What's Driving Bitcoin? Innovation and the Growth in Stablecoins

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree Market Health Update; Issue 70

The recent strength in Bitcoin is puzzling. The speculative excesses in financial markets are easing, yet Bitcoin remains strong. Institutional demand is cooling, yet Bitcoin remains strong. Even the on-chain metrics are slowing, as I discussed last week, yet Bitcoin remains strong.

Sometimes the obvious is staring us in the face. Bitcoin and the crypto space is rife with innovation. Whatever is thrown at it, it comes back fighting.

- Bitcoin transactions are too slow. No problem - let’s build a lightning network along with additional payment layers. We’re now as fast as Visa.

- Bitcoin doesn’t pay a yield. No problem - we’ll build DeFi. You can freely lend and borrow crypto assets. You can even return 8% per annum on a USD stablecoin.

- The regulators want KYC and AML checks. No problem - dozens of solutions will confirm identities at the touch of a button.

- It’s hard to deal with the banks. No problem - introducing stablecoins.

The point is that when you combine a scarce and mobile asset with unlimited software and innovation, the result sees endless possibilities. That is the underlying story that has maintained interest in the network.

Rising bond yields

The Fed, along with other governments, are spending like 1970s rock stars. As victory in the battle against this tedious real-world virus is within sight, the world economy is accelerating. This benefits the old world as the planes and restaurants fill up again.

Understandably, the tech sector has enjoyed a huge run over the past year, exacerbated by lockdown and easy money, but that is now cooling. It’s the old world’s turn to fight back as the industry finally outperforms the internet.

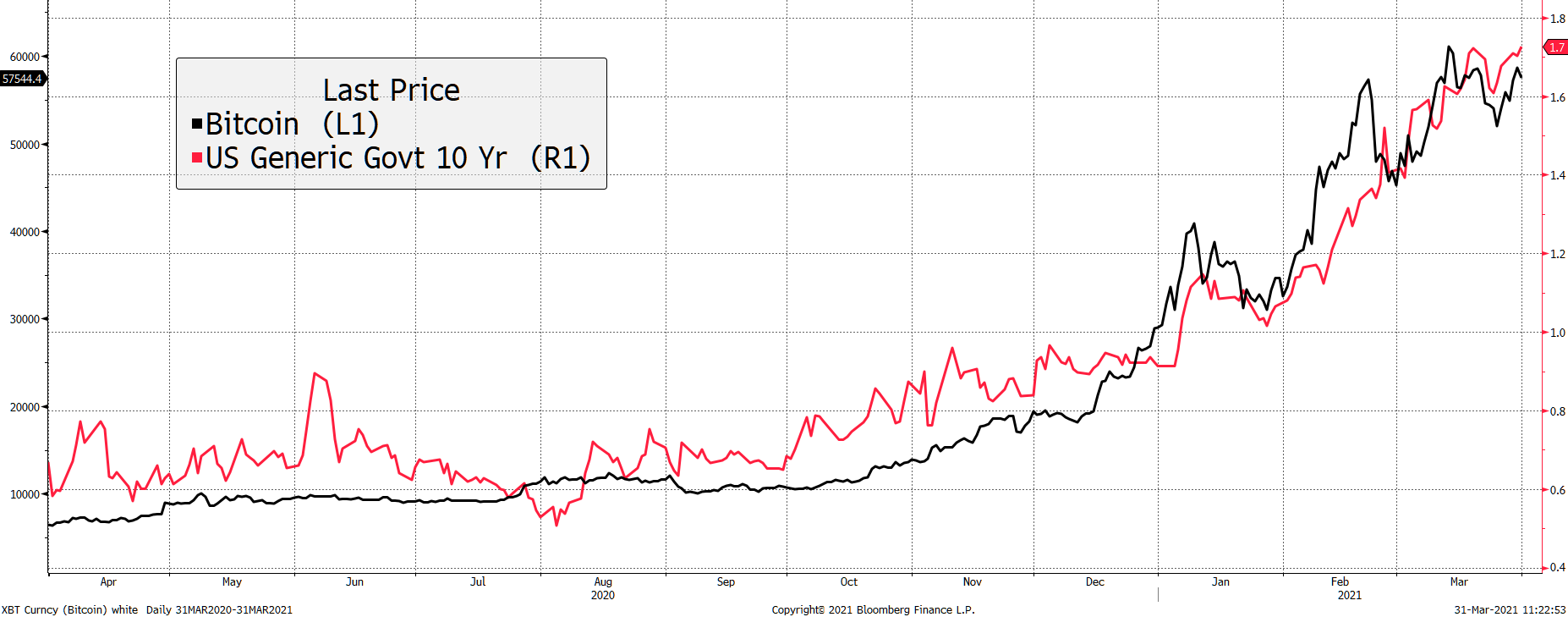

Yet Bitcoin seems to have it all. It is one of the few assets that seems to benefit from a rising bond yield – something we reserve for true growth stocks and those cyclicals enjoying recovery. Conversely, this is normally detrimental to traditional low-growth safe assets such as gold, defensive yield stocks and bonds.

Unlike defensive stocks and bonds, Bitcoin and gold are both inflation-sensitive, but gold is happiest when the world faces a downward spiral. In contrast, Bitcoin prefers a stronger economy, when the yield is rising. This is where we are today.

Bitcoin still likes a rising bond yield

Assets that thrive when the bond yield is rising do so because they can demonstrate future growth while being reasonably priced to reflect a positive return. If an asset was overpriced, like much of the tech sector, it would eventually come under pressure, just like we saw 21 years ago. Back then, a 6.5% yield proved too much to handle. This time 1.5% was enough to slow the march.

Bitcoin’s resilience against a rising bond yield, and sensitivity to it, is telling us this is a highly innovative growth asset.

Show me the growth

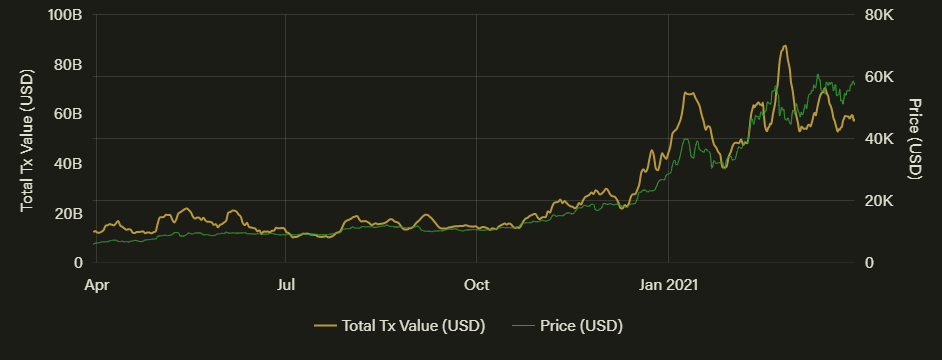

Probably the most bullish case for Bitcoin is that it is an open-source project that is fuelled by innovation. But I would expect that growth to be reflected by increased on-chain activity. But as I showed you last week, that has stalled. Despite the price finding its way to new highs, on-chain activity has not budged.

On-chain network value transfer is back to January levels

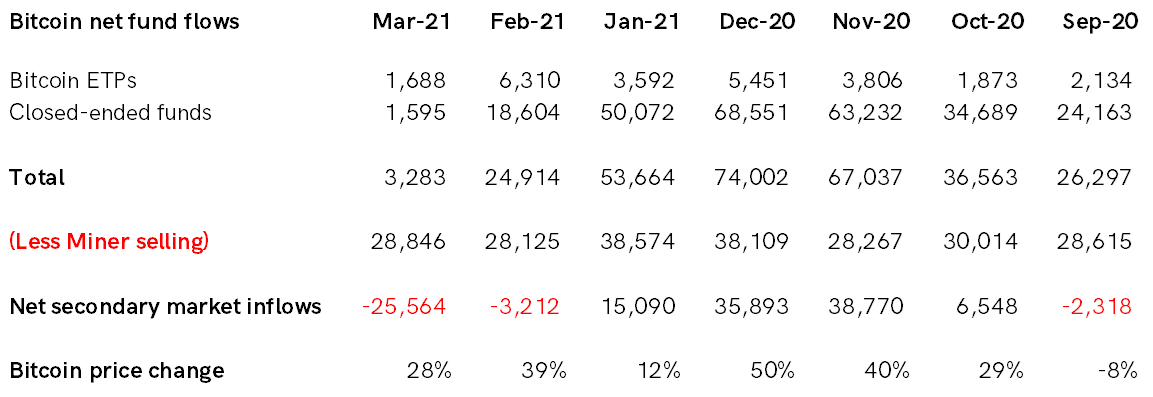

I would also be excited to see institutional demand. Yet in March thus far, the 13 funds we track have seen just 3,283 BTC purchased, which is the lowest level we have seen in months. There is a conundrum at play.

I am not suggesting that these funds are the only source of demand, but they provide a consistent sample from institutional investors. Moreover, they have been a hugely important driver since last autumn.

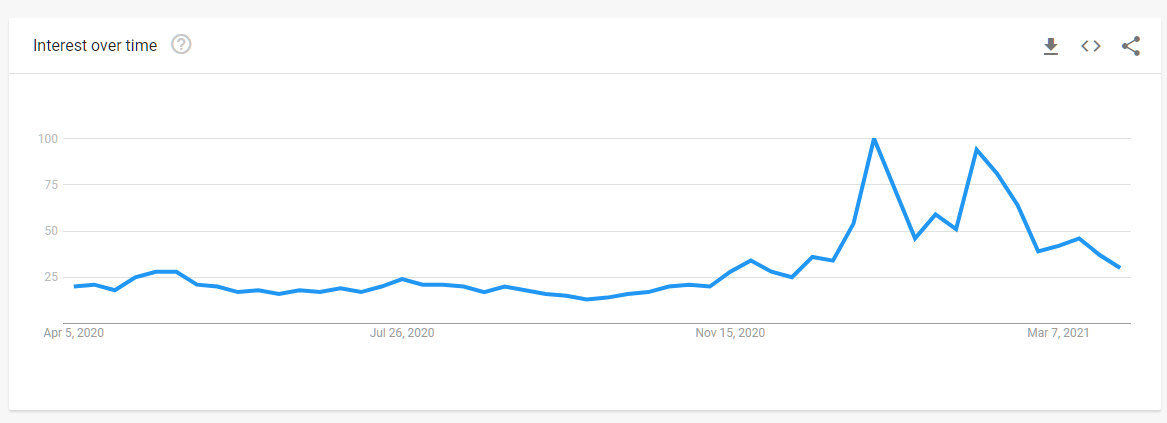

Then look to retail investors for which a Google search is a reasonable proxy. They have already loaded up, and interest from new parties has waned.

Google search “buy bitcoin”

Perhaps institutions and sovereign wealth funds are buying directly and ignoring the funds. That is entirely possible, but unlikely as there would be some overspill into the funds from at least the smaller institutions. I would also suggest that if institutional demand was high, the Grayscale Bitcoin Trust (GBTC) discount wouldn’t be narrowing like it is.

Stablecoins

Stablecoins have driven the long-standing issues between digital asset companies and traditional banks to the side-line. Demand for digital FIAT, i.e. stablecoins, has grown exponentially over the past year. Tether’s name is being cleared, and the adoption of digital assets amongst large institutions, such as VISA and Circle’s USDC, has certainly helped.

There is one source of demand that stands tall, and this brings us back to innovation. Tether USD (USDT), which recently carried out a full audit demonstrating that it was fully backed, has doubled issuance from $20bn to $40bn this year alone.

USDT is printed as and when needed, and in some cases, in anticipation of high-demand events. Perhaps, the links to quasi-fractional-reserve banking have caused many to turn away, but one cannot ignore the facts. Once a USDT is minted and put into circulation, it tends to stay. As the saying goes, there are always two sides to a trade.

If Tether is not for you, then there is Circle’s stablecoin (USDC), which has issued close to $10bn, Binance’s BUSD with $3bn and Paxos Standard (PAX) with another billion. Sure, the market cap of the digital asset ecosystem is $1.8trn, and this makes stablecoins’ $63bn seem insignificant, but that is still the same as the market cap for Adidas.

Assuming an average Bitcoin price of $45,000 in 2021, the newly issued stablecoins have seen $30bn come to light, which is enough money to buy over 650,000 BTC. That’s nearly as much as has ever been invested in the funds I mentioned above.

This is remarkable stuff and shows you how Bitcoin has detached itself from the real world.

Maybe, just maybe, Bitcoin can survive and thrive regardless.

Comments ()