Cryptocurrency Custody Solutions

Disclaimer: Your capital is at risk. This is not investment advice.

Custodianship in traditional finance (‘TradFi’) is an inherently centralised notion. Contrastingly, digital assets promise a decentralised future. Therefore, custodianship within digital assets warrants consideration of both centralised and decentralised solutions.

This article will focus on the primary custody solutions, both centralised and decentralised, within the digital asset space. Specifically, it will first consider custody solutions within TradFi before emphasising the need for custodianship in the digital assets space. Next, it will assess Coinbase Custody as a centralised solution before evaluating Gnosis Safe and the protocol’s native GNO token. This article will utilise Gnosis Safe and Coinbase Custody as proxies for decentralised and centralised custody solutions, respectively.

Traditional Custody Solutions

The Financial Dictionary defines custody as:

“A service in which a brokerage or other financial institution holds securities on behalf of the client.”

Examples of custodians include financial behemoths such as JP Morgan, Citi, UBS and the Bank of China.

Centralised custodians present natural risks. Centralisation caters for domino effects from the potential event of custodian insolvency to the conceivable occurrence of custodian error or misconduct. While the collapse of Archegos Capital Management is not necessarily a direct example of custodial failure, it demonstrates the contagion effect that can occur in a centralised system.

Cryptocurrency & Custody

The exponential growth of the digital asset economy emphasises the need for concrete custodial solutions. On top of this, the finality and self-governance of transactions on public blockchains mean that custody solutions are required to a unique extent. The $9.8 billion that has been lostin this space since 2011, excluding unannounced losses, evidences the dire need for a custody solution within an ecosystem where stakes are high.

Custody solutions can take advantage of the booming Total Value Locked (TVL) within the decentralised finance (‘DeFi’) sector. At the time of writing this article, the TVL in DeFi is $76.37 billion, as per data from DeFi Pulse. A majority of this amount can and needs to be placed in custody. The right custody solutions can accelerate institutional adoption in the digital assets space.

Types of Crypto Custody Solutions

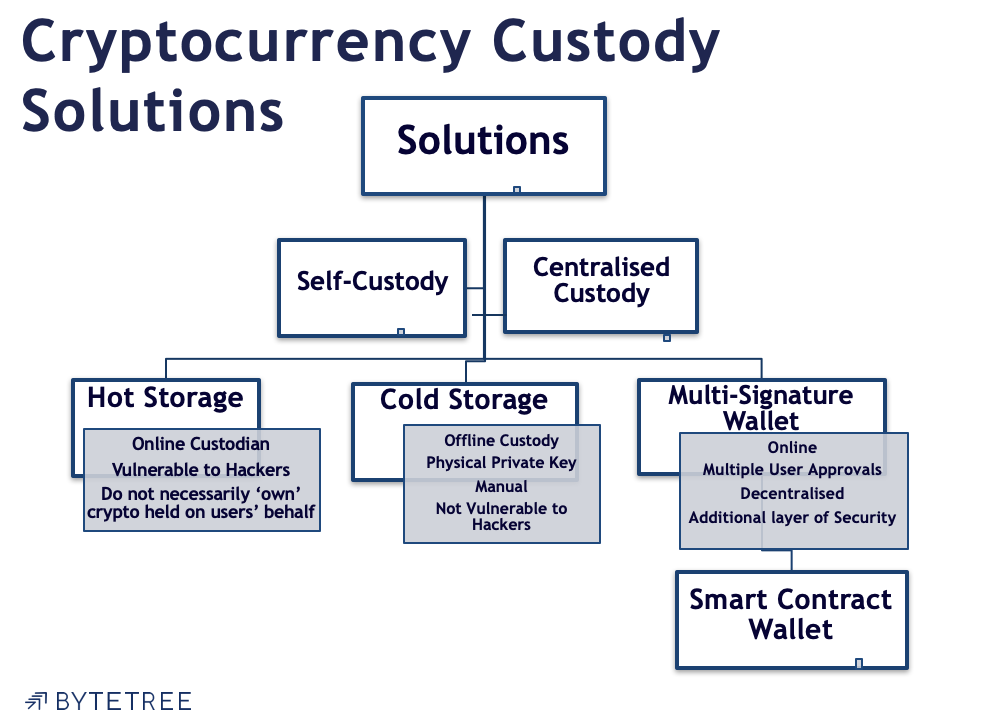

Before considering the actual protocols and custodians themselves, it is first important to understand the types of crypto-custody solutions.

As indicated above, Hot Storage wallets are online solutions, making them more accessible at the expense of an added vulnerability to hacks. Cold Storage solutions are physical, offline solutions, such as hard drives or USBs, removing any vulnerability to hacks, though adding a degree of inaccessibility.

A multi-signature wallet requires multiple user approvals to access and control of wallets, adding a layer of security. Moreover, it enables groups to manage the flow of funds.

Evidently, there is a range of custody solutions available for digital assets. What do they look like in action?

De-Decentralisation: Coinbase Custody

Where users and/or institutions are uncomfortable with the idea of custody without a known custodian, centralised solutions are an attractive solution. For the purposes of this article, I consider Coinbase Custody.

Coinbase Custody offers an enterprise-grade cold storage solution, enabling auditability and insurance to the extent that is difficult to achieve in a decentralised solution like Gnosis Safe. Furthermore, Coinbase Custody is a qualified custodian under New York State Banking laws, promising absolute regulatory compliance in Know Your Customer (KYC) and Anti-Money Laundering (AML) contexts. The further success of Coinbase Custody is partly from its balancing of private keys with easy client access to holdings, facilitating both security and accessibility. It is also partly due to combining their custodial services with staking and pairing with Coinbase Pro for immediate liquidity.

Interestingly, the Coinbase Annual Report 2020stated that ‘more than 50%’ of the $90 billion in assets on Coinbase are attributed to Coinbase Custody.

While this number will certainly have risen going into this year, this article will discuss how it is still a compelling representation of the neck-and-neck contest between Gnosis Safe and Coinbase Custody, or even between decentralised and centralised custodial solutions in general.

Coinbase Custody impersonates a traditional solution in the not-so-traditional digital asset space very well. Arguably, this attracts institutional clients. In its Q2 earnings, Coinbase announceda further 1,000 institutional customers, and a total of 9,000 financial institutions using its services, with 10% of the largest hedge funds beginning to use its services. Undoubtedly, its custody solution is a big part of this onboarding.

What is the decentralised alternative?

Gnosis Safe

Gnosis Safe is the first MultiSig Smart Contract wallet within the crypto ecosystem. The robust safety element within Gnosis Safe is a consequence of its MultiSig and Smart Contract capabilities. Analogous to the two-factor authentication we employ to protect our email accounts, multi-signature wallets diversify the risks of single-factor authentication.

Gnosis Safe exists as a series of smart contracts on top of the Ethereum Network. Funds are not stored in a singular wallet as such but are governed by rules that dictate the movement of coins. In other words, the level of security is enhanced by diversifying the digital ‘location’ of funds, whereas the accessibility of funds is improved due to the variability of smart contracts.

Gnosis Safe Adoption

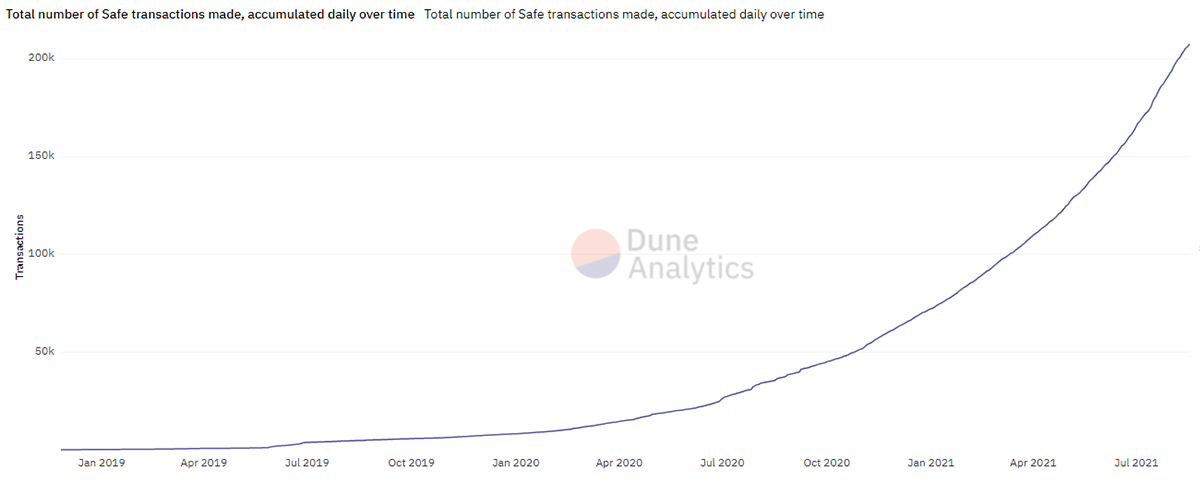

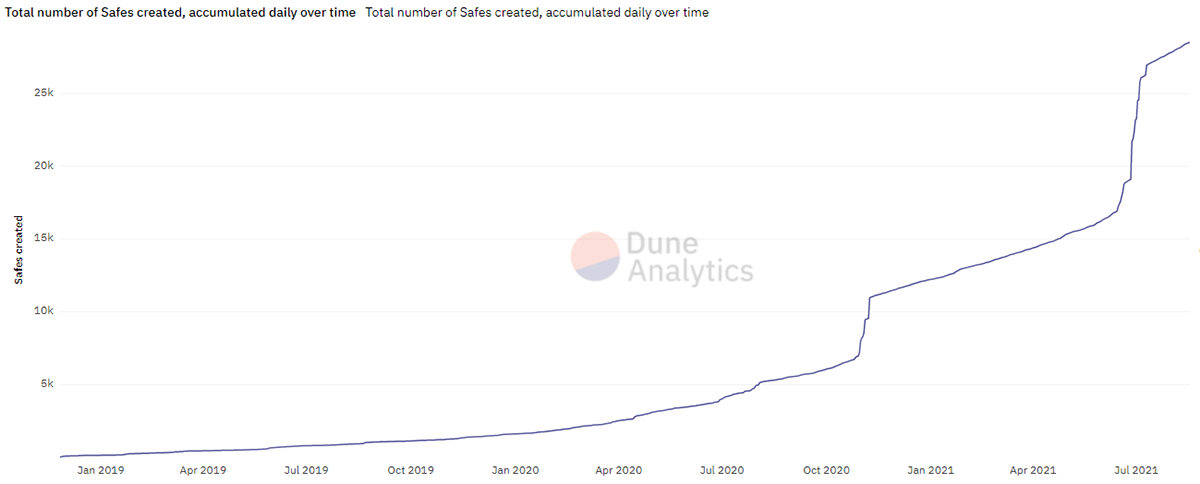

The technological innovations inaugurated by Gnosis Safe are just as impressive as the extent and rate of the protocol’s adoption. Over $53 billion worth of ETH and ERC-20 tokens are stored in Gnosis Safe contracts today, and this number does not look like it is slowing down, as illustrated by the charts below.

The data above highlights three interesting premises. Firstly, there is a growing demand for smart contract wallet security. This comes from individuals, teams, DAOs and institutions that do not want a single point of failure in their fund setup.

Secondly, this growing demand may evidence the entry of more sophisticated investors into the digital assets ecosystem, signifying a maturing industry.

Third, the adoption of Gnosis Safe’s MultiSig wallet by widely known protocols such as Aave, SushiSwap, MakerDAO, Yearn Finance, and 1inch, legitimises and contributes to this growing demand. Through these protocols, Gnosis Safe can act as a secure medium, or portal, to the TVL in DeFi.

Gnosis Safe Investment Exposure: The GNO Token

Investment exposure to Gnosis Safe can be gained through the GNO token, Gnosis’s native token. It is important to note that Gnosis Safe is a segment of the overall Gnosis offering.

Gnosis consists of a combination of interoperable product lines. First, it offers an open-source prediction market built on the Ethereum Network. The protocol seeks to create the world’s most efficient prediction market and the most accurate forecasting tool. The creation of such a decentralised prediction market enables users to make arbitrary events tradeable. Second, Gnosis consists of a decentralised exchange. Finally, we have Gnosis Safe, the secure and decentralised mechanism to manage assets.

The GNO token is utilised to govern and operate the Gnosis Network. The value of the GNO token is realised through market speculation. Holding GNO enables users to utilise Gnosis smart contracts, govern the network and transact on it.

While it is outside the scope of this article, readers should note that ownership of the GNO token does not relay 1:1 exposure to Gnosis Safe.

Concluding Remarks

The discussion of custodial services within the digital assets sector rekindles the centralised vs decentralised debate. Coinbase Custody offers a reliable and centralised solution to what is a complex problem. On the other hand, Gnosis Safe provides a unique and decentralised solution to the same complex problem. Though both platforms are terrific solutions, the trustworthiness and institutional exposure that Coinbase Custody maintains suggests that it provides a more comprehensive solution than Gnosis Safe.

Ultimately, it is clear that both the exponential growth of Gnosis Safe and the constant procurement of institutional clients by Coinbase Custody are net-positive occurrences for the growth of the digital assets sector overall.