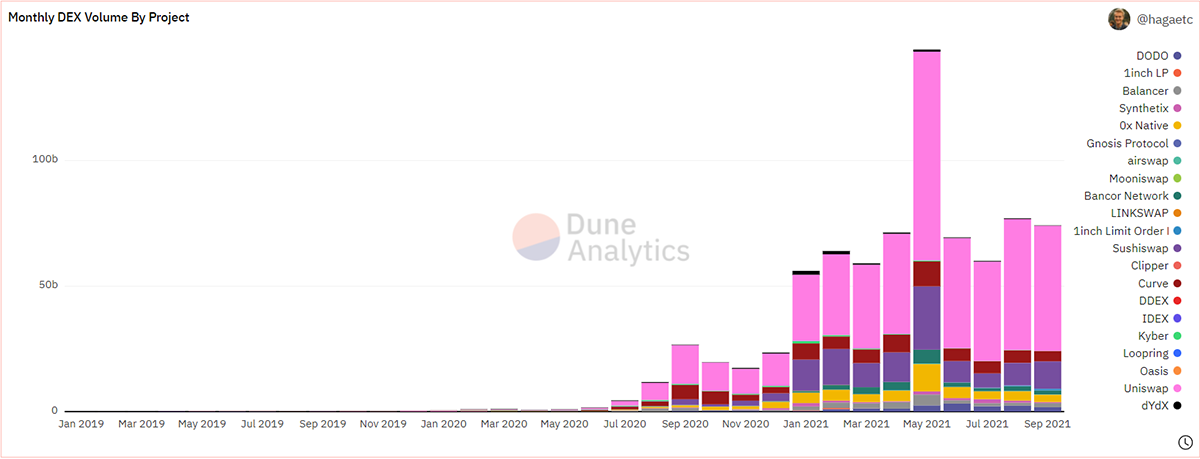

Digital asset exchanges have become the central access point for the crypto market. The rise of DEXs, which specialise in derivative offerings, should look appealing to investors. DEXs have gone from settling under $750m a month (collectively in January 2020) to settling nearly $75bn a month (collectively). Uniswap alone experienced $50bn of trading volume this month. With centralised exchanges, big players like Binance, Coinbase and FTX often surpassing $20bn in 24hr trading volume.

Products such as Coinbase Custody offer professional investors a reliable and essential service. This has not existed in previous bull-runs and is quite possibly the reason we saw such parabolic growth in asset prices over the past year.

Neo-exchanges, such as FTX, dYdX, and Bybit, offer users futures, options and other derivatives markets, and in some cases, mirrored assets and Initial Coin Offerings. Many see these as no more than gambling opportunities. On the other hand, leverage is one product that has been growing, causing liquidation flushes that were a major factor in recent price crashes.

Crypto Does Leverage Larger

Leverage is common practice in traditional investment but at a much lower multiple. Using debt to boost your investment essentially increases your potential risk of downside but also increases the upside of the investment. There’s a reason why 100x leverage is not considered in the traditional world, and I’m certainly more inclined to see the digital asset market follow suit. This is a dangerous game in traditional finance, let alone for a coin like Dogecoin.

The Rise of Leverage in Cryptocurrency Sphere

While the thought of leverage might seem like a no-brainer to many, the words “margin call” might make many people’s stomachs turn. Remember, leverage multiplies your risk significantly and can bring investors a bill that they can no longer afford.

In the traditional world, Archegos Capital Management failed to meet their margin calls which caused a fire sale of $20bn of stocks just to try and cover the margin call, resulting in major corporates losing billions. Credit Suisse lost $5.5bn, Nomura lost nearly $3bn, and the $10bn Archegos family office shut down. Even Goldman’s reported a loss of nearly $1bn.

If supposedly competent banks and investment houses can mismanage risk at this scale, how is the crypto-space doing? Not very well. For example, on a singular day in May 2021, Bybt reported $9.8bn of liquidations in Singapore.

Mike Novogratz attributes the mismanagement of leveraged positions as a key factor behind the 17% drop pre-El Salvador accepting Bitcoin as legal tender. He stated that:

“I think we just got too excited and this was a little air being popped out of the balloon”

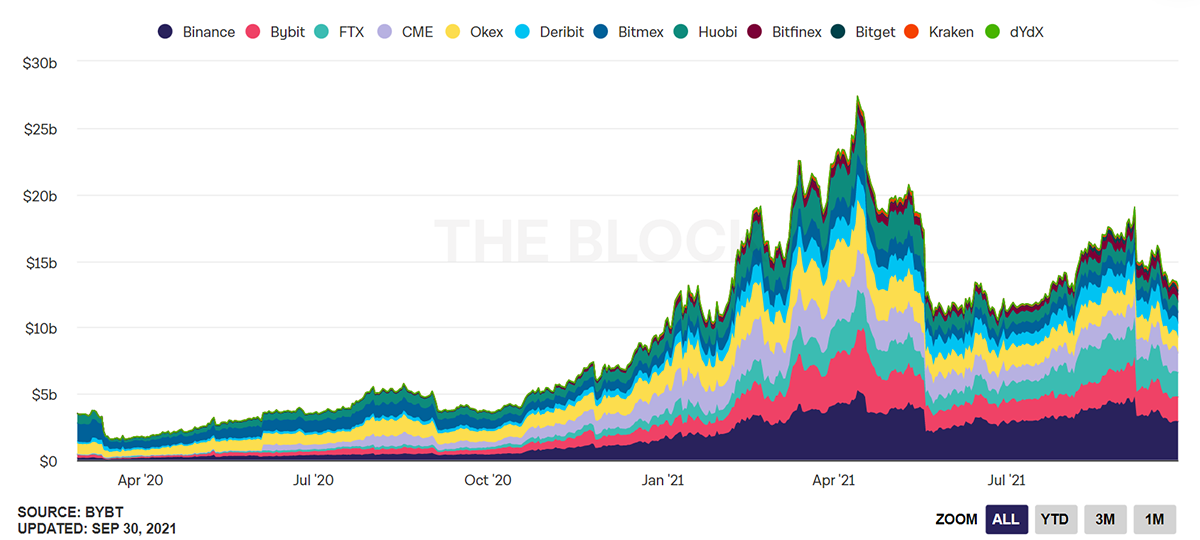

In March 2020, open positions struggled to jump above $2bn, which is insignificant in comparison to the peak Bitcoin price in April this year, where nearly $30bn of positions were open. Within a couple of months, half of these positions were closed. Using leverage is not the investment play.

Before going into the dYdX token and why it poses a good investment opportunity, we should look at why an investor would want to gain exposure to the leverage/derivatives “sector”. Although leverage currently tends to be portrayed as the wild west, it is likely that growing institutional involvement will generate increased demand for leverage. Furthermore, if narratives like digital gold come to fruition for larger assets such as Bitcoin, then leverage seems like a more palatable affair. Therefore, it will likely be popular.

dYdX turned heads in September

From a high level, dYdX is a non-custodial exchange that is based on Ethereum, focusing on futures and leverage markets. It has gained the attention of many due to two key events:

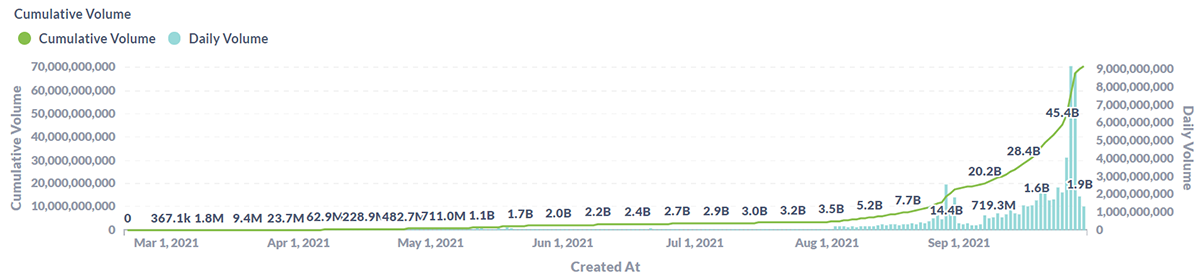

- Trading more than $9bn in a 24hr period on 27-28 September. This not only dwarfed Uniswap (V1,V2 and V3), but it also meant that dYdX out-traded the entire DEX sector over that given period. The other 104 DEXs traded a total of $5.5bn, which is $3.5bn less than dYdX.

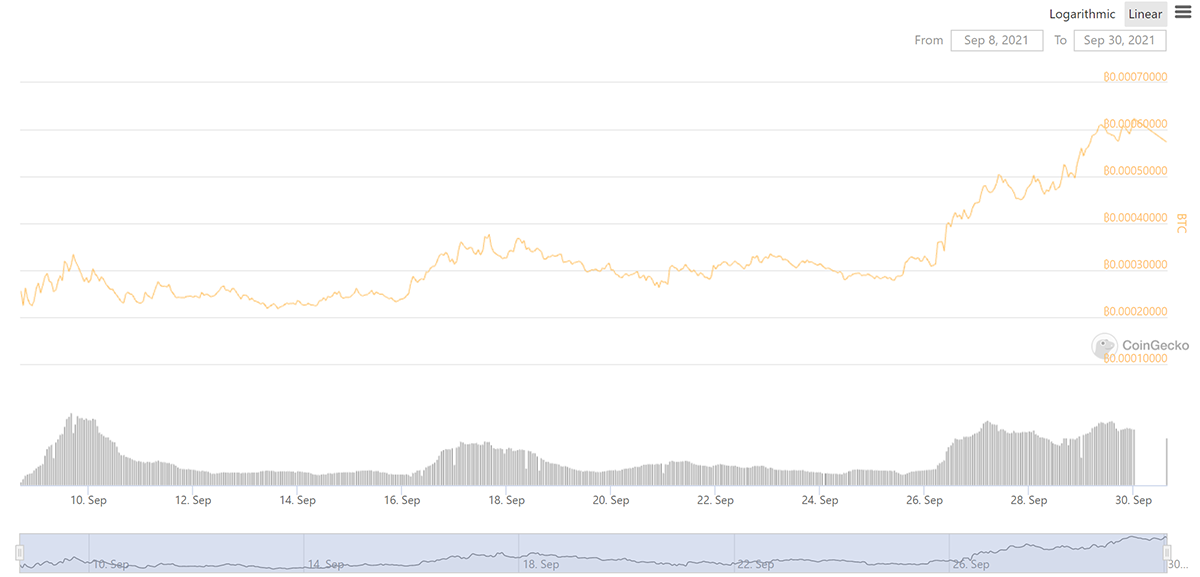

- Its recent breakout into a solid relative-high against BTC, which signals a positive trend. The recent trading contest on dYdX is likely a factor in this relative high, helped by leading trading volume. Relative highs often are good trading opportunities as well.

The Team, Funding, and Growth

As far as the team goes, dYdX boasts some competent employees. Antonio Juliano, Founder of dYdX, was an engineer at Coinbase and Uber. Ironically, on dYdX’s largest trading day, the exchange also 3x the trading volume of Coinbase.

dYdX also has impressive backers and funding. Over the past year, A16z, Polychain Capital, Bain Capital, Naval Ravikant, Dragonfly Capital and many more helped them raise over $75m. This shows that as a business, this DEX is set up for success.

dYdX aims to be a company with a working business model. They achieve this by charging between 1.5bps-10bps for maker and taker fees on the platform. This has enabled them to pay for all gas fees incurred by their users and still stay afloat. Due to its efficient gas use, Starkware’s zk-rollup scalability solution has been their saving grace.

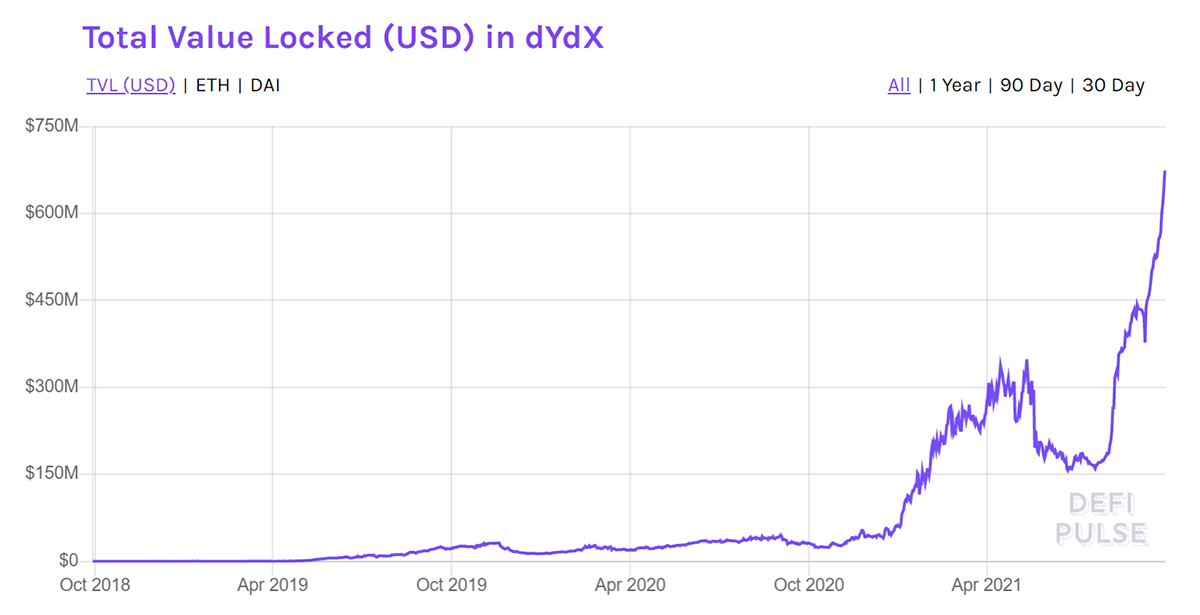

As we know, a growing network effect is hugely positive for an investment opportunity. From an on-chain perspective, dYdX continues to grow.

After a 3 to 4-month slumber, the total value locked (TvL) on dYdX has broken from its trend. A continuation of this upward trend will be beneficial to its governance token’s market price.

Exchange volume has spiked due to the gas efficiency of its Starkware scalability solutions and its $250k trading competition sponsored by USDC (Circle Group). As a DEX, it settled $9bn and then $8bn in trading volume over two consecutive days. More interestingly, in terms of layer 2 revenue, dYdX has on average ranged between $5-$20m of revenue weekly.

The exchange has experienced significant growth in users as well. In July alone, the total number of unique users count grew from 1,000 to nearly 9,000 in the space of a week - huge growth.

In terms of open interest, between March 2021 and August 2021, open positions grew from $4,000 to $35m. Furthermore, since 1 August, open positions have grown to nearly $600m. If this sharp increase continues, we could see dYdX become one of the big players in the digital asset exchange industry.

The Airdropped Token: DYDX

The DYDX token is the platform’s governance token, released via airdrop on 2 September. While the token currently offers a decent investment case, it will likely improve over time.

Being a governance token, it enables users to vote on the future of the protocol. For some, this is not enough utility when the protocol does not dominate the exchange sector. The dYdX protocol has been rewarding platform users with trading, liquidity, and mining rewards. In total, 40% of the initial token supply has been allocated to these reward categories. Therefore, the token is providing utility at a large scale for its users.

When it comes to the risks of a protocol like dYdX, an investor should be wary of consumer protection; exchanges like FTX offer users 100x leverage. Therefore, I would argue that companies involved in derivatives are cashing in before regulation tells them to reduce the multiply, especially to retail customers. With the issues that Binance has been experiencing globally, there is a case for exchanges like dYdX to be the next target.

Conclusion

Overall, leverage will continue to grow and become a more influential part of the digital asset world. While investors should be wary of regulation, dYdX’s initiative to offer users Ethereum gas fee-free trading and efficient transactions through their revenue and Starkware solutions makes it a contender in the ever-growing crypto-exchange industry.

DYDX CONVICTION SCORE

Digital Asset Market: Still faltering - US regulation looks to be causing a lot of investor worry.

Hype vs Reality: Reality. Leverage is here to stay.

Trade or Trend: Arguments for both. Trade due to spikes in on-chain, relative-high and open interest growth. Trend has a case too. The token is in its early days and sits high on market cap rankings. However, with the nature of the current market it is hard to see long-term view, especially with US regulation round the corner.

Market Outperformance: Yes - limited time trading but it is still outperformed BTC.

Competitive Advantage: Although it is heavily concentrated in the derivative markets, it is certainly a contender in the wider exchange sector. Starkware gives dYdX a massive advantage.

Token Takeaway Score: 3/5

Comments ()