Bitcoin Back to Trend Growth on Regulatory Relief

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 10

If ATOMIC was solely looking at the technical view, we would have no hesitation in upgrading to a bull market. The price action has been stunning, blasting though resistance and stopping the 200-day moving average from turning down. We see regulatory relief as the key driver, reversing much of the spring malaise.

ByteTree ATOMIC

Highlights

| Technicals | Strong - breakout from the base |

| On-chain | Remains soft |

| Macro | Dollar strength |

| Investment Flows | Where are you? |

| Crypto | Regulatory acceptance explains all |

Technical

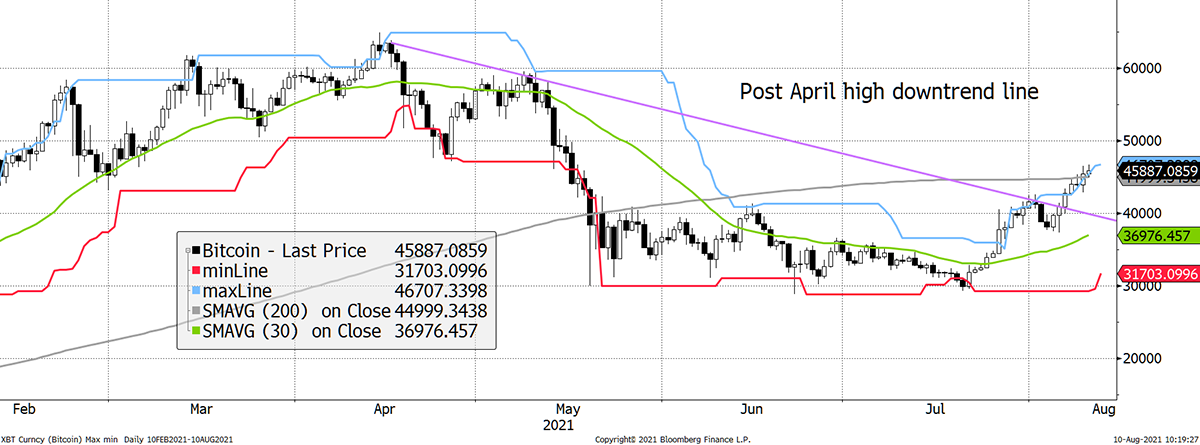

If ATOMIC was solely looking at the technical view, we would have no hesitation in upgrading to a bull market. The price action has been stunning. First, it made a 20-day high, then broke through the 30-day moving average. It then broke above the top of the trading range since mid-May at $40k. Then it broke through the downtrend line that marked this correction. To cap it all, bitcoin has stopped the 200-day moving average from turning down, which seemed inevitable until days ago. From a technical perspective, this looks like a return to a bull market.

Bitcoin trend

Source: Bloomberg. Bitcoin with 20-day max and min lines, 30-day and 200-day moving averages over the past six months.

That said, the next round of gains faces resistance. The February low at $45k has been broken, but next up comes the old April low (remember China) at $48k. Thereafter, there’s continued resistance into the all-time high. A new high is possible, but it won’t come easily.

Through $45k, $48k comes next

Source: Bloomberg. Bitcoin price performance since February 2021.

A comforting long-term chart is the post-2013 regression that has been rising at 94.5% per year. It was rising at 100% per year a few months ago, but the recent correction has cooled that slightly. Still, doubling your money each year isn’t bad.

Back to trend growth

Source: Bloomberg. Bitcoin regression since the 2013-high.

The price is now mid-range in the regression, and for bitcoin to stay within the grey bands would be agreeable. For what it is worth, the central red trendline will make a new all-time high in June 2022.

We would caution using pre-2013 data to calculate the long-term trend. Yes, it’s nice to see a 200% annualised trend, but the early years will never be repeated (650% ann. 2010 to 2013 peak), so best to stick with reality. Doubling isn’t bad.

If you want the big numbers, then make sure you’re paying attention to ByteTree’s Token Takeaway on Thursdays.

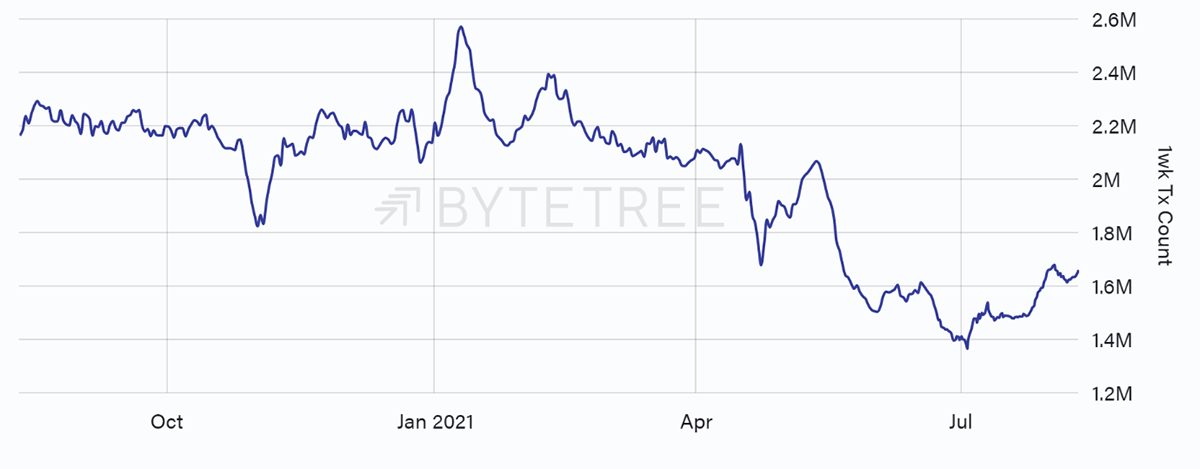

On-chain

This remains soft. What is clear is that this rally was not caused by a material pick up in either retail or institutional demand. It was a lack of sellers, and as you’ll read later, regulatory relief.

Transactions have been rising, which is positive, but remain low. That implies retail demand remains soft.

Transactions pick up from low levels

Source: ByteTree. Transaction count, 1-week cumulative rolling, over the past 52 weeks.

Yet, some large transactions have been going through. As you’ll see, it wasn’t buying by funds. More likely, it was the bitcoin whales that followed short covering. They’ve been right.

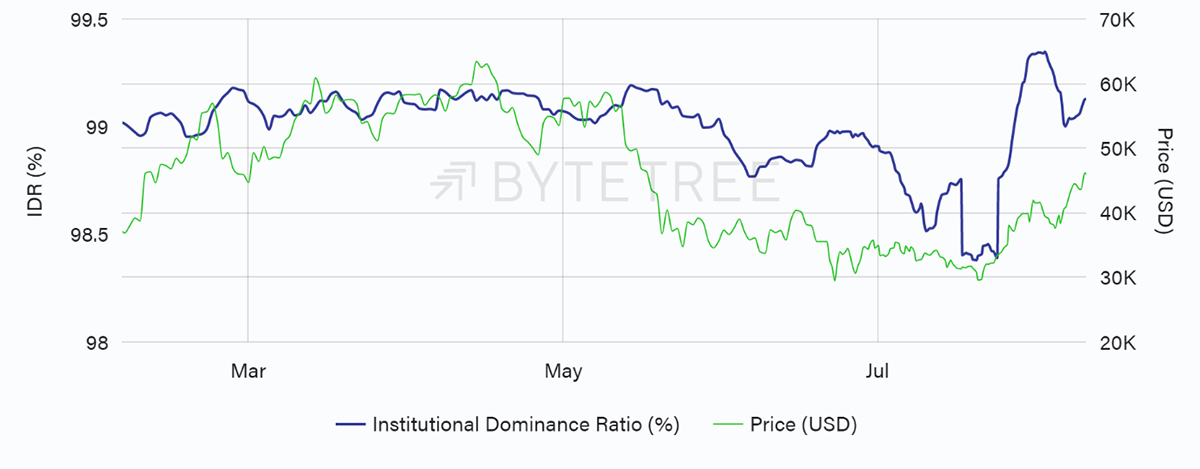

IDR is back to bullish levels

Source: ByteTree. The Institutional Dominance Ratio and the price of bitcoin since February 2021.

Investment flows

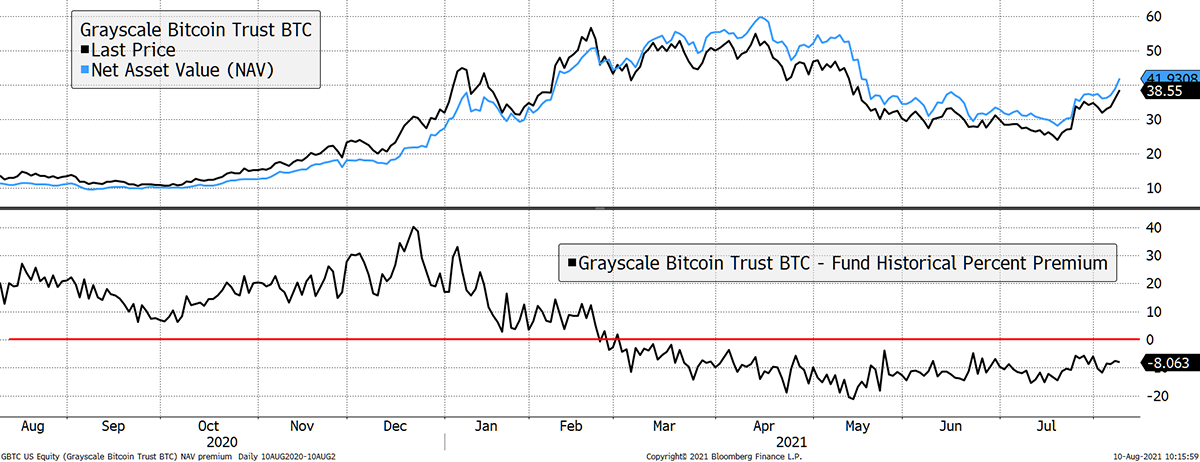

More evidence that buying has come from within the space comes from the Grayscale discount. There have been influential events, such as the end of the lock-up of new shares, but that’s now old news.

The discount is at 8%, which is not structurally tighter. The outside world is not (yet) flocking in. The recovery from -20% in May is clearly a relief, but there are no signs of external activity wherever we look.

Grayscale discount

Source: Bloomberg. Grayscale Bitcoin Trust (GBTC) price and net asset value per share. Discount/premium lower chart past year.

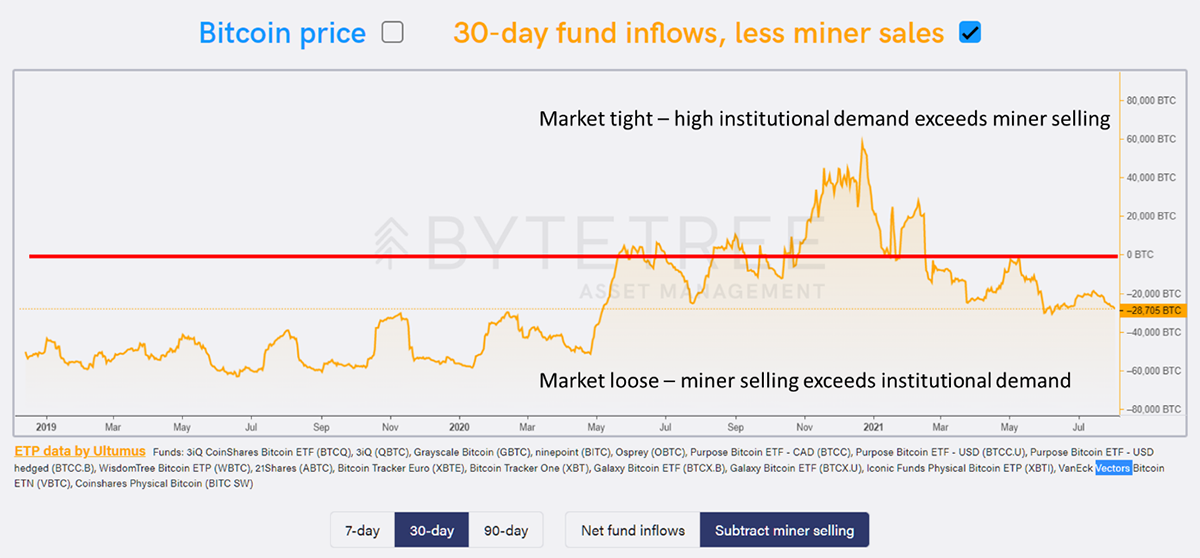

I reiterate that the funds aren’t buying. They may have just about stopped selling, but the mining deficit is running at 28k BTC per month, or $1.26bn at a price of $45k per BTC. That is every month.

We haven’t seen this since pre-halving in May 2020.

Source: ByteTree Asset Management. Bitcoin 30-day fund inflows, less miner sales.

It could be that companies such as Coinbase (COIN – which reports today) and NYDIG are enjoying a splurge, but we can’t tell as the data is not publicly available. It seems unlikely that they are seeing materially stronger fund flow than their peers.

Macro

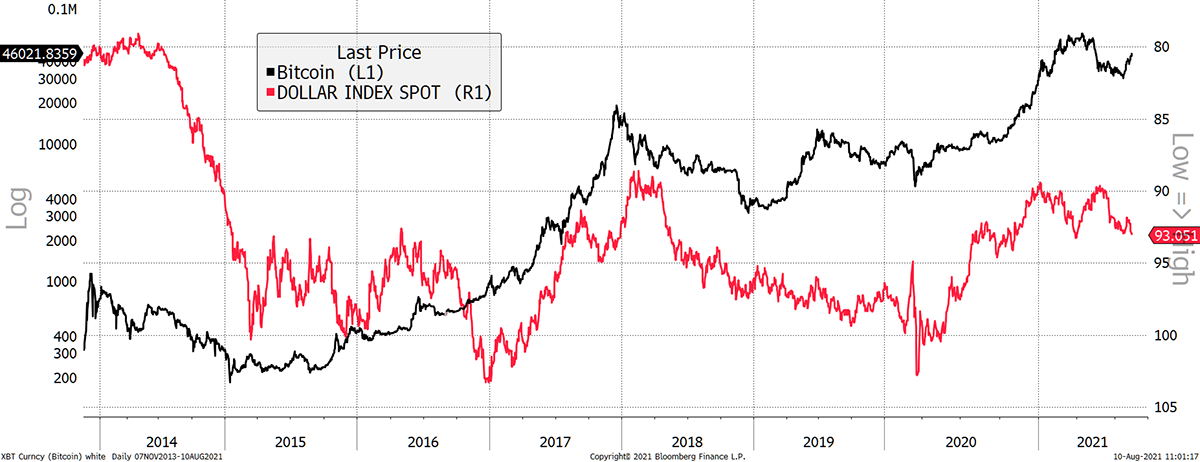

The dollar is rising (shown inverted), which is generally not a good thing. That bitcoin can rally into a rising dollar is further evidence that this rally has regulatory relief at its core.

Bitcoin fights a strong dollar

Source: Bloomberg. DXY index inverted and Bitcoin since 2014.

That has coincided with a jump in real interest rates. Inflation fell while the bond yield rose in response to strong US economic data. A divergence between Bitcoin and the dollar can last for a while but unquestionably poses a risk to this rally.

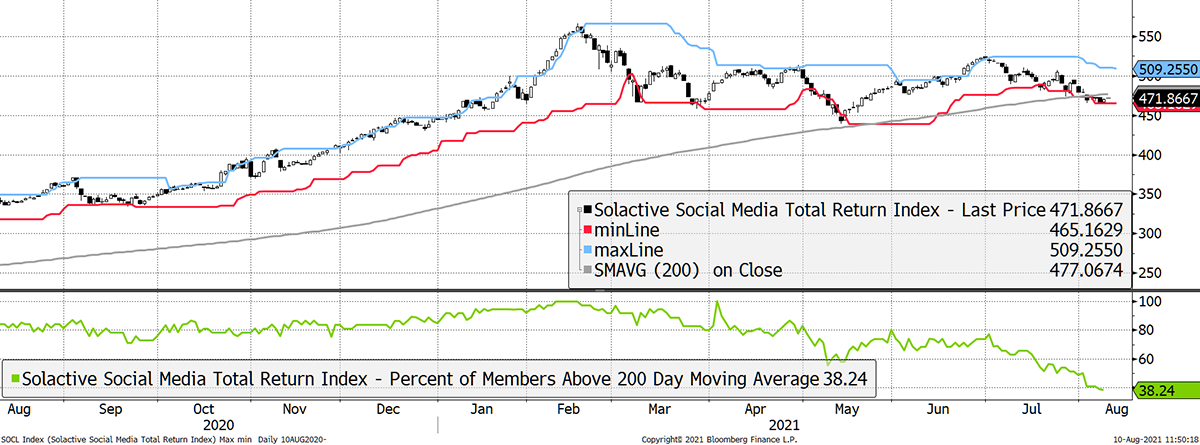

Elsewhere, the social media stocks (SOCL) are coming under pressure, with just 38% of them trading above their 200-day moving averages. The index is also trading below its 200-day moving average with a falling trend channel.

Social media comes under pressure

Source: Bloomberg. Solactive Social Media Stocks Index in the past year.

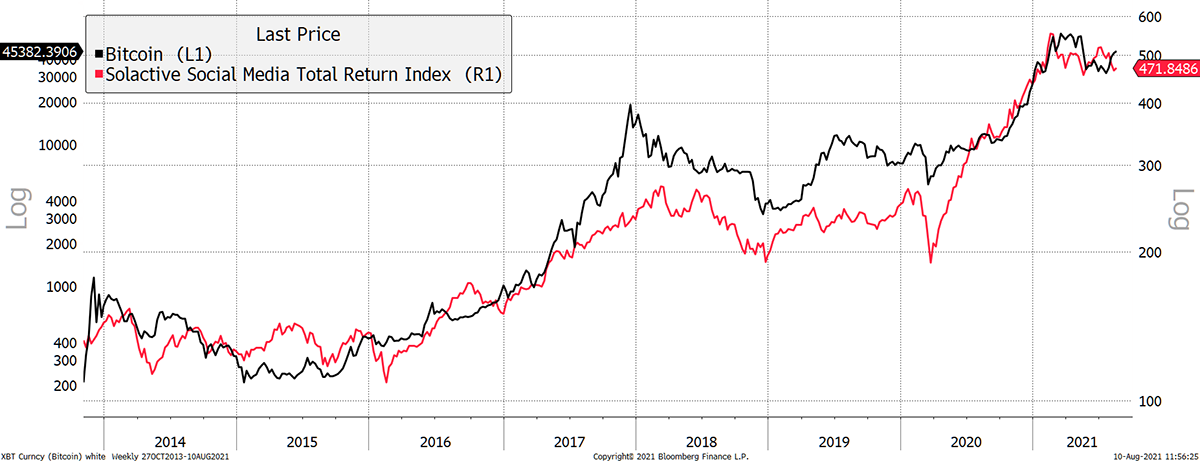

This is hardly a smoking gun, but SOCL has been a close friend of bitcoin over the years. If you consider Bitcoin to be an extension of social media, but where value is exchanged, then this correlation still matters.

Bitcoin moves with social media

Source: Bloomberg. Solactive Social Media Stocks Index and Bitcoin since 2014.

Bitcoin has done much better pre-2017, but the correlation is clear. They have consistently moved together.

Post-2017 is a different story. Bitcoin is only slightly ahead of SOCL. A breakaway move is needed to put this link to rest.

Bitcoin slightly ahead since the 2017 peak

Source: Bloomberg. Bitcoin relative to the Solactive Social Media Stocks Index since 2014.

Crypto

The big news has been regulatory. It explains a lot because we have seen a strong upward price move on seemingly little investment activity. It all points to a relief rally that has reversed the regulatory fears that emerged in April. My colleague, Charlie Erith, CEO of ByteTree Asset Management, shares his thoughts.

The US Infrastructure Bill

Crypto has been heavily in the news in the US over the last couple of weeks. This is because it has become a controversial feature of President Biden’s US$1 trillion infrastructure bill, currently going through the Senate. The reason for its inclusion is a desire to raise taxes from the space to help meet the colossal expense. In order to achieve this, there will be new reporting requirements to the IRS (Inland Revenue Service) for crypto companies.

This hasty inclusion has a number of ramifications.

Firstly, it brings crypto properly into the legislated universe at a Federal level. It has not been banned, and it is no longer an outlaw. The fact that there are so many senators battling in its corner for sensible legislation is hugely encouraging in terms of the future path of acceptance and adoption. Many will see this as a seminal moment, the moment when it became clear that crypto was here to stay.

Less encouragingly, the reporting requirements are onerous, in many cases totally impractical, for certain industry players. This all surrounds the definition of a “broker”, all of whom, under the existing bill, would be required to report crypto gains in a 1099 form (this is a record that a person or entity, not your employer, gave or paid you money). The concern is that the definition is far too broad and will encompass miners, developers and others who don’t have or know their customers and therefore don’t have access to the information needed to comply. The worry is that without a narrower definition of “brokers”, many companies in the space will be forced to leave the US or be obliged to close their operations.

This would be a blow to US innovation in the space, although theoretically, a change of location doesn’t necessarily stifle innovation in what is a borderless asset class. However, given that China has recently driven out the engine room of the industry – miners - there must be concerns that the US is doing the same, albeit with more subtlety. The irony of driving out an industry in an attempt to reap tax rewards will be entirely lost on those politicians who have introduced such clumsy legislation.

On balance, the development is broadly positive. Bringing crypto inside the legislative fold is the proverbial foot in the door and sets up the industry for further positive developments, such as the introduction of ETFs. But those who wish to stand in its way have demonstrated that they still have teeth.

Briefly on the London Hard Fork - Tom Salter, Digital Asset Analyst

In the wider market, Ethereum has dominated the news with its well-anticipated London Hard Fork. The upgrade houses five Ethereum Improvement Proposals, EIP’s, which in conjunction aim to improve the end-users network experience.

Most notably, EIP-1559 adds a burn mechanism to network fees which have caused speculation relating to its potential to make Ethereum’s supply deflationary. Make sure to keep a close eye on this because since launch, around 6,500 Ether has been taken out of circulation over the last 24 hours. That equates to around $20m.

Feedback

ATOMIC reader: I have recently added ByteTree Premium and I have to say it is a fantastic product. There is so much noise in the crypto space but you manage to consistently eliminate it. It’s like putting in a pair of crypto-noise cancelling earbuds. But I digress. I listened to the Grant Williams podcast about the fraud that seems to have been (and continues to be) committed around Tether. I’m guessing the reason you think this would only break with crypto already on its knees is because the big guns would be given time to unwind their positions first. However, given the scale of the fraud and the downside risk that this involves, how, as Grant Williams himself might say, could one justify committing one Dime to these crazy markets, at least until this scandal fully blows over? I’d be interested to know your thoughts.

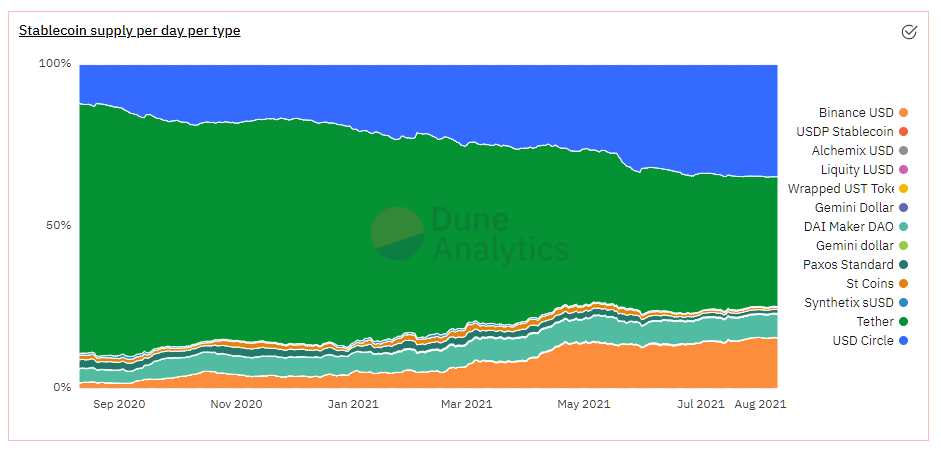

ByteTree: Where do we start? Crypto is jam-packed full of risks and always has been. This is why it is so volatile. The difference between Tether and other risks is that it is potentially systemic.

One positive is that it is rapidly losing market share to more credible alternatives. Last September, it had a 77% market share. Today, that has fallen to 39.9%. Still too big.

Tether is losing market share

Source: Dune Analytics. Stablecoin supply since September 2020 – Tether in green.

The problem with saying no to crypto because of Tether is that it may not blow up for years. Certainly, if crypto prices remain buoyant, it probably won’t. Also, consider that a Tether explosion would cause a price shock just like a banking crisis did for equities in 2008. But it didn’t impact their long-term prospects, and equities duly recovered.

Tether concerns us in that it will likely cause a price shock at some point in the future, but it won’t kill crypto. As the saying goes, what doesn’t kill you makes you stronger.

Yes, crypto is a high risk, high reward space.

Summary

A welcome price recovery. Institutions are followers rather than leaders so it is no surprise that the world didn’t buy the dip. Following numerous internal discussions, the regulatory acceptance, albeit not directly bullish, is a game changer. Crypto is not illegal, and so therefore it must be legal. That’s bullish.

Comments ()