Bitcoin Fund Flows Stall

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 75

I have written much on these pages describing Bitcoin’s sweet spot. Important factors include robust technicals, macro tailwinds, positive investment flows (people buying it), and above all, robust on-chain network data. I shall go through these in turn.

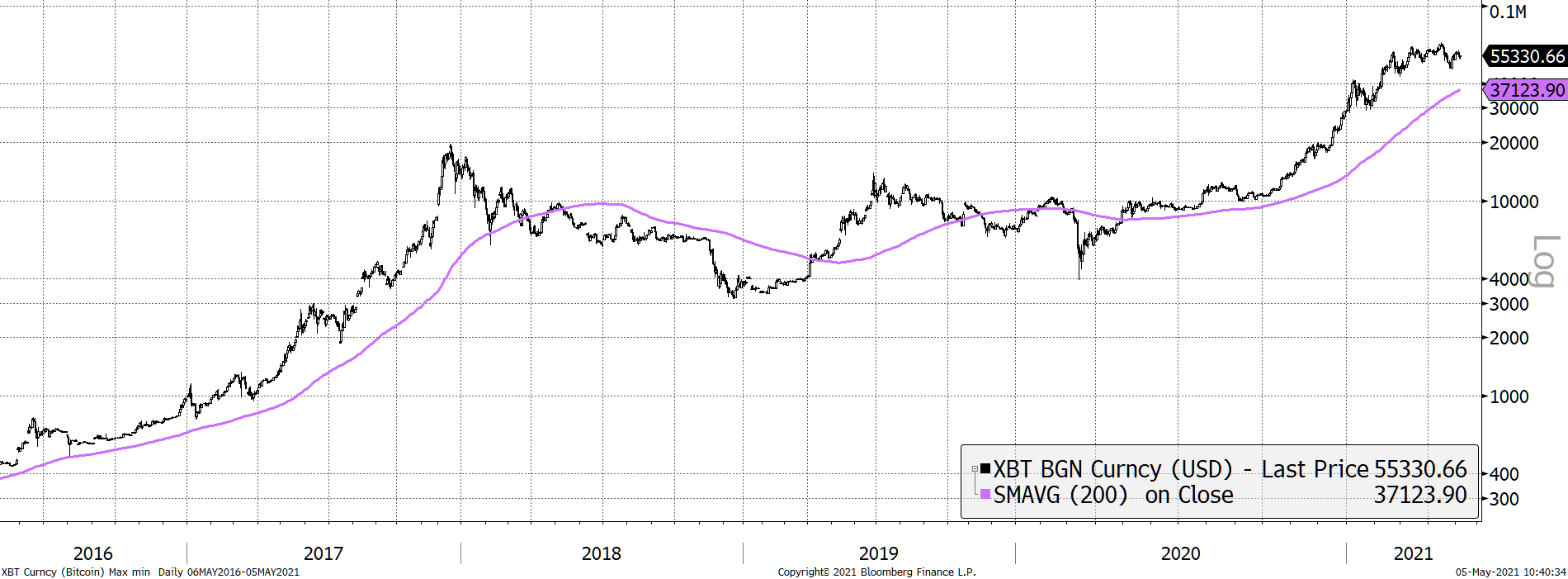

Technicals

The long-term picture remains bullish as the 200-day moving average is happily rising. The trend has slowed, but even the best space rockets eventually run low on fuel.

Positive trend

Other technical indicators, such as weekly MACD, show the trend to be slowing, but there is no sign of breakdown. It is more of a frustration that the price of Bitcoin has stalled for the past 2 ½ months.

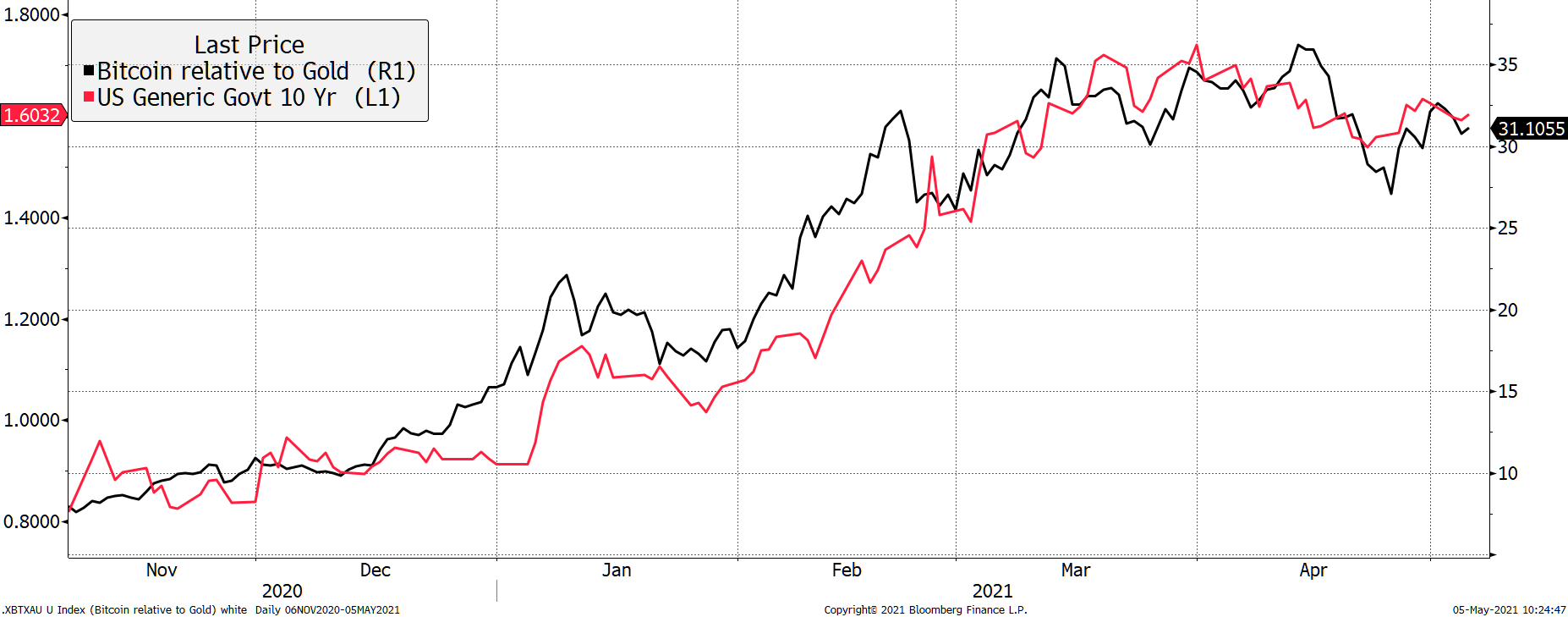

Macro

I have written much about Bitcoin’s relationship with the bond yield, which broadly reflects the state of the economy. Like industrial commodities, Bitcoin is happiest when inflation is rising, and the economy is doing well. A stronger economy tends to coincide with a rising bond yield and more vibrant markets - and vice versa.

In late March, the bond yield put in a high, marking Bitcoin’s peak, but then soon reversed.

Bitcoin eases as bond yields fall

Last summer, a Bitcoin was worth five ounces of gold and subsequently rallied to 35 ounces. Now at 31, having touched 27, gold has started to rebound from its lows.

Unlike Bitcoin, gold thrives on a falling bond yield which explains its recent recovery, while Bitcoin has eased. I stand by my gold price target for 2030 of $7,000 per ounce (currently $1,777). The hare can see the tortoise.

I have told the gold versus bitcoin story and its relationship with the bond yield, but it fell on deaf ears. This rule has worked, and it will keep on working. Identifying assets with different characteristics is the holy grail when investing, and that’s why I am so bullish on BOLD.

Risk-on conditions are cyclical. In recent months, a narrative has been building that Bitcoin is immune to this cycle as it is the “hardest money ever”. Even if it is the hardest money ever, there are times when hard money falls. End of. Besides, if being hard was so valuable, Glasgow would resemble Monte Carlo.

I very much doubt that Bitcoin is cycle proof. It will face the macro winds like everything else. It will thrive in risk-on and slump during risk-off.

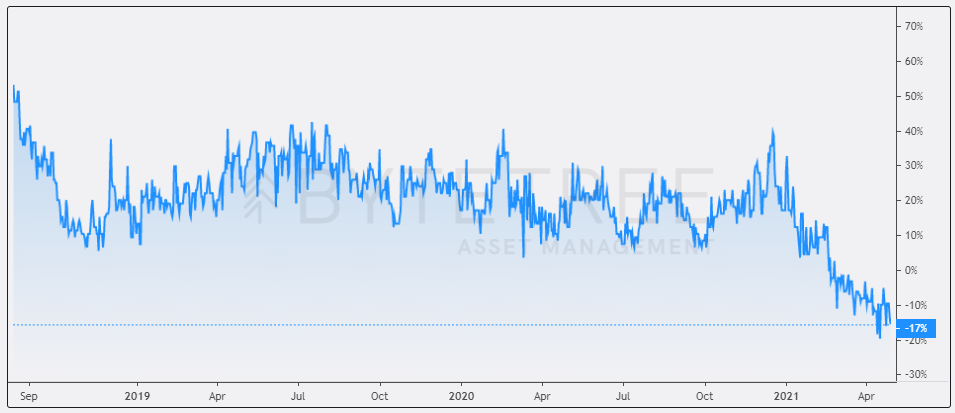

Institutional Bitcoin flows

Investors see this and are acting as expected. In recent weeks, the inflows have dried up. The most visible sign of this comes from the Grayscale Bitcoin Trust (GBTC). When it was hard to invest in Bitcoin via the stockmarket, GBTC was one of the few solutions. Now there are many, with more favourable structures and lower fees, there is a scramble for the exit.

I wrote about this some weeks ago. Since then, the discount to net asset value of the bitcoins held, has widened further.

The Grayscale discount

This discount has refused to close despite a $250m purchase last month by the manager, Digital Assets Group. Failing to have much impact, they upped the ante by announcing a further $500m stock purchase last weekend. Yet still, the discount persists.

This is a $30bn fund, and large amounts of money want to leave. Under such circumstances, modest buybacks will not be enough. I say modest because so far, $750m of stock has been earmarked for a buyback, yet the discount is around $5bn in dollar terms.

This discount will continue to widen until investors that wish to sell have been able to do so. That will only come when an exit mechanism has been established.

Yet it goes beyond GBTC, as premiums in all Bitcoin and crypto funds have closed too. Even Grayscale’s Ethereum Fund (ETHE), which traded at a 948% premium last summer (no typo) now trades at a 6% discount. ETHE shareholders are up 22% since the worst day (4 June 2020), when Ethereum rose 13-fold. This stuff matters.

It is hard to say whether this important issue within crypto is down to the legacy structures now having better alternatives or selling pressure in general. Selling pressure in Grayscale funds does not necessarily cause crypto prices to fall, as there is no direct transmission mechanism, but it does demonstrate the desire to cash out to some degree. We know that pressure is building from what we can see in the rest of the Bitcoin fund space.

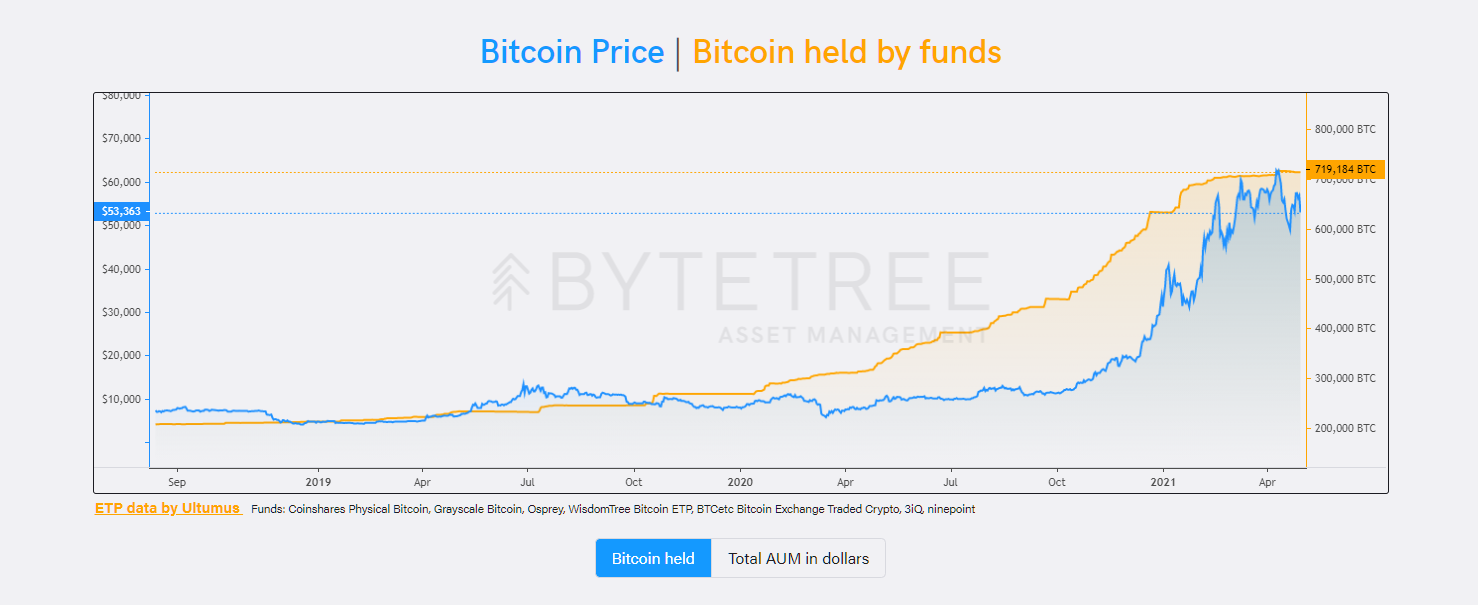

Bitcoin fund flows

Flows into Bitcoin funds have dried up, and over the past three weeks have seen 3,095 BTC leave. That’s modest compared to the near 800,000 BTC under management, but when you consider how instrumental these funds have been in driving performance in the fourth quarter, there can be no doubt that the bulls should pray for inflows while fearing outflows.

On-chain metrics

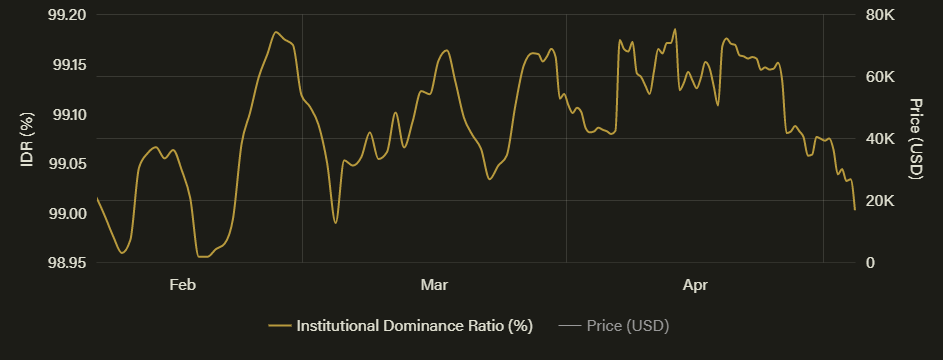

If the discounts are widening and the Bitcoin ETFs are seeing outflows, then someone is picking up the slack because markets must balance. ByteTree’s institutional dominance ratio (IDR) tells us how large transactions have eased as a percentage of all transactions. A reading around 99% is indicative of heavy institutional activity. In 2018, this dramatically fell as they left.

Institutional dominance dips

IDR is not so much about the short-term peaks and troughs but rather the level. 99% is fine and shows stability, but if it drops to 98%, 97% and so on, then that would warn of trouble ahead.

Ever since the Chinese mining outage a few weeks ago, network activity has eased back. That led to a fee spike, which led to a drop in transactions. With the level of mining difficulty lowering in response, things are returning to normal.

It all points to a more subdued and prolonged period of consolidation. Volatility, despite what you might think, is still below average, which provides yet more evidence of stability.

The thing that curtails my bullish feelings continues to be the long-term selling pressure that weighs on the market. Just under a million BTC are coming by May 2024. That is painful.

The thing that keeps me bullish is the ongoing innovation, and just like Bitcoin, it never seems to sleep.