Revisiting Bitcoin's Macro Links and Valuing MicroStrategy (MSTR)

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 76

Bitcoin has much in common with the tech sector, especially social media and other internet-related stocks. I became excited last autumn when Bitcoin started to outperform a buoyant NASDAQ at the time. That saw a three-year relative high (green line break) followed by an all-time relative high in Q1 this year (red line break).

Bitcoin and Nasdaq

While Bitcoin has enjoyed long-term outperformance, it has remained correlated much of the time. That means prices rise and fall together, but not necessarily to the same degree. This took a break after the Q4 2020 breakout, but last week, it returned.

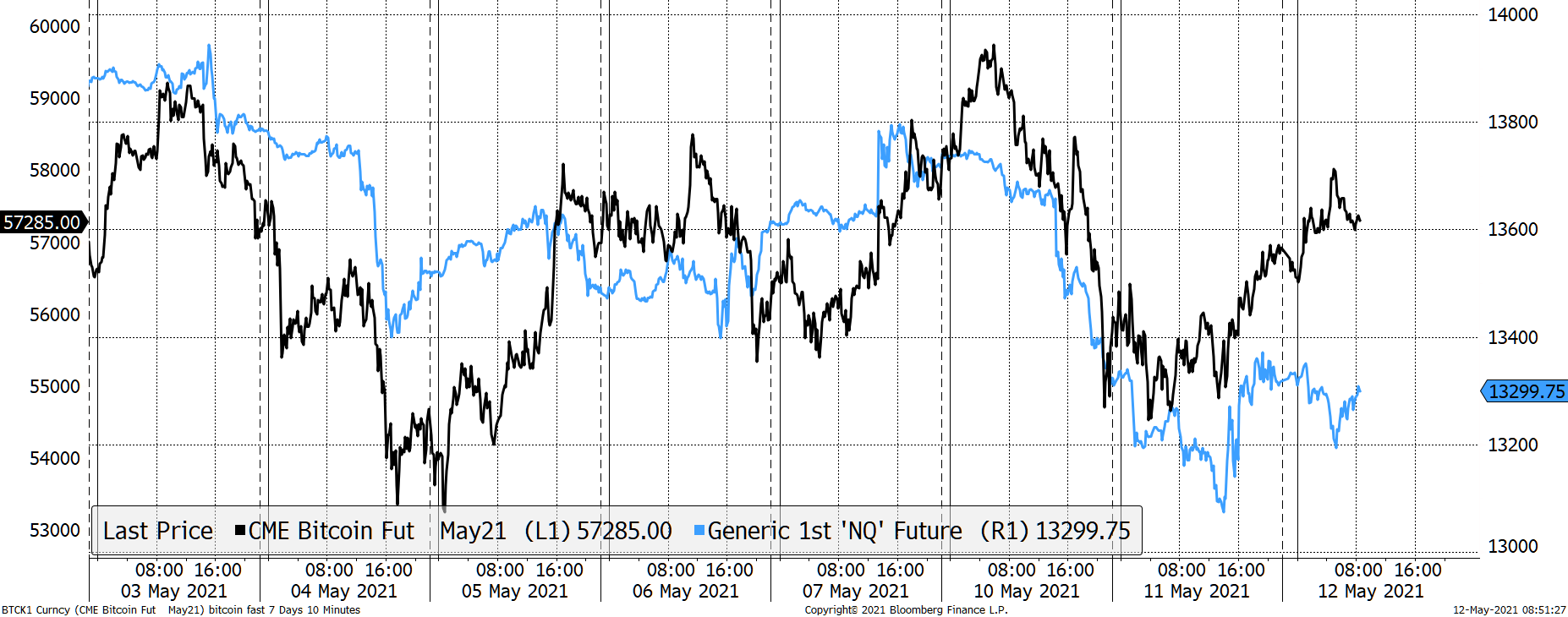

The NASDAQ (blue line), home to the great tech stocks, has had a rough week, with a sharp fall on Monday, in what resembled a mini-macro selloff. Bitcoin fell in sync with general markets, which reminds us that it is unreasonable to expect it to be exempt from macro shocks.

Bitcoin resembled tech during Monday’s selloff

With Bitcoin’s Q4 2020 relative high versus the NASDAQ settling at more than 4x outperformance (first chart), it’s been one hell of a run. It is fair to say that during periods of explosive excess return, correlations with the mainstream fall. Not only did Bitcoin outperform, but acted with greater independence. However, once the excess return is complete, they would start to move in sync again.

Monday’s miserable market move cannot be dismissed. We all know we are living in excessive times. Bitcoin is unlikely to be sheltered from a collapse in general asset prices.

What are the equity markets telling us?

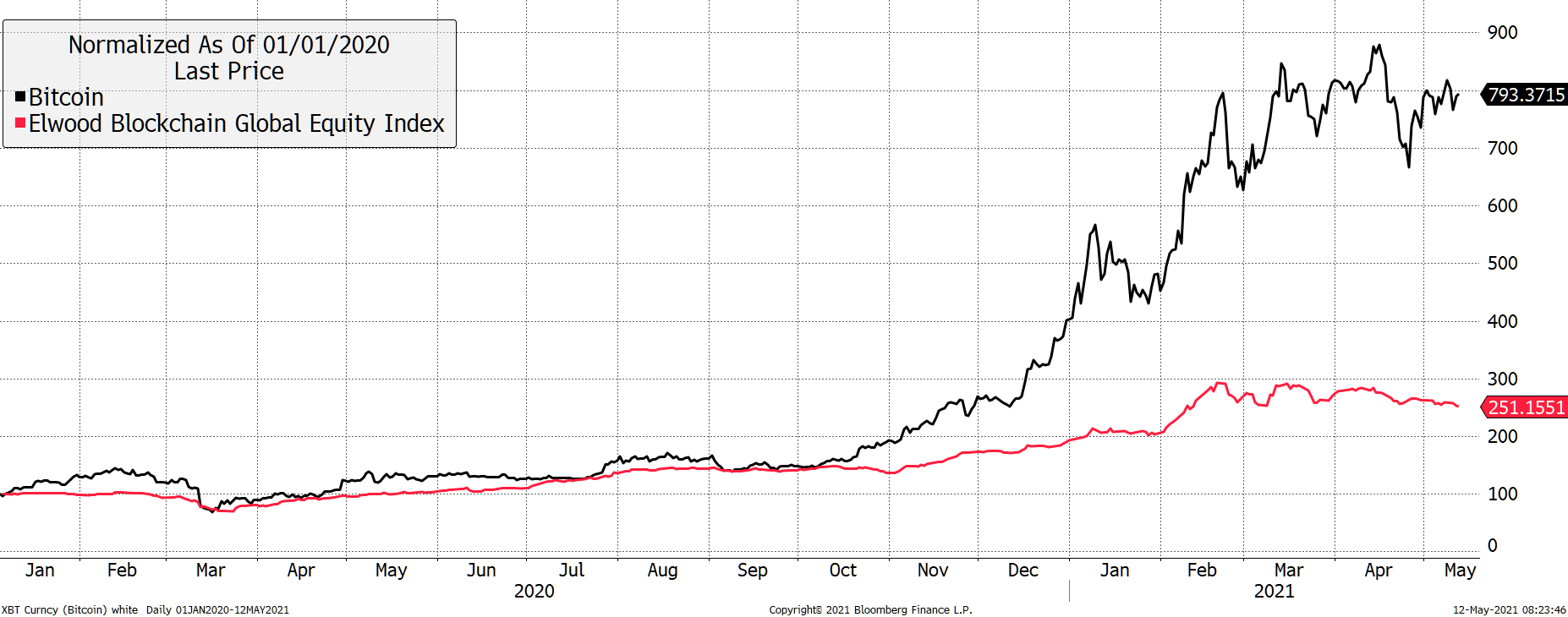

Following a stream of IPOs, there are now more blockchain-related stocks directly linked to Bitcoin, such as Coinbase and CoinShares. There are also various miners, such as Bitfarms, Argo and Hive. And of course, the great MicroStrategy, run by Michael Saylor, Bitcoin’s Head of Sales. Elwood has created an equity index of blockchain-related stocks.

Bitcoin and the related stocks

I was reminded by a colleague, Charlie Erith, CEO of ByteTree Asset Management, how mining stocks (the old school type) normally drift off ahead of the peak in the underlying commodities. This index is still relatively defensive compared to crypto, as it holds stocks with tenuous links, such as Taiwan Semiconductors and CME group. Still, it’s the best we’ve got.

On a relative basis, I have highlighted Bitcoin bull (blue) and bear markets (red); outperformance of Blockchain stocks occurs during Bitcoin bears.

Blockchain stocks relative to Bitcoin

But as I said, this equity cousin is calmly constructed. No doubt, if it solely held pure plays, such as MicroStrategy, the asset managers, and the miners, a very different picture would emerge. Many of these stocks are so new to the market, but this idea will start to evolve in 2022 and beyond.

Perhaps a better way to understand this is through valuations. I have written much about the Grayscale Bitcoin Trust (GBTC) and its drift from an eye-watering premium to a stubborn high-teen discount. I can show you a similar exercise with MicroStrategy.

MicroStrategy

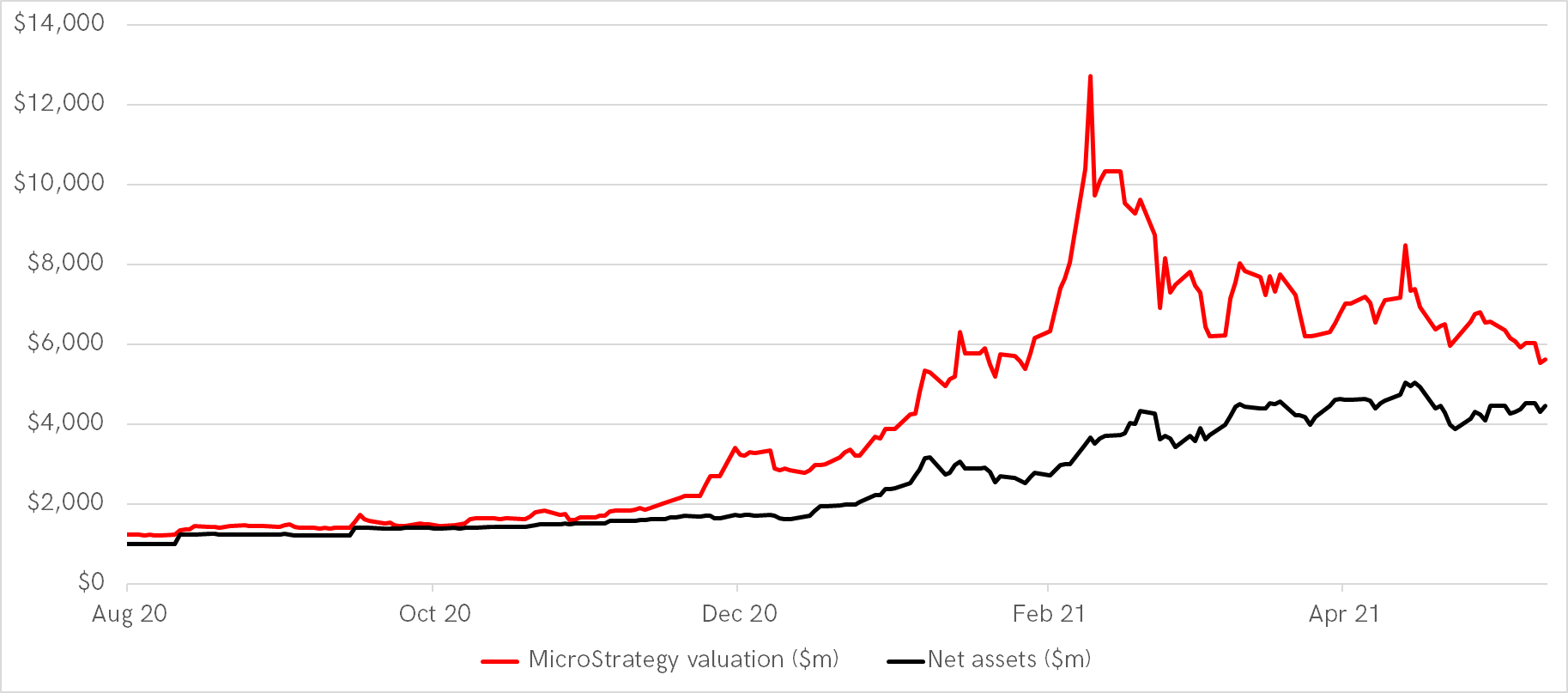

MicroStrategy (MSTR), at its core, is a $1bn software company, judging by its enterprise value over recent years (market cap less cash plus debt). Last summer, it had around $600m of cash on its balance sheet, which was invested into Bitcoin.

By placing Bitcoin onto its balance sheet, the share price went from reflecting the cashflows of a software company towards a Bitcoin fund. It became a must-have for institutional investors, as many were not allowed to invest in crypto either directly or via funds.

MicroStrategy’s holding has grown to 90,859 BTC at the last count, worth over $5bn. This large holding was acquired with help from two convertible bond issues, amounting to $1.7bn. MSTR made a cool $3bn + profit for shareholders.

MicroStrategy valuation compared to assets

It was a great call as MSTR stock rose from $124 in August 2020 to $1,300 on 9 Feb 2021. Yesterday it closed at $576.

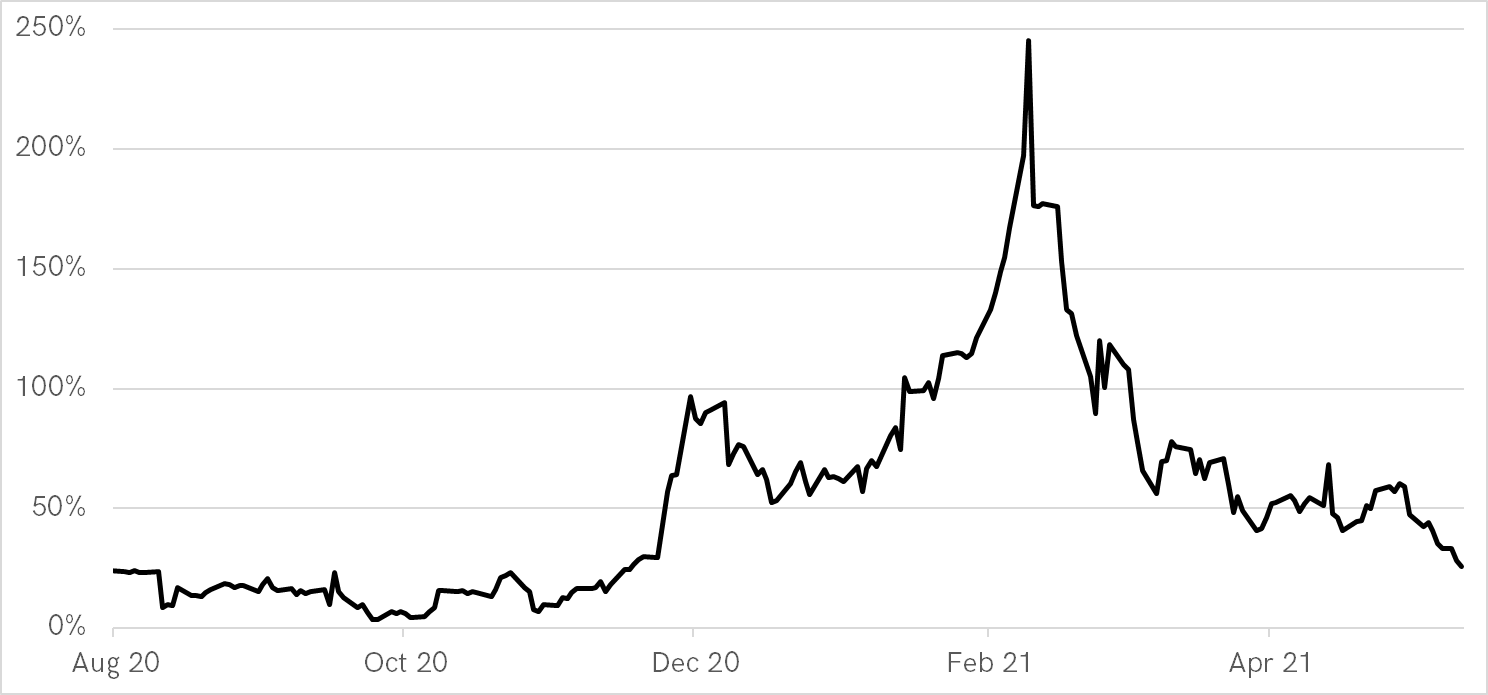

This idea can be expressed as a premium to net asset value. How much is MSTR valued beyond its breakup value?

The MicroStrategy Premium

The premium to net assets peaked at 250% in February and has fallen to 26% as of yesterday’s close. I see this as another institutional investor sentiment indicator. GBTC also expresses that, but it has structural issues, as it currently cannot buyback stock and close its discount. Maybe that will change.

In contrast, MSTR can. It has the legal freedom to sell its bitcoins if it wanted to, although I can’t see Saylor agreeing to that anytime soon. At least that right to sell, and to subsequently buyback stock, gives investors comfort.

MSTR has a cushion. Using this simple analysis, the company remains solvent, provided the price of Bitcoin stays above $8,000. The bonds would go into a tailspin well before that. Below $20k, perhaps?

Say Bitcoin corrected to $15k, MSTR bonds would bleed, and the equity would collapse. I recall Amazon convertible bonds offering a 55% yield in 2001 – little wonder the equity was so cheap at the time (down 95% from its peak). If Amazon 2001 is the model, MSTR would see a $50 share price.

But Bitcoin wouldn’t stay low forever; it would recover because that’s what it does. The network isn’t going away, but as we know, the price is volatile. Then if Bitcoin rallies beyond $100k post the 2024 halving, MSTR would have a fair value of around $1,500. Being a bull market, it shoots to a premium. Now $3,000!! What a trade that would be.

This isn’t a prediction, just a scenario. The more financial instruments that come to this space, the better it gets, as there are more pricing anomalies to exploit. For the big money, the greatest profits will come from the cycle.

What did Buffett say? Be fearful when others are greedy. Be greedy when others are fearful. It worked for him.

Comments ()