Why Is Gold So Cheap?

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report - Issue 62;

I have been writing about gold in Atlas Pulse since 2012 and have decided to move it to ByteTree as we embrace gold as part of the broader crypto conversation. I feel an understanding of the gold market enhances crypto analysis because that is how it was designed at the outset.

Highlights

| Regime | Gold lags the S&P 500 |

| Macro | Falling real rates fail to trigger a rally |

| Valuation | Undervalued in a bull market |

| Flows and Sentiment | Speculative longs collapse by 76% |

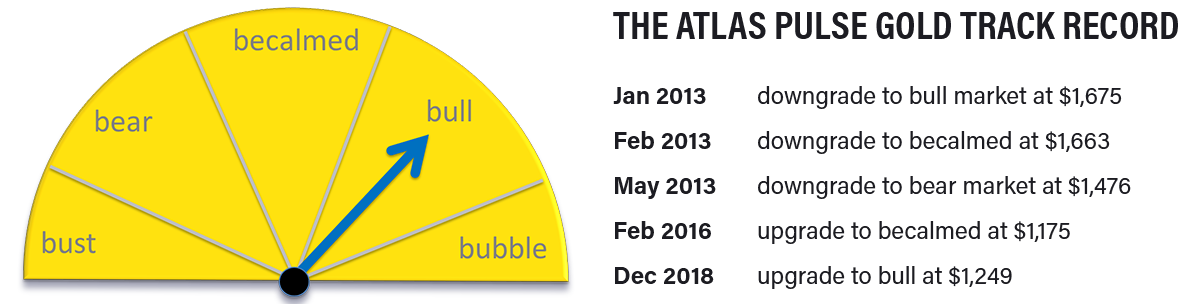

There might not be much happening in the gold market right now, but I get a sense that it will soon change. I’ll kick off with the gold regime, which is a simple long-term directional model.

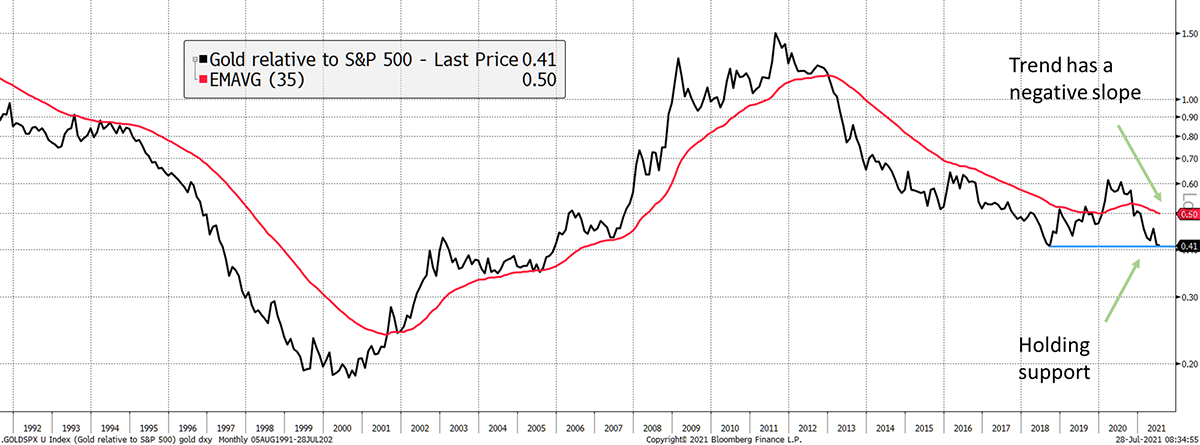

Gold lags the S&P 500

Out of the three criteria of the gold regime model, two remain bullish, while the third is somewhat bearish. That is enough to still call this a bull market:

- Short-term real interest rates are below 1.8%. TRUE

- The gold price, measured in a basket of currencies, is rising, measured by a 35-month exponential moving average. TRUE

- The gold price relative to the S&P 500, measured by a 35-month exponential moving average. FALSE

Focusing on the third, the US stockmarket has marched ahead since the last gold peak a year ago.

Gold Lags Equities

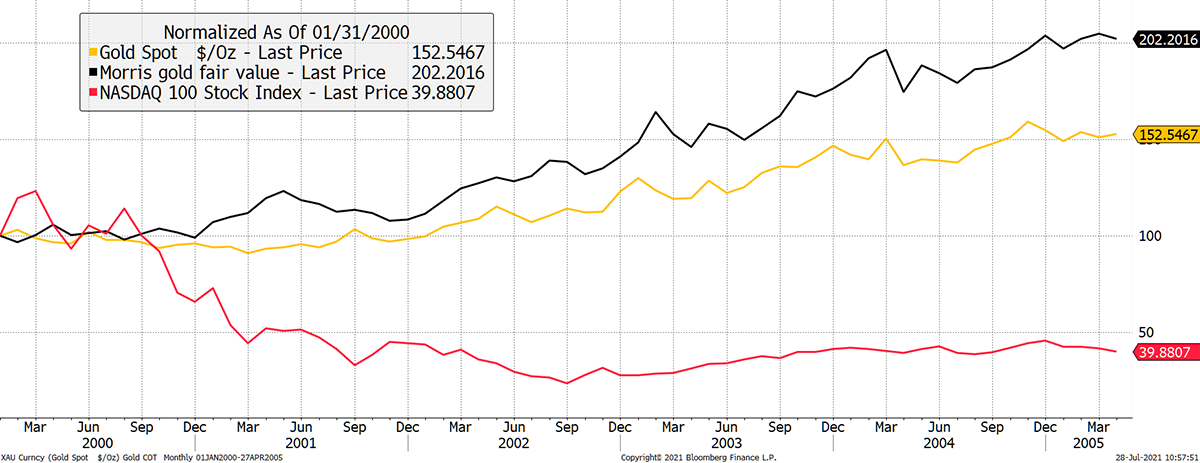

It is hardly controversial to say equities are highly priced, just as they were in the late 1990s. Gold has lagged equities since its 2011 peak, but has delivered twice the capital returns since the last tech bubble, two decades ago. That is no mean feat.

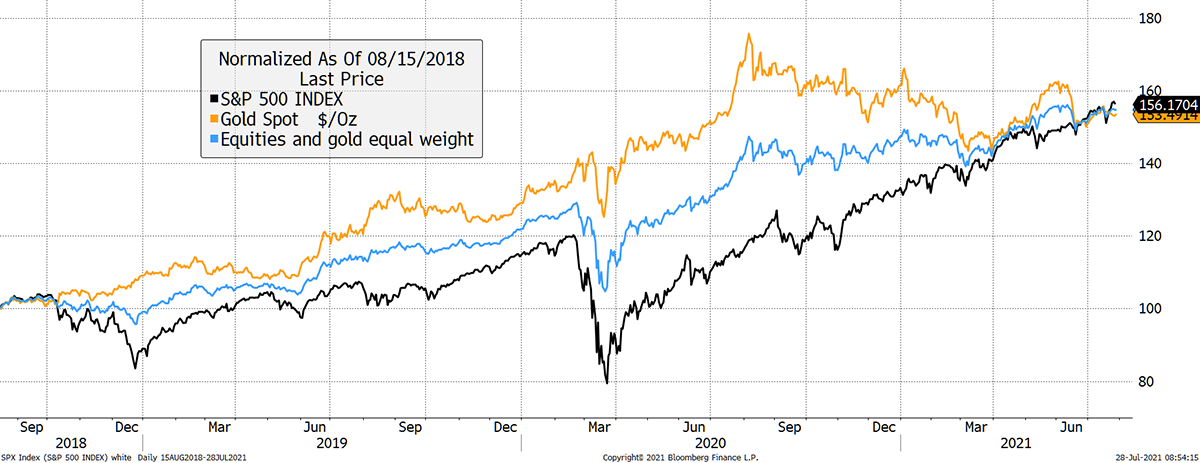

I last upgraded gold to bull market in December 2018, following a painful slump since 2013. Notwithstanding the past year, things have been going well. Since the Sept 2018 low, equity and gold returns have been matched, and those who held both assets have enjoyed considerable diversification benefits over the period.

Gold and Equities Smoothed the Ride

In the immediate aftermath of the Covid-19 crisis, gold was a must-have asset. Yet over the past year, things have cooled as markets have remained in risk-on mode.

Is this a rerun of the dotcom bubble, where gold reasserts itself as the knight in shining armour after the equity peak? Or is it more like 2012, where gold didn’t respond to the continuing fall in real interest rates before collapsing on their reversal? I vote for the former but will examine the latter.

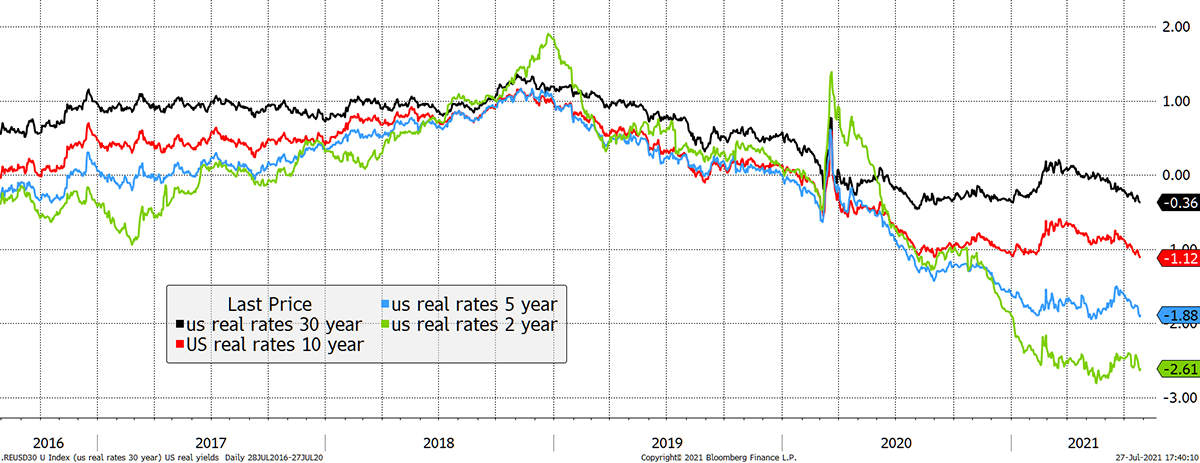

Falling Real Rates Fail to Trigger a Rally

It is well known that gold responds to falling real interest rates (bond yield less inflation). That is, when the cost of borrowing is below the level of inflation, it is generally better to own gold than have cash in the bank.

Real rates turned down in late 2018, which was when the last great gold rally began. The rally came to an abrupt halt a year ago, just as longer-term real interest rates stopped falling.

Real Rates Are Plunging

Shorter-term real rates did carry on falling, which incidentally coincided with a Bitcoin surge. I will cover this another time but hold that thought.

Gold Is Undervalued in a Bull Market

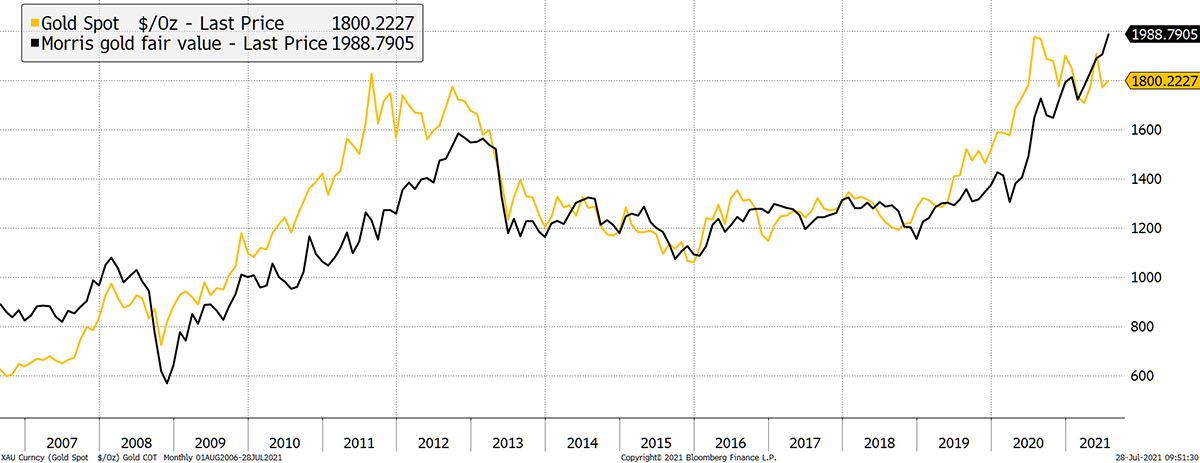

My gold valuation methodology places the fair value at close to $2,000, while the price lags at $1,800. The fair value sits at an all-time high, but gold is failing to respond.

Cheap Gold

In 2012, gold was sliding back from a 50% premium (above fair value) seen in September 2011. Fair value was rising, but gold saw darkness over the horizon. The taper tantrum of 2013 saw the Federal Reserve discuss tighter monetary policy, and gold didn’t like it. For a while, a bank deposit won the day over gold.

Today’s gold lag could be forecasting a future spike in real interest rates. Could it be that the Fed tighten policy into this economic boom? While seemingly unlikely, it is possible.

The alternative thesis is the dotcom comparison. From March 2000, as the dotcom stocks started to unwind, gold held its ground. The fair value rose (as did 20-year TIPS) for the next five years, but gold was always a step behind. It wasn’t until 2009 that gold rose to a premium valuation. Maybe gold is just slow on the uptake, and it took time for the investment case to rebuild.

Gold Was Slow Post the Dotcom Crash

Which scenario is it? Given the taper tantrum marked the early days of a tech surge as opposed to a peak, that is unlikely to be repeated. Can this really be the start of a boom in risky assets as opposed to the finish? It seems unlikely.

For whatever reasons, today’s asset allocators aren’t buying gold.

Gold Outflows Have Slowed

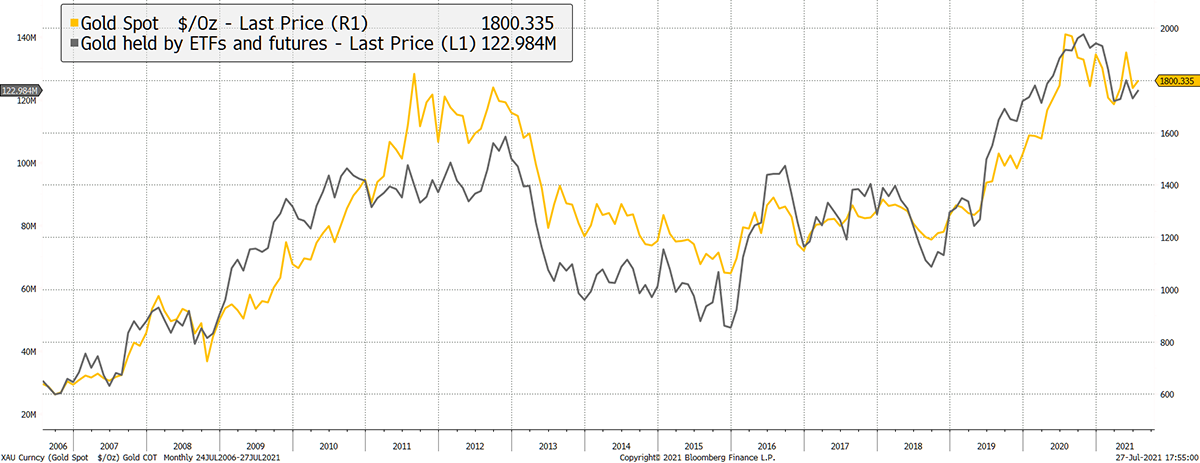

When you look at the gold ETFs and futures combined (longs less short speculative contracts), the link with price never fails to disappoint. Gold has fallen over the past year because investors have sold it. Or, of course, the price slipped first and then they sold it.

Flows Turn Down with Price

Bitcoiners take note. Flows matter in non-yielding, non-perishable assets. Despite the plethora of data blockchain offers, flows are harder to accurately track with Bitcoin than gold. Ironic perhaps. In any event, ByteTree is in the lead here with tracking of Bitcoin flows and gold flows.

Notice how in 2012, gold flows rose ahead of a crash to an all-time high after the price peak. That is not happening this time, as flows are absent, which I deem to be bullish.

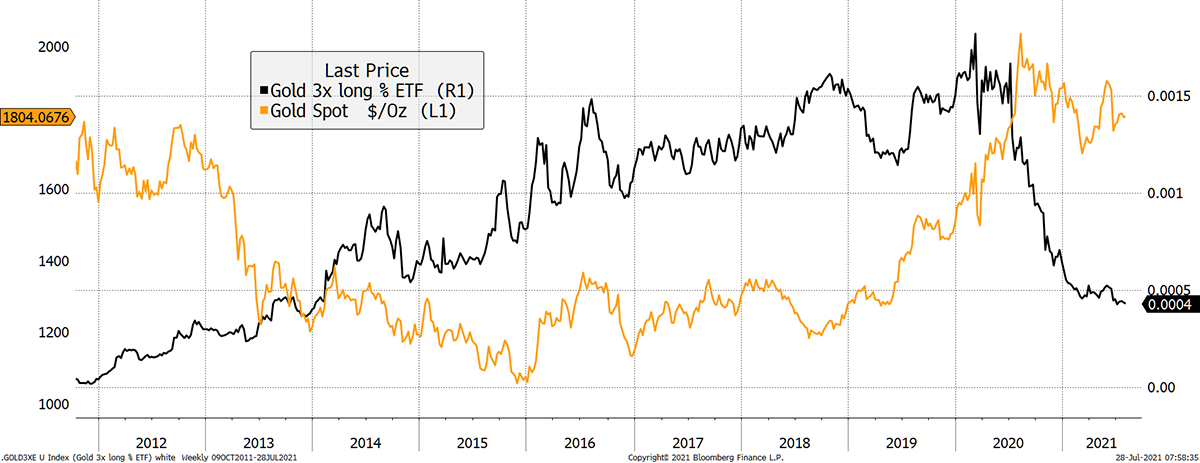

Another confirmation of investor sentiment comes from the assets held by the 3x leveraged gold ETF (ticker UGLDF), compared to all gold ETFs. It was growing until last year, but no more.

Leveraged Longs Have Given Up

There could be other reasons for the unwinding of leveraged assets, but the simple reading is that investors have given up. When that happens, and the fundamental outlook is attractive, that makes gold a contrarian idea, which is generally a comfortable place to be.

Summary

If you wish to receive Atlas Pulse from ByteTree, then please sign up to our free mailing list. I write a short piece each week on Bitcoin, and increasingly as the story rebuilds, gold.

At ByteTree, we aim to comprehensively cover what you need to know about both topics. Some of the charts above are already available, and in good time, they will all be.

I remain bullish. Thank you for reading Atlas Pulse.

Thank you for reading Atlas Pulse. The Gold Dial Remains on Bull Market.

Charlie Morris is the Founder and Editor of the Atlas Pulse Gold Report, established in 2012. His pioneering gold valuation model, developed in 2012, was published by the London Mastels Bullion Association (LBMA) and the World Gold Council (WGC). It is widely regarded as a major contribution to understanding the behaviour of the gold price.

Please email charlie.morris@bytetree.com with your thoughts.

Comments ()