Is Binance Smart Chain the future?

Disclaimer: Your capital is at risk. This is not investment advice.

Binance vs Ethereum;

The recent Coinbase offering has left many wondering whether this float will set a precedent for the other exchanges in the digital asset ecosystem. While Coinbase is valued at $62bn (as of 22/04/21), it often has trading volume below that of Binance exchange, FTX and even decentralised exchanges like UniSwap. The obvious difference between Binance’s token (BNB) and Coinbase’s ($COIN) is that the latter is equity. However, it certainly sets a benchmark for other digital asset exchanges.

Ethereum has been a victim of its own success; it consistently dominates the decentralised application (dApp) ecosystem, but high network costs have hindered its usage. As a result, the market share has been shifting to ‘Ethereum Killers’, which are alternative blockchains that aim to capitalise on an inefficient Ethereum Network.

The good news for crypto users is that we are starting to see some credible alternatives. The FLOW blockchain has managed to lead the NFT collectables sector with NBATopShots, which has experienced a record-breaking $500m in trading volume since it launched. Make no mistake, Ethereum is still the dominant force when it comes to dApps, but investors should evaluate alternatives as a hedge against the inevitable Ethereum network congestion.

The Multi-Chain Paradigm

Ethereum’s network congestion should not be a long-term warning signal to prospective investors; think about the social media boom. If Facebook were to take on Twitter, LinkedIn, Clubhouse and TikTok’s throughput, would it be able to keep its servers up at top speed? Certainly not. This highlights an outdated view of the digital asset application ecosystem; it is not a winner-takes-all space, but a winner-takes-most.

Ethereum’s layer two solutions continue to grow and blockchains such as Polkadot and Cosmos look ever more promising. However, none have experienced the growth that Binance Smart Chain, or BSC, has in such a short time. For many, BSC has emerged as a credible contender for Ethereum, simply disregarding security and decentralisation for a blockchain that is fast and cheap to use.

Binance Coin, or BNB

Binance coin, also known as BNB, is the native token of the Binance Smart Chain (BSC) and is used as an exchange token (ExToken) on the Binance platform.

| Utility of BNB | Use Cases |

|---|---|

| Exchange Token, ExToken | BNB provides its holders with a 6.25% reduction to their trading fees on spot, derivatives, futures, options, mining pool |

| Binance Launchpad (IEOs) | Initial Exchange Offerings, or IEOs, take place on Binance’s launchpad. To get involved in these token sales, investors must stake their BNB to buy. |

| Binance Smart Chain, Native Token | Just like Ethereum, BNB is used on Binance’s alternative blockchain; Binance Smart Chain, or BSC. |

Source: ByteTree. The utility of BNB.

BNB started as just an ExToken,providing Binance exchange users with a 50% reduction to their trading fees. However, since its release, this reduction has periodically been decreasing.

| BNB Trading Fee Discount | ||||

|---|---|---|---|---|

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| 50% | 25% | 12.50% | 6.25% | 0% |

Source: ByteTree. BNB trading fee reductions.

The fee reduction is fairly irrelevant at the moment and certainly does not warrant an $80bn network value, as valued by CoinGecko (accurate as of 20/04/2021). This is relevant when valuing BNB because the fee discount was initially the main purpose of BNB and gave the ExToken the majority of its value. With the diminishing utility of the token with respect to trading fees, some would expect the price per token to be negatively affected. In reality, trading fees are only part of the picture. Binance has countered the reduction in trading fee benefits with the release of Binance Smart Chain (BSC) and through burning BNBs circulating supply.

Binance Coin’s ‘Burn’ Initiative

BNB generates value for its tokenholders through a ‘burn’ process. This is a pledge made by Binance to remove a certain amount of BNB tokens from circulation every quarter, as determined by the quarterly demand for its financial products. In the traditional world, it is similar to a stock buy-back. Binance aims to stop once there are 100m BNB (there are currently 150m BNB). By perpetually reducing BNBs supply, their tokenholders benefit from increased scarcity and short-term buying pressure before a burn event.

From a technical viewpoint, these burn-backs tend to cause very short-term positive price action, but in the long-term, they are not as powerful as the market correlation between BNB and BTC. Burns are not the drivers behind the exponential growth BNB has experienced in recent months; BSC is responsible for this.

Decentralised Finance vs Centralised DeFi

The BSC has been the main driver behind BNBs exponential growth. The more volume and utility a blockchain can provide its tokenholders, the more valuable its native token will be. The network effect benefits the entire Binance ecosystem as it experiences continual adoption.

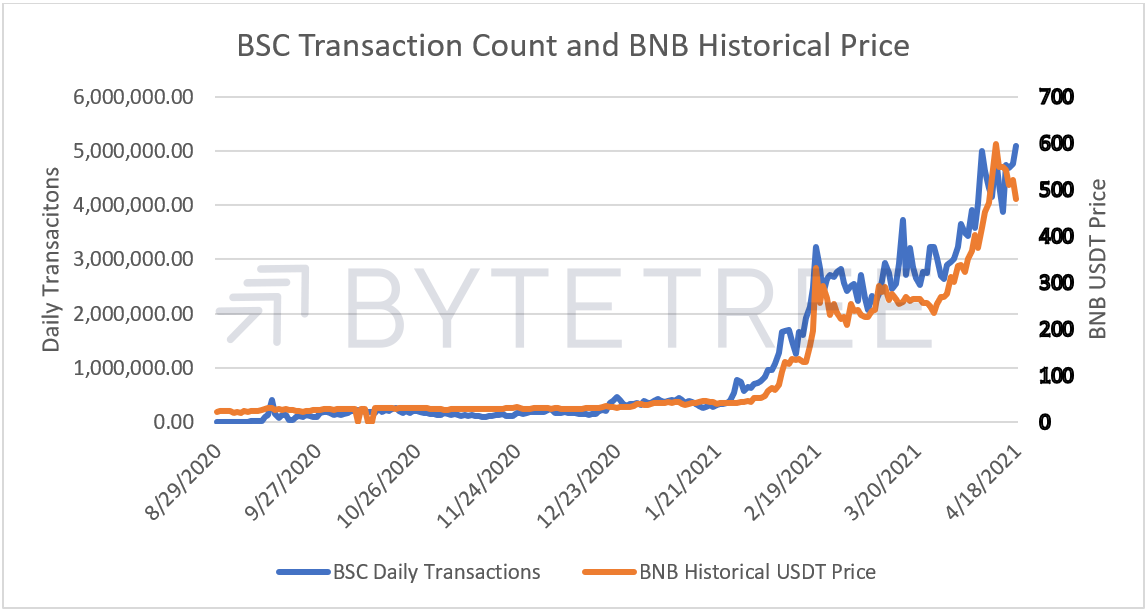

Source: ByteTree; BSCscan; Yahoo Finance. A comparison between BSC daily transactions and BNB historical closing price.

The chart above shows a positive correlation between the number of transactions on BSC and the price of BNB. This is significant because it shows that the growth of BSC is a strong driver behind the value of BNB, more so than its burn initiative or trading fee reduction.

If this correlation continues, then investors could see their BNB investments profit as a result of BSC growth. Considering the comparatively low gas fees of BSC, we will likely see the alternative blockchain gain more market share from Ethereum, especially in time of high network congestion.

The Risks of BSC

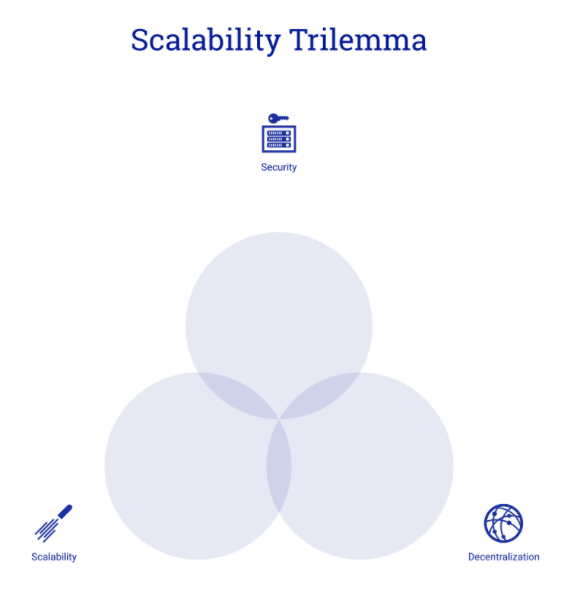

From a blockchain perspective, BSC is essentially the same as Ethereum. However, Binance has chosen to take a different stance on the scalability trilemma.

This trilemma refers to the technical make-up of a blockchain. Ethereum is one of the most decentralised dApp blockchains due to its nearly 7,000 active global nodes (as of 22/04/21), and for crypto-maximalists, decentralisation is key. While security and decentralisation tend to come hand in hand, Ethereum is also the prime example of comprising on scalability.

On the other hand, BSC has compromised on both decentralisation and security (and therefore put emphasise on scalability) by reducing block time to three seconds (compared to 13 seconds on Ethereum), which enables higher throughput. The BSC is much more centralised due to its permissioned nodes and the management of the blockchain by Binance. Investors should be aware of the risks caused by fewer validators (21), as this opens the blockchain up to a higher probability of network outages.

Lastly, BSC could be at risk of being shut down or unmanaged due to recent legal filings against Binance. According to Bloomberg, the Commodity Futures Trading Commission, or CFTC, are currently investigating Binance Holdings Ltd over concerns that they have facilitated trade to American customers whilst violating U.S. rules. However, to combat these legal issues, Binance has bolstered their regulation teams with several high-profile hirings. Most notably, Brian Brooks, a former OCC director to Donald Trump is set to be the next CEO of Binance US. Among other things, Brooks oversaw the conditional approval of the first federal bank charter to go to the crypto-native company, Anchorage.

If any of these risks actualise, we can expect the price of BNB to take a big hit. Investors should bear in mind that owning BNB is also a bet on the future success of the BSC.

Summary

Overall, the value proposition of BNB has been significantly improved by the BSC. Investors can expect to see a positive correlation between increased adoption of BSC and the value of BNB as a native token. BNB should not be treated as synthetic equity in Binance. Instead, investors should value the token based on its utility and the growth in trading volume on the Binance exchange and BSC.

When it comes to Ethereum, it is looking more and more likely that it will co-exist with a wide array of application blockchains, as Ethereum is unable to house the entire market for finance, art, gaming, collectables, social media, exchanges, and gambling. If we think of the social media market, although Facebook is the leader, it co-exists with several big players, which brings us to the conclusion that the application ecosystem is a winner-takes-most.

Binance is playing into a more centralised ideology that adds risk but enables efficient throughput. BSC and the FLOW blockchain are prime examples of the market simply wanting a protocol to be fast and cost-effective. However, Investors should be aware of the security implications that occur due to fewer nodes and a more centralised approach to an application blockchain.

So, is BSC the future? Yes, but only in co-existence. Make no mistake, Ethereum rules and will have the first pick for future sections of dApps. In the long-term, it is hard to see Binance gaining a significant share from Ethereum, but ultimately, BSC will be viewed as the start of the dApp multichain paradigm.