This Time Is Different

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 13

This cycle has been less volatile than in past cycles. That could mean we haven’t had the blow-off top yet, or equally, we won’t have one. A steadier bull market, not driven around the halving cycle, would be progress.

Highlights

| Technicals | Resistance at $50k holds |

| On-chain | Difficult enough |

| Macro | Rates to remain low |

| Investment Flows | Institutions still soft, but they are buying ETH |

| Crypto | El Salvador makes bitcoin legal tender |

ByteTree ATOMIC

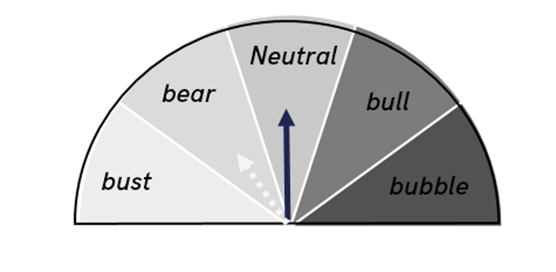

Maintaining neutral. The technicals remains positive, but we still can’t put a finger on demand.

Technical

The price has remained flat for the past two weeks, but the trend remains positive. The $50k level has provided resistance for further appreciation, and that is unsurprising given that 22% of all historic trading activity took place between February and April this year. Resistance can be overcome, but it can take time.

Bitcoin trend

Source: Bloomberg. Bitcoin with 20-day max and min lines, 30-day and 200-day moving averages past six months.

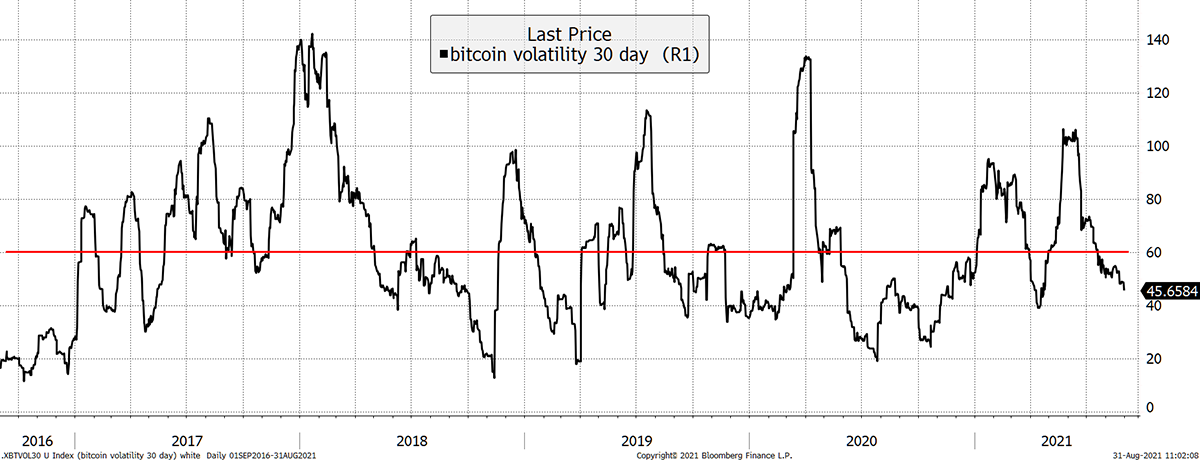

Volatility is becoming interesting again because it is falling. The 30-day reading is 45% and falling. That compares to a five-year average of 60%.

Bitcoin volatility is falling

Source: Bloomberg. Bitcoin volatility, realised over 90 days, since 2016.

Over the period, $100 in bitcoin returned $7,845. Being in the market was key, but the $100 grew to $2,027 when volatility was below 60% and $386 when it was above. It reminds us that the calm trends are the best trends, and hype is overrated, despite being fun at the time.

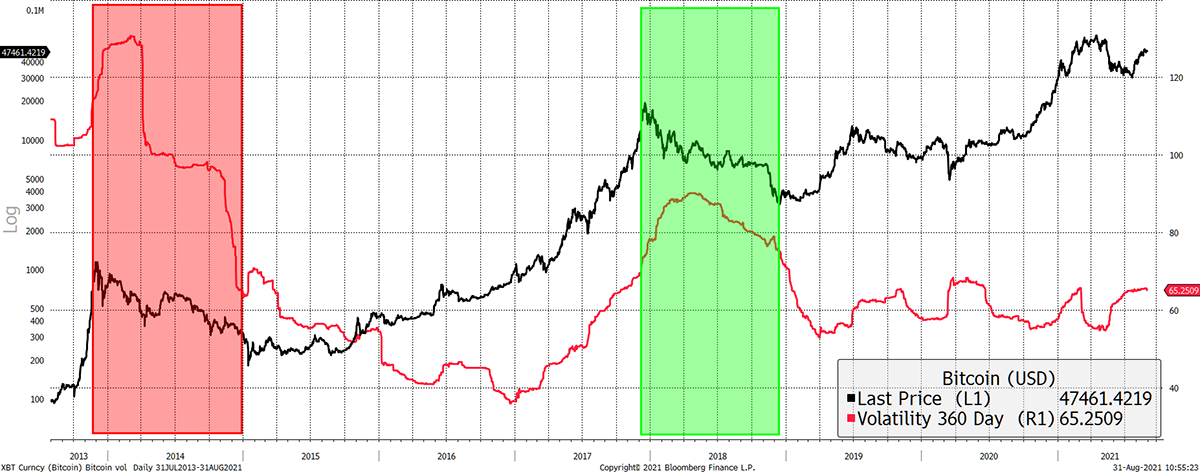

That is illustrated below using 360-day volatility, which is smoother. The two highest readings coincided with bear markets. It is clear how the big money was made when things were calm.

High volatility can be damaging

Source: Bloomberg. Bitcoin price and volatility, realised over 360 days, since 2013.

This cycle has been materially less volatile than past cycles. That could mean we haven’t had the blow-off top yet, or equally, we won’t have one. A steadier bull market, not driven around the halving cycle, would be progress.

Logically, this should happen, as it is known that the new coin supply will halve in 2024, then again in 2028, and so on, an efficient market should discount this. But that doesn’t prevent the real cost that comes from miner selling.

The current fourth epoch (fourth cycle after halving events in 2012, 2016 and 2020) will see 1,312,500 BTC come to market by 2024. So far 428,800 BTC have been mined (most sold) with 883,700 BTC to go.

Yet from 2032, that drops to 164,063 BTC. This is a fact, and as new supply falls, so should volatility as a major overhang will be removed.

Consider that the second epoch absorbed 5,250,000 new BTC and the third 2,625,000 BTC. These were huge numbers and must have been major contributors to volatility during the bear markets.

As more institutional investors understand this, perhaps egged on by the need for an inflation hedge, they will get more involved. Lower volatility will be instrumental in attracting them. Recall how keen they were in 2020 when volatility was low and basically stopped buying in the spring of 2021 as volatility surged.

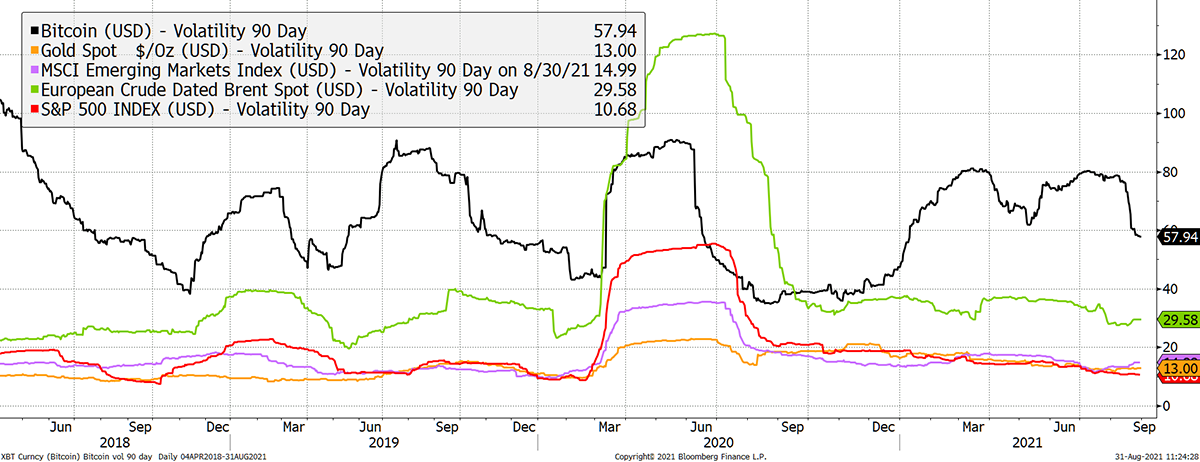

Up until December, Bitcoin’s volatility was in line with oil and much higher than equities and gold.

Bitcoin remains volatile comparted to traditional assets

Source: Bloomberg. Bitcoin volatility, realised over 90 days, since 2016.

Falling volatility is hugely bullish because institutional investors like it and they bring money which scoops up the bitcoin from the miners. This time let’s just keep Elon Musk, Wall Street Bets and so on as far away as possible.

The best bull markets go unnoticed.

On-chain

Network activity remains soft, yet the growth in layer 2 transactions is becoming more notable. They tend to be small and have so far had little impact on the size of the network.

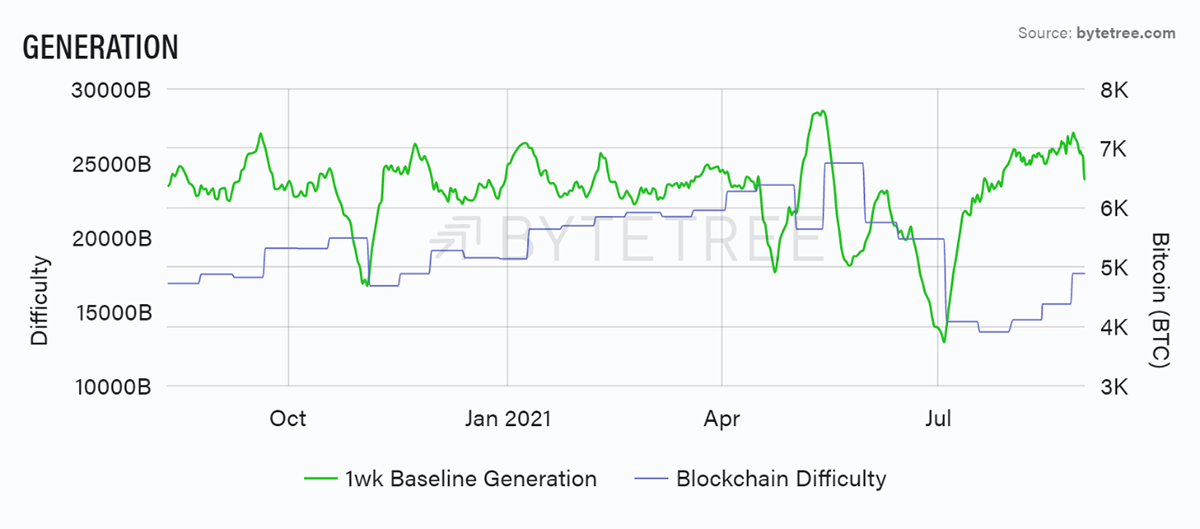

On the supply side, difficulty rose as expected last week, and the miners have slowed down their rigs since. This indicates the network has returned to equilibrium, albeit at a lower hashrate than we saw before the China mining ban. This is likely to be price neutral but puts to rest a source of concern.

Source: ByteTree Terminal. New coin generation and blockchain difficulty over the past year.

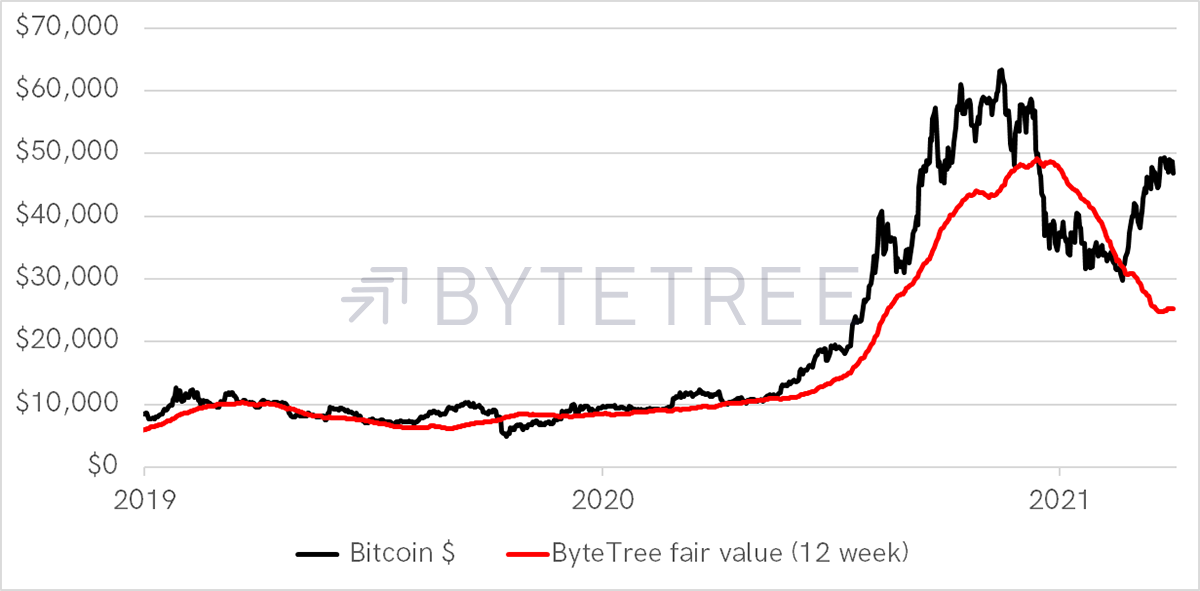

The thing we grapple with the most is the relationship between price and the level of transaction value over the network. This has been the bedrock of bitcoin valuation since the beginning of time. Network activity still points towards a Fair Value of around $25,000 (on the Terminal, the live chart is based on a 1-week measure, this is 12-week).

Current cycle

Source: ByteTree. Bitcoin price and implied Fair Value given network activity 2019/21.

The 12-week Fair Value is lagging but serves as a sense check. The recovery in price has not been matched by a recovery in the network.

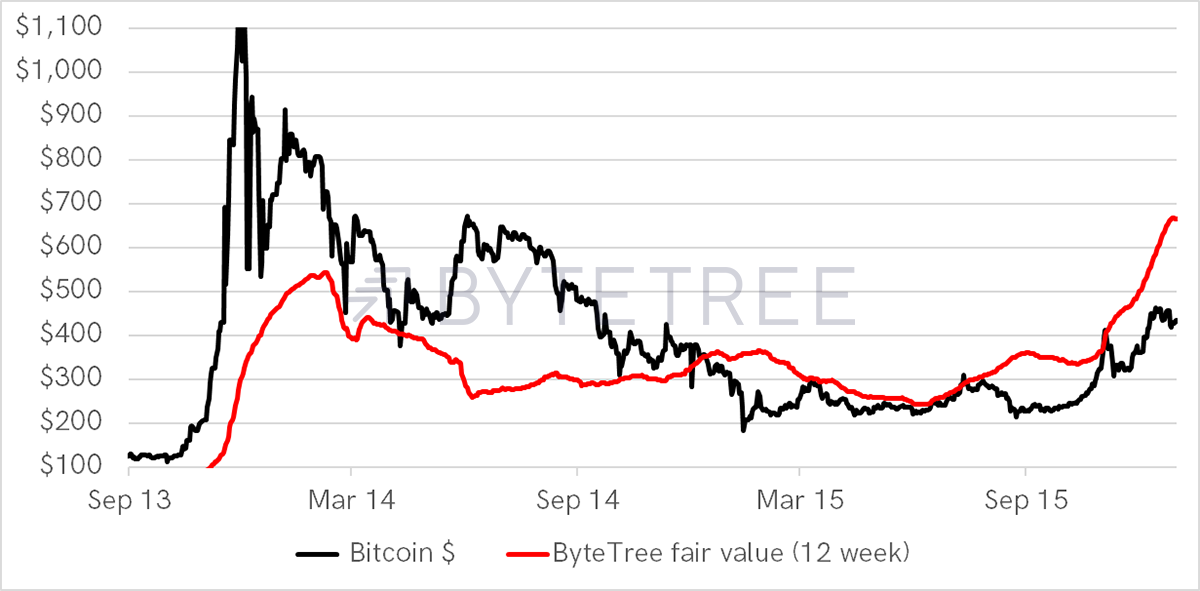

In the 2014 bear market, this divergence was over 100% at times, and it proved to be correct. 2015 was the year of consolidation, and the new bull market was led by the network, while price took time to catch up.

2014 bear market

Source: ByteTree. Bitcoin price and implied Fair Value given network activity 2013/15.

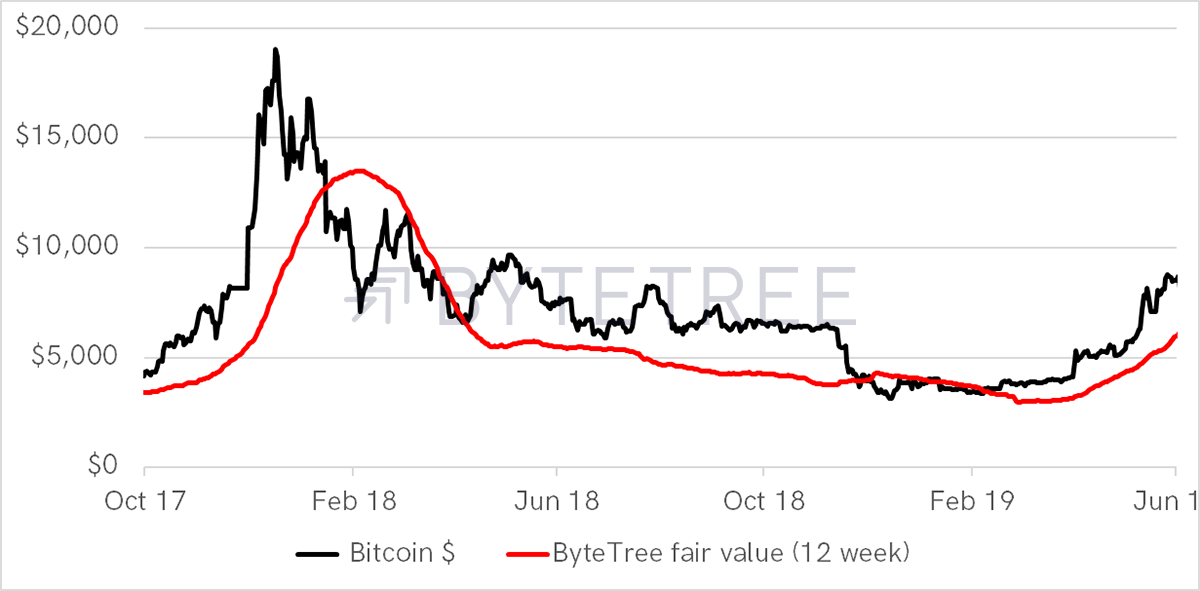

The 2018 bear also saw a 100% gap open up. That wasn’t closed until the November 2018 crash. Thereafter, the network growth resumed, but this time was led by price.

2018 bear market

Source: ByteTree. Bitcoin price and implied Fair Value given network activity 2017/19.

What to make of the current cycle?

We understand that the growth in stablecoins has removed a huge amount of bitcoin network activity as it is no longer the gateway to the crypto space. It could be that it doesn’t matter, as bitcoin’s monetary role has become more important.

Whichever argument you care to make, it is simply too early to tell if the current divergence between the bitcoin price and the underlying network value is no longer relevant.

The 2014 peak to trough lasted for 328 days, whereas the 2018 bear lasted for 311 days. This cycle, the last high occurred 138 days ago. If bitcoin is behaving as it has in past post-halving cycles, the return to Fair Value will be realised by February next year.

The hope is that this time is different. The volatility discussed earlier suggests that it is. And if so, this model will need to be recalibrated, or even replaced. It could be the case that the growth in stablecoins has not detracted intrinsic value from bitcoin, but it’s still too early to tell.

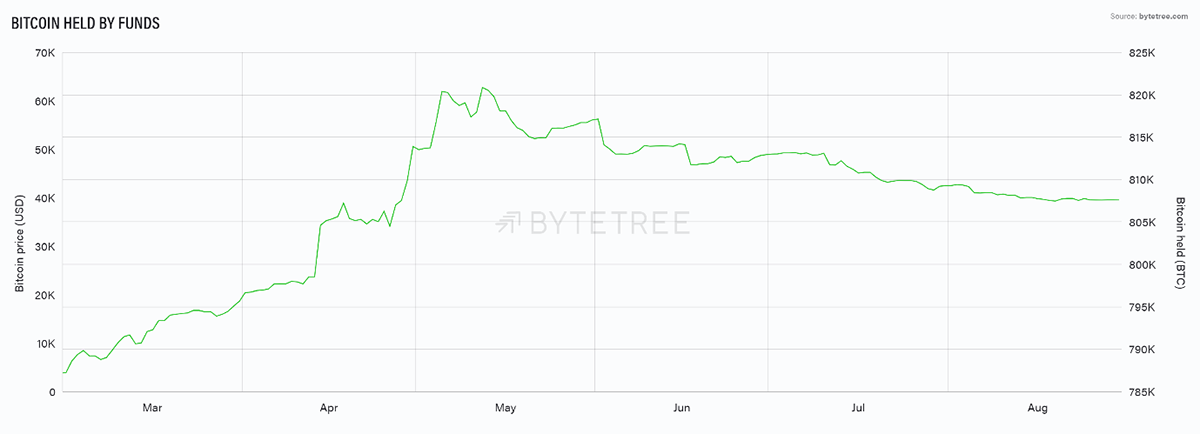

Investment flows

The good news is that the institutions aren’t running away, and outflows seem to have stabilised, but we’d rather see them keep on buying. As said earlier, we suspect lower volatility will be a positive force, especially as many portfolio risk systems live by it. High volatility makes a portfolio appear to be riskier, regardless of whether that is true or false.

Source: ByteTree Terminal. Bitcoin held by funds, since March 2021.

ByteTree will soon publish the fund flows for Ethereum (ETH), and no time too soon as they keep on rising. The funds have added 69,100 ETH since the June low, worth a cool $234 million. It’s proof that the money is out there looking for a home in crypto.

Institutions prefer ETH

Source: Bloomberg. Ether price and fund flows in ETH since April 2021.

Elsewhere, the Grayscale discount languishes at 14%. Institutions prefer ETH.

Macro

Jackson Hole passed by relatively quietly. Real yields dropped modestly, which boosted equities, gold and bitcoin a bit, though not by much. More importantly, it provided relief to emerging currencies such as the Rand, which rallied.

The news that the reduction of quantitative easing would likely begin later this year was welcome as the fear was that a rate rise would be on the agenda. The message was that rates would rise no time soon, meaning the bull market in everything continues. In favour of easy money, the economy is cooling, and so they are in no hurry to slam on the brakes.

The masters of the universe that control our fiat money believe inflation is transitory. Supermarkets are stocking fewer products, and everyone struggles to recruit drivers. Microchips remain in short supply, and freight rates are still through the roof. Oil barely notices a renewed push for an Asian lockdown. Inflation is unlikely to be transitory.

Bigger things are happening. The embarrassing withdrawal from Afghanistan has created a power vacuum to be exploited by Russia and China. The US will become increasingly cut off and protectionist, and this will have consequences. Sooner or later, financial markets will become more volatile.

What is bad for fiat should be good for hard assets. That is not to welcome disaster but reminds us why the likes of gold and bitcoin have their place in a diversified portfolio.

Crypto

El Salvador will make bitcoin legal tender on 7 September, and each citizen will be airdropped $30 to help get them started. They are welcoming foreigners with residency if they invest 3 BTC, which will no doubt draw a crowd. The IMF and their friends aren’t happy.

This is too much fun to watch. Just imagine how upset the establishment will be if it works.

Summary

The ATOMIC view is neutral. That is neither bullish (expect a surge) nor bearish (expect a collapse). Lower volatility is telling us that things are quieting down.