Cloned Equities: The Mirror Protocol

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: MIR;

Quant (QNT) dominated the first two weeks of my Token Takeaway articles. If you have not seen my analysis of the promising QNT token, see part I and part II. This week, we are looking at a very different but equally encouraging token: MIR.

Sector: Synthetic Assets

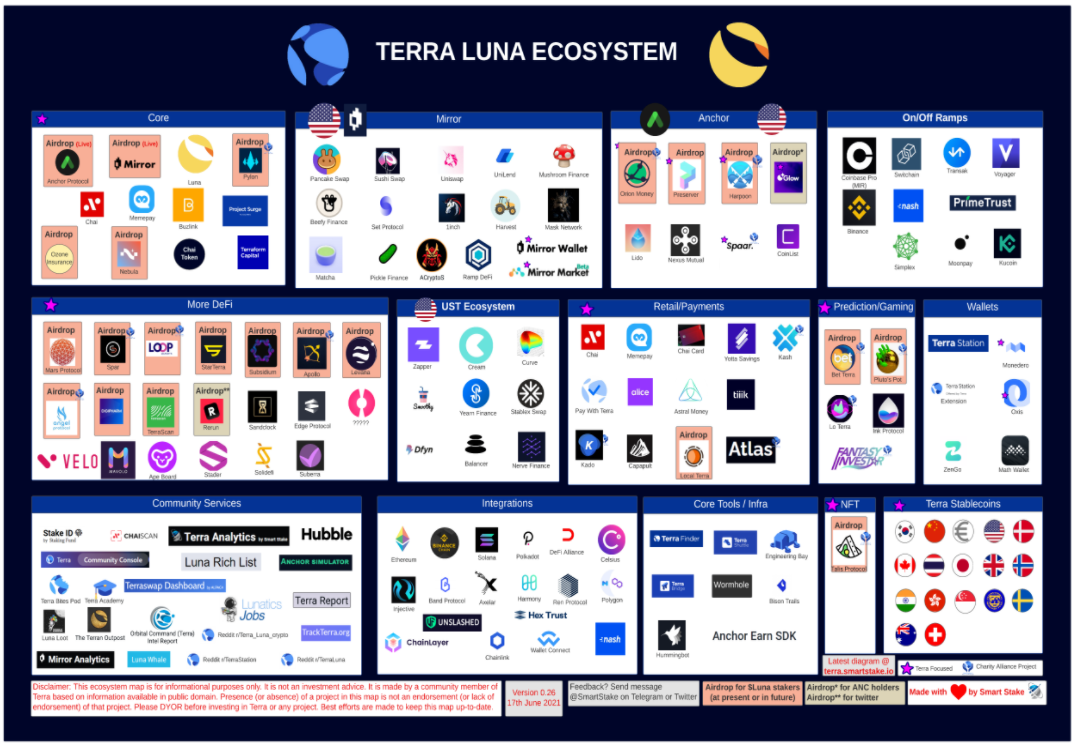

MIR is the governance token for the Terra and Binance blockchain-based protocol, Mirror Protocol. In the first part of this article, we will examine the team and ecosystem around MIR, followed by an analysis of the MIR token itself. The second part will provide readers with a technical and quantitative analysis of MIR and its main competitor, Synthetix.

High-Level Summary

MIR is dependent on the success of the Mirror Protocol, which aims to create a more accessible and less restrictive stock market by tokenising real-world equities on the Terra, Ethereum and Binance Smart Chain (BSC). These tokens are called mAssets; for example, mIAU, a tokenised version of iShares Gold Trust, had nearly $750,000 in volume over the last 24hrs. mAssets can be found here.

MIR acts as the governance token for the Mirror Protocol. Meaning, tokenholders have voting rights on protocol-based proposals. MIR also presents its holders with a yield-generating opportunity through staking and providing liquidity on the Protocol.

The potential for growth in creating a decentralised stock market is significant. However, readers should not ignore the regulatory risks that come with disrupting this real-world sector. More on this in the second half of the article.

The Team

The company behind the Mirror Protocol is the well-respected Terra Money Group, based in South Korea. The Group is part of Terraform Labs, which is behind the Terra blockchain and stablecoins.

Do Kwon, the Co-Founder of Terraform Labs, is behind the Mirror protocol. He appears on the Forbes Asia’s Finance and Venture Capital 30 under 30 list. This is a very promising founder to have built Mirror. In my view they have a credible team, which according to Terraform Labs’ LinkedIn is 56 people strong.

The funding behind the Terra Money team is promising too. In just 2021, Terra has completed two high profile funding rounds, raising $33m, through credible investors such as Coinbase Ventures, Pantera Capital and Galaxy Digital.

Terra has been actively raising capital since August 2018, when it announced a successful funding round of $32m raised from the likes of Binance Labs, OKEx and Polychain Capital.

The Ecosystem Surrounding MIR: Synthetic Assets and CDPs

The Mirror Protocol is aiming to be a leader in the rapidly growing synthetic-asset sector. In essence, synthetic assets are tokens that harness price oracles to track the value of any asset; commodity or equity. In this case, Mirror has been minting tokens that track real-world stock prices, such as Google or Facebook.

Mirror Protocol’s synthetic assets are called mAssets, which, when minted through a collateralised debt position (CDP), reflect the price of real-world equities. CDPs was a term originally coined by the Maker Protocol, one of the longest standing DeFi protocols. This feature provides DeFi protocol users with digital assets in escrow, which (in this case) enables users to mint mAssets.

Readers should understand that CDPs are the backbone of the DeFi sector. A good explainer on the topic can be found here. The CPDs equivalent in the traditional world are collateralised debt obligations (CDOs).

Mirror is not the only protocol involved in synthetic assets; Synthetix is currently the leader in this area. We will provide a more in-depth comparison of the two in our comparative section below.

Another part of MIR’s ecosystem is the Terra Blockchain and the Binance Smart Chain (BSC). According to Smart Stake, Terra has rapidly grown to a $2.15bn market cap.

On the other hand, BSC has cemented itself as a less secure but equally powerful contender to Ethereum. According to DeFiStation, BSC DeFi has nearly $25bn in TVL. You can see why the recent bridge built between the Mirror Protocol and BSC could expose Mirror and MIR to a much wider audience.

The Token, MIR – Governance and Yield

The native governance token of the Mirror Protocol is MIR, but its usefulness does not end there. I have highlighted MIR’s utility in further detail in the table below.

| MIR’s Utility | Explanation |

|---|---|

| Governance Rights | Only available to users that have staked their MIR tokens. Governance rights are key in ensuring that MIR tokenholders can reach a consensus on the changes that happen to the Mirror Protocol. Token holders play a large part in the future outlook of the protocol. |

| Staking | Staking provides MIR tokenholders with dual utility. Firstly, staking gives voting rights to the staker. Secondly, the Protocol’s CDP fees generate yield for tokenholders. This, in effect, is a protocol revenue that is distributed to stakers of MIR. |

| Liquidity Providing | MIR plays a large part in keeping the Mirror Protocol running. MIR is an incentive to on-platform liquidity providers, which are entities that make sure money markets on Mirror have deep liquidity. |

Recent Timeline

25 June 2021: Mainnet Launch of Mirror Protocol V2. Mirror V2 is a possible catalyst.

12 March 2021: Mirrored FAANG Index Launched on Set Protocol and UniSwap. The decentralised asset management protocol, Sets Protocol, has launched a mAsset fund to represent the FAANGs.

2 February 2021: Mirrored TSLA Stock Launched through the Mask Network. Tokenised Tesla stock has been added as an mAsset.

22 January 2021: Mirror Completes Bridge to Binance Smart Chain. mAssets are exposed to a huge market through a bridge between Mirror Protocol and BSC.

15 January 2021: Mirror and Mask Network Partner. This partnership will enable the Mirror Protocol to have access to Mask Network Assets.

14 January 2021: Mirror and UniLend Partner. This partnership has the potential to enable lending and borrowing of mAssets.

24 December 2020: Injective Launches the World’s First Decentralized Stock Futures Trading Platform in Partnership with Mirror and Band Protocol. This partnership has the potential to increase the mAssets futures market.

8 December 2020: Band Protocol chosen to be Mirror’s price oracle. Band Protocol is the chosen oracle for mAssets and helps to determine the variance between real-world and mAsset market price.

December 2020: Launch of the Mirror Protocol.

Technical Analysis

Due to the limited time that MIR has been listed on key exchanges, readers should focus on a swing trade opportunity. Investors should be wary of a drop below the red line (see above), as a new support level would need to be found.

Analysis of MIR’s Closest Competitor

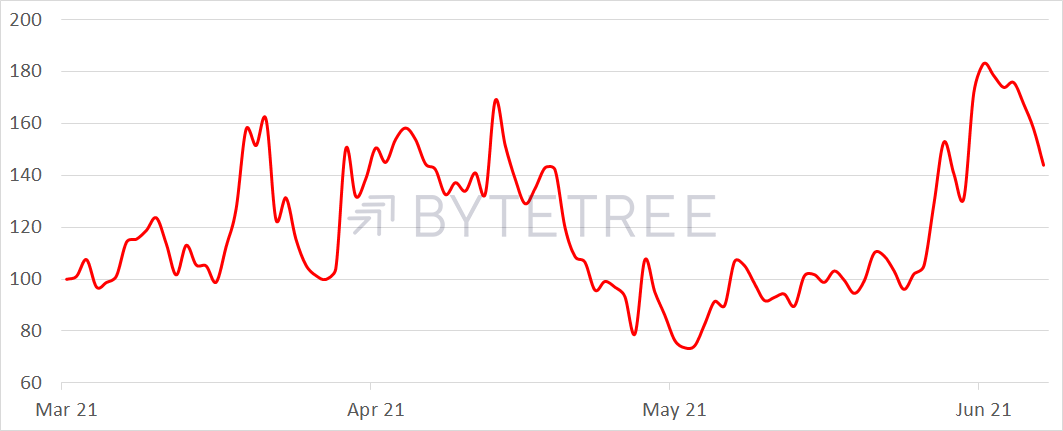

As we can see, MIR has consistently outperformed Synthetix (SNX) since March. However, June has seen a sharp drop in relative performance, signalling that the gap is shortening.

General Statistics

| General | |

| Token Ranking (by Market Cap) | 140 |

| Market Cap | $304,616,586 |

| Price | $3.92 |

| 24hr Exchange Volume | $29,647,898 Terra MIR Volume (24hr): 3m UST |

| Token Analysis | |

| Total Supply (current distribution) | Terra: 256,499,482 MIR ETH: 111,199,248 MIR BSC: 2,876,270 MIR |

| Max Supply | 370,575,000 MIR |

| Circulating Supply | 77,742,701 MIR |

| Supply Held by Top 100 Holders | ETH: 98.44% BSC: 99.10% |

| Total Holders | ETH:24,186 BSC:3,899 Active Terra MIR Users: 4,151 |

| Transfers | ETH: 226,780 BSC: 78,192 |

| Comparative | |

| Traditional Equities Market Size | Q4 Total Value of Global Equity Trading Market: $34.8t |

| Competitor: SNX | |

| Token Ranking (by Market Cap) | 74 |

| Market Cap | $1,075,097,636 |

| Price | $6.78 |

| 24hr Exchange Volume | $45,519,180 |

| Competitor Token Analysis | |

| Total Supply (current distribution) | 158,303,390 |

| Max Supply | 229,059,300 |

| Supply Held by Top 100 Holders | 84.04% |

| Total Holders | 76,845 |

| Transfers | 1,163,324 |

If we compare the “General” and “Competitor” sections, we can see the SNX has a significant margin on market cap. However, I urge readers to also look at the 24hr volume, which has a much slimmer margin between the two.

To me, the “Traditional Equities Market Size” indicates a wider opportunity. Neither token is even remotely close to traditional world levels, which opens up the synthetic asset sector to a significant growth margin.

Where to Buy

| Centralised Exchanges | Crypto.com, Coinbase Pro, Binance and KuCoin |

| Decentralised Exchanges | UniSwap and PancakeSwap |

Conclusion

The Mirror Protocol and MIR have experienced exponential growth since the launch in December 2020. Perhaps capitalising on the uncompetitive synthetic asset market has enabled MIR to outperform the digital asset market. Considering the addressable market share of the global equity markets, I believe that there is room for more than one synthetic protocol.

MIR offers its holders not just governance rights but also two separate yield-generating opportunities. Add the real-world edge of a synthetic asset, and we can see how promising the outlook of MIR is.

On the other hand, we are dealing with a traditional market that is regulated to the brim, and I see this as the biggest risk to MIR; no KYC/AML or jurisdiction regulations seem a bit too good to be true. Big money will not be seen in an equity market without more regulation.

MIR Conviction Summary

- Crypto market: Still weak, on-chain market data needs to up-tick to prove better buying conditions.

- Hype vs Reality: Nearly reality; regulation needs to be addressed - quasi-mania until then.

- Trade or Trend: Too young to call. However, the launch of Mirror V2 could see a price movement from this potential catalyst.

- Market Outperformance: Short-term, yes.

- Competitive Advantage: Synthetix’s has the market share. MIR has performed better and has a relatively higher trading volume (short-term).

Token Takeaway Score: 2.5/5