DeFi Insurance: A Decentralised Solution to a Decentralised Problem

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Internship Program

As Total Value Locked (“TVL”) in decentralised finance (“DeFi”) protocols continues to grow, digital assets continue to disrupt traditional finance. Compound.Finance generates yield opportunities unavailable in traditional financial markets, while decentralised exchanges (“DEXs”), like UniSwap, streamline currency exchange through a peer-to-peer approach. What about the insurance sector?

Decentralised Insurance Can Produce Huge Efficiency Gains

The traditional insurance market is riddled with inefficiencies. A sector that was once driven by community-based initiatives is now dominated by a small number of large, profit-hungry firms.

Consumers are forced to pay hefty premiums to cover against financial loss, which presents a principal-agent problem. Insurers, who aim to maximise profit, are incentivised to charge high premiums and avoid paying out claims. Clearly, an adversarial relationship exists between the institution and the consumer.

Typically, traditional insurers only return 65% of premiums to customers via claims, while the remaining 35% is lost to profit and frictional costs, as stated by the Nexus Mutual whitepaper. Like in the wider finance sector, a decentralised solution built upon smart contracts can streamline the process of offering insurance.

Nexus Mutualis the leader in decentralised insurance with active covers amounting to 30x its nearest competitor. They believe they can return 83% of premiums to customers. This is due to the more efficient nature of their in-house economy, which firstly provides in-house solutions that reduce frictional costs and, secondly, alleviates the principal-agent problem via alignment of incentives.

DeFi Insurance

The traditional insurance system is far from perfect. However, before protocols can start disrupting the real world, they must focus on solving the issues existing within the digital asset space.

One of the main advantages of DeFi is that it enables users to access financial products that only banks can offer in the “real” world. Additionally, through its inherently global nature, DeFi generates unbeatable value for its users. This does not come without risks; smart contract bugs, irreversible transactions, and lack of central support can cause bad actors to thrive.

| Type of Exploit | Value Stolen in 2020 |

|---|---|

| Exchange hacks | $300m |

| Wallet theft | $3bn |

| Smart contract | $154m |

Source: ByteTree; CryptoDaily; CoinGeek. Crypto theft figures in 2020.

The figures in the table above show the extent of the problem. The need for DeFi insurance is further highlighted when you take into account the fact that 96% of digital assets are uninsured, despite the very real threat of economic loss to users.

The lack of extensive insurance within the digital asset space is serving as a barrier to institutional adoption. Due to their fiduciary responsibilities, institutions, unlike many retail users, cannot engage with the space without insurance. Traditional firms, such as Lloyds and Aon, who underwrite insurance for Coinbase, can provide insurance solutions to idle digital assets kept in wallets or exchanges. However, the complexity of cover provision materially increases when these assets are put to work.

Complex DeFi Needs Insurance

Ethereum smart contracts enable participants to engage in trustless contractual agreements. These contracts are recorded and traceable with zero discretion. They are the lifeblood of every DeFi protocol, utilised by expert coders to create unparalleled financial products.

Smart contracts, like any code, come with a risk to the end user. In DeFi, users often must lock their assets in a contract to unlock the yield potential of a protocol. These locked assets can then be lost when bugs in the smart contract code are exploited, as evidenced by the very recent Poly Network exploit.

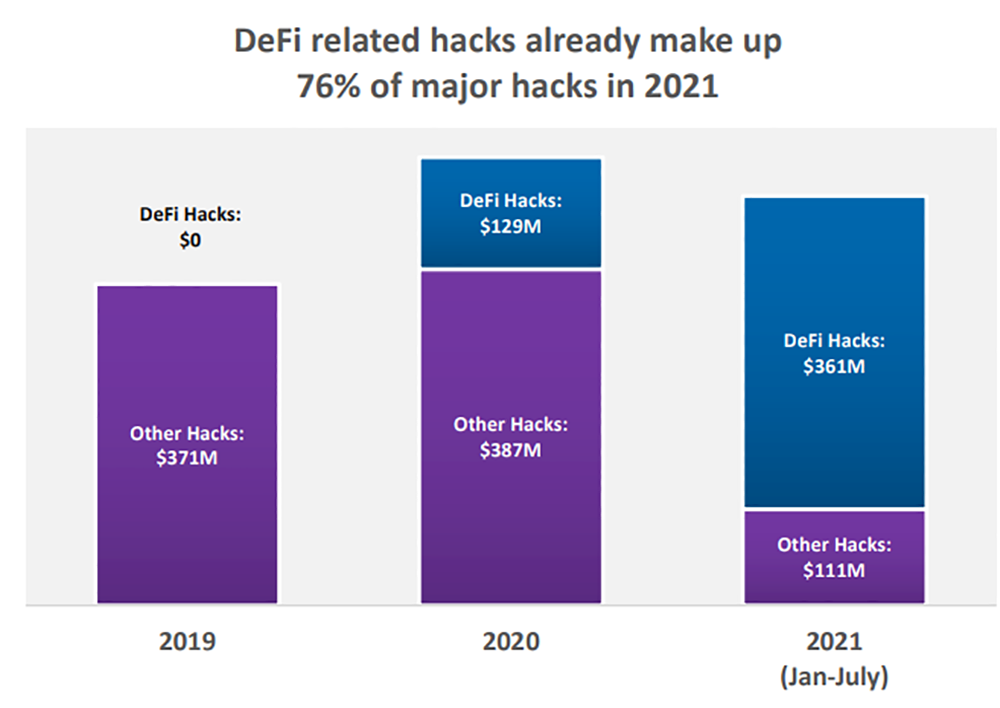

The chart below shows the growth in DeFi hacks. The value lost in the first half of 2021 is almost triple that of 2020 as a whole.

Source: CipherTrace. DeFi hacks between 2019 and July 2021.

The need for DeFi insurance is more pressing than ever before. Currently, the decentralised half of the digital asset ecosystem is responding to that need and has chosen to adopt a more community-driven approach.

Nexus Mutual

Nexus is a registered UK discretionary mutual that was founded by Hugh Karp in 2017. The development team consists of blockchain and insurance experts who came together to create a decentralised alternative to insurance. The members of Nexus are guarantors of the company and, through the purchase of the native token NXM, they share the risk of the cover the mutual provides. This community-based solution allows users in the DeFi space to protect their assets without having to place trust in an insurance company.

Nexus Mutual aims to reduce the unnecessary costs associated with the traditional provision of cover and ultimately provide lower premiums to its customers. They have started by targeting the security issues within the digital asset space through the provision of smart contracts, yield-bearing tokens, and wallet/custodial cover, which has grown from $70m to $537m since the beginning of this year.

However, despite its significant growth, Nexus’ active cover represents less than 1% of TVL in DeFi – there is a lot of room for growth.

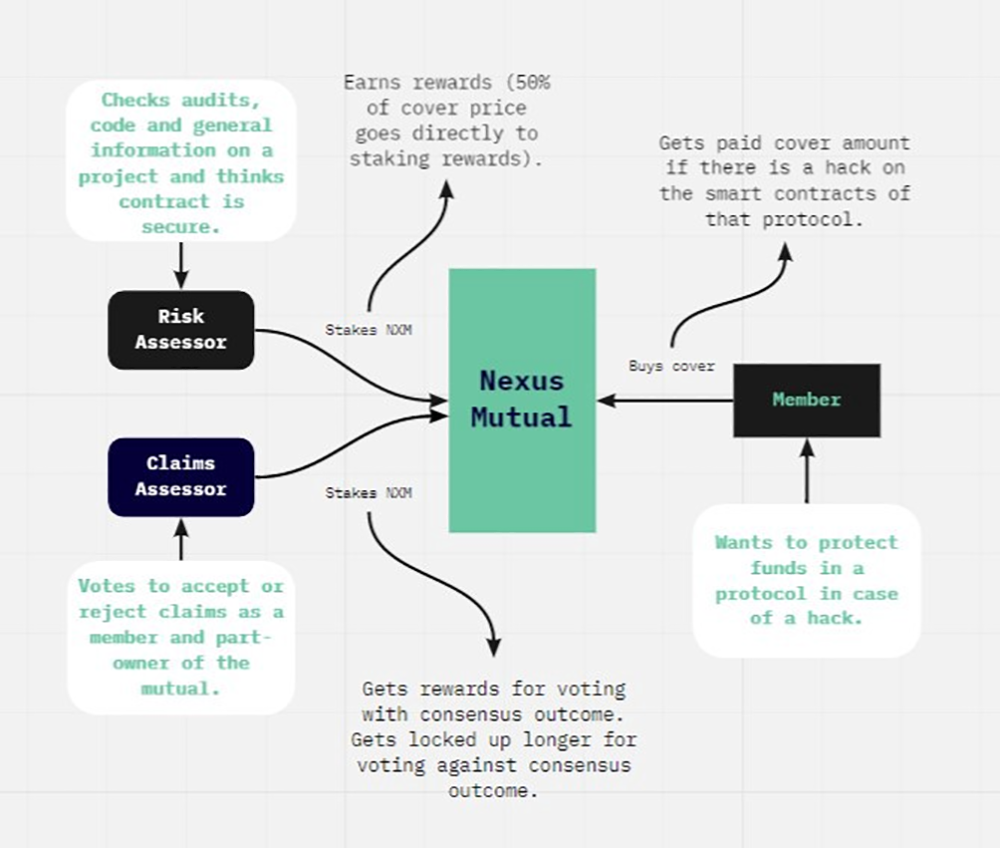

Nexus’ vision is of a truly decentralised insurer that is governed by its members who perform roles within the in-house economy, enabling the provision of low-cost and trusted cover. Concerning the mechanics of insurance provision, the members of the Nexus economy perform two key roles: risk assessment and claims assessment.

Source: Nexus Mutual. Nexus Roles.

Risk Assessment

As per the diagram above, Risk Assessors are skilled smart contract auditors who comb through the smart contract code of protocols in search of bugs that may leave them vulnerable to exploitation. Risk Assessors stake their personal NXM tokens against protocols they believe to be airtight and thus assume the risk of cover purchased against their failure. In return for risking their tokens, they receive 50% of the premiums.

The premium calculation takes into account the amount of NXM staked against the protocol that members desire to cover. The more staked against it, the ‘safer’ risk assessors deem it to be. This translates into lower premiums charged on the cover.

Claim Assessment

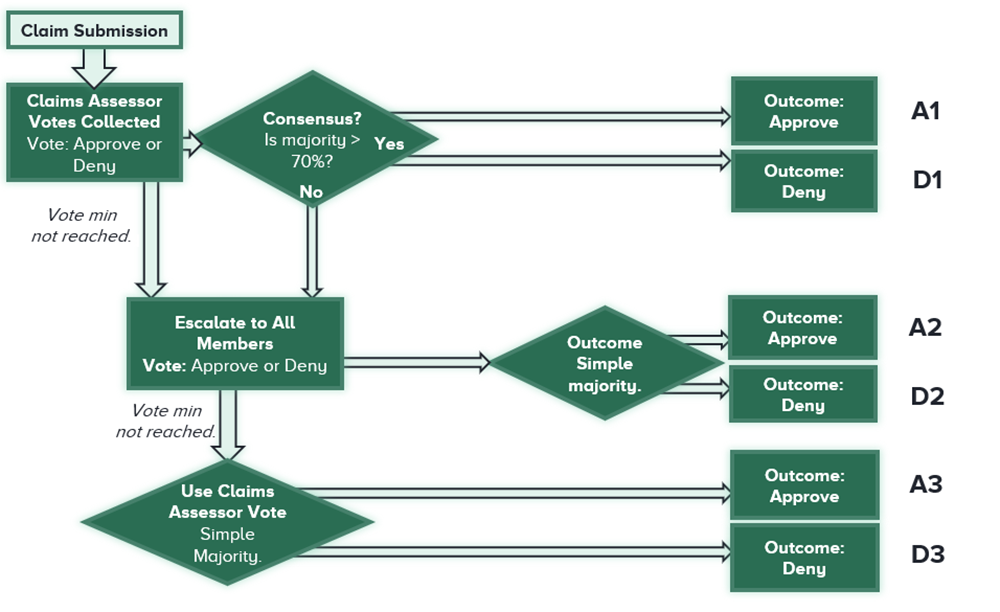

Members also play a role in the claim assessment process. Claims Assessors stake their NXM in favour of, or against, the claim approval. The significance of their vote is proportional to the amount of NXM staked. The chart below shows a detailed version of the process.

Source: Nexus Mutual. The claims assessment process.

Claim Assessors are rewarded for voting in line with the general consensus outcome, as 20% of the premiums from the claim in question are shared amongst those who vote in agreement with the majority. However, if they fail to vote with the majority, their NXM staked is locked for a further seven days.

Currently, the mutual insurance model incentivises members not to approve claims, as the subsequent depletion of the capital pool financially impacts token holders. The in-house economy is not mature enough for the economic incentive structure to reliably enforce the payment of valid claims unassisted.

To provide reassurance to cover purchasers, the Nexus Mutual Advisory Board acts as an overseer. The board holds a large proportion of the token supply, allowing them to swing pay-out decisions in the ‘right direction’.

| Board Member | Area of Expertise |

|---|---|

| Hugh Karp (Founder) | Insurance |

| Reinis Melbardis | Insurance |

| Graeme Thurgood | Mutual Insurance |

| Roxana Danila | Technical |

| Nick Munoz-McDonald | Security |

Source: ByteTree; Nexus Mutual. Nexus Mutual Advisory Board.

What Could Go Wrong?

Although the in-house economy developed by Nexus has generated efficiency gains, it does not come without risks. Firstly, after the Advisory Board hands the reins over to the community, making Nexus completely decentralised, the Claim Assessors could collectively decide not to pay out any claims. The incentive structure of the mutual discourages this, as token holders benefit from capital pool growth, which is dependent on the sustained purchase of cover. However, it is still possible and would render Nexus Mutual extremely unattractive as a cover provider.

Secondly, Nexus would be most threatened by a bad actor who possesses a significant proportion of the NXM token supply. In this circumstance, the individual could use their large voting power to make and accept false claims and thus drain funds from the capital pool into their personal wallet. Once Nexus is fully decentralised, the Advisory Board cannot step in and liquate the individual’s NXM for fraudulent voting.

Concluding Remarks

Traditional issuers cannot currently provide complex DeFi cover, which is serving as a barrier to institutional involvement in the space. However, Nexus Mutual’s community-based approach is able to concentrate digital asset expertise to service this unfulfilled demand.

Despite the risks that accompany the full decentralisation of Nexus, it remains the sector leader, while its impressive growth in its cover provision will surely follow the growth of DeFi. However, the vast proportion of digital assets still remain uninsured, which is particularly concerning in light of the increased frequency of smart contract exploits.

This is clearly a problem that needs to be addressed before Nexus expands its product offering to real-world solutions.

Comments ()