GBTC Soars as Shareholders HODL

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 83

The Grayscale Bitcoin Trust (GBTC) remains the largest Bitcoin fund in the world, holding an estimated 653,847 BTC. ByteTree’s Bitcoin fund data shows all the Bitcoin funds hold 794,520 BTC, which means GBTC represents 82% of all BTC held by funds. It’s a giant.

Established in 2013 by Barry Silbert, it was way ahead of the curve. To launch at a time when Bitcoin couldn’t be held by a traditional fund, Grayscale adopted a closed-ended fund structure. That means it is a bit like a company that holds BTC on its balance sheet while investors own shares in the company. That worked out well, and GBTC has been a huge success story ever since.

While closed-ended funds are credible long-term investment vehicles, the main disadvantage is that the price of the shares, which are freely traded over the stockmarket, can differ from the value of the asset, known as the net asset value (NAV).

GBTC share price and the value of the Bitcoin per share held

A buyer of GBTC on 18 December 2017, when GBTC traded at a high premium, has lost 18%, despite the price of BTC rising by 85% since. Yet a buyer of GBTC on the 13 May 2021, when GBTC traded at a discount, has lost 17% in contrast to BTC, which is down 30%.

It is important that investors in GBTC understand discounts and premiums. Discounts will almost certainly increase your returns over the asset in the long run, whereas premiums will inevitably quash them. Anything is possible in the short-term, but I reiterate that prices always drift towards fair value over time.

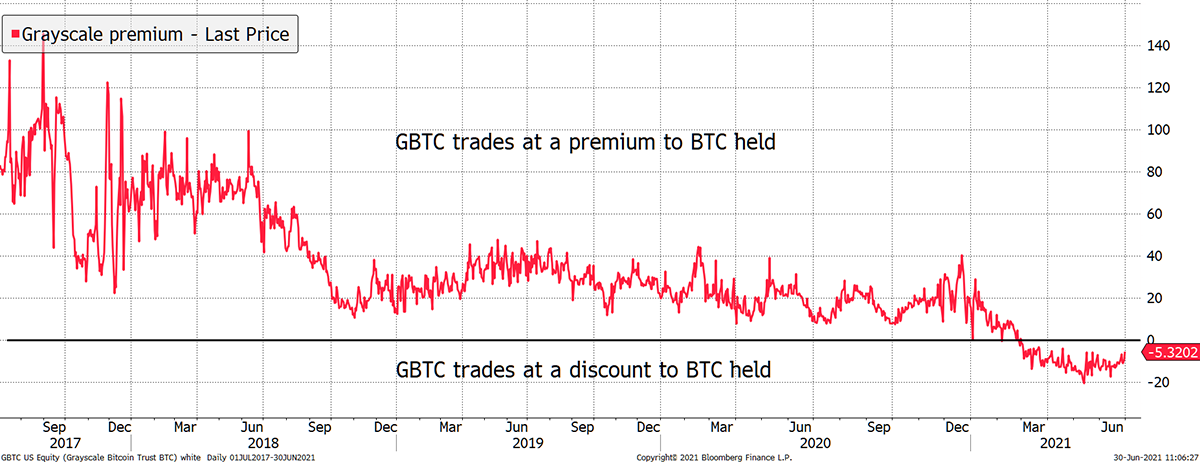

The percentage difference between GBTC and the NAV is shown below. When the shares are above the NAV, GBTC trades at a premium, and when below, at a discount. In September 2017, GBTC investors were paying twice the price of BTC as the premium was 100%. Yesterday they were paying -5% (or a 5% discount), meaning investors were getting some free BTC for every dollar invested.

The GBTC premium/discount

The closed-ended fund structure contrasts with the open-ended funds and exchange traded funds (or products), whereby the share price and the NAV are linked. This provides more certainty to investors, as you know your returns will match the returns of bitcoin.

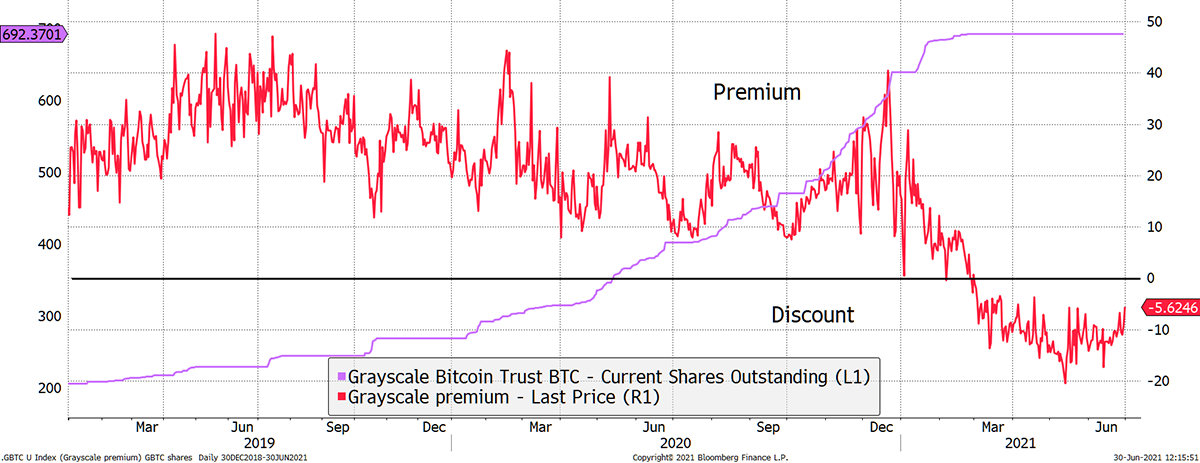

Despite being a less investor-friendly structure, GBTC has ballooned since early 2019 from 200 million shares in issue to 692 million by February this year. The main attraction turned out to be the premium, not because investors wanted to pay more for bitcoin than it was worth, but because investors received the premium.

The deal was that accredited investors could subscribe for shares at NAV and receive their shares six months later. At that point, they were free to sell their shares into the market. If the premium was 30%, their return would be the change in the price of bitcoin plus 30%, assuming the premium held over the six months while they waited.

The Grayscale premium drove the growth in assets

Some investors liked that idea but were concerned about the volatility of bitcoin. They wanted to lock in the price of bitcoin so they only had exposure to the change in the premium. Some did this using bitcoin futures, whereby they would subscribe to GBTC at NAV and hedge their exposure to the price of bitcoin by shorting futures.

The number of BTC futures contracts held short, and the GBTC premium was linked. Not only did the premium attract more investment flows to GBTC, but it led to the growth in short futures contracts. Notice how the number of short contracts fell in 2021 as the GBTC premium collapsed.

The futures market provided the hedge for GBTC

Why did the GBTC premium disappear?

There are probably two reasons for this. The first is that a large number of ETFs appeared in Europe and Canada this year, which have grown their assets at a much faster rate than the closed-ended funds. Consequently, the GBTC monopoly on bitcoin exposure via the stockmarket for non-European investors came to an end.

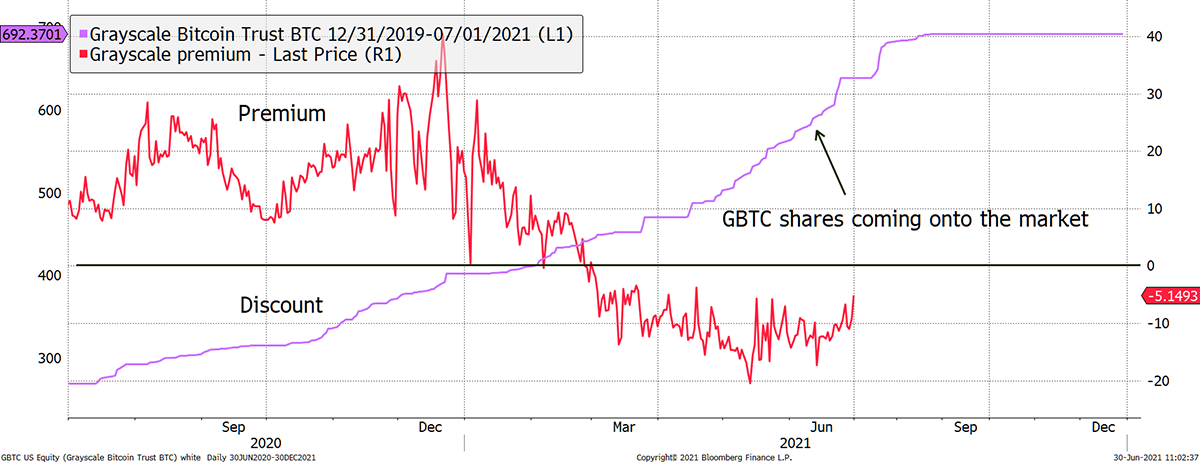

The second is the law of large numbers, where GBTC became a victim of its own success. As I said, the investors had to wait six months before they could sell their shares. In the next chart, I have lagged the shares in issue to reflect the selling pressure coming to the market.

The overhand in GBTC shares is nearly done

Over the past year, GBTC shares in issue increased from around 250m to 692m, which is a huge increase. The premium peaked in late December when the demand for bitcoin was high due to the price surge. At that time, around 150m new GBTC shares had already come to market, with a further 300m on the way over the following six months.

This was huge. With GBTC shares trading above $40, this meant some $12bn worth of stock was coming to market by July 2021. As the market absorbed this, the premium fell, and new subscriptions soon dried up. It was simply too much.

The good news is that the last shares will come to market in the coming weeks, meaning the selling pressure is largely behind us. This has helped to restore confidence in GBTC, and recent trading sessions have seen the discount narrow.

I suspect the future of GBTC will see the premium/discount trade within a much tighter range than we have seen in the past. Naturally, during periods of high demand, modest premiums will return, and during the occasional bitcoin death spiral, we will see a discount.

The bottom line is that the GBTC risk to the bitcoin ecosystem is now behind us. But I would still encourage Grayscale to reduce their fees. You can track the GBTC premium here, along with the Bitcoin fund and ETF daily inflows.