A Compelling Token with Real Use Cases

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree ATOMIC; Issue 2

I want to highlight Quant (QNT) because it stands out from the crowd. It is one of the few coins trading at an all-time high when the crypto market has come under pressure. This is the sort of thing that gets me excited.

Highlights

| Technicals | Short-term rally into resistance |

| On-chain | BTC price 100% premium to fair value |

| Investment Flows | 15k BTC outflows since 11th May |

| Crypto | BTC dominance grows |

| Macro | Rates outlook cools and dollar rallies |

Quant (QNT)

Source: CoinGecko. Quant priced in Bitcoin.

Unlike most altcoins, QNT deserves to keep progressing because there is a credible team behind it, and it serves a useful purpose. That is to link blockchains together and enable them to interact efficiently. Our analysts Tom Salter had this to say:

From a high level, Quant have highly ambitious targets and has performed incredibly well as an investment (even in this year alone). If they can achieve their potential of being the OS and Crypto-AppStore for the digital asset space, then we can assume this success will continue. With such a fast-moving sector, it is refreshing to see a niche idea.

Real-world use cases for blockchains are always welcome in the space. However, I would stress that they are very long and expensive processes. Gilbert Verdian (CEO) has an impressive background, and the wider team seem to have the credibility to see it through. I’m slightly surprised they haven’t tried for another funding round; $11m in July last year is not enough, and this year has been crazy for company valuations.

From a tokenomics perspective:

- I am worried about the supply of the token. No more minting with such a young token suggests a future migration, or a different quant token will be released in the future (or perhaps another mint); this could be detrimental to current tokenholders.

- The distribution of tokens is decentralised. However, as a protocol, I am worried about the centralised nature of their business plan.

- It needs more use cases.

How to Value:

- Number 1 technique should be to look at the use cases and demand for said use cases. Simply, if the QNT token a lot of demand due to the popularity of OverLedger and Quant then, it’s a very positive investment.

- Ultimately, with an enterprise-focused protocol, a lot of integration and many partnerships are needed. Currently, I am not entirely convinced of their partnerships. Safe to say, the names are fantastic, but for a big investment, I would personally have to be convinced a bit more.

- Regulation: this is a significant factor, especially when trying to branch into different jurisdictions.

Time to Buy:

Sadly, I’m not in a position to advise on when to buy QNT, but its journey has a long way to go, so I would say there will likely be a number of opportunities in the future.

Competition:

- At the moment, the competition is fairly slim. That being said, the niche idea isn’t exactly proven. Meaning, I expect competition to increase once the concept is proven. This is not as bearish as it seems; the digital asset space is full of unproven concepts, just as the internet was in the 1990s.

We’ll follow up with a more comprehensive look at QNT on Thursday in our Token Takeaway series. QNT is a breath of fresh air because it reminds us of the scale of innovation within crypto that never seems to end.

And then there’s DOGE

The rise of Dogecoin to a $40 billion valuation and sixth place in the crypto league tables has made a mockery of this space. It is beyond me why people would buy it just because Musk thinks it’s funny to suggest it will be used on Mars.

DOGE is starting to give up ground relative to BTC, which is indicative of the cooling of the altcoin boom. There are similarities to 2017, when Bitcoin lost market share within crypto during the later stages of the bull market, only to regain much of it during the subsequent bear.

Bitcoin dominance

Source: CoinMarketCap. Percentage of Bitcoin’s total market cap, April 2013 to present.

In Jan 2018, BTC dominance fell to 33% of the total value of the crypto space. In contrast, the recent low in dominance was 40%. Some weakness in altcoins is coming through in our models. To my mind, that confirms the crypto tide is ebbing.

I would expect Bitcoin dominance to rise significantly during a bear market, even while the price may be falling, as the altcoins will inevitably fall faster. Should this hold true, Bitcoin will prove yet again to be the superior store of value within the space.

Bear markets are the most exciting part of crypto. You just sit them out and wait for the turn, which you can be sure will come just as night follows day. When things settle and the data improves, you buy. It’s like climbing the escalators.

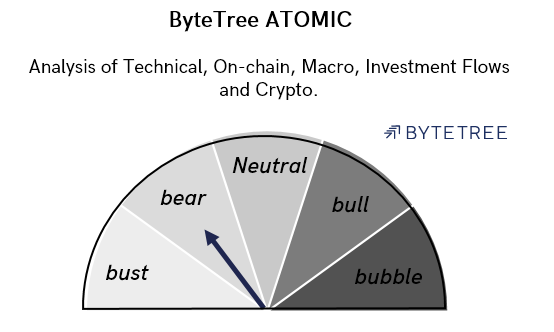

ByteTree ATOMIC

Technical

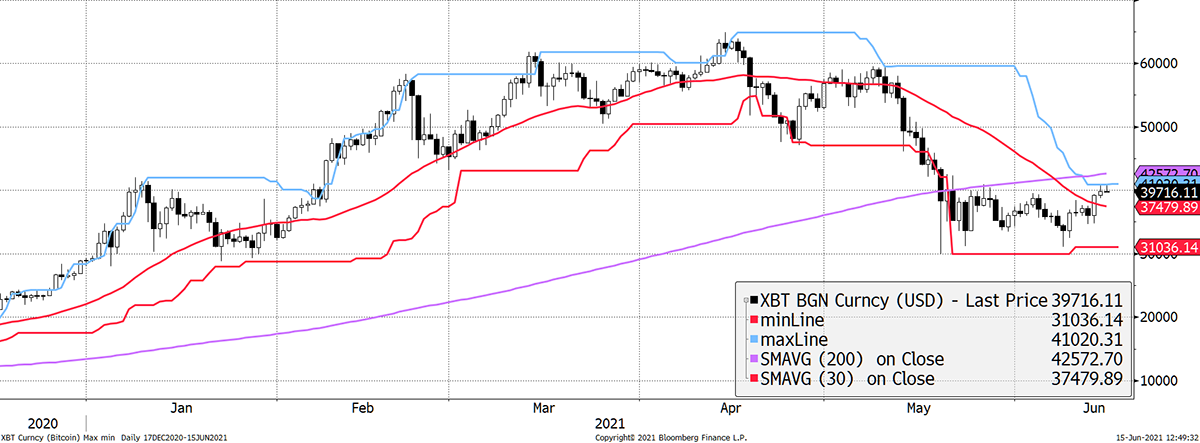

Despite a bounce over the past week, Bitcoin is back at the top of the range. The price remains below the 200-day moving average, with a death cross as the 30-day has crossed through. The 20-day max/min lines would need to see $41,000 broken before evidence of a reversal seems likely.

Source: Bloomberg. Bitcoin price performance for the past six months.

Bitcoin is not one of those assets that sit comfortably below the 200-day moving average. If the price remains below the 200-day moving average for another 43 days, it will flatten and start to turn negative. It looks like a $30k to $40k range until proven otherwise.

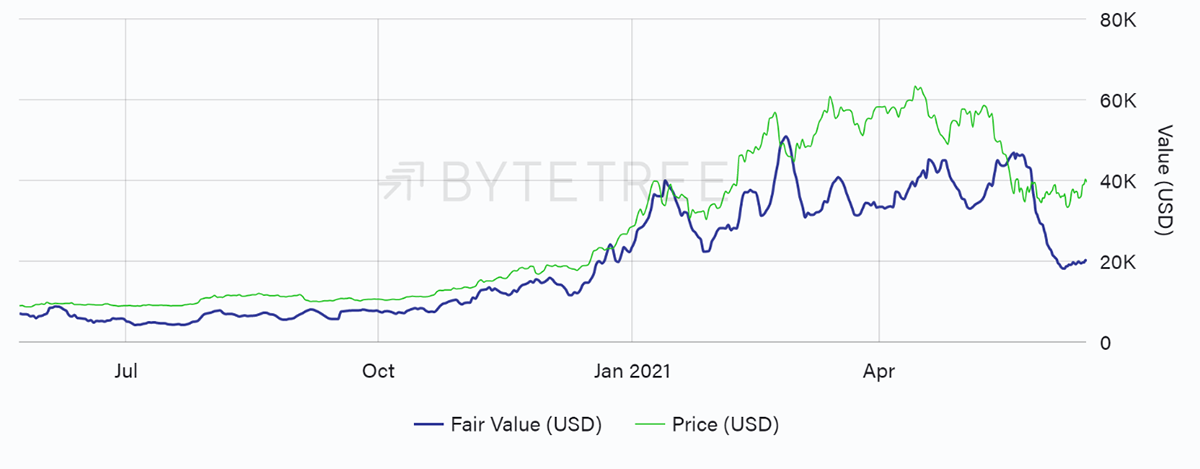

On-Chain

Fair value (7-day average), derived from the prevailing level of on-chain activity, has settled at $20k.

Fair value points to a break below $30k

Source: ByteTree. ByteTree Fair Value for the past year.

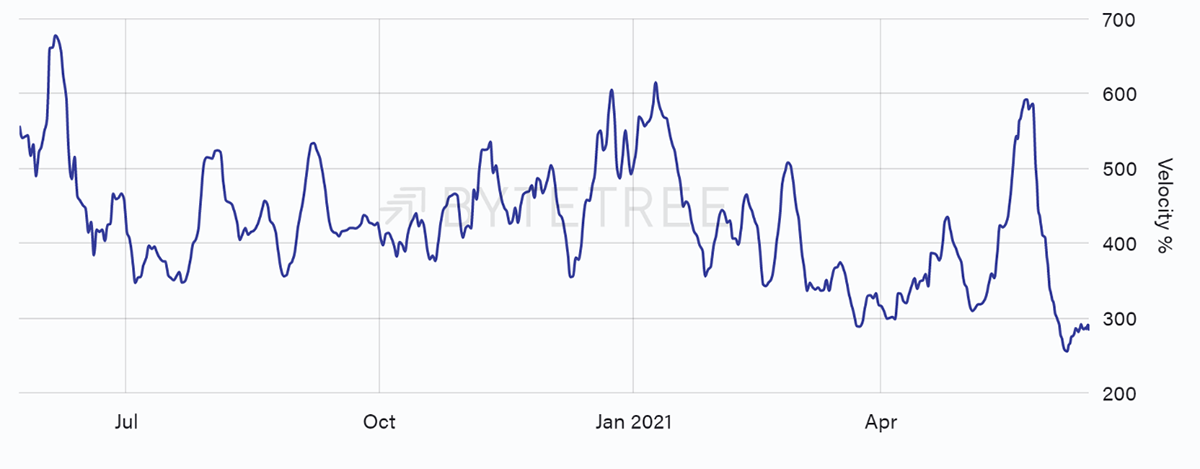

It is hard to get enthusiastic when network velocity is so weak. 300% means an average Bitcoin moves around the network three times per year. With so much HODL going on, it’s a number that seems to be structurally falling over time, but even so, 300% is too low to get bullish.

I would add that the difference between “buy the dip” and ignoring it shows up in velocity. Violent price corrections accompanied by a velocity spike have led to V-shaped recoveries. In contrast, falls on weak velocity haven’t.

Velocity remains low

Source: ByteTree. ByteTree Velocity over the past year.

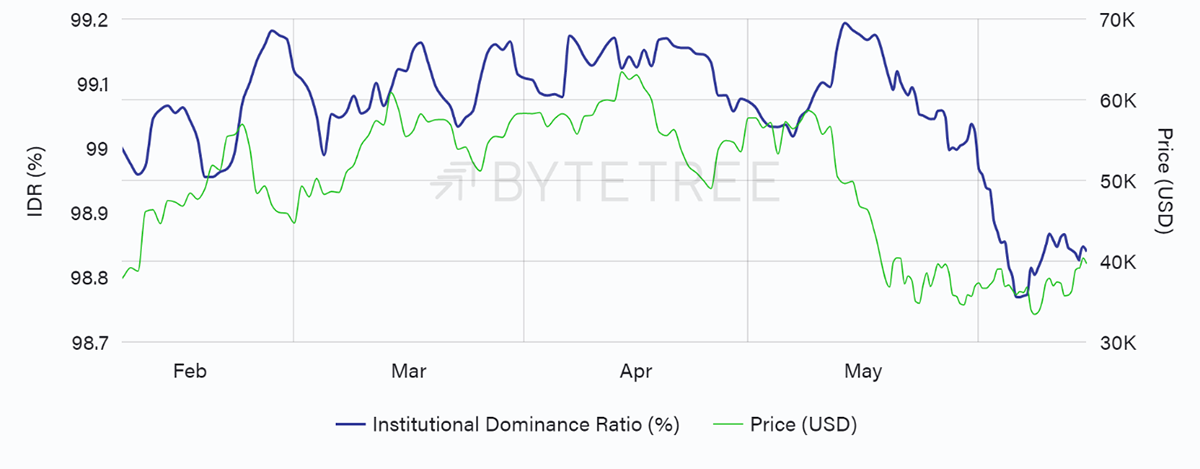

The main culprit seems to be a drop in the level of institutional activity. Not even MicroStrategy buying $500m of BTC last week has managed to budge that.

Institutional activity slows

Source: ByteTree. Institutional Dominance Ratio (IDR%) and the price of Bitcoin, since February 2021.

Macro

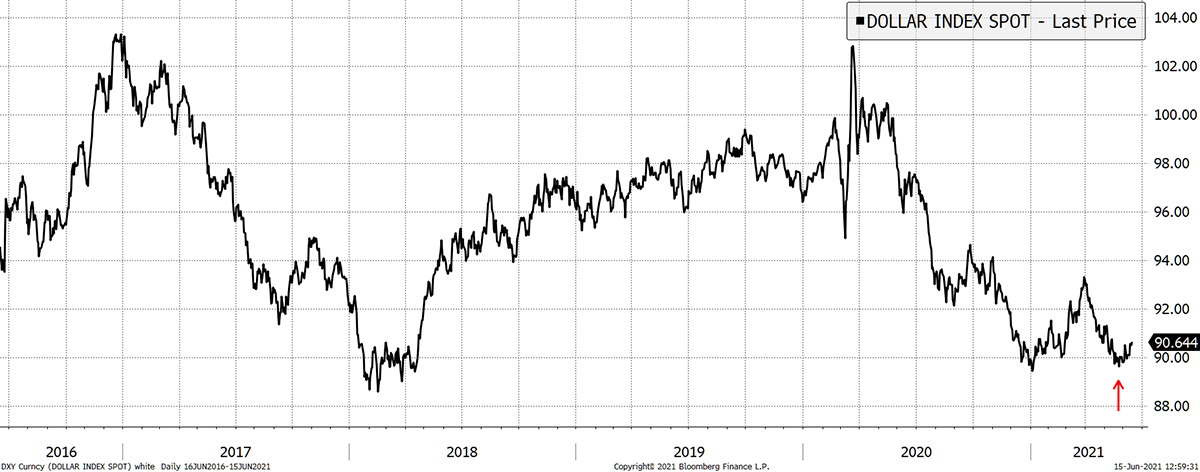

It may be nothing, but the dollar isn’t collapsing despite vast deficits and so forth. The trouble is that all the major currencies are fighting out an ugly contest.

Dollar turns up

Source: Bloomberg. US dollar index since 2016.

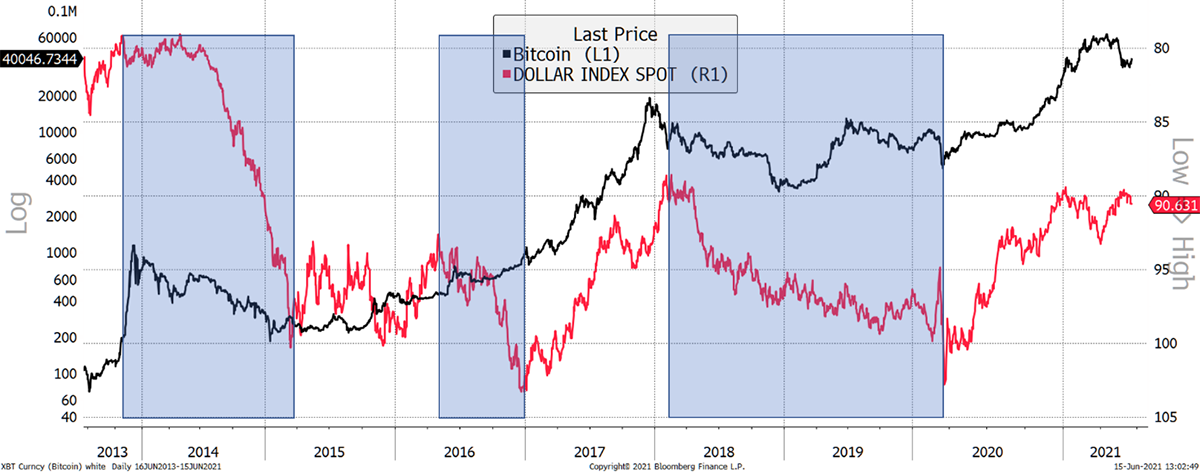

A dollar rally isn’t much fun for crypto. I have shown the dollar (inverted) against Bitcoin. The dollar rallies are highlighted in blue (as falls because it is inverted). The 2016 rally perhaps stalled a bull market, but the 2014 rally was devastating. The 2018/9 wasn’t much fun either.

Dollar rallies are headwinds

Source: Bloomberg. US dollar index and Bitcoin shaded areas highlight dollar rallies since 2013.

With quantitative easing underway, a sudden dollar surge seems unlikely. But we should watch out for the Fed tomorrow, who will have something to say.

We all know that markets are so buoyant because the Fed is printing money, and the risk is they take their foot off the pedal. A rate rise is off the cards, but a slowing of QE is becoming increasingly likely.

Investment Flows

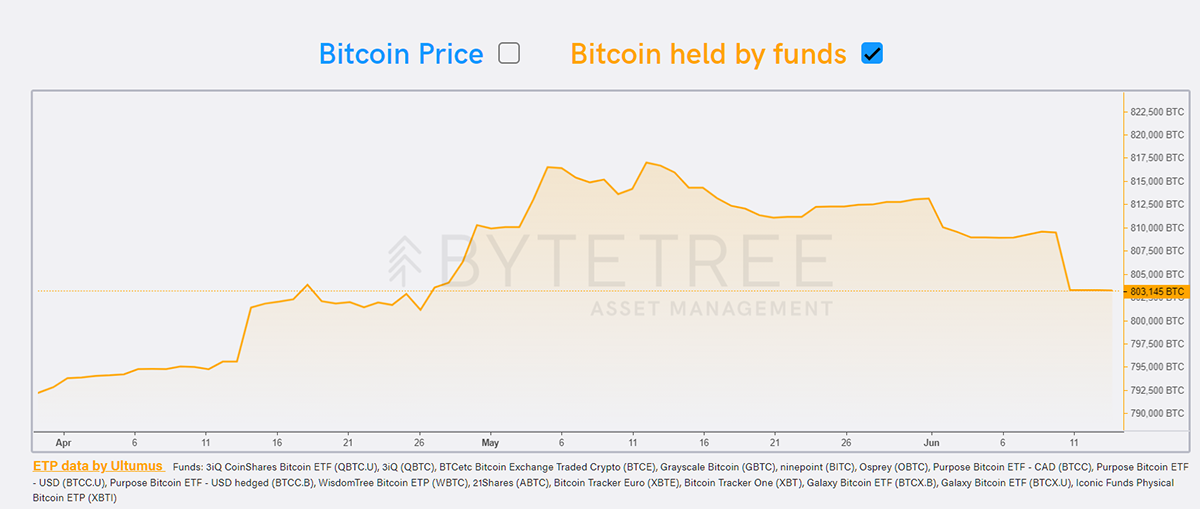

Bitcoin funds have now seen 15k BTC leave since the high on 12 May. There is so much talk about institutional adoption, but we can’t see it in fund activity. Yet I know it will come, possibly at lower prices.

Souce: ByteTree Asset Management. Bitcoin held by funds.

The beauty of Bitcoin is its self-correcting nature. Lower prices reduce the impact of miner selling and attract inflows. Early last year, institutions didn’t see a single Bitcoin during the March 2020 Covid-19 related selloff. In fact, they purchased around 120,000 BTC by the end of June.

This will happen again, but I would think allocators are turned off by the noise. A quieter Bitcoin will see them return.

Crypto

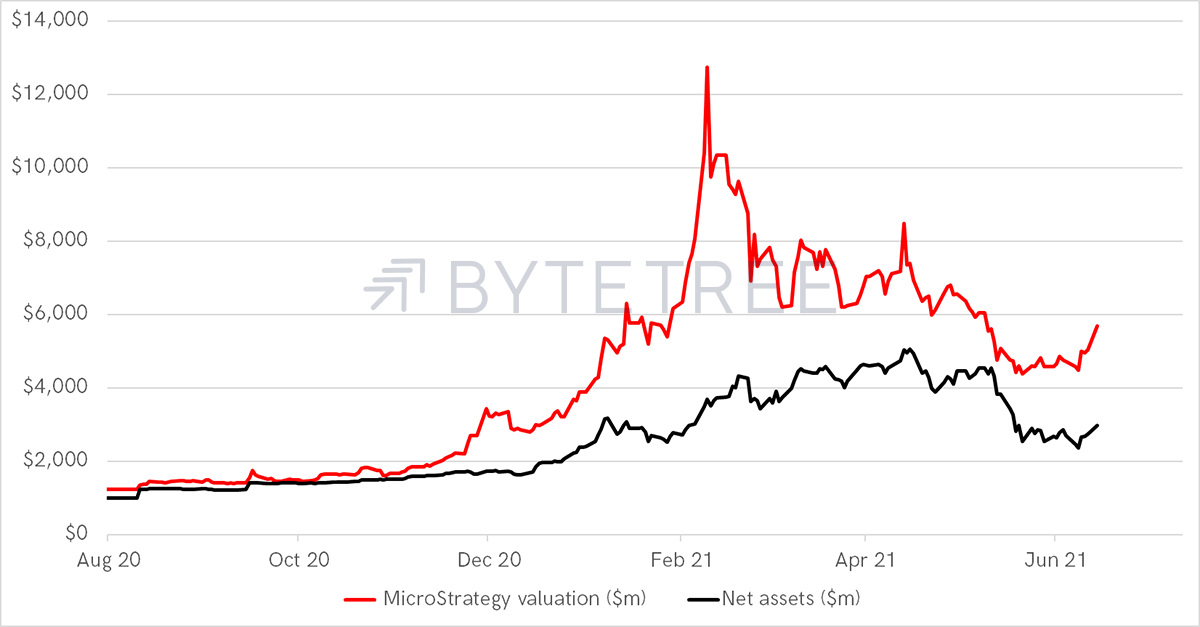

Interestingly, the 15,000 BTC sold by the ETF over the past month is more or less what MicroStrategy (MSTR) has just purchased. That may well explain last week’s bounce.

I did some work on MSTR. They added $500m of debt to bring the total to $2.200bn. They hold approximately 106,365 BTC, and I would say their legacy business is worth $1bn. That means they have assets of $5.187 bn and liabilities of $2.200 bn, leaving net assets of $2.897bn. Yet, the company is valued at $5.7bn or 91% above fair value.

MicroStrategy Premium

Source: ByteTree. MSTR net assets and market cap since Aug 2020.

As a geared play, it should move 1.4x more than Bitcoin in response to a price change. That’s all well and good at fair value, but at a 91% premium, it has a wipe-out downside should Bitcoin fall below $20k. It’s an efficient hedge in that sense because you don’t need much of it to cover the worst outcomes.

Disclosure – I am short MicroStrategy.

Comments ()