Profit from the Short Side

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree ATOMIC; Issue 1

In this first issue of ByteTree ATOMIC, you will see actionable ideas and a different tone that gets straight to the point. If you do not understand something, then please write to ATOMIC@ByteTree.com, and I will answer your questions. There is no such thing as a stupid question, so please ask away.

With that, I’ll make my maiden trade.

ATOMIC sells MicroStrategy (MSTR)

In my opinion, this latest chapter within the long Bitcoin bull market is over. It’s been a great run since March 2020, rallying from a $5k low to a $64k peak in May. Do people seriously still expect more?

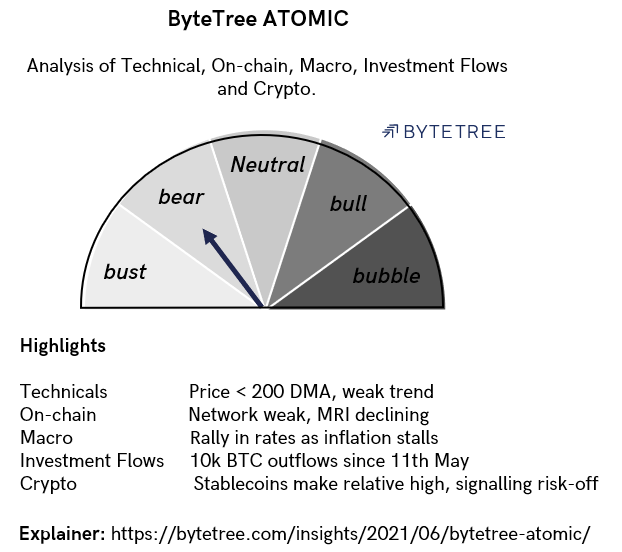

Guessing the top is a fool’s game but picking up the change in the trend is not. The deterioration in the ATOMIC factors, especially on-chain activity, will be hard to reverse anytime soon - more on this in ATOMIC below.

That means the opportunities are on the short side. You can short Bitcoin, but it is volatile (30-day volatility 115%) and will only fall as much as Bitcoin. Better to sell assets that have captured gains beyond Bitcoin, without good reason, because they can fall much further than Bitcoin.

DOGE is an obvious candidate. It isn’t serious, and the price has held up, but trading against Musk’s tweets is unpredictable. More importantly, DOGE is even more volatile than Bitcoin.

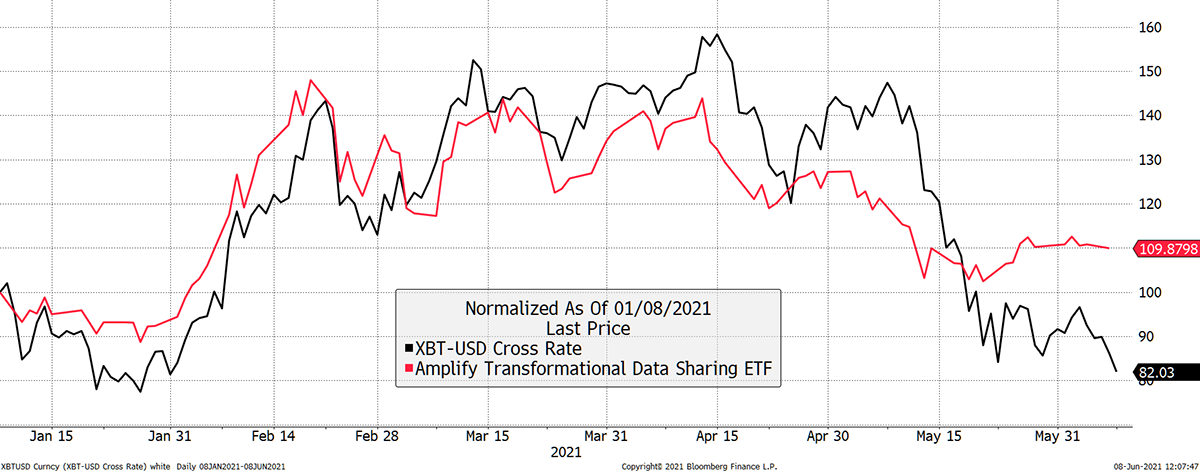

An area with far better risk-adjusted opportunities comes from crypto stocks. The Amplify Transformational Data Sharing ETF (BLOK) groups the leading crypto stocks, and I will use that as my crypto proxy from the stockmarket. Volatility is just 50%, and starting on 8 Jan, when Bitcoin made its first major high at $40k, BLOK is 30% higher than Bitcoin.

Crypto equities are ignoring reality

Source: Bloomberg. BLOK ETF and Bitcoin since 8/1/21 rebased to $100.

This is a simple trade. BLOK has more downside than Bitcoin, despite the fact that BLOK is slightly diluted by stocks with only modest crypto exposure (Square, PayPal, NVIDIA etc.).

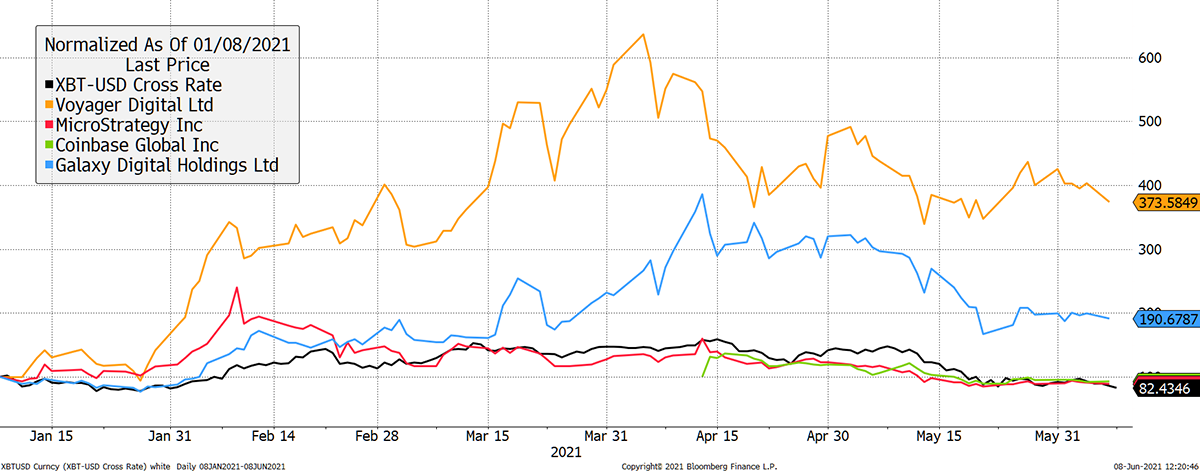

I show some of the top holdings here. Voyager (VYGR CN) and Galaxy (GLXY CN), which are still way ahead of Bitcoin this year, have volatilities of 130% and 120%, respectively. They inevitably have more downside than Bitcoin but with much higher volatility. Consider that.

Source: Bloomberg. BLOK ETF top crypto holdings and Bitcoin coin since 8/1/21 rebased to $100.

MicroStrategy (MSTR) and Coinbase (COIN) are less volatile. COIN is not far from its IPO price in April, which was unquestionably hyped, so we can presume it is overvalued.

MSTR is the most interesting because we can accurately value it. The core software business is perhaps worth $1bn. The company has $1.7bn of debt (so far, although they are issuing a high yield bond), and at the last count, the company owned 92,079 BTC.

MicroStrategy Premium

Source: ByteTree. MSTR premium to net asset value since Aug 2020.

That’s just shy of a 100% premium as at yesterday’s close. That means if Bitcoin recovers, you could still make money as the shares will struggle to maintain this premium. And if Bitcoin goes down, MSTR will fall hard and fast.

Disclosure: I am short MicroStrategy.

All in all, the conservative trade is BLOK. With less volatility, and some overvaluation, it’s the sleep at night option.

VYGR CN and GLXY CN have the furthest to fall but come with high volatility, which isn’t for everyone.

COIN is hard to gauge on valuation as we have little information, but likely expensive.

MSTR is measurably overvalued, and if Bitcoin falls, the bonds will start reeling, and the share price will implode.

ByteTree ATOMIC

Technical

The price remains below the 200-day moving average, with a death cross as the 30-day crosses through. The 20-day max/min lines would need to see $42,540 broken before evidence of a reversal seems likely.

Source: Bloomberg. Bitcoin past year.

Longer-term, the six-year regression rises at 120% per annum, which is still incredible. $40k was the mid-point. $20k seems a likely short-term target as it is the only point of support once/if the $30k level is breached.

Source: Bloomberg. Bitcoin since 2014 log scale regression lines.

On-chain

The Network Demand Model update will be published on Wednesday.

ByteTree metrics point toward a 74% price premium in the short-term, which would see the price revisit $20k without network recovery.

Source: ByteTree Terminal. Bitcoin Premium/Discount, 1 week cumulative rolling, for the past 5 weeks.

On the plus side, lower fees have seen the number of transactions pick up slightly but not that significantly.

Source: ByteTree Terminal. Bitcoin Transaction Count, 1 week cumulative rolling, for the past 52 weeks.

And the percentage of high-value network traffic, Institutional Dominance Ratio (IDR) has fallen to the lowest levels in months. This means the big money has moved on.

Source: ByteTree Terminal. Bitcoin Institutional Dominance Ratio (IDR), 1 week cumulative rolling, for the past 12 weeks.

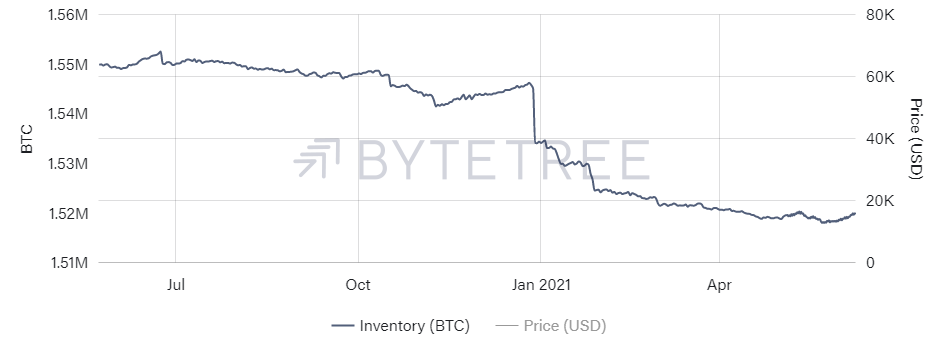

Aside from the slow network data, we know the market bid is soft because the miners’ inventories are rising. This is because the miners don’t want to sell because they know the market can’t take it.

Source: ByteTree Terminal. Bitcoin Inventory, 1 week cumulative rolling, for the past 52 weeks.

Macro

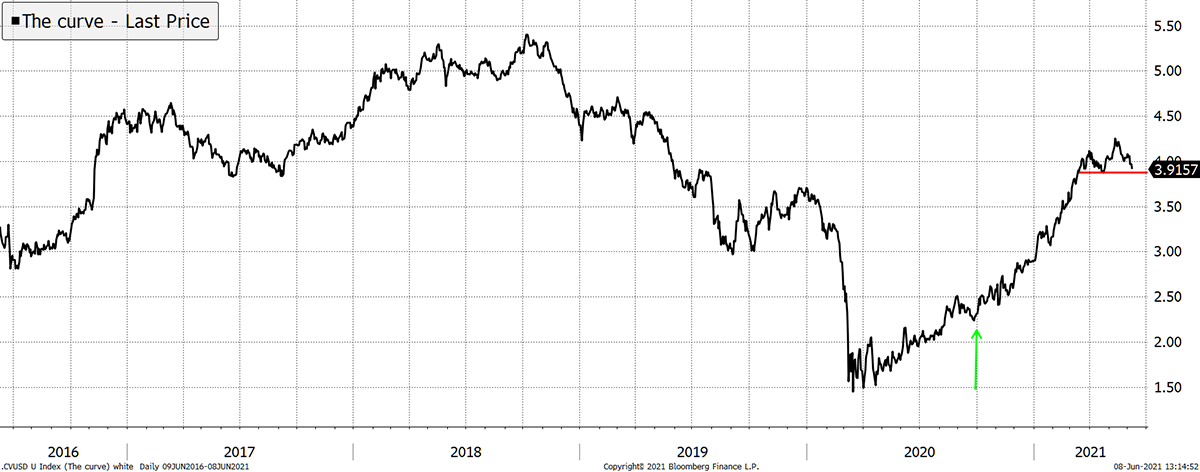

I’ll come back to this in more detail when confirmed but recall that Bitcoin is a risk-on asset. It rises alongside both inflation and the bond yield. In “the curve”, I add them together. Bitcoin has been happy since the curve started rising in March 2020, and the breakout occurred in October once the green arrow marked a continuation of the trend. Right now, the curve is potentially signalling a reversal. Early days, and against the majority view, but there you have it. Risk-off on the horizon?

Source: Bloomberg. US 10-year bond yield plus US 10-year breakeven rate since 2016.

Investment Flows

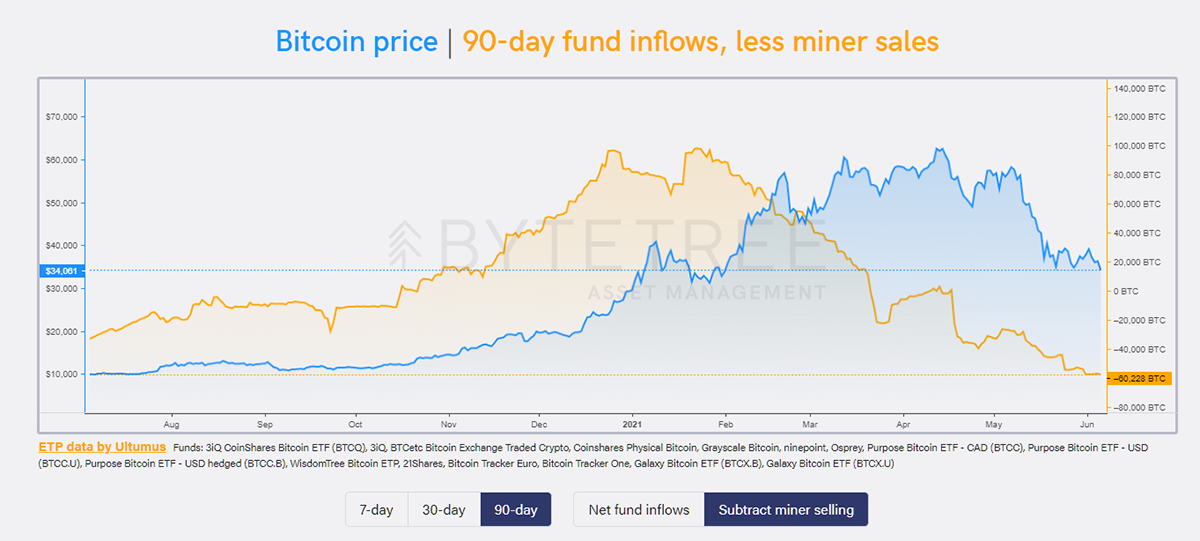

Bitcoin funds have seen 10k BTC leave since the high on 12 May. It’s hardly surprising given the uncertainty. I want to highlight how the net flows (fund BTC holdings less miners selling BTC) peaked earlier this year on a 90-day basis. By that time, the majority of the rally ($5k to $40k) was already banked. The crawl towards $64k took more work because the fund inflows had slowed below the rate of miner selling.

Source: ByteTree Asset Management. Bitcoin price and 90-day fund inflows, less miner sales.

Currently, we are seeing a “network deficit” of 60,000 BTC per quarter, in contrast to an 80,000 surplus in January. That means the miners are selling 60k more BTC than the funds are buying, and as you have just seen, the funds have stopped buying and are now selling.

This is a problem and confirms everything we are seeing elsewhere.

Crypto

Crypto stocks just seem to have their head in the sand. They have held up too well and will likely snap. I see that as the best opportunity.

Looking at the world of tokens, there are no standout situations that want to defy the trend. There will be at some point, but none popping up quite yet.